Table of Contents

Kiosk Software Market Size

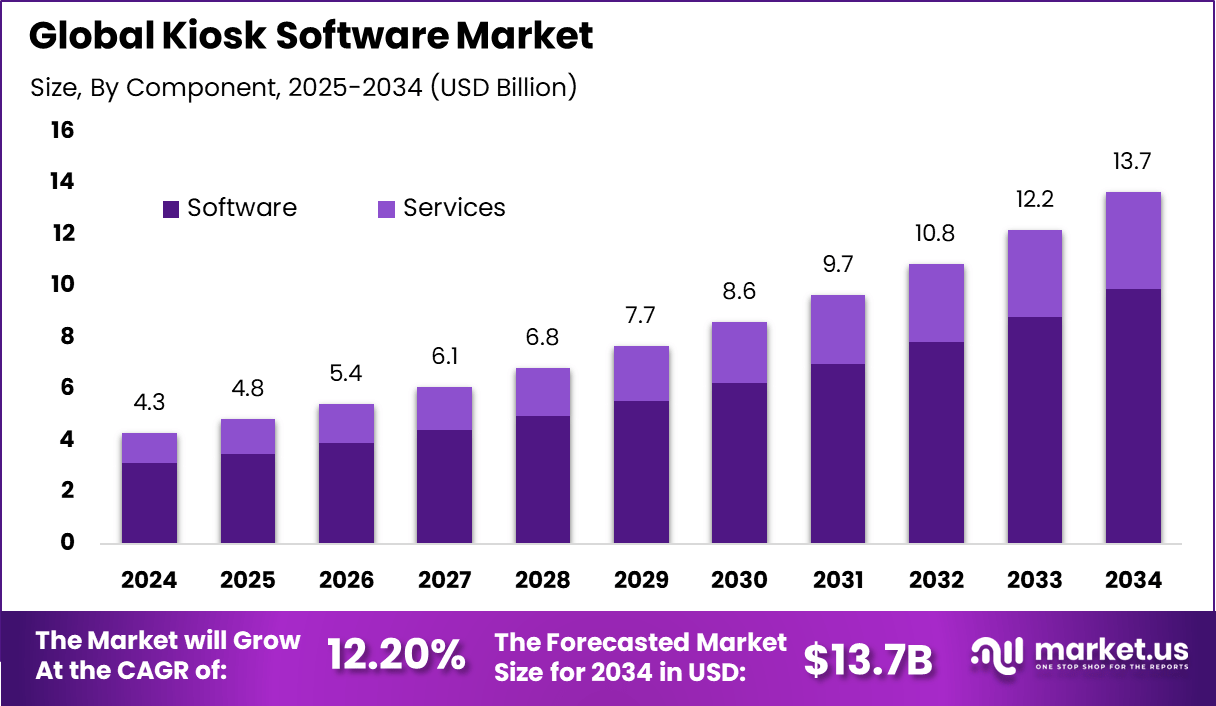

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.3 Bn |

| Forecast Revenue (2034) | USD 13.7 Bn |

| CAGR(2025-2034) | 12.20% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Get PDF Sample For Technological Breakthroughs: https://market.us/report/global-kiosk-software-market/request-sample/

Kiosk Software Market refers to digital platforms that enable self-service kiosks to operate securely, reliably, and independently without continuous human supervision. This software controls the kiosk interface, manages applications, restricts system access, and ensures stable performance across different use cases such as payments, information access, ticketing, check-in, and order placement. Kiosk software acts as the core intelligence layer that transforms standard hardware into purpose-built self-service terminals. The market has expanded as organizations increasingly adopt unattended service models to improve efficiency and customer experience.

The market is closely linked to the broader shift toward automation and digital self-service across public and private sectors. Businesses and institutions deploy kiosk software to standardize user interactions, reduce service queues, and maintain consistent service availability. Centralized management features allow operators to monitor, update, and control thousands of kiosks remotely. This capability is critical for maintaining uptime and ensuring compliance across large kiosk networks.

Top Driving Factors include the rising demand for contactless and self-service interactions across retail, healthcare, transportation, and government services. Following changes in consumer behavior, self-service solutions are preferred for reducing wait times and minimizing direct human interaction. Kiosk software enables these deployments by locking devices into specific workflows and preventing misuse. This demand continues to grow as service expectations emphasize speed and convenience.

Another key driver is the need for operational cost optimization. Organizations use kiosks to offload repetitive tasks that were traditionally handled by staff. Over time, this reduces labor dependency and improves service scalability without proportional increases in workforce size. Kiosk software ensures these systems operate reliably while maintaining security and user control.

Demand Analysis shows strong adoption in environments with high customer footfall and repetitive service needs. These include locations where transactions or information requests follow standardized steps. Kiosk software supports consistent execution of these steps regardless of location or time of day. Demand is particularly strong where service continuity and uptime are critical.

Small and mid-sized organizations are also contributing to demand as deployment costs decline and software becomes easier to configure. Cloud-based management and remote monitoring reduce the need for on-site technical teams. As a result, kiosk deployments are no longer limited to large enterprises. The addressable market continues to widen across sectors and regions.

Investment and Business Benefits

Investment Opportunities are emerging around advanced analytics, remote diagnostics, and adaptive user interfaces. Software platforms that provide insights into user behavior and kiosk performance enable data-driven optimization. There is also growing interest in solutions that support multi-language interfaces and accessibility compliance. These enhancements increase kiosk relevance across diverse user groups.

Opportunities also exist in modular software architectures that allow rapid customization for different industries. As organizations seek flexible deployments, software that adapts without extensive redevelopment becomes more valuable. Long-term investment potential is supported by recurring service and subscription models.

Business Benefits include reduced operational costs, faster service delivery, and improved customer satisfaction. Automated kiosks handle high volumes without fatigue, enabling consistent performance during peak hours. This reliability improves overall service throughput. Organizations also gain better utilization of human resources by reallocating staff to higher-value roles.

Data generated by kiosk software supports performance monitoring and service improvement. Usage trends help operators optimize placement, workflows, and service design. Over time, these insights contribute to better decision-making and stronger return on investment. The result is a more efficient and responsive service environment.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Growing demand for contactless services | Increased need for self-service kiosks during the pandemic | ~6.4% | Global | Short Term |

| Retail automation adoption | Enhanced customer experience and operational efficiency | ~5.2% | North America, Europe | Short Term |

| Expansion in the hospitality industry | Kiosks for check-in and room service | ~4.6% | Global | Mid Term |

| Technological advancements | Enhanced functionality through AI and machine learning | ~3.8% | Global | Mid Term |

| Increased use of digital signage | Kiosks for advertising and promotions | ~2.9% | North America, Europe | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| High hardware and installation costs | Expensive initial setup for kiosks | ~5.3% | Emerging Markets | Short to Mid Term |

| Data privacy and security concerns | Handling customer data via kiosks | ~4.2% | Europe, North America | Short Term |

| Technological integration complexity | Difficulty integrating kiosks into legacy systems | ~3.8% | Global | Mid Term |

| Market competition | Price pressure from alternative technologies | ~3.0% | Global | Mid to Long Term |

| Consumer resistance | Lack of familiarity and trust in self-service technology | ~2.5% | Global | Long Term |

Restraint Impact Table

| Restraint Factor | Restraint Description | Impact on Market Expansion (%) | Most Affected Regions | Duration of Impact |

|---|---|---|---|---|

| High setup cost | Capital investment for kiosks and supporting infrastructure | ~6.0% | Emerging Markets | Short to Mid Term |

| Limited technical expertise | Shortage of qualified personnel for kiosk management | ~5.2% | Global | Mid Term |

| Consumer preference for human interaction | Resistance to automated services in certain industries | ~4.1% | Global | Mid Term |

| Maintenance costs | Ongoing service and software updates for kiosks | ~3.4% | Global | Long Term |

| Data security concerns | Protection of personal and payment data | ~2.6% | Europe, North America | Long Term |

Driver Analysis

The kiosk software market is being driven by the increasing deployment of self‑service kiosks across retail, hospitality, healthcare, transportation, government, and banking sectors to enhance service efficiency and user experience. Self‑service kiosks enable organisations to reduce wait times, improve process accuracy, and support multi‑channel interaction without heavy reliance on staffed counters.

Kiosk software provides interactive interfaces, secure transaction handling, content management, and backend integration with enterprise systems, making it central to efficient service delivery. Rising consumer preference for contactless and on‑demand services, accelerated by digital transformation initiatives, further reinforces investment in software that can power intuitive, reliable kiosk interactions.

Restraint Analysis

A key restraint in the kiosk software market relates to integration complexity with existing enterprise systems and data infrastructure. Effective kiosk operations often depend on seamless connectivity with point‑of‑sale systems, customer relationship management tools, inventory databases, or appointment scheduling engines.

Organisations with legacy IT environments may face significant planning, customisation, and testing requirements to ensure secure, reliable communication between kiosks and back‑end systems. These integration challenges can increase project timelines and total cost of ownership, particularly for smaller businesses without dedicated technical capabilities.

Opportunity Analysis

Emerging opportunities in the kiosk software market are linked to expanding use cases that go beyond basic information display or transaction processing to include personalised service delivery, analytics‑driven engagement, and omnichannel continuity. Software that incorporates artificial intelligence, behavioural analytics, and adaptive user interfaces can customise content and recommendations based on user behaviour, demographics, or historical interactions.

There is also potential for software that supports dynamic pricing, loyalty programmes, and digital wallet payments, which enhance convenience and drive revenue opportunities. Vertical‑specific solutions for sectors such as healthcare check‑in, quick‑service restaurant ordering, and smart wayfinding in large venues further broaden the addressable market.

Challenge Analysis

A central challenge facing this market involves ensuring security, compliance, and data privacy across distributed kiosk deployments. Kiosk software must manage sensitive customer information, payment credentials, and transactional data while protecting against unauthorised access, tampering, and cyber threats.

Implementing robust authentication, encryption, and device management policies adds technical and governance demands. Additionally, ensuring consistent software performance across diverse hardware configurations and environmental conditions requires rigorous testing, maintenance frameworks, and real‑time monitoring to avoid disruptions and maintain user trust.

Emerging Trends

Emerging trends in the kiosk software landscape include increased adoption of cloud‑based kiosk platforms that support remote management, real‑time updates, and centralised content distribution across varied locations. Another trend involves incorporation of multimodal interaction capabilities such as touchless gestures, voice recognition, and facial analytics to enhance accessibility and reduce physical contact.

Integration with mobile devices and digital wallets continues to grow, enabling seamless handovers between personal devices and kiosk interfaces. Analytics dashboards that track engagement, conversion, and operational metrics are also becoming standard to help organisations optimise kiosk performance and user experience.

Growth Factors

Growth in the kiosk software market is supported by expanding demand for self‑service models that improve operational efficiency, reduce staffing pressure, and enhance customer satisfaction. Advances in hardware capabilities, network connectivity, and user interface design make kiosk solutions more appealing and cost‑effective for organisations of all sizes. As service expectations evolve toward faster, personalised, and contactless interactions, investment in robust, secure kiosk software remains central to enabling scalable, adaptable self‑service ecosystems that align with broader digital transformation objectives.

Key Market Segments

By Component

- Software

- Services

By Deployment

- On-Premises

- Cloud-based

By Application

- Retail & QSR (Quick Service Restaurant)

- Healthcare

- BFSI

- Hospitality

- Transportation

- Government

- Others

By End-User

- Small and Medium Enterprises

- Large Enterprises

Top Key Players in the Market

- Provisio

- KioWare

- ProMobi

- Antamedia

- Meridian

- Toast

- Advanced Kiosks

- Livewire

- Cammax

- Coinage

- Xpedient

- Acante

- Global Software Applications

- MAPTMedia

NetKiosk - KioskSimple Kiosk Software

- Porteus Kiosk

- Others