Table of Contents

- Overview

- Key Takeaways

- Increasing Adoption Technologies

- Emerging Trends Analysis

- China Market Size

- Growth Driver Impact Analysis

- Restraints Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Report Scope

Overview

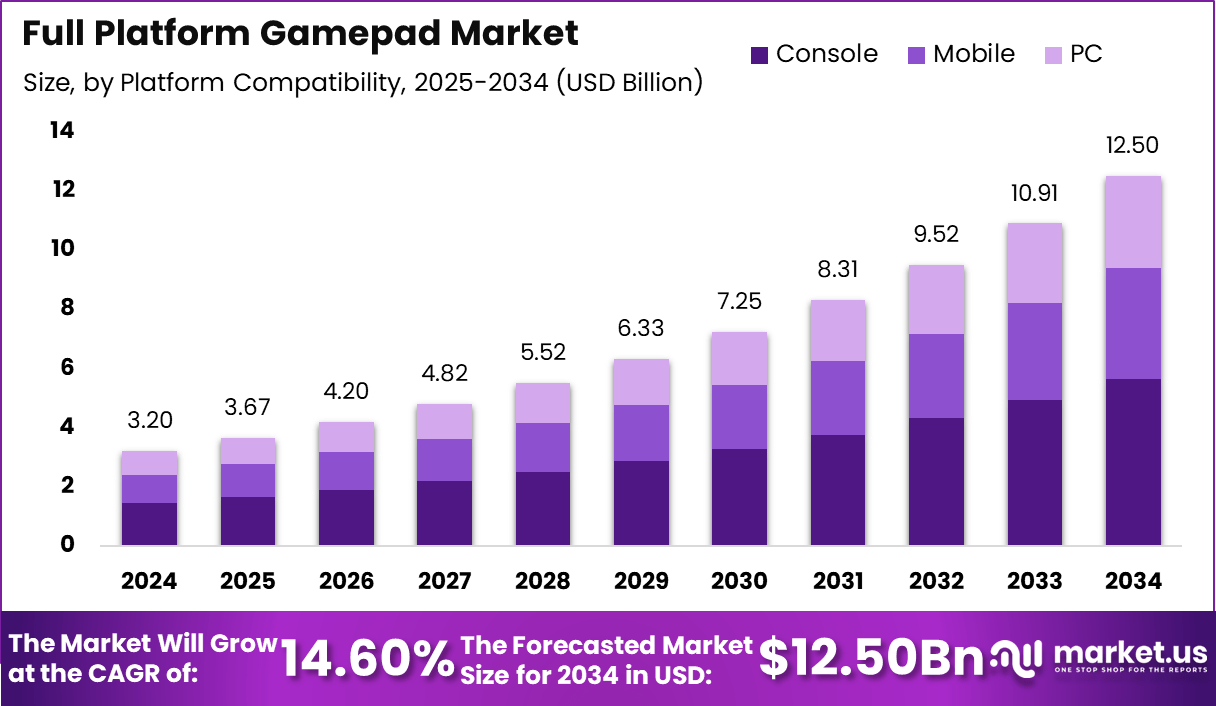

The Global Full Platform Gamepad Market presents a compelling consumer electronics and gaming accessories investment opportunity, growing from USD 3.2 billion in 2024 to approximately USD 12.5 billion by 2034, at a CAGR of 14.6%. Supported by cloud gaming proliferation, cross-platform play, and hardware innovation, the market is well-positioned for long-term capital deployment driven by evolving gamer preferences.

The full platform gamepad market refers to the industry segment focused on the production, distribution, and use of controllers that are compatible with multiple gaming platforms such as consoles, personal computers, and mobile devices. These gamepads provide physical input mechanisms like buttons, triggers, analog sticks, and directional pads that translate user motion into digital commands during gameplay.

The market includes wired and wireless solutions designed to serve casual players, competitive gamers, and individuals participating in immersive digital entertainment environments. The role of full platform gamepads has expanded as gaming has become more interactive across diverse platforms and connected ecosystems.

A primary driving factor for the full platform gamepad market is the rising demand for immersive gaming experiences that blend performance with user comfort. Gamers now expect intuitive control layouts, ergonomic structures, and responsive inputs that can support fast action and complex gameplay. The shift toward multiplayer online gaming, competitive esports, and cloud gaming ecosystems has increased expectations for controllers that maintain consistent performance across different hardware environments.

Another key driver is the increasing adoption of cross-platform gaming, which encourages users to access games on a range of devices including consoles, PCs, and smartphones. This trend has stimulated developers to produce gamepads that can function reliably across diverse systems, reducing the need for platform-specific controllers. As connectivity technologies such as Bluetooth mature, interoperability has improved, supporting broader user acceptance and market growth.

Key Takeaways

- The global full platform gamepad market was valued at USD 3.2 billion in 2024 and is expected to grow steadily during the forecast period.

- The market is projected to expand at a 14.6% CAGR, reaching an estimated value of USD 12.5 billion by 2034.

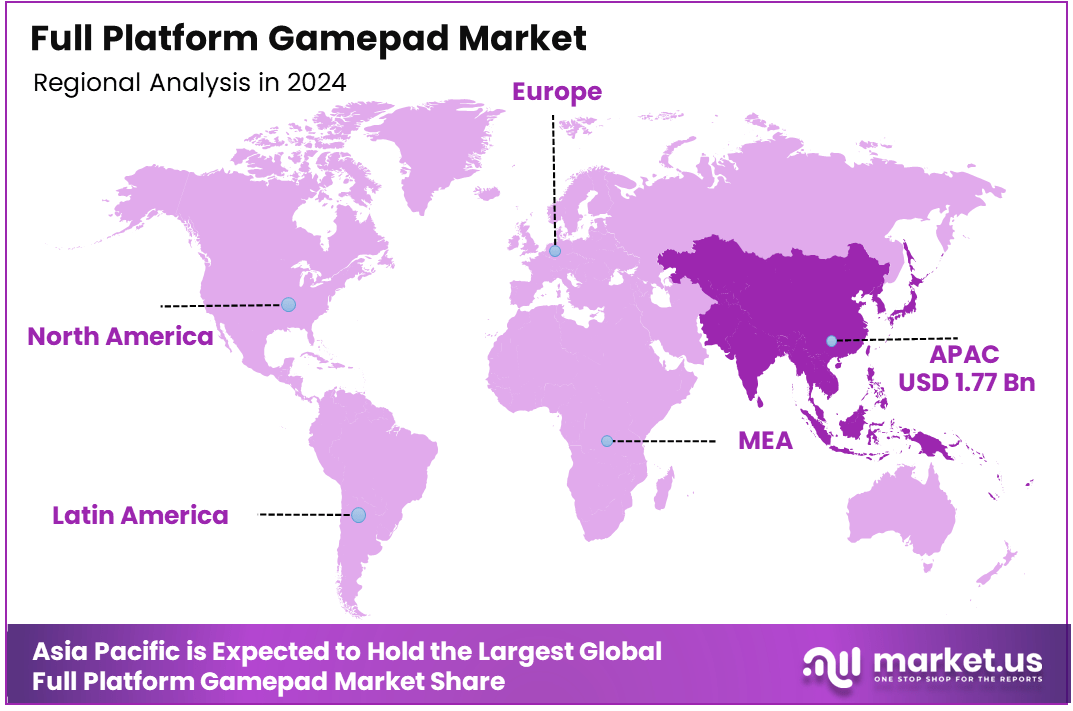

- Asia Pacific accounted for 37.2% of the global market in 2024, with a market value of USD 1.19 billion, supported by a large gaming population and rising console and PC usage.

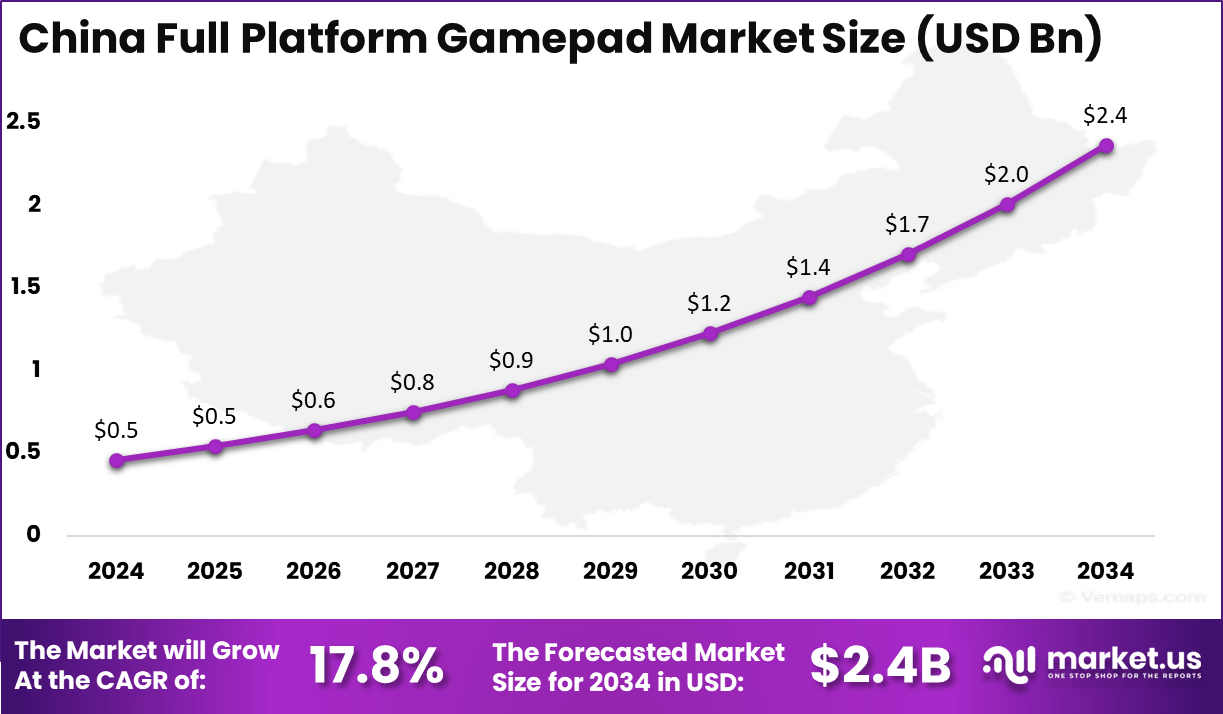

- China generated USD 0.46 billion in 2024 and is projected to reach USD 2.4 billion by 2034, growing at a 17.8% CAGR.

- By platform compatibility, PC gamepads held the largest share at 45.3%, reflecting strong demand from PC gamers.

- By connectivity type, wireless gamepads dominated with an 80.4% share, driven by convenience and improved connectivity performance.

- By distribution channel, online retail led with 70.8%, supported by wide product availability and competitive pricing.

- By price range, the mid range segment (USD 40 to 100) accounted for 50.7%, indicating strong preference for balanced performance and affordability.

- By end user, casual gamers represented 75.5% of the market, reflecting broad adoption across non professional gaming audiences.

Increasing Adoption Technologies

Technological advancements play a significant role in shaping the full platform gamepad market. Innovations such as low-latency wireless communication protocols, adaptive haptic feedback, and modular components improve the controller experience and attract a wider range of gamers. These technologies allow for seamless interactions, reduced input lag, and more realistic tactile responses during gameplay.

In addition, improvements in battery efficiency, connectivity options, and sensing mechanisms enhance the usability and portability of gamepads. Integration with cloud gaming platforms and mobile devices has further extended the relevance of these controllers, enabling users to engage in high-quality gaming without reliance on traditional console environments. As gaming hardware and software ecosystems evolve, full platform gamepads continue to adopt technologies that align with user expectations for performance and convenience.

Emerging Trends Analysis

The full platform gamepad market is experiencing growth due to the increasing convergence of gaming across multiple devices, including consoles, personal computers, mobile devices, and cloud gaming platforms. Gamers now expect controllers that work seamlessly across ecosystems, which is driving demand for versatile gamepads with universal compatibility. This trend reflects a shift from platform-specific hardware toward controllers that support cross-platform play and cloud streaming services.

Another emerging trend is the incorporation of advanced haptic feedback, adaptive triggers, and customisable control mapping in gamepads. These technologies enhance player immersion and allow users to adjust settings to match game genres and personal preferences. As immersive gaming experiences become more central to user expectations, hardware features that support nuanced feedback and responsiveness are becoming key differentiators in the market.

China Market Size

The China market for full platform gamepads is expected to grow strongly over the forecast period. In 2024, the market was valued at approximately USD 0.46 billion, and with a CAGR of 17.8%, it is projected to reach around USD 2.4 billion by 2034, supported by rising gaming adoption and demand for multi platform accessories.

The Asia Pacific region accounted for 37.2% of the global full platform gamepad market in 2024, making it the largest regional contributor. This strong position reflects widespread adoption.

Growth Driver Impact Analysis

| Key Growth Driver | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| Rapid growth of cross platform and multi device gaming | +4.9 | North America, Europe, Asia Pacific | Short to medium term |

| Expansion of cloud gaming and subscription based game services | +4.3 | North America, developed Asia Pacific | Medium term |

| Rising demand for premium gaming peripherals and accessories | +3.8 | Global | Medium term |

| Growth of PC and mobile gaming with controller support | +3.2 | Asia Pacific, Europe | Medium to long term |

| Increasing esports participation and competitive gaming | +2.6 | North America, Asia Pacific | Long term |

Restraints Impact Analysis

| Key Restraint | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| High price sensitivity among casual gamers | -2.3 | Emerging markets | Short to medium term |

| Compatibility and latency issues across platforms | -2.0 | Global | Medium term |

| Strong competition from first party console controllers | -1.8 | North America, Europe | Medium term |

| Short product replacement cycles and rapid innovation | -1.5 | Global | Medium to long term |

| Dependence on overall gaming hardware sales | -1.2 | Global | Long term |

Investor Type Impact Matrix

| Investor Type | Strategic Objective | Risk Tolerance | Market Influence |

|---|---|---|---|

| Gaming accessory manufacturers | Expansion of cross platform hardware portfolios | Medium | High |

| Consumer electronics brands | Diversification into gaming peripherals | Medium | Medium to High |

| Venture capital firms | Innovative controller designs and input technologies | High | Medium |

| Private equity investors | Scalable consumer hardware brands | Medium | Medium |

| Strategic gaming ecosystem investors | Improved player experience and engagement | Low to Medium | Medium |

Technology Enablement Analysis

| Technology Enabler | Functional Role | Impact on Adoption | Adoption Timeline |

|---|---|---|---|

| Universal multi platform connectivity standards | Seamless use across console, PC, and mobile | Very High | Short term |

| Low latency wireless communication | Enhanced responsiveness for competitive gaming | High | Short to medium term |

| Advanced haptic feedback and adaptive triggers | Improved immersion and gameplay realism | High | Medium term |

| Modular and customizable controller components | Personalization for different gaming styles | Medium | Medium to long term |

| Cloud gaming optimized input protocols | Reliable performance over streaming platforms | Medium | Long term |

Driver Analysis

A primary driver of the full platform gamepad market is the rapid expansion of gaming audiences globally. More players are engaging in gaming on various devices, including consoles, PCs, mobile devices, and tablets. This expansion increases demand for controllers that can bridge these platforms, providing consistent gameplay experiences regardless of the device. The global growth of gaming communities and esports has also contributed to this trend, encouraging peripheral manufacturers to build controllers that appeal to diverse user needs.

Another strong driver is the rise of cloud gaming and subscription services that allow users to stream games to a variety of screens. These services often require compatible input devices, and gamepads that support Bluetooth, USB, and wireless connectivity are preferred due to their flexibility. The availability of multi-platform gaming titles further supports demand for controllers that work across ecosystems, reinforcing the utility of full platform gamepads in both casual and competitive gaming contexts.

Restraint Analysis

One significant restraint for the full platform gamepad market is the technical challenge of achieving seamless compatibility across disparate operating systems and hardware form factors. Developing firmware and control schemes that work reliably on consoles, PCs, mobile devices, and smart TVs requires extensive testing and optimisation. Differences in platform APIs and Bluetooth implementations can complicate development and result in inconsistent user experiences.

Another restraint is the cost sensitivity among consumer segments, particularly casual gamers and budget buyers. High-end gamepads with advanced haptics, adaptive triggers, and customisable buttons often carry premium price tags. These prices can deter some buyers who are satisfied with basic input devices or who prefer to use built-in touch controls on mobile platforms. As a result, price pressures can slow adoption among less committed gaming audiences.

Opportunity Analysis

An important opportunity exists in expanding support for accessibility and inclusive design in gamepads. Customisable controls, ergonomic designs for diverse hand sizes, and support for adaptive technologies can make gamepads usable for a wider audience, including players with physical impairments. This focus on accessibility can open new market segments and strengthen brand loyalty among underserved gamers.

Another opportunity lies in collaboration with cloud gaming service providers and software platforms to certify controllers for optimal performance. Partnerships that ensure gamepad compatibility and performance can improve consumer confidence and encourage higher adoption rates. Additionally, developers can integrate APIs that allow gamepads to communicate directly with game engines for enhanced responsiveness and feature support.

Challenge Analysis

A core challenge is ensuring consistent quality and reliability in wireless connectivity across various devices and environments. Technologies such as Bluetooth and proprietary wireless protocols must deliver stable performance without latency issues, especially for competitive gaming. Interference, device pairing differences, and connection drops remain technical hurdles that affect user satisfaction.

Another challenge is maintaining ongoing firmware and driver support after product launch. As operating systems and gaming platforms update, gamepad manufacturers must provide timely software updates to sustain compatibility and address any issues that emerge. This need for continuous support requires dedicated development resources, which can strain smaller vendors.

Key Market Segments

By Platform Compatibility

- Console

- Mobile

- PC

By Connectivity Type

- Wired

- Wireless

- Bluetooth

- Rf Wireless

By Distribution Channel

- Offline Retail

- Electronics Retailers

- Specialty Stores

- Online Retail

- E-Commerce Platforms

- Manufacturer Websites

By Price Range

- Entry Level

- Mid Range

- Premium

By End User

- Casual Gamers

- Esports Organizations

- Professional Gamers

Top Key Players in the Market

- Sony Interactive Entertainment LLC

- Microsoft Corporation

- Nintendo Co., Ltd.

- Razer Inc.

- Logitech International S.A.

- PowerA Inc.

- Performance Designed Products, Inc.

- MCW Creative SAS

- HORI Co., Ltd.

- Guillemot Corporation

- 8Bitdo

- Scuf

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.2 Billion |

| Forecast Revenue (2034) | USD 12.50 Billion |

| CAGR(2025-2034) | 14.60% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |