Table of Contents

- Screenless Laptop Market Size

- Market Overview

- Top Driving Factors

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Table

- Regional Driver Comparison

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Use Case Adoption by Industry Vertical

- Technology Maturity Roadmap

- Competitive Capability Matrix

- Increasing Adoption Technologies

- Investment and Business Benefits

- Regional Analysis

- Key Market Segments

Screenless Laptop Market Size

The global Screenless Laptop market was valued at USD 161.3 billion in 2025 and is expected to expand rapidly over the forecast period. The market is projected to reach approximately USD 1,529.8 billion by 2034, growing at a strong CAGR of 28.4% from 2025 to 2034. This growth is driven by rising interest in immersive computing experiences and increasing adoption of alternative display technologies such as AR and holographic interfaces. Demand is also supported by use cases in remote work, design, and advanced computing environments.

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 125.6 Bn |

| Forecast Revenue (2034) | USD 1,529.8 Bn |

| CAGR(2025-2034) | 28.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Market Overview

The screenless laptop market refers to computing devices that operate without an integrated display and rely on external screens, projectors, or augmented and virtual reality devices for visual output. These systems provide full computing capabilities while removing the traditional built-in screen. Screenless laptops are designed to improve portability, reduce hardware weight, and enable flexible display options. Adoption is seen among mobile professionals, developers, digital nomads, and privacy-focused users. These devices support modular and adaptable computing environments.

Market development has been influenced by changing work patterns and demand for lightweight computing solutions. Traditional laptops are limited by fixed screen size and form factor. Screenless designs allow users to choose display types based on context and preference. This flexibility aligns with mobile and hybrid work models. As computing becomes more modular, interest in screenless systems increases.

Top Driving Factors

One major driving factor of the screenless laptop market is the demand for ultra-portable computing devices. Professionals seek lightweight systems that are easy to carry. Removing the built-in screen significantly reduces device weight. Improved portability supports frequent travel and remote work. Mobility requirements strongly drive adoption.

Another key driver is growing interest in customizable and modular hardware setups. Users want flexibility in choosing display size and type. Screenless laptops support connection to monitors, head-mounted displays, and projection systems. Custom setups improve productivity and comfort. Personalization trends support market growth.

Demand for screenless laptops is influenced by the rise of mobile and hybrid work environments. Users work from multiple locations and devices. Screenless systems adapt easily to different setups. Compatibility with shared and public displays increases usability. Work flexibility strengthens demand. Demand is also shaped by privacy and security considerations. Screenless laptops can be used with private visual displays. Reduced exposure to shoulder surfing improves confidentiality. Security-conscious users value controlled visibility. Privacy needs contribute to adoption.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Growth of voice first computing | Hands free and eyes free workflows | ~7.8% | North America, Europe | Short Term |

| Advances in AI and speech recognition | Accurate natural language interaction | ~6.6% | Global | Short Term |

| Accessibility driven device adoption | Inclusive computing requirements | ~5.9% | North America, Europe | Mid Term |

| Expansion of remote and mobile work | Screen independent productivity | ~4.7% | Global | Mid Term |

| Energy efficiency and minimal hardware | Reduced display power consumption | ~3.4% | Global | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| User adoption resistance | Dependence on visual interfaces | ~6.1% | Global | Short Term |

| Speech recognition accuracy limits | Noise sensitive environments | ~5.0% | Global | Short Term |

| Privacy and data security concerns | Continuous voice data processing | ~4.2% | North America, Europe | Mid Term |

| Limited application compatibility | Screen dependent software | ~3.5% | Global | Mid Term |

| Regulatory uncertainty | Voice data governance frameworks | ~2.6% | Global | Long Term |

Restraint Impact Table

| Restraint Factor | Restraint Description | Impact on Market Expansion (%) | Most Affected Regions | Duration of Impact |

|---|---|---|---|---|

| High development cost | Advanced AI and spatial audio systems | ~6.4% | Emerging Markets | Short to Mid Term |

| Limited consumer awareness | Early stage product understanding | ~5.2% | Global | Mid Term |

| Ecosystem dependency | Reliance on voice platforms | ~4.1% | Global | Mid Term |

| Learning curve | Shift from visual to auditory UX | ~3.3% | Global | Long Term |

| Hardware integration challenges | Specialized microphones and sensors | ~2.5% | Global | Long Term |

Regional Driver Comparison

| Region | Primary Growth Driver | Regional Share (%) | Regional Value (USD Bn, 2024) | Adoption Maturity |

|---|---|---|---|---|

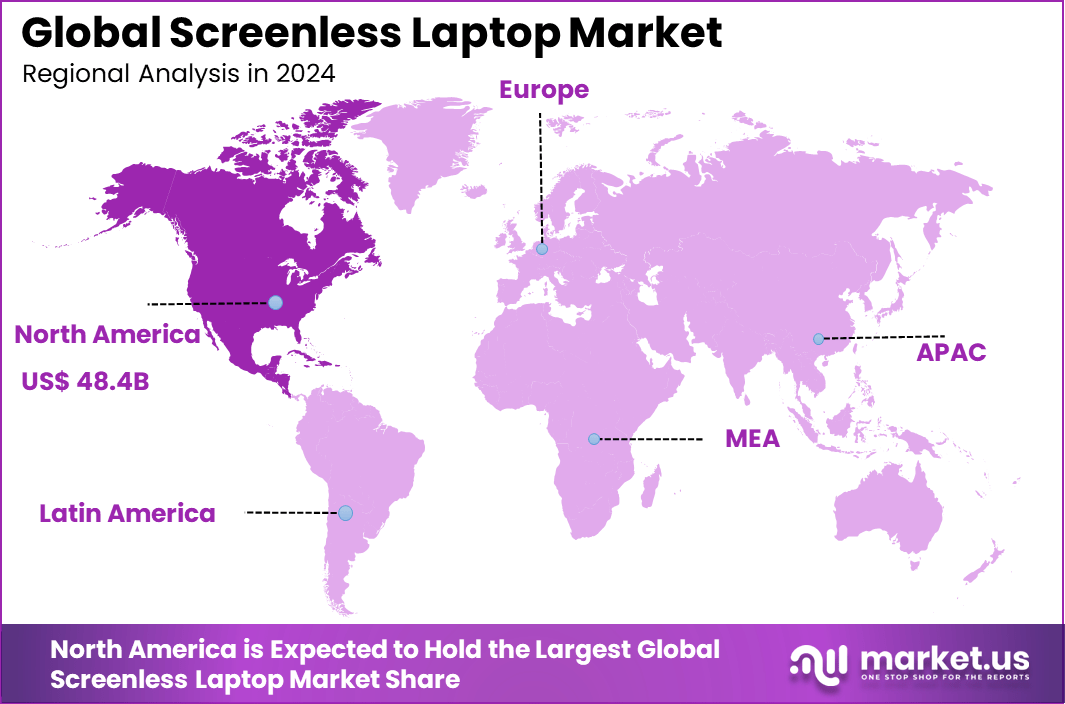

| North America | Early adoption of AI first devices | 38.6% | USD 48.4 Bn | Advanced |

| Europe | Accessibility focused technology uptake | 29.4% | USD 36.8 Bn | Advanced |

| Asia Pacific | Mobile workforce and AI adoption | 22.1% | USD 27.7 Bn | Developing to Advanced |

| Latin America | Digital inclusion initiatives | 5.7% | USD 7.1 Bn | Developing |

| Middle East and Africa | Early stage smart device adoption | 4.2% | USD 5.3 Bn | Early |

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Technology manufacturers | Very High | ~41% | Product differentiation | R&D intensive |

| Enterprise buyers | High | ~29% | Productivity and accessibility | Fleet deployment |

| Accessibility solution providers | Moderate | ~14% | Inclusive computing | Program based adoption |

| Software platform vendors | Moderate | ~10% | Voice ecosystem expansion | Strategic partnerships |

| Individual consumers | Low | ~6% | Novel user experience | Gradual adoption |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| Speech recognition engines | Voice command accuracy | ~7.1% | Mature |

| Conversational AI models | Contextual task execution | ~6.4% | Growing |

| Spatial audio systems | Non visual user feedback | ~5.2% | Growing |

| Edge AI processors | Low latency voice processing | ~4.1% | Developing |

| Secure voice data frameworks | Privacy protection | ~3.0% | Developing |

Use Case Adoption by Industry Vertical

| Industry Vertical | Primary Use Case | Adoption Share (%) | Adoption Maturity |

|---|---|---|---|

| Enterprise and professional services | Voice driven productivity tasks | 38.9% | Advanced |

| Accessibility and assistive tech | Inclusive computing solutions | 21.6% | Advanced |

| IT and software development | Hands free coding and navigation | 16.4% | Developing |

| Education and research | Screen independent learning | 13.2% | Developing |

| Consumer personal computing | Voice centric daily tasks | 9.9% | Early |

Technology Maturity Roadmap

| Technology Stage | Key Focus Area | Adoption Level (%) | Timeframe |

|---|---|---|---|

| Mature | Voice assistants and basic commands | 31% | Current |

| Growth | AI driven workflow automation | 34% | Short Term |

| Emerging | Multimodal spatial interaction | 22% | Mid Term |

| Early | Fully screen independent OS | 9% | Mid to Long Term |

| Experimental | Cognitive ambient computing | 4% | Long Term |

Competitive Capability Matrix

| Capability Area | Market Leaders | Strong Contenders | Emerging Players | Importance |

|---|---|---|---|---|

| Voice recognition accuracy | Very High | High | Moderate | Critical |

| AI contextual understanding | Very High | High | Moderate | Critical |

| Privacy and data security | Very High | High | Moderate | Critical |

| Ecosystem integration | High | High | Moderate | High |

| Hardware innovation | High | Moderate | Moderate | High |

| Cost efficiency | Moderate | High | High | Medium |

| User experience design | High | Moderate | Moderate | High |

Increasing Adoption Technologies

Wireless display and connectivity technologies play a key role in adoption. High-speed wireless connections enable seamless display output. Low latency improves user experience. Stable connectivity supports professional workflows. Technology reliability improves acceptance. Augmented reality and virtual reality display technologies also support adoption. Head-mounted displays provide private and immersive viewing.

Virtual screens replace physical monitors. Advanced optics improve clarity and comfort. Immersive display adoption strengthens market appeal. One key reason users adopt screenless laptops is improved flexibility in display usage. Users choose screens based on task and environment. Multi-display setups improve productivity. Display independence supports adaptability. Flexibility drives adoption. Another reason is reduced device size and simplified hardware maintenance. Fewer components reduce wear and damage risk. External displays are easier to replace or upgrade. Simplified hardware improves durability. Maintenance efficiency supports adoption.

Investment and Business Benefits

Investment opportunities in the screenless laptop market exist in professional and enterprise-focused devices. Businesses seek lightweight and secure computing solutions. Enterprise adoption supports scalable deployment. Specialized designs attract interest. Professional use cases offer growth potential. Another opportunity lies in integration with immersive display ecosystems. Screenless laptops paired with AR and VR displays create new workflows. Integrated hardware and software solutions improve value. Ecosystem development attracts investment.

Innovation-driven products support expansion. Screenless laptops improve operational efficiency by enabling flexible work setups. Employees adapt devices to different environments. Reduced hardware weight improves mobility. Productivity improves through adaptable displays. Business performance benefits from flexibility. These systems also support cost efficiency over time. External displays can be shared or reused. Reduced hardware complexity lowers repair costs. Modular upgrades extend device life. Financial efficiency improves return on investment.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 38.6% of total revenue. The region generated around USD 48.4 billion, supported by early adoption of emerging hardware technologies and strong investment in next generation computing solutions. Presence of leading technology innovators and a mature consumer electronics ecosystem strengthened regional leadership. As a result, North America continues to shape innovation and adoption trends in the screenless laptop market.

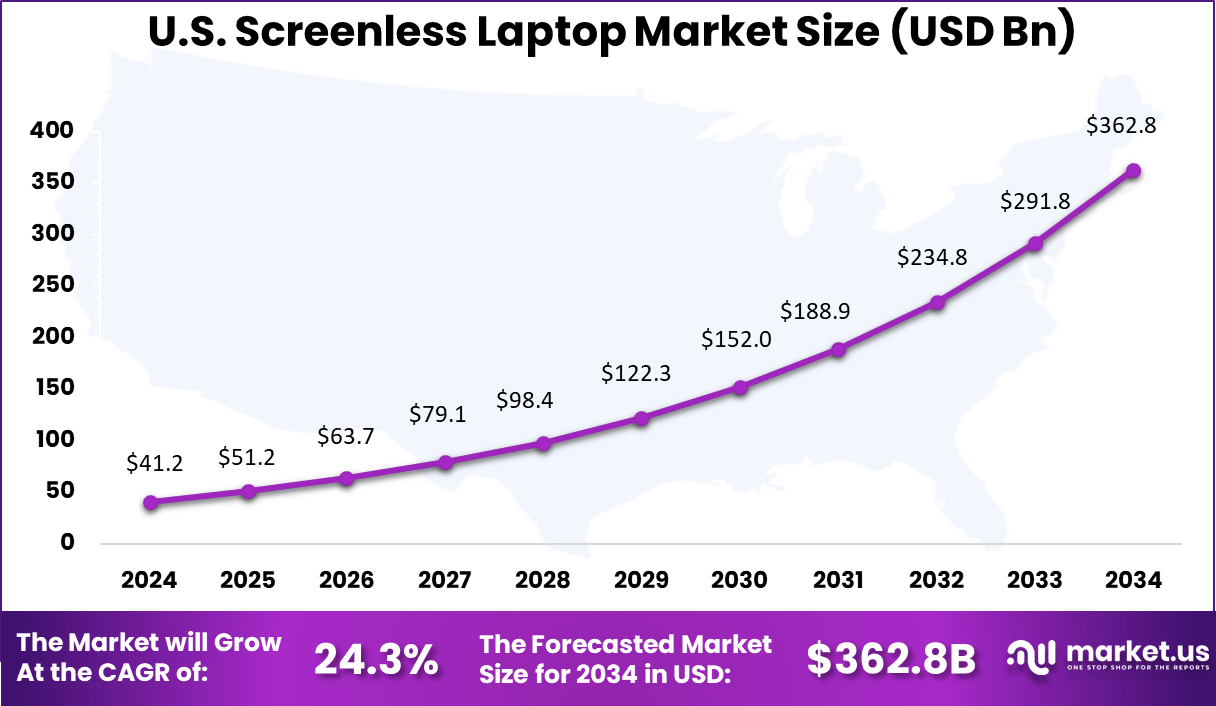

The United States reached USD 41.23 Billion with a CAGR of 24.37%, reflecting rapid expansion. Growth is driven by innovation and evolving consumer preferences. Screenless laptops appeal to users seeking flexibility and portability. Adoption is supported by rising digital lifestyles. The market shows strong growth momentum.

Key Market Segments

By Type

- Standard Screenless Laptops

- Hybrid/Convertible Screenless Devices

- Wearable/Integrated Screenless Interfaces

By Technology / Interface

- Projection-Based Interfaces

- Holographic Display Systems

- Retinal / Direct-Eye Output

- Voice & Gesture Interaction Systems

By Application

- Personal & Home Use

- Professional / Enterprise Use

- Gaming & Entertainment

- Development & Programming

- Industrial & Field Operations

- Healthcare

- Government

- Others

By Distribution Channel

- Online Sales

- Offline Retail

By Price

- Mid-Range Screenless Devices

- Entry-Level / Budget Screenless Laptops

- Premium & High-Performance Devices

Top Key Players in the Market

- Sightful

- Lenovo

- XREAL, Inc.

- Qualcomm Technologies, Inc.

- Microsoft Corporation

- ASUSTeK Computer Inc.

- HP Development Company, L.P.

- Wistron Corporation

- Others