Table of Contents

Investor Summary

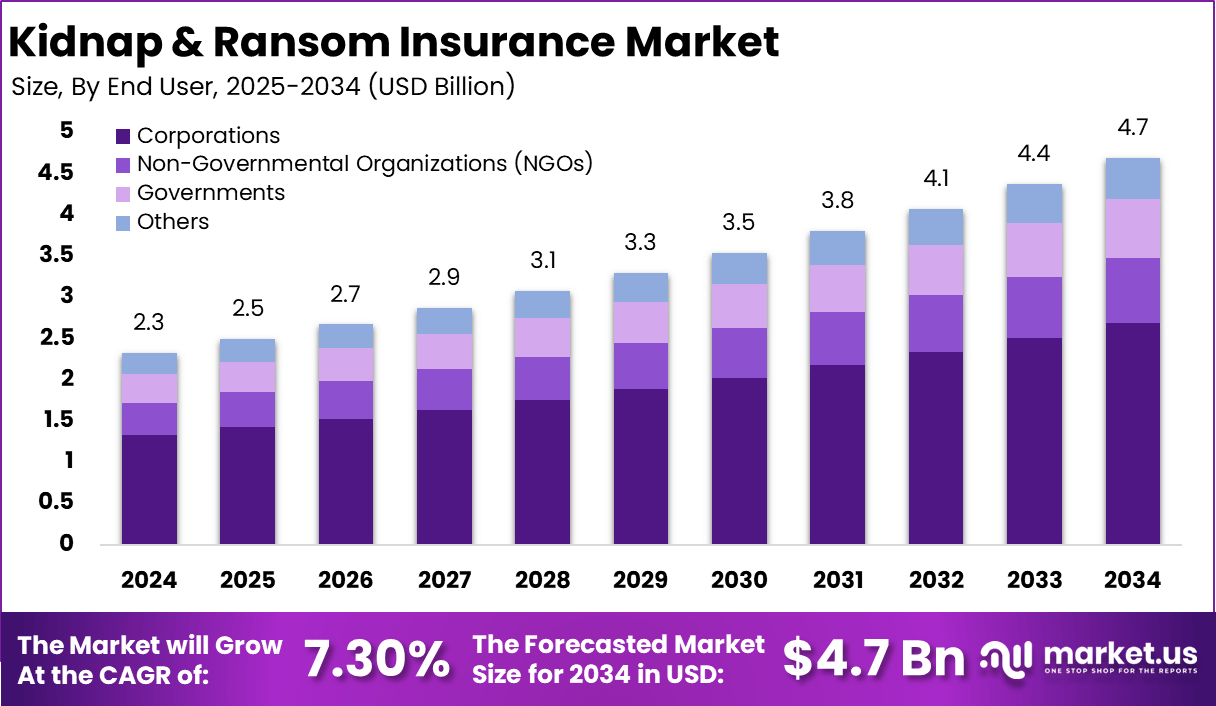

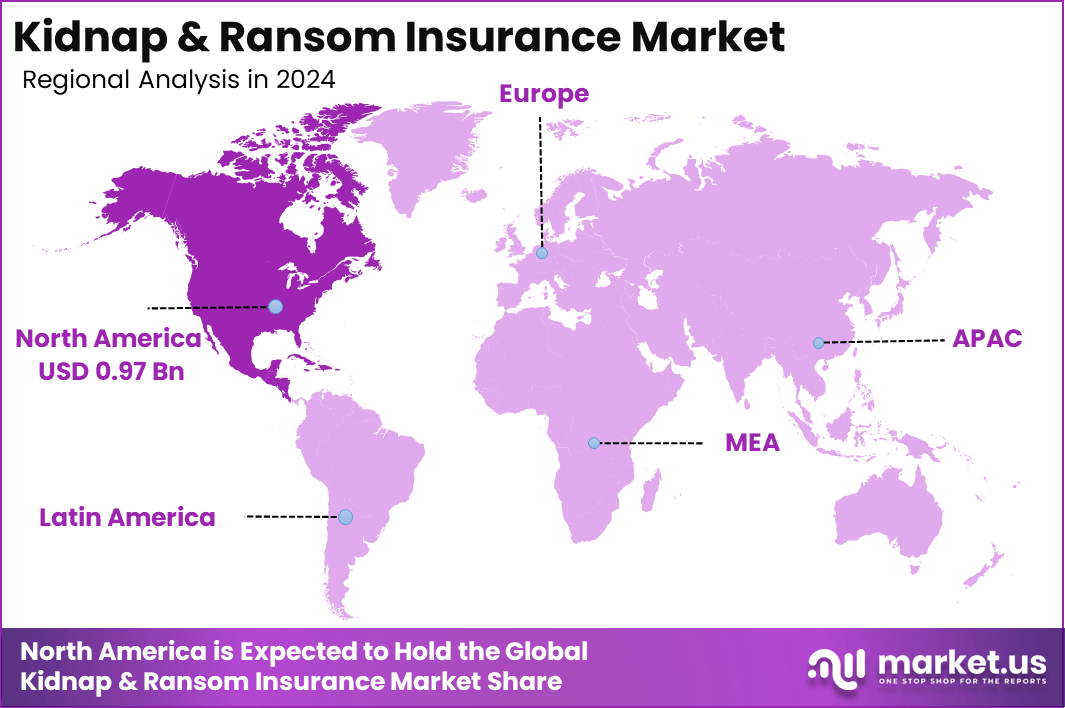

The Global Kidnap & Ransom (K&R) Insurance Market generated USD 2.32 billion in 2024 and is projected to grow to around USD 4.7 billion by 2034, registering a CAGR of 7.3% during the forecast period. Growth is driven by increasing global security risks, political instability, and rising demand from corporations, NGOs, and media organizations operating in high-threat regions. North America held a dominant market position in 2024, capturing 42.2% share and generating USD 0.97 billion in revenue, highlighting strong regional leadership and long-term value creation potential for investors.

Kidnap & Ransom Insurance is a specialized form of coverage designed to protect individuals and organizations from financial losses and liabilities that arise from kidnapping, extortion, wrongful detention, and related criminal threats. This type of insurance typically reimburses ransom payments, crisis response costs, legal fees, and other expenses related to a covered event. It offers access to expert consultants who assist with negotiations and crisis management during high-stress incidents. The role of this insurance has expanded as global mobility and operations in volatile regions have increased.

The market has grown steadily because both individuals and corporations face varied security risks in high-risk zones, including extortion and threat of abduction. Corporations with employees traveling or stationed abroad rely increasingly on these policies to manage risk and protect personnel. High-net-worth individuals who travel frequently are also seeking protection against unexpected incidents. As global operations expand, Kidnap & Ransom Insurance is becoming an established risk management tool rather than a niche option.

Key Takeaways

- The Kidnap and Ransom insurance market is expected to grow at a 7.3% CAGR from 2024 to 2034, driven by higher exposure to security risks, political instability, and corporate expansion into higher risk regions.

- North America held the largest share at 42.2% in 2024, valued at USD 0.97 billion, supported by strong demand from multinational firms and risk aware industries.

- The US market was valued at USD 0.88 billion in 2024 and is projected to reach USD 1.59 billion by 2034, growing at a 6.1% CAGR, reflecting increased focus on employee safety and crisis readiness.

- By coverage type, kidnap and ransom coverage led with 36.8%, driven by rising cases of extortion, cyber linked kidnapping, and politically motivated abductions involving executives and global travelers.

- By end user, corporations accounted for 57.2%, as companies strengthen employee protection programs and secure coverage for overseas assignments.

- By distribution channel, insurance brokers captured 49.5%, highlighting their role in structuring tailored policies, advising on risk, and coordinating crisis response services.

Top Driving Factors

One of the primary drivers for the Kidnap & Ransom Insurance market is the rising incidence of kidnapping, extortion, and related criminal activities in various regions worldwide. These threats are influenced by geopolitical instability, economic disparity, and transnational crime that targets individuals and corporate personnel. As business and travel patterns become more global, exposure to such risks has increased, making protective coverage more relevant. Organizations and individuals recognize that unmanaged risk in high-threat environments can lead to significant financial losses and reputational damage.

Another important factor is heightened awareness of personal and corporate security needs. Corporations, non-governmental organizations, and financial institutions increasingly incorporate Kidnap & Ransom Insurance into their risk mitigation strategies. This inclusion reflects the need to protect employees in volatile areas, reassure families of traveling staff, and uphold organizational responsibility. In turn, this awareness has steadily supported market uptake and policy innovation.

Demand Analysis

Demand for Kidnap & Ransom Insurance is influenced by global operations that span multiple markets where security risks vary. Multinational companies with personnel in regions prone to criminal activity or political unrest are especially active buyers of these policies. The demand extends beyond large corporations to smaller firms with international travel obligations, as well as high-wealth individuals seeking mitigation against personal threat exposure. This broadening demand reflects the recognition that risk is not limited to any single sector or geography.

Another reason for rising demand is the increasing complexity of modern threats. Kidnapping is no longer always confined to traditional abduction for ransom. Policies are evolving to include coverage for cyber extortion, wrongful detention, and other forms of coercive criminal behavior. This expansion of what is covered has made policies more attractive to diverse user groups. Individuals and organizations value the comprehensive scope of support that extends beyond financial reimbursement to include crisis response and expert negotiation guidance.

Investment Opportunities

Investment opportunities in the Kidnap & Ransom Insurance market emerge from the need for tailored coverage products that address evolving risk landscapes. Insurers can develop specialized policies for distinct buyer segments such as corporate travelers, expatriates, and high-net-worth individuals. Customized solutions that combine traditional coverage with advisory services and crisis response support are gaining traction. These offerings allow insurers to differentiate and better meet buyer expectations.

Additional opportunities exist in emerging geographic regions where awareness and uptake remain low but risks are increasing. Regions with growing foreign direct investment and expanding international travel present openings for insurers to educate potential buyers and introduce relevant products. Partnerships with local brokers and security firms can extend reach and provide localized expertise. As these markets mature, they are likely to contribute meaningfully to overall industry growth.

Business Benefits

Kidnap & Ransom Insurance provides financial protection against large, unpredictable costs associated with ransom demands and related crises. Without such coverage, organizations and families might face substantial outlays for payments, legal support, and crisis management services. Insurance ensures that these expenses are reimbursed or supported, which helps maintain financial stability. This benefit is especially significant for corporations operating across diverse risk environments.

Beyond financial reimbursement, another business benefit is access to expert crisis consultants and response teams. These specialists guide negotiation, coordinate with local authorities, and help manage communication during critical incidents. Their involvement often reduces the time it takes to resolve a situation safely and minimizes adverse outcomes. This support capability can be a deciding factor for buyers choosing between policy options.

Regional Analysis

North America represents a major region for Kidnap & Ransom Insurance demand due to strong corporate risk management practices and heightened awareness of global threats. Organizations in this region often operate internationally, exposing employees to varied security environments. Insurance solutions offering financial protection and crisis support are therefore widely adopted by multinational enterprises. This regional prevalence reflects established risk governance frameworks in corporate policies.

Europe also demonstrates considerable uptake as companies manage diverse geopolitical and security risks across different countries. The presence of formal risk assessment procedures and regulatory reporting requirements incentivizes firms to secure comprehensive protective coverage. Organizations that engage in cross-border operations find value in policies that account for complex exposures. Meanwhile, regions such as Asia Pacific and Latin America are emerging markets for Kidnap & Ransom Insurance, with rising demand as global business activity increases and awareness expands.

Use Case Analysis

One prevalent use case for Kidnap & Ransom Insurance is corporate international travel and expatriate assignments. Companies with employees stationed in or traveling to high-risk regions procure policies to protect staff and support families in the event of an incident. These policies provide reassurance and risk mitigation in locations where instability or criminal activity may be higher. The inclusion of crisis response services further enhances operational preparedness

Another key use case is for non-governmental organizations and humanitarian workers in unstable environments. NGOs often operate in regions with social unrest or security threats and require insurance that covers kidnapping, extortion, and wrongful detention. This coverage supports both project continuity and personnel safety. The ability to engage professional negotiators and advisors is a practical necessity in such complex scenarios.

Regulatory Environment Overview

Regulatory frameworks for insurance in general influence how Kidnap & Ransom Insurance products are structured and sold. Insurers must comply with insurance laws, consumer protection standards, and licensing requirements in each region where they operate. These rules help ensure that policies are financially sound and that buyers receive clear policy information. Adherence to regulatory standards supports trust and reliability in the market.

In addition, crisis response activities that accompany many Kidnap & Ransom Insurance policies may involve coordination with law enforcement and diplomatic entities, depending on the country of occurrence. Firms and buyers must consider these interactions as part of their risk planning. Regulatory compliance helps clarify responsibilities and reduces potential legal complications in crisis scenarios.

Buyer Decision Criteria

Buyers evaluating Kidnap & Ransom Insurance prioritize coverage scope and clarity of policy terms. Clear definitions of what is covered, including ransom, extortion, and wrongful detention, influence purchasing decisions. Buyers also consider the availability of crisis support services and expert consultants included in the policy. These factors ensure that financial protection is paired with practical assistance during an incident.

Another key criterion is alignment with operational risk profiles and travel patterns. Organizations assess how well a policy matches their specific exposures, such as frequent travel to high-risk regions or assignments in volatile zones. Price competitiveness and ease of claims processes also influence decisions. Buyers often seek policies that balance cost with comprehensive protection and responsive service.

Key Market Segments

By Coverage Type

- Kidnap & Ransom Coverage

- Extortion Coverage

- Disappearance Coverage

- Detention Coverage

- Hijackings Coverage

- Hostage Crises

- Others

By End User

- Corporations

- Non-Governmental Organizations (NGOs)

- Governments

- Others

By Distribution Channel

- Insurance Brokers

- Direct Sales

- Online Platforms

- Banks

Top Key Players in the Market

- The Travelers Indemnity Company

- American International Group, Inc.

- Alliant Insurance Services Inc.

- Starr Insurance Companies

- W. R. Berkley Corporation

- Arch Insurance

- Great America Insurance Group

- Norwegian Hull Club

- Tokio Marine HCC

- Hiscox USA

- AXA S.A.

- Chubb

- Beazley Plc

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.32 Billion |

| Forecast Revenue (2034) | USD 4.7 Billion |

| CAGR(2025-2034) | 7.30% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |