Table of Contents

Synchronizing Systems Market Size

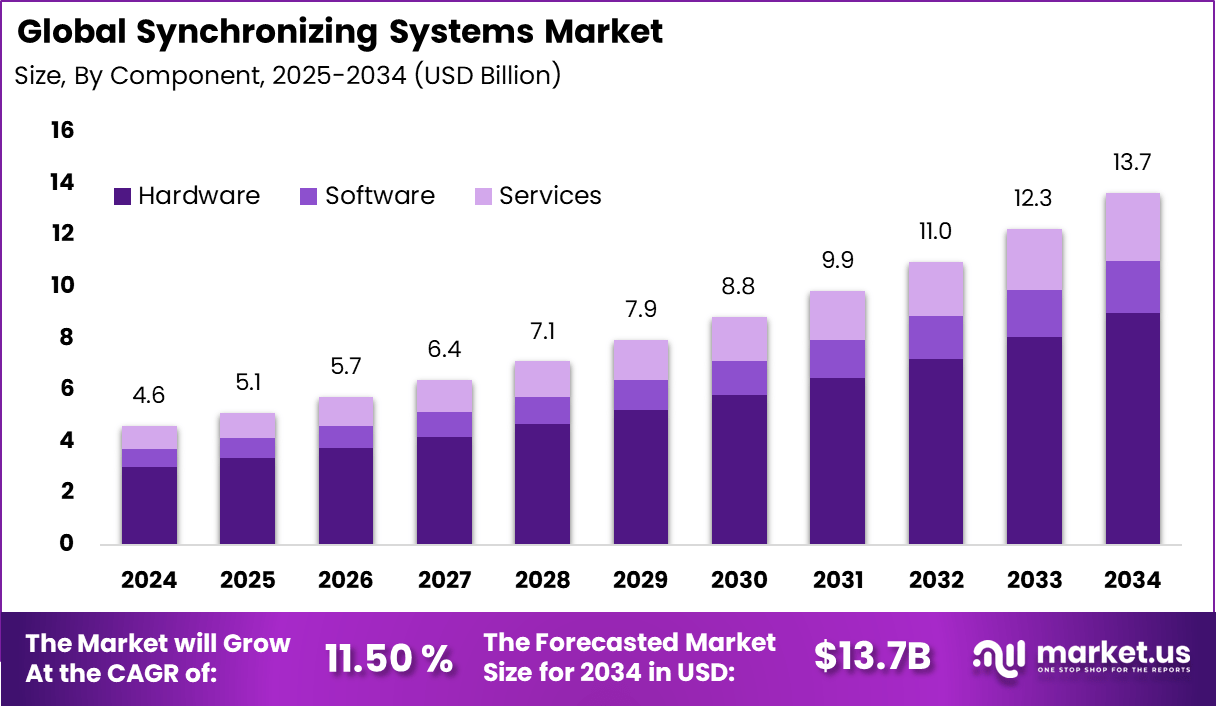

The global Synchronizing Systems market generated USD 4.6 billion in 2024 and is expected to grow steadily over the forecast period. Market revenue is projected to increase from USD 5.1 billion in 2025 to approximately USD 13.7 billion by 2034, registering a CAGR of 11.50% throughout the forecast span. This growth is driven by rising demand for precise time synchronization across telecommunications, power grids, data centers, and industrial automation. Increasing reliance on high speed networks and real time systems is further supporting market expansion.

The synchronizing systems market refers to technologies and solutions that ensure precise time and frequency alignment across devices, machines, and networks. These systems coordinate operations in environments where timing accuracy is critical, such as telecommunications, industrial automation, power grids, and data centers. Synchronizing systems manage clock distribution, signal alignment, and timing consistency. Accurate synchronization supports stable and reliable system performance. Adoption is essential for complex and distributed infrastructures.

Market development has been influenced by the increasing interconnection of digital systems. Modern networks rely on coordinated operations across multiple locations. Traditional timing methods are often insufficient for high precision requirements. Advanced synchronizing systems provide higher accuracy and stability. As systems become more distributed, synchronization becomes a core requirement.

Key Insights Summary

- Hardware dominated the synchronizing systems market with 65.7%, as clocks, GPS receivers, and timing devices remain essential for precise and reliable operations.

- Network-based solutions held 56.2%, driven by widespread use of PTP and NTP protocols to support distributed timing in telecom networks and data centers.

- Phase and time synchronization accounted for 52.4%, reflecting its critical role in 5G base stations and high-speed financial trading platforms that require microsecond-level accuracy.

- Telecommunications led end-user adoption with 44.9%, supported by large-scale 5G rollouts and stringent synchronization requirements between cell sites.

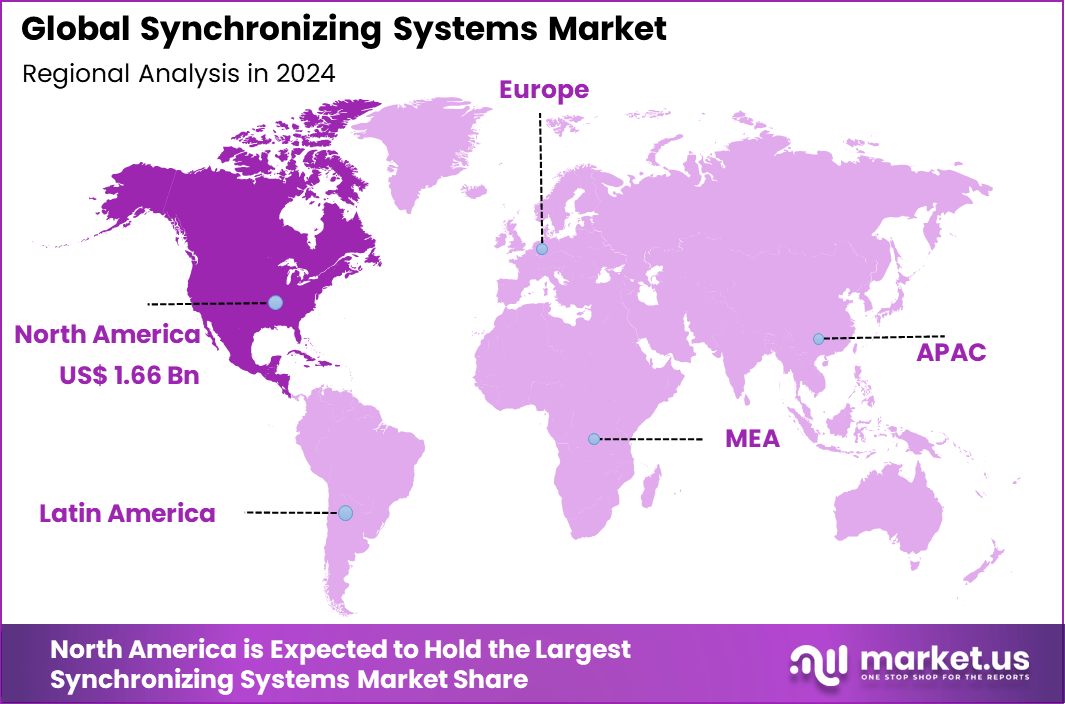

- North America captured 36.3% of the global market, with the U.S. valued at USD 1.52 billion in 2025 and expanding at a 9% CAGR.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 36.3% of total revenue. The region generated around USD 1.66 billion, supported by advanced network infrastructure and strong adoption of synchronization technologies. High investment in 5G, smart grids, and mission critical systems strengthened regional leadership. As a result, North America continues to influence growth and adoption trends in the synchronizing systems market.

Regional Driver Comparison

| Region | Primary Growth Driver | Regional Share (%) | Regional Value (USD Bn, 2024) | Adoption Maturity |

|---|---|---|---|---|

| North America | Advanced telecom and financial networks | 36.3% | USD 1.67 Bn | Advanced |

| Europe | 5G rollout and power grid modernization | 27.8% | USD 1.28 Bn | Advanced |

| Asia Pacific | Rapid mobile infrastructure expansion | 24.6% | USD 1.13 Bn | Developing to Advanced |

| Latin America | Telecom network upgrades | 6.4% | USD 0.29 Bn | Developing |

| Middle East and Africa | Smart infrastructure projects | 4.9% | USD 0.23 Bn | Early |

Driver Analysis

The synchronizing systems market is being driven by the growing need for precise timing and coordination across modern digital and industrial infrastructures. Industries such as telecommunications, power utilities, transportation, and data centers rely on accurate synchronization to ensure stable operations, low latency, and reliable data exchange.

As networks become faster and more distributed, even minor timing mismatches can lead to performance degradation, data errors, or system failures. Synchronizing systems help align clocks, signals, and processes across devices and locations, supporting operational accuracy and efficiency in complex environments.

Restraint Analysis

A key restraint in the synchronizing systems market relates to the technical complexity and cost of deploying high-precision timing solutions. Advanced synchronization requires specialised hardware, calibration, and integration with existing systems, which can increase implementation effort and capital expenditure.

Legacy infrastructure may not be fully compatible with modern synchronization technologies, leading to additional upgrade or retrofit requirements. These challenges can slow adoption, particularly for organisations operating with limited budgets or ageing systems that are still functional but not optimised for precise timing control.

Opportunity Analysis

Strong opportunities are emerging as synchronizing systems become essential enablers of next-generation technologies and digital transformation initiatives. The expansion of high-speed networks, industrial automation, smart grids, and real-time analytics creates demand for reliable and scalable synchronization solutions.

Synchronizing systems that support flexible architectures and software-defined control can be applied across multiple use cases, improving interoperability and future readiness. As organisations invest in automation, real-time monitoring, and distributed computing, synchronization capabilities offer strategic value by ensuring system stability and performance consistency.

Challenge Analysis

A central challenge in the synchronizing systems market involves maintaining accuracy and reliability across heterogeneous and multi-vendor environments. Modern systems often combine equipment from different suppliers, operating under varied protocols and standards, which complicates synchronization management.

Ensuring consistent timing performance under changing environmental conditions, network loads, and system upgrades requires continuous monitoring and optimisation. Balancing precision requirements with energy efficiency and system scalability also presents an ongoing technical challenge for system designers and operators.

Emerging Trends

Emerging trends in the synchronizing systems landscape include increased adoption of software-based synchronization and time-aware networking that enhances flexibility and reduces dependency on dedicated hardware. There is also growing focus on synchronizing systems that support distributed and edge computing environments, where precise timing is critical for real-time processing.

Integration of synchronization capabilities into broader network and control platforms is gaining traction, enabling centralised management and improved visibility. These trends reflect a shift toward more adaptive, intelligent, and scalable synchronization approaches.

Growth Factors

Growth in the synchronizing systems market is supported by the rapid expansion of digital infrastructure, real-time communication networks, and automated industrial systems. Increasing reliance on data accuracy, low latency operations, and coordinated system behaviour reinforces the importance of reliable synchronization.

Advances in timing technologies, network protocols, and system integration tools enhance accessibility and performance of synchronizing solutions. As industries continue to modernise and adopt real-time, distributed architectures, demand for robust synchronizing systems is expected to remain strong.

Top Key Players in the Market

- Siemens AG

- ABB Ltd.

- General Electric Company

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Schweitzer Engineering Laboratories, Inc. (SEL)

- Woodward, Inc.

- Larsen & Toubro Limited (L&T)

- Yokogawa Electric Corporation

- OMRON Corporation

- Others

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- GNSS-based

- Network-based Synchronization

- Others

By Precision

- Phase and Time Synchronization

- Frequency Synchronization

- Time-of-Day Synchronization

By End-User Industry

- Telecommunications

- Power and Energy

- Financial Services

- Industrial Automation and Transportation

- Government and Defense

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.6 Bn |

| Forecast Revenue (2034) | USD 13.7 Bn |

| CAGR(2025-2034) | 11.50% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |