Table of Contents

Strategic Agri-Insurance Investment Perspective

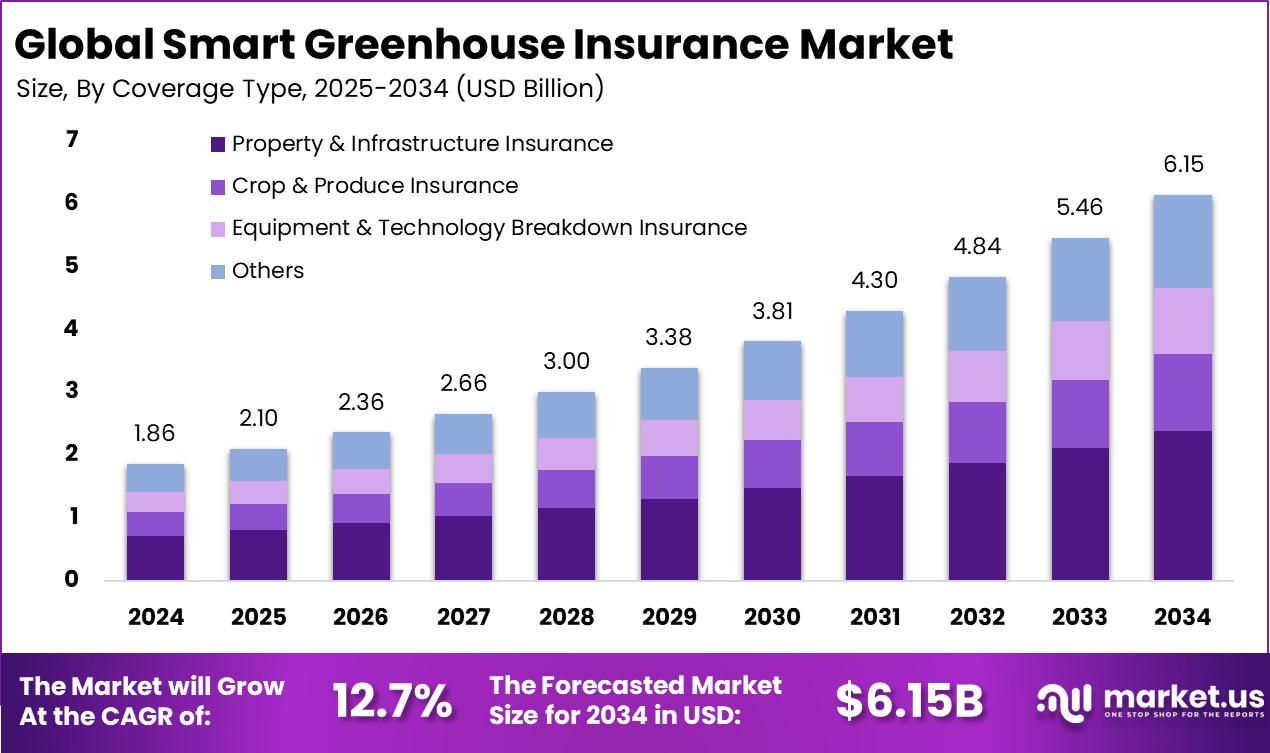

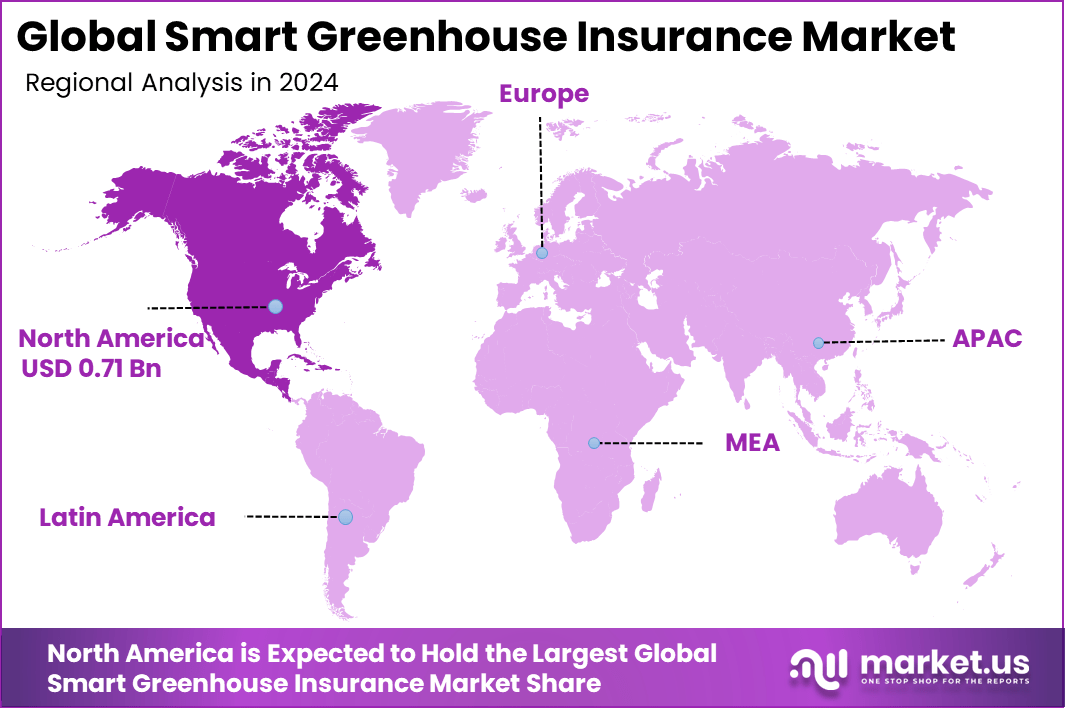

Valued at USD 1.86 billion in 2024, the Global Smart Greenhouse Insurance Market is on a steady growth trajectory, forecast to reach around USD 6.15 billion by 2034 at a CAGR of 12.7%. North America led the market with over 38.5% share and USD 0.71 billion in revenue, driven by climate volatility, precision agriculture adoption, and growing reliance on data-driven insurance products to protect high-value controlled-environment farming assets.

Smart greenhouse insurance refers to specialised insurance products designed to protect greenhouse operations that use advanced technologies for environmental control, automated systems, and data-driven farming practices. These insurance solutions cover risks unique to greenhouse environments, including damage to physical structures, crop losses due to equipment failure or extreme weather, and interruptions in business operations. Coverage often includes protection for high-value assets and may extend to liabilities arising from operational failures or third-party claims, reflecting the complexity and value of modern greenhouse setups.

One prominent factor driving demand for smart greenhouse insurance is the increasing frequency and severity of weather-related events and climate instability. Even though greenhouses provide controlled environments, extreme weather such as high winds or flooding can still cause structural damage or operational disruptions, leading operators to seek comprehensive insurance protection. Growth of greenhouse technology adoption across regions has amplified the financial value at risk, prompting insurance uptake to safeguard high-cost systems and the crops they support.

Demand for smart greenhouse insurance has grown as greenhouse farming itself has expanded, driven by the need for sustainable, controlled environment agriculture that can support year-round production. Commercial growers and research institutions investing in hydroponic, aeroponic, or climate-controlled systems are seeking risk management tools that align with the complexity of these operations. The value of insured assets, which now include digital control systems and sensors in addition to physical infrastructure, has elevated the importance of specialised insurance coverage.

Key Takeaways

- In 2024, property and infrastructure insurance led the smart greenhouse insurance market with a 38.7% share, driven by the need to protect high value structures, climate control systems, and automation equipment.

- Commercial hydroponic and aeroponic farms dominated with 52.4%, reflecting higher insurance demand from technology intensive and capital heavy farming operations.

- Annual and multi year policies accounted for 83.5%, showing a strong preference for long term coverage that aligns with crop cycles and investment planning.

- Large commercial growers captured 58.9%, as larger scale operations face higher asset exposure and operational risk, increasing the need for comprehensive insurance solutions.

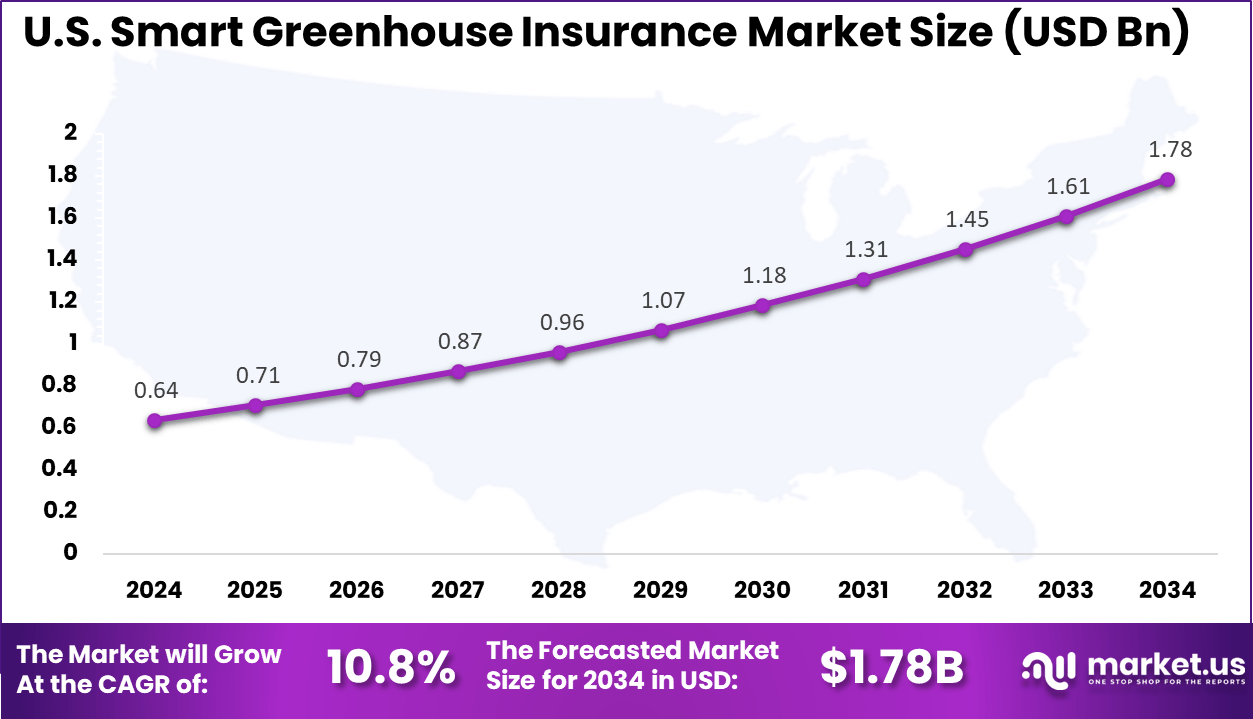

- The US smart greenhouse insurance market reached USD 0.64 billion in 2024 and is growing at a 10.8% CAGR, supported by expansion in controlled environment agriculture.

- North America held more than 38.5% of the global market, backed by advanced greenhouse adoption, strong insurer presence, and growing focus on climate resilient farming systems.

Drivers Impact Assessment

| Key Growth Driver | Estimated CAGR Influence (%) | Primary Affected Regions | Expected Influence Period |

|---|---|---|---|

| Rising Climate Volatility and Weather Risk | +3.1% | North America, Europe | Near to Mid Term |

| Growth of Smart and Automated Greenhouse Assets | +4.2% | Asia Pacific, Europe | Mid Term |

| Integration of IoT, Sensors, and Real Time Monitoring | +2.4% | North America, East Asia | Mid to Long Term |

| Public Incentives for Protected and Sustainable Farming | +1.8% | Europe, Asia Pacific | Mid Term |

| Advanced Data Analytics in Insurance Underwriting | +1.2% | Global developed markets | Long Term |

Restraints Impact Assessment

| Key Market Constraint | Estimated CAGR Drag (%) | Most Impacted Regions | Constraint Time Horizon |

|---|---|---|---|

| High Cost of Comprehensive Insurance Policies | -2.6% | Asia Pacific, Latin America | Near Term |

| Low Insurance Penetration Among Small Growers | -1.9% | Emerging economies | Near to Mid Term |

| Fragmented Risk Evaluation and Loss Models | -1.4% | Global | Mid Term |

| Regulatory and Compliance Complexity | -1.1% | Europe, Selected Asian markets | Mid Term |

| Insufficient Historical Climate and Yield Data | -0.8% | Developing regions | Long Term |

Technology Risk Factors Impact Analysis

| Technology Risk Factor | CAGR Sensitivity Impact (%) | Risk Concentration Regions | Risk Evolution Timeline |

|---|---|---|---|

| Sensor and IoT System Failure | -1.3% | North America, Europe | Near Term |

| Cybersecurity and Data Breach Risks | -1.0% | Global smart greenhouse operators | Mid Term |

| Automation Dependency and System Downtime | -0.9% | High tech greenhouse clusters | Mid Term |

| Limited Interoperability of Smart Systems | -0.6% | Emerging smart farming regions | Mid to Long Term |

| High Maintenance Cost of Advanced Technologies | -0.7% | Asia Pacific | Long Term |

Opportunity Analysis

Emerging opportunities in the smart greenhouse insurance market are linked to the integration of real-time data streams and predictive risk modelling to enhance policy design, pricing, and claims handling. Insurers can leverage data from greenhouse sensors, weather feeds, and operational systems to refine risk profiles and offer usage-based or parametric insurance that triggers coverage based on measurable conditions. This approach allows faster, more objective claim settlement and supports proactive risk management by greenhouse operators. Additionally, expanding coverage options for niche applications such as urban agriculture and research greenhouses can broaden the market footprint.

Challenge Analysis

A central challenge confronting the smart greenhouse insurance market involves aligning insurance terms with the evolving technologies used in greenhouse environments. Smart greenhouses often incorporate advanced automation, sensors, and environmental controls that introduce risks such as software failures, cybersecurity vulnerabilities, and complex interdependencies among systems.

Crafting insurance products that appropriately address these emerging exposures without imposing prohibitive premiums requires insurers to develop new risk models, data integration capabilities, and expertise in both agricultural operations and technology risk management. This technical and actuarial complexity can limit product availability and slow coverage adoption.

Emerging Trends

Emerging trends in the smart greenhouse insurance landscape include growth in tailored insurance segments based on greenhouse type and end use. Commercial growers, research institutions, and community agriculture projects exhibit distinct risk profiles and insurance needs, prompting insurers to develop flexible policy options that reflect these variations.

Another trend is the use of digital platforms and brokers to distribute smart greenhouse coverage, improving accessibility and helping operators compare options and customise protection. The use of data analytics and remote sensing to support underwriting, pricing, and risk mitigation planning is also gaining momentum as digital agriculture expands.

Growth Factors

Growth in the smart greenhouse insurance market is supported by expanding investment in smart agriculture technologies and the increasing value of greenhouse assets that require protection. Smart greenhouses support precision agriculture, sustainable production, and year-round crop cultivation, which increases their economic importance and the potential financial impact of interruptions, equipment damage, or crop losses.

Regulatory frameworks and industry standards that emphasise risk management and business continuity further encourage greenhouse operators to adopt comprehensive insurance coverage. The continued integration of AI, automation, and data analytics into greenhouse operations not only raises asset value but also enhances the ability of insurers to model and manage risk, reinforcing market expansion.

Regional Analysis

The United States reached USD 0.64 Billion with a CAGR of 10.8%, reflecting consistent expansion. Growth is driven by investment in controlled-environment agriculture.

In 2024, North America held a dominant market position in the Global Smart Greenhouse Insurance Market, capturing more than a 38.5% share, holding USD 0.71 billion in revenue

Key Market Segments

By Coverage Type

- Property & Infrastructure Insurance

- Crop & Produce Insurance

- Equipment & Technology Breakdown Insurance

- Others

By Greenhouse Type

- Commercial Hydroponic/Aeroponic Farms

- Commercial Traditional Soil-Based Greenhouses

- Research & Educational Facilities

By Policy Duration

- Annual/Multi-Year Policies

- Seasonal/Percrop Cycle Policies

By End-User

- Large Commercial Growers

- SME & Independent Growers

- AgTech Startups & Vertical Farms

Top Key Players in the Market

- Chubb, Ltd.

- AXA SA

- Zurich Insurance Group, Ltd.

- Allianz SE

- American Financial Group, Inc.

- Tokio Marine Holdings, Inc.

- Sompo Holdings, Inc.

- Munich Re

- Swiss Re, Ltd.

- ICAT

- Farmers Insurance Group

- The Hartford Financial Services Group, Inc.

- QBE Insurance Group, Ltd.

- RSA Insurance Group plc

- FM Global

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.8 Bn |

| Forecast Revenue (2034) | USD 6.1 Bn |

| CAGR(2025-2034) | 12.7% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |