Table of Contents

- Marketing Cloud Platform Market Size

- Top Market Takeaways

- Key Insight Summary

- Growth Driver Impact Analysis

- Restraints Impact Analysis

- Emerging Trends Analysis

- Opportunity Analysis

- Challenge Analysis

- Regional Driver Comparison

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Report Scope

Marketing Cloud Platform Market Size

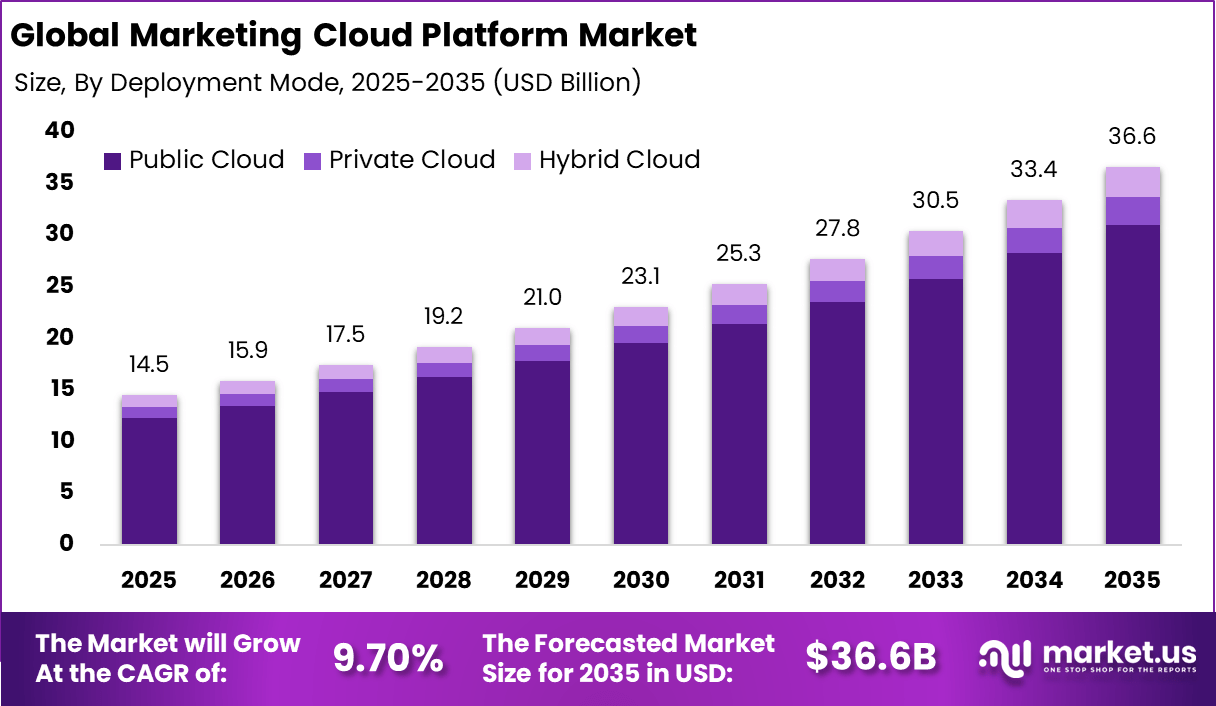

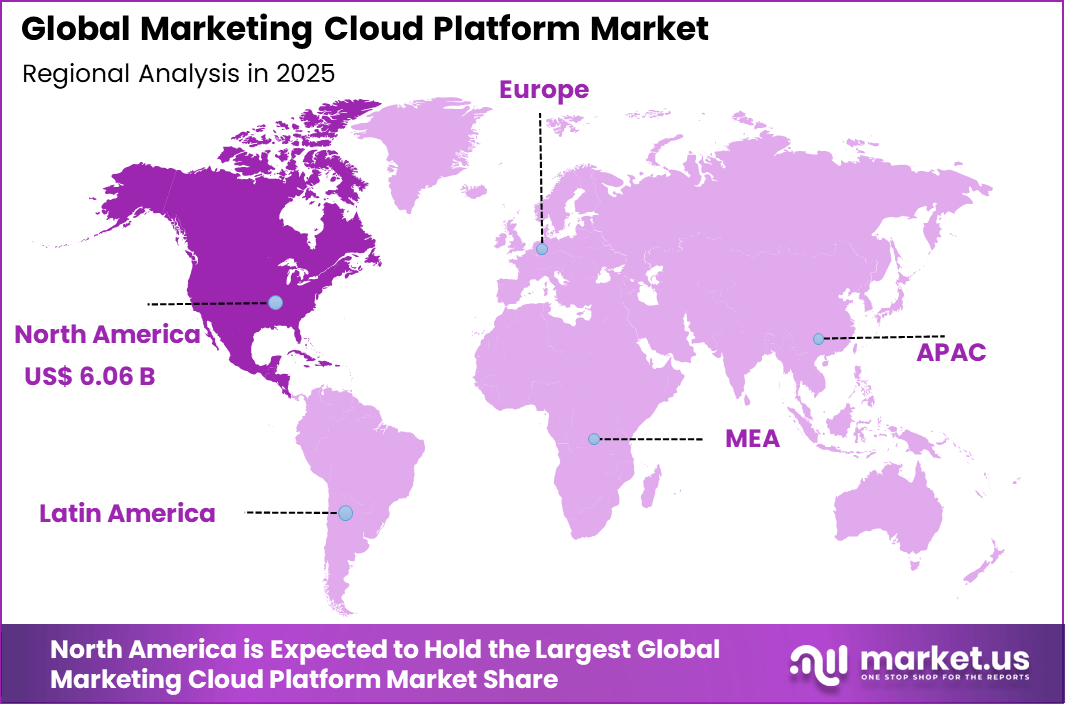

The Global Marketing Cloud Platform Market offers a compelling digital marketing infrastructure investment opportunity, having generated USD 14.5 billion in 2025 and expected to grow from USD 15.9 billion in 2026 to nearly USD 36.6 billion by 2035, at a CAGR of 9.70%. North America’s dominant position, with more than 41.8% market share and USD 6.06 billion in revenue in 2025, reinforces the region’s role as a primary growth engine for long-term capital deployment.

The Marketing Cloud Platform market refers to the collection of cloud-based digital marketing systems that allow businesses to plan, execute, coordinate, and analyze marketing activities across multiple channels from a single environment. These platforms combine data management, customer segmentation, automated campaign delivery, and performance analytics to help brands engage customers with timely and personalized content. The objective of these solutions is to unify marketing operations such as email, social media, web, and mobile engagement through a centralised system that uses data to inform decisions and responses.

Marketing cloud platforms help organisations improve customer experience by connecting interactions at every stage of the customer journey. The significance of this market has grown as businesses increasingly adopt digital and data-driven strategies to reach diverse audiences across channels. Cloud-based marketing systems eliminate the need for fragmented tools by providing integrated functionality that supports campaign orchestration, audience insights, and automation. These platforms are built for scalability, allowing small and large enterprises to manage complex campaigns without requiring extensive on-premises infrastructure.

A key driver of the Marketing Cloud Platform market is the escalating demand for personalized customer experiences that span channels such as email, mobile, social media, and web. As customers interact with brands through multiple touchpoints, organisations need unified systems that deliver consistent messaging and relevant content based on individual behaviour and preferences. This need encourages investment in platforms that can unify customer data and automate tailored interactions at scale.

Demand for marketing cloud platforms is closely linked to the growth of digital marketing and the increasing complexity of audience engagement. As organisations strive to attract and retain customers in crowded online markets, they prioritise systems that support data-driven insights and precise targeting. Platforms capable of handling multi-channel interactions help marketers build deeper relationships with their audiences while tracking the effectiveness of campaigns across channels. The need for real-time monitoring and performance feedback increases demand for integrated cloud-based solutions.

Top Market Takeaways

- By component, solutions accounted for 78.3% of the marketing cloud platform market, supporting integrated tools for campaign execution, analytics, and customer engagement.

- By deployment mode, the public cloud led with 84.7% share, driven by scalability, flexibility, and support for data driven personalization.

- By organization size, large enterprises held 67.4%, using marketing cloud platforms to manage high volumes of customer data and interactions across channels.

- By end user industry, retail and e commerce captured 32.9%, reflecting strong use of marketing platforms for promotions, loyalty programs, and customer retention.

- By application, customer segmentation and targeting represented 41.6%, enabling more precise messaging and improved engagement performance.

- North America accounted for 41.8% of the global market, with the US valued at USD 5.37 billion and growing at a 8.12% CAGR.

Key Insight Summary

General Adoption and Usage Rates

- Around 94% of enterprises use cloud services as of early 2026.

- Nearly 74% of large enterprise workloads are hosted in cloud environments.

- Cloud adoption among small and mid sized businesses ranges from 44% to 63%.

- SaaS is expected to represent 85% of all business software by the end of 2025.

- Organizations use an average of 371 SaaS applications across operations.

- Large enterprises average 131 SaaS applications, while mid sized firms have reduced usage to about 101 applications to manage complexity.

Marketing Focused Adoption

- 88% of marketers use analytics and performance measurement tools.

- 86% rely on CRM platforms for customer data management.

- 84% actively use first party data to guide marketing decisions.

- 63% of marketers currently use generative AI tools.

- More than 80% of companies are expected to deploy AI enabled applications by 2026.

- Over 70% of high performing organizations use marketing automation platforms.

- Marketers engage customers across an average of 10 channels, while leading teams personalize across 6 channels.

Platform Performance and Market Share

- Salesforce Marketing Cloud is used by more than 12,370 organizations.

- Over 90% of Fortune 500 companies use Salesforce related tools.

- HubSpot leads marketing automation adoption by user volume.

- HubSpot, ActiveCampaign, and Adobe together account for about 50% of the market.

- Mobile devices generated 58.67% of global website traffic by the end of 2025.

- Around 78% of digital advertising spend is directed toward mobile platforms.

Usage Challenges in 2026

- Organizations lose 30% to 32% of cloud budgets due to inefficiencies and unused resources.

- Only 31% of marketers report satisfaction with current data unification capabilities.

- About 87% of organizations report shortages in cloud related skills.

- Digital transformation initiatives face average delays of around 5 months due to talent gaps.

Growth Driver Impact Analysis

| Key Growth Driver | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| Rising demand for unified customer data and personalization | +3.8 | North America, Europe | Short to medium term |

| Increasing adoption of cloud based marketing automation | +3.2 | Global | Medium term |

| Growth in omnichannel customer engagement strategies | +2.9 | North America, Asia Pacific | Medium term |

| Expansion of AI driven analytics and campaign optimization | +2.5 | North America, developed Asia Pacific | Medium to long term |

| Rising digital advertising spend across industries | +2.1 | Global | Long term |

Restraints Impact Analysis

| Key Restraint | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| High implementation and integration complexity | -2.6 | Global | Short to medium term |

| Data privacy and regulatory compliance challenges | -2.2 | Europe, North America | Medium term |

| Budget constraints among small and mid sized enterprises | -1.9 | Asia Pacific, Latin America | Medium term |

| Skills gap in advanced marketing analytics | -1.5 | North America, Europe | Medium to long term |

| Vendor lock in concerns among enterprises | -1.2 | Global | Long term |

Emerging Trends Analysis

Marketing cloud platforms are increasingly central to first-party data strategies as third-party cookie support is being reduced by major web browsers. This shift forces organisations to build direct data capture and activation systems within owned channels such as websites and email lists to maintain personalised engagement. The transition towards first-party data centric models is heightening the strategic role of marketing cloud solutions within enterprise technology stacks.

A second emerging trend is that marketing cloud platforms are evolving to integrate advanced automation and artificial intelligence to support tailored customer journeys. Recent developments in AI-driven workflow tools are enabling platforms to deliver personalised interactions at scale across multiple channels. The adoption of these innovations is accelerating the capabilities of marketing teams to orchestrate complex campaigns with automated segmentation, optimisation, and engagement.

Opportunity Analysis

A notable opportunity lies in leveraging artificial intelligence and advanced analytics to expand the value proposition of marketing cloud platforms. The integration of AI can enable more precise segmentation, dynamic content delivery, and predictive insight generation, which enhances the effectiveness of marketing campaigns. Organisations that adopt these capabilities may achieve higher engagement and improved return on marketing investment.

Another opportunity exists in capturing demand from small and medium sized enterprises in emerging markets. Increased technology adoption and digital transformation initiatives in developing economies are creating interest in cloud-based marketing solutions that can support growth without extensive in-house infrastructure. Opening solutions tailored for these segments could broaden platform adoption.

Challenge Analysis

A key challenge is the complexity involved in implementing and integrating marketing cloud platforms with existing systems and processes. Organisations may struggle to define a clear strategy and align technology with business goals, which can result in suboptimal outcomes and user adoption issues. This implementation complexity requires skilled resources and careful planning to achieve value.

Another challenge is intense competition and rapid technological evolution within the marketing cloud landscape. Platforms must continuously adapt to new technologies and changing market demand, which can strain development resources and create uncertainty for long-term planning. This competitive intensity requires ongoing investment in innovation to maintain relevance.

Regional Driver Comparison

North America accounted for 41.8% share, supported by advanced digital marketing adoption and strong focus on data driven customer engagement across industries.

| Region | Core Demand Driver | Growth Influence Level | Market Maturity |

|---|---|---|---|

| North America | Advanced digital marketing adoption and data maturity | Very High | Mature |

| Europe | Strong focus on compliant customer engagement | High | Mature |

| Asia Pacific | Rapid digital commerce and mobile first marketing | Medium to High | Developing |

| Middle East | Enterprise digital transformation initiatives | Medium | Developing |

| Latin America | Gradual shift toward cloud based marketing tools | Low to Medium | Developing |

| Africa | Early stage digital marketing modernization | Low | Early stage |

Investor Type Impact Matrix

| Investor Type | Strategic Objective | Risk Tolerance | Market Influence |

|---|---|---|---|

| Enterprise software providers | Expansion of SaaS marketing ecosystems | Medium | High |

| Cloud service providers | Increased platform utilization and workloads | Low to Medium | High |

| Private equity investors | Stable recurring revenue from SaaS platforms | Medium | Medium |

| Venture capital firms | Innovation in AI driven marketing capabilities | High | Medium |

| Strategic brand investors | Improved customer acquisition and retention | Low to Medium | Medium |

Technology Enablement Analysis

| Technology Enabler | Functional Role | Impact on Adoption | Adoption Timeline |

|---|---|---|---|

| Customer data platforms within marketing clouds | Unified customer profiles and insights | Very High | Short term |

| AI driven personalization engines | Real time content and offer optimization | High | Short to medium term |

| Cloud native campaign management tools | Scalable and flexible deployment | Very High | Short term |

| Marketing analytics and attribution modeling | Improved ROI measurement | Medium to High | Medium term |

| Privacy first data management frameworks | Compliance and consumer trust assurance | Medium | Medium to long term |

Key Market Segments

By Component

- Solutions

- Campaign Management

- Customer Data Platform

- Email Marketing

- Social Media Marketing

- Content Management

- Marketing Analytics

- Others

- Services

- Professional Services

- Managed Services

- Others

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- Retail & E-commerce

- Banking, Financial Services, and Insurance

- Healthcare

- Media & Entertainment

- Travel & Hospitality

- Manufacturing

- Others

By Application

- Customer Segmentation & Targeting

- Lead Management & Nurturing

- Multi-channel Campaign Orchestration

- Customer Engagement & Personalization

- Marketing Measurement & ROI

- Others

Top Key Players in the Market

- Salesforce, Inc.

- Adobe Inc.

- Oracle Corporation

- SAP SE

- International Business Machines Corporation

- Microsoft Corporation

- HubSpot, Inc.

- Marketo, Inc.

- SAS Institute Inc.

- Teradata Corporation

- Acoustic, LP

- Zeta Global Holdings Corp.

- Sprinklr, Inc.

- Emarsys eMarketing Systems AG

- Act-On Software, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 14.5 Bn |

| Forecast Revenue (2035) | USD 36.6 Bn |

| CAGR(2025-2035) | 9.70% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2024 |

| Forecast Period | 2025-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |