Table of Contents

5G Enterprise Market Size

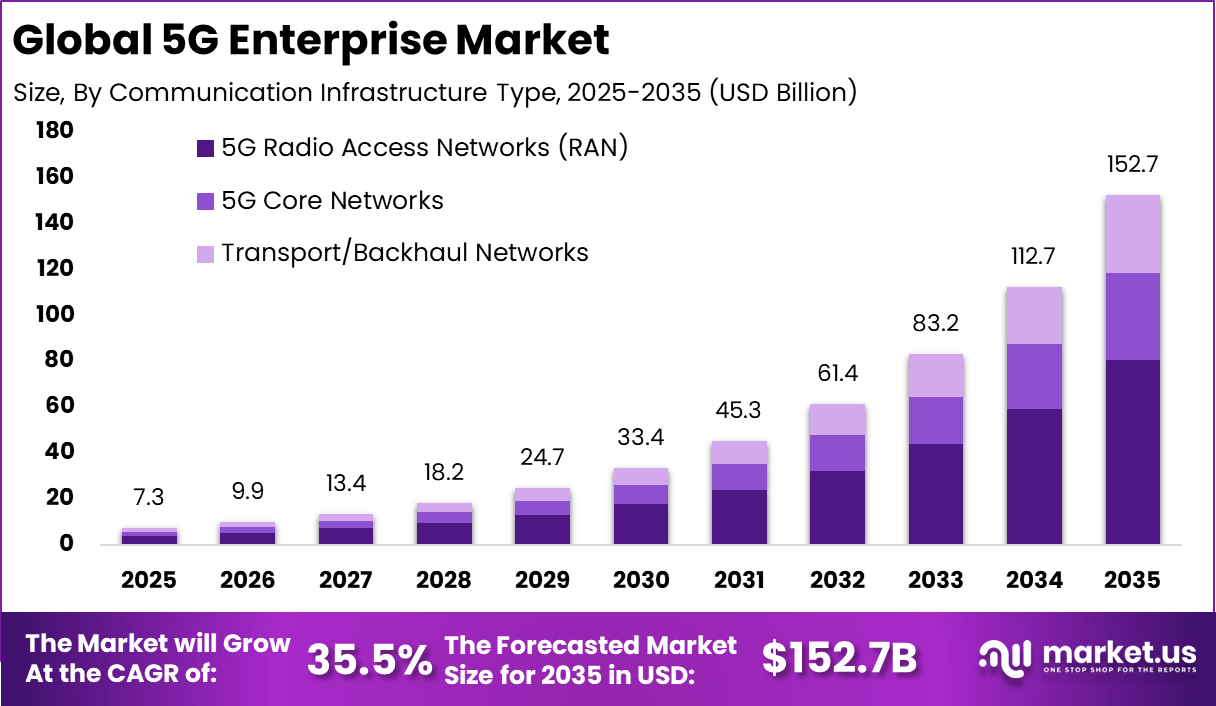

The Global 5G Enterprise Market offers a transformative investment opportunity, having generated USD 7.3 billion in 2025 and expected to scale to nearly USD 152.7 billion by 2035, expanding at a CAGR of 35.5%. North America’s dominant position, with over 38.7% market share and USD 2.8 billion in revenue in 2025, reinforces the region’s role as a key growth engine for long-term capital deployment.

The 5G Enterprise Market refers to the adoption of fifth generation mobile network technology by enterprises to support advanced connectivity, automation, and digital transformation initiatives. Unlike consumer focused 5G use cases, enterprise deployment emphasizes private networks, ultra low latency, high reliability, and secure connectivity for business operations. These capabilities enable organizations to connect machines, systems, and applications in real time across industrial, commercial, and service environments. The market has gained importance as enterprises seek network performance that exceeds the limits of traditional wired and wireless technologies.

One of the primary driving factors of the 5G Enterprise Market is the growing need for reliable and low latency connectivity. Industries such as manufacturing, energy, transportation, and healthcare require real time communication between devices and systems. 5G networks support these requirements by enabling fast data transmission and consistent performance even in dense or complex environments. Another important factor is the limitation of existing network technologies in supporting modern enterprise use cases.

Top Market Takeaways

- 5G Radio Access Networks led communication infrastructure with a 52.7% share, as enterprises focused on high capacity and low latency connectivity for mission critical operations.

- Public 5G networks dominated deployment models at 54.6%, supported by faster rollout timelines, lower initial investment, and broad geographic coverage.

- Licensed spectrum accounted for 48.9%, reflecting enterprise preference for secure, reliable, and interference free network performance.

- IT and telecommunications emerged as the leading enterprise vertical with 37.6%, driven by early adoption of advanced network services and edge based applications.

- North America captured 38.7% of the global market, supported by strong investment in 5G infrastructure and enterprise digital transformation programs.

- The US market reached USD 2.40 billion and is expanding at a 30.7% CAGR, driven by rising demand for private connectivity, automation, and real time data applications.

Quick Market Facts

Adoption Rates and Scale

- Global 5G connections are expected to reach 3.2 billion by the end of 2026.

- Asia Pacific accounts for over 60%, equal to around 2 billion connections.

- Enterprise 5G adoption continues to expand across both industrial and service sectors.

Sector Leadership

- Manufacturing leads adoption, with 68% of firms deploying private 5G networks.

- Manufacturing users report up to 40% reduction in production downtime through improved connectivity and automation.

- Healthcare is the fastest growing vertical, expanding at a 36.4% CAGR.

- Healthcare investment in connected devices and remote surgery platforms increased by 65%.

Usage and Performance Statistics

- 76% of enterprises testing private 5G report operational efficiency gains of 45%.

- Network latency declines by up to 60% in private 5G environments compared with traditional networks.

- Global cellular data traffic is expected to reach 2,900 exabytes by 2026.

- This represents nearly 300% growth compared with 2021 levels.

IoT and Infrastructure Trends

- 5G IoT connections are forecast to reach 116 million globally by 2026.

- Cellular IoT devices are expected to outnumber smartphones for the first time.

- Hardware holds 73.3% of current revenue, driven by base station and radio investments.

- Software and services are expanding faster, growing at a 49% CAGR.

Investment and Business Benefits

Investment opportunities in the 5G Enterprise Market are concentrated in solutions that integrate connectivity with industry specific applications. Platforms that combine 5G with automation, analytics, and management software are well positioned as enterprises seek end to end solutions rather than standalone connectivity. There is also opportunity in managed services and integration offerings that simplify enterprise adoption. Many organizations lack in house expertise to design and operate 5G networks.

Providers that deliver deployment, optimization, and lifecycle management services are likely to benefit from growing demand. 5G enterprise solutions deliver clear benefits by enabling faster and more reliable operations. High bandwidth and low latency connectivity support real time control, monitoring, and decision making. This leads to improved productivity and reduced operational delays.

Another significant benefit is support for innovation and new business models. With advanced connectivity in place, enterprises can deploy digital twins, autonomous systems, and immersive collaboration tools. These capabilities help organizations stay competitive and adapt to evolving market demands.

Driver Analysis

The 5G enterprise market is being driven by the increasing need for high-speed, low-latency connectivity that supports advanced digital applications in business environments. Enterprises are adopting 5G to improve operational efficiency, enable real-time data communication, and support technologies such as industrial automation, artificial intelligence, augmented reality, and Internet of Things devices.

These capabilities are important for sectors such as manufacturing, logistics, healthcare, and smart buildings, where reliable, responsive connectivity can improve processes, reduce downtime, and enable new services. The ability of 5G networks to support massive device connections and high throughput continues to encourage organisational investment in 5G-enabled solutions.

Restraint Analysis

A key restraint in the 5G enterprise market is the cost and complexity of deploying 5G infrastructure within business operations. Implementing 5G often requires upgrades to network architecture, acquisition of spectrum licences in certain regions, and investment in compatible devices and edge computing capacity.

Smaller enterprises or those with constrained IT budgets may find these costs difficult to justify in the near term, particularly if current 4G or wired networks meet their basic connectivity needs. Integration with existing enterprise systems and cybersecurity frameworks also requires careful planning and technical expertise to ensure reliability and safety.

Opportunity Analysis

Opportunities in the 5G enterprise market are emerging as businesses explore private 5G networks and dedicated connectivity tailored to specific operational needs. Private 5G can deliver enhanced performance, coverage, and control for industrial campuses, logistics hubs, and remote sites where consistent connectivity is critical.

There is also potential to combine 5G with edge computing and analytics to support real-time decision making, machine monitoring, and autonomous systems. Service providers that can offer customised 5G solutions, managed services, and seamless integration with cloud platforms are well positioned to capture demand from enterprises seeking digital transformation.

Challenge Analysis

A central challenge in the 5G enterprise market involves ensuring network security and interoperability across diverse systems and devices. As enterprises connect more endpoints, sensors, and applications over 5G, the complexity of managing secure access, data protection, and threat mitigation increases.

Organisations must implement robust security policies and controls to protect data in transit and at rest while maintaining performance. Ensuring interoperability between legacy systems, multi-vendor equipment, and evolving 5G standards also demands ongoing technical coordination and governance to avoid fragmentation and performance issues.

Emerging Trends

Emerging trends in the 5G enterprise landscape include the adoption of network slicing, which allows enterprises to allocate dedicated virtual network segments with specific performance characteristics. Another trend is the convergence of 5G with edge computing to reduce latency and support real-time analytics for critical applications in manufacturing, autonomous vehicles, and remote monitoring.

There is also growing use of 5G in private network deployments that serve discrete enterprise environments with enhanced control and tailored service levels. Integration with artificial intelligence and automation tools to optimise network performance and resource allocation is gaining interest.

Growth Factors

Growth in the 5G enterprise market is supported by rising demand for digital transformation, real-time connectivity, and intelligent automation across sectors. Organisations prioritise tools and technologies that can improve operational insight, reduce downtime, and scale with evolving business needs.

Advances in 5G standards, device support, and cloud-native infrastructure enhance the feasibility of enterprise implementations. As companies seek competitive advantage through faster connectivity, responsive systems, and enhanced data services, investment in 5G enterprise solutions continues to expand.

Key Market Segments

By Communication Infrastructure Type

- 5G Radio Access Networks (RAN)

- 5G Core Networks

- Transport/Backhaul Networks

By Deployment Model

- Public 5G Networks

- Private 5G Networks

- Hybrid/Shared Networks

By Spectrum Licensing Type

- Licensed Spectrum

- Unlicensed/Shared (e.g., CBRS, LAA)

- Mixed Licensing

By Enterprise Vertical

- IT and Telecommunications

- BFSI

- Manufacturing – Discrete

- Manufacturing – Process

- Retail and E-commerce

- Healthcare

- Energy and Utilities

- Transportation and Logistics

- Other Verticals

Top Key Players in the Market

- Cisco Systems

- Ericsson

- Huawei Technologies

- Nokia

- NEC Corporation

- Samsung Electronics

- ZTE Corporation

- Qualcomm

- Intel Corporation

- Hewlett Packard Enterprise (Aruba)

- Dell Technologies

- Juniper Networks

- Mavenir

- Rakuten Symphony

- CommScope

- AT&T

- Verizon Communications

- Deutsche Telekom AG

- Siemens AG

- Fujitsu

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 7.3 Bn |

| Forecast Revenue (2035) | USD 152.7 Bn |

| CAGR(2026-2035) | 35.5% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |