Table of Contents

IT Leasing and Financing Market Size

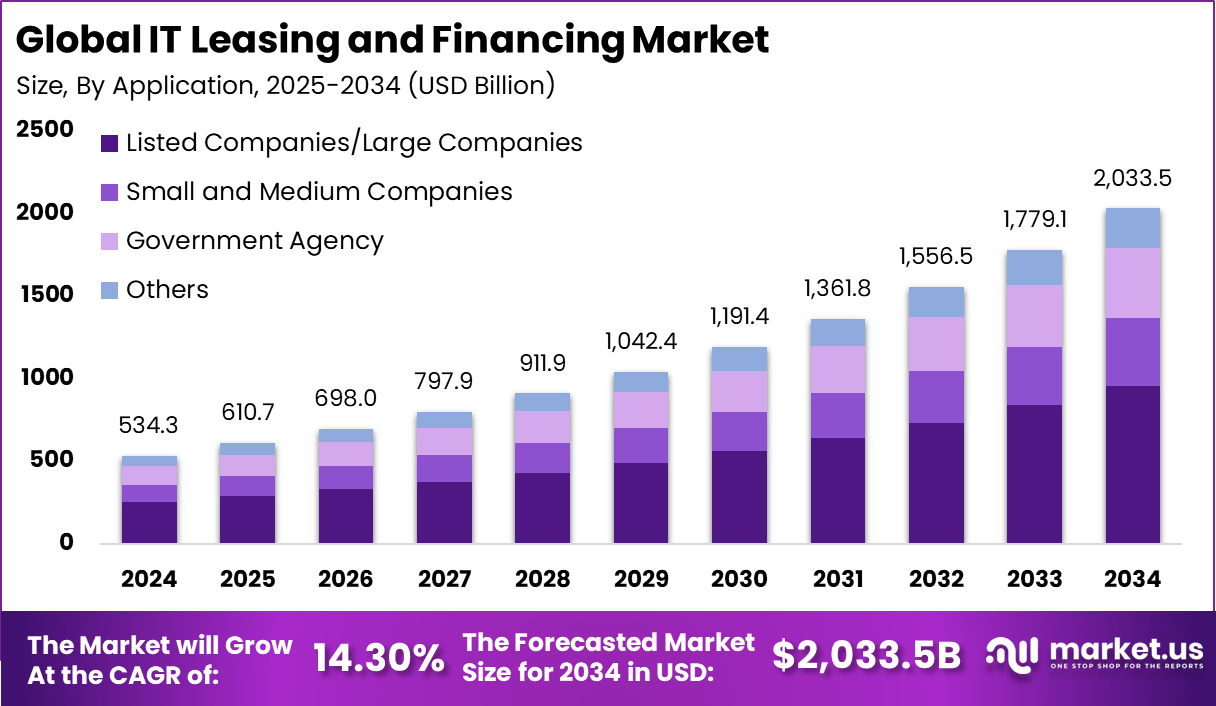

The global IT Leasing and Financing market generated USD 534.3 billion in 2024 and is expected to expand steadily over the forecast period. Market revenue is projected to grow from USD 610.7 billion in 2025 to approximately USD 2,033.5 billion by 2034, registering a CAGR of 14.30% throughout the forecast span. This growth is driven by rising demand for flexible IT procurement models and increasing adoption of subscription based and as a service technology frameworks. Organizations are using leasing and financing options to manage capital expenditure and accelerate digital transformation.

The IT leasing and financing market refers to financial solutions that allow organizations to acquire information technology assets through leasing, rental, or structured financing models. These assets include hardware, software, data center equipment, networking devices, and end-user computing systems. IT leasing enables businesses to access modern technology without large upfront capital expenditure. Adoption is common across enterprises, small businesses, public sector organizations, and technology service providers. These solutions support flexible technology adoption and cost management.

Market development has been influenced by rapid technology obsolescence and budget constraints. Organizations must frequently upgrade IT infrastructure to remain competitive. Purchasing equipment outright can strain capital resources. Leasing and financing provide predictable payment structures and flexibility. As IT refresh cycles shorten, demand for alternative financing models increases.

Top Market Takeaways

- Packaged software led by type with a 30.8% share, as enterprises increasingly lease bundled software instead of purchasing licenses upfront.

- Listed and large companies dominated applications at 47.2%, using IT leasing to manage large refresh cycles while maintaining cash flow discipline.

- Finance leases accounted for 32.5%, offering predictable payments, long-term asset use, and potential ownership at contract end.

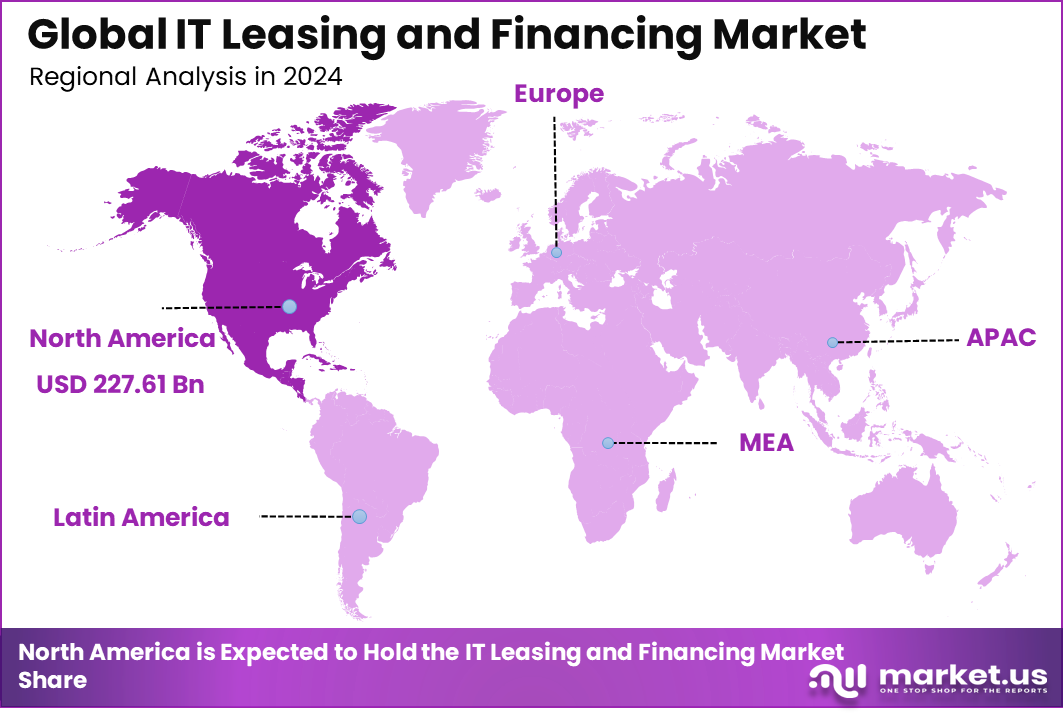

- North America held 42.6% of the global market, supported by established financing frameworks and high enterprise technology spending.

- The U.S. market reached USD 204.17 billion in 2025, expanding at a 12.8% CAGR, driven by continued digital transformation and preference for flexible IT financing models.

Top Driving Factors

One major driving factor of the IT leasing and financing market is the need to preserve capital and improve cash flow. Businesses prefer to allocate capital toward growth initiatives rather than hardware ownership. Leasing spreads costs over time and reduces upfront spending. Predictable payments support financial planning. Capital efficiency drives adoption.

Another key driver is rapid technological change. IT assets can become outdated quickly due to innovation and performance demands. Leasing allows organizations to refresh technology more frequently. Flexible terms reduce the risk of holding obsolete assets. Technology lifecycle management supports market growth.

Demand Analysis

Demand for IT leasing and financing solutions is influenced by digital transformation initiatives. Organizations invest in cloud infrastructure, cybersecurity, and analytics platforms. These initiatives require scalable and flexible financing options. Leasing supports phased deployment and upgrades. Transformation goals increase demand. Demand is also shaped by growth in small and mid-sized enterprises. These businesses often lack large capital budgets for IT purchases. Leasing enables access to enterprise-grade technology. Flexible financing supports competitiveness. SME adoption strengthens demand.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 42.6% of total revenue. The region generated around USD 227.61 billion, supported by strong enterprise IT spending and widespread use of asset financing solutions. A mature financial services ecosystem and early adoption of advanced IT infrastructure strengthened regional leadership. As a result, North America continues to shape growth and innovation trends in the IT leasing and financing market.

Driver Analysis

The IT leasing and financing market is being driven by the increasing adoption of flexible financing solutions that enable organisations to access advanced technology without large upfront capital expenditure. Information technology assets such as servers, networking equipment, laptops, and software platforms have high acquisition costs that can constrain budgets, particularly for small and medium sized enterprises.

Leasing and financing arrangements allow companies to align payment structures with technology lifecycle planning, preserve working capital, and scale infrastructure in step with business growth. As digital transformation accelerates across sectors, demand for leasing and financing options that support faster technology deployment and operational flexibility continues to strengthen.

Restraint Analysis

A key restraint in the IT leasing and financing market relates to the variability of credit risk assessments and the cost of capital, which can affect eligibility and terms for technology financing. Providers must evaluate borrower creditworthiness, asset depreciation rates, and residual values, which introduces risk management complexity and influences cost structures.

Organisations with limited financial history or volatile revenue streams may face higher financing costs or restrictive terms, which can diminish the attractiveness of leasing relative to outright purchase alternatives. Additionally, discrepancies in regulatory frameworks and tax treatment of leased IT assets across jurisdictions can complicate lease structuring and impact adoption, especially for multinational corporations.

Opportunity Analysis

Emerging opportunities in the IT leasing and financing market are linked to expanding service offerings that align with consumption-based and subscription technology models. As software licences, cloud services, and managed IT solutions shift toward recurring revenue contracts, financing providers can offer integrated packages that bundle hardware, software, and support services into unified payment plans.

This creates value for organisations seeking simplification of vendor contracts and predictable budgeting. There is also potential for financing solutions that support sustainability goals, such as leasing terms linked to energy-efficient hardware upgrades or technology refresh cycles that reduce e-waste and enhance performance.

Challenge Analysis

A central challenge confronting this market relates to balancing risk management with competitive pricing and customer experience. Providers must structure leases and financing agreements that adequately protect against asset obsolescence and default risk while remaining compelling in cost compared with alternative acquisition methods.

Rapid technology evolution accelerates asset depreciation and can shorten usable life, which complicates valuation and residual forecasting. Ensuring transparent terms, flexible end-of-lease options, and customer support throughout the technology lifecycle is essential to satisfying lessee expectations and maintaining long-term provider relationships, yet this requires operational sophistication and risk acumen.

Emerging Trends

Emerging trends in the IT leasing and financing landscape include increased adoption of pay-per-use and outcome-based financing models that align payments with actual technology utilisation or business performance. Providers are also exploring digital platforms that simplify application, approval, and asset tracking, improving speed to decision and transparency.

Another trend involves financing bundled solutions that incorporate predictive maintenance, upgrade pathways, and support services, enhancing total value delivered through lease arrangements. Collaboration between technology vendors, leasing partners, and service providers is becoming more common to deliver comprehensive and tailored financing solutions.

Growth Factors

Growth in the IT leasing and financing market is supported by expanding enterprise investments in cloud computing, modernisation of IT infrastructure, and digital transformation initiatives across industries. The increasing pace of technology adoption creates demand for financing mechanisms that reduce financial barriers and support iterative upgrade strategies.

Organisations prioritise financial flexibility to preserve liquidity, manage risk, and respond to competitive pressures, reinforcing the appeal of leasing and financing as strategic financial tools. Continued innovation in asset lifecycle management, risk analytics, and customer experience further strengthens market momentum as businesses seek adaptable financing solutions for evolving IT needs.

Key Market Segments

By Type

- Packaged Software

- Enterprise Resource Planning (ERP)

- Customer Relationship Management (CRM)

- Others

- Server Systems

- PCs and Smart Handhelds

- Networking and Telco

- Routers

- Switches

- Others

- Mainframes and Service

- Others

By Application

- Listed Companies and Large Companies

- Small and Medium Companies

- Government Agency

- Others

By Financing Model

- Operating Lease

- Finance Lease

- Subscription-Based Financing

- Others

Top Key Players in the Market

- Dell Technologies

- IBM Corporation

- GRENKE AG

- 3 Step IT Group

- Lenovo

- SHI International Corp.

- Cisco Systems, Inc.

- PCM Leasing

- CSI Leasing, Inc.

- Edianzu

- Hypertec Direct

- Fujitsu Finance

- Hewlett Packard Enterprise

- Verdant Finance

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 535.3 Bn |

| Forecast Revenue (2034) | USD 2,033.5 Bn |

| CAGR(2025-2034) | 14.30% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |