Table of Contents

Insurtech E&O Insurance Market Overview

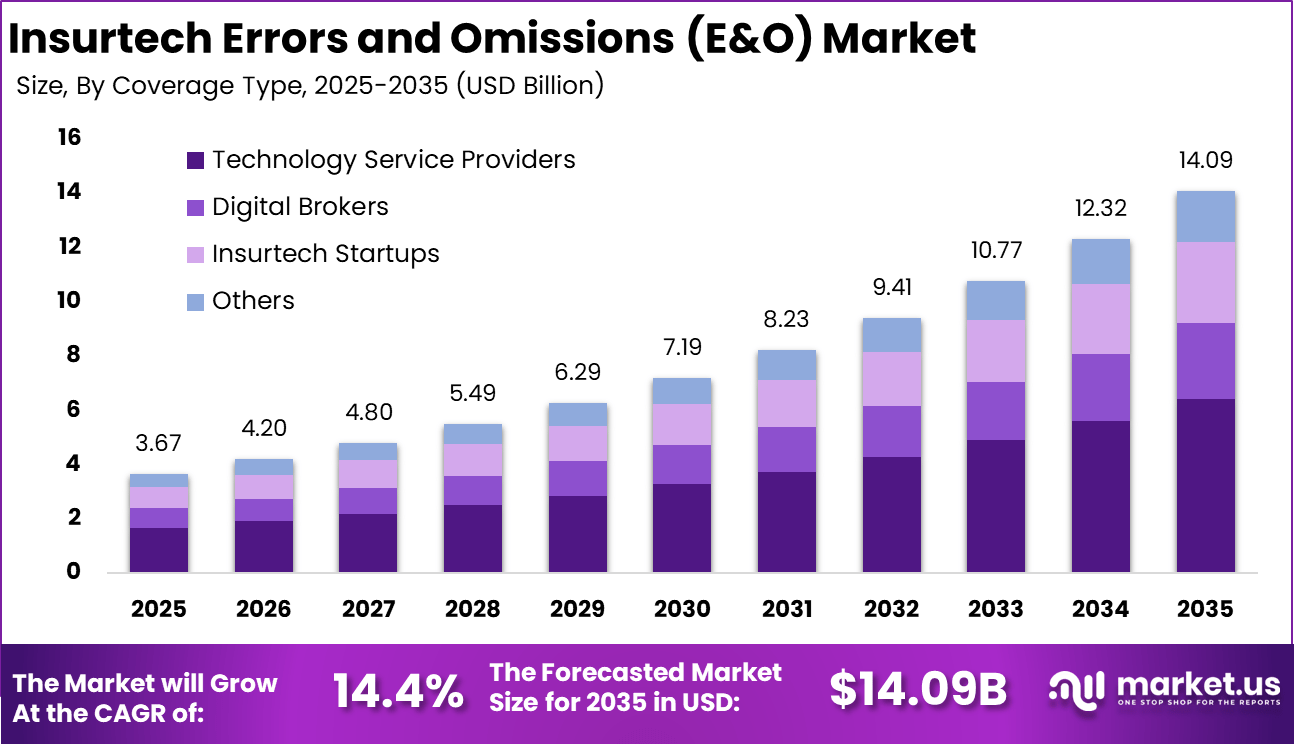

The Global Insurtech E&O Insurance Market is positioned for strong expansion, projected to grow from USD 3.67 billion in 2025 to approximately USD 14.09 billion by 2035, registering a CAGR of 14.4% during the forecast period. North America led the market, capturing more than 36.1% share and generating USD 1.32 billion in revenue, driven by the rapid growth of digital insurance platforms and increasing demand for professional liability protection in the fintech and insurtech ecosystem.

The Insurtech E&O Insurance Market refers to professional liability coverage designed to protect insurtech firms against claims arising from errors, omissions, system failures, or professional negligence. Insurtech companies operate at the intersection of insurance and technology, offering digital underwriting, automated claims, pricing algorithms, and customer platforms. These activities introduce technology driven risks that differ from traditional insurance operations. Errors and omissions insurance is therefore treated as a critical risk transfer mechanism.

Insurtech E&O insurance covers financial losses linked to incorrect advice, faulty algorithms, data handling errors, and service delivery failures. As insurtech platforms interact directly with customers and partners, exposure to disputes increases. Industry observations indicate that digital insurance platforms process thousands of automated decisions daily, amplifying the impact of even minor system errors. This operational scale reinforces the importance of structured E&O coverage.

One of the primary driving factors is the increasing reliance on automated decision making within insurtech platforms. Pricing engines, claims automation, and policy issuance systems operate with limited human oversight. Errors in logic or data inputs can lead to incorrect outcomes. E&O insurance helps manage the financial consequences of such failures.

Another key driver is heightened regulatory scrutiny of digital insurance activities. Regulators expect insurtech firms to meet professional conduct and consumer protection standards. Failure to comply can result in claims and penalties. E&O coverage supports risk management in this regulated environment. The growing use of third party integrations also drives demand. Insurtech platforms often rely on external data sources and application interfaces. Breakdowns in these dependencies can affect service quality. Insurance coverage helps mitigate exposure arising from interconnected systems.

Demand for insurtech E&O insurance is strongest among early stage and scaling insurtech firms. These companies face rapid growth but limited operational history. Investors and partners often require proof of liability coverage before engagement. This requirement directly fuels market demand. Demand is also increasing among established insurers launching digital subsidiaries. As traditional insurers adopt insurtech models, they encounter new professional risks. E&O insurance provides continuity of protection across traditional and digital operations. This crossover expands the market base.

Top Market Takeaway

- Technology Service Providers led demand in 2025, contributing 45.6% of total market share, reflecting increased liability exposure linked to digital platforms and API driven insurance models.

- Large Enterprises dominated purchasing activity with a 74.7% share, supported by higher transaction volumes and complex compliance requirements.

- Direct Sales remained the preferred distribution route, accounting for 44.8% of total policies issued, as insurers maintained closer underwriting control and customized coverage terms.

- Insurance Companies represented the largest end-user segment with 42.7% share, driven by expanding partnerships with technology vendors and insurtech platforms.

- The U.S. market reached USD 1.15 billion in 2025 and expanded at a strong 29.6% growth rate, supported by rapid digital insurance transformation and increased regulatory scrutiny.

- North America secured more than 36.1% of global market share, reflecting advanced technology adoption and a mature insurance ecosystem.

- Over 82% of global insurers have integrated AI and machine learning into core operations, raising the need for enhanced E&O coverage to address algorithm related liability risks.

- Technology and telecommunications firms account for nearly 12% of professional liability claims, indicating elevated exposure among digital service providers.

- Managed service offerings contributed more than 42% of sector revenue, as integrated E&O and cyber protection models gained wider enterprise acceptance.

Drivers Impact Analysis

| Key Driver | Impact on CAGR Forecast (~) % | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rapid growth of insurtech platforms and digital insurance models | +4.1% | North America, Europe | Short to medium term |

| Increasing technology and algorithm-related liability exposure | +3.2% | Global | Short term |

| Expansion of API-driven insurance distribution and automation | +2.8% | North America, Europe | Medium term |

| Rising regulatory scrutiny on digital insurance operations | +2.4% | Europe, North America | Medium term |

| Growth in B2B insurtech services and SaaS-based insurance tools | +1.9% | Global | Medium to long term |

Restraint Impact Analysis

| Key Restraint | Impact on CAGR Forecast (~) % | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High premium costs for early-stage and small insurtech firms | -2.6% | Global | Short to medium term |

| Limited historical claims data for emerging technologies | -2.1% | Global | Medium term |

| Complexity in underwriting AI- and algorithm-driven risks | -1.8% | North America, Europe | Medium term |

| Inconsistent regulatory frameworks across regions | -1.5% | Asia Pacific, Latin America | Medium to long term |

| Risk perception gaps among founders and startups | -1.2% | Emerging Markets | Medium term |

Increasing Adoption Technologies

Policy underwriting for insurtech E&O insurance increasingly incorporates technology risk assessment tools. These tools evaluate system architecture, automation level, and data usage practices. Improved risk profiling supports more accurate coverage terms. Technology driven assessment is becoming standard practice. Continuous risk monitoring technologies are also gaining adoption.

Insurers use real time indicators to assess operational changes at insured insurtech firms. This dynamic approach improves risk alignment over time. Technology adoption enhances underwriting confidence. Digital policy management platforms further support adoption. Automated policy issuance and claims handling improve efficiency. Faster turnaround is important for fast moving insurtech businesses. Technology simplifies insurance engagement.

Insurtech firms adopt technology aligned E&O solutions to match their operating speed. Traditional insurance processes can be slow and inflexible. Digital tools provide coverage that adapts to evolving business models. This alignment improves usability and relevance. Another reason is transparency. Technology based risk assessment clarifies coverage expectations.

Firms gain better understanding of insured risks and exclusions. Clear alignment reduces disputes during claims. Adoption is also driven by scalability. As insurtech platforms grow, risk exposure changes rapidly. Technology enabled insurance solutions adjust more easily. This flexibility supports long term coverage continuity.

Investment and Business Benefits

Investment opportunities in this market exist in insurers and platforms specializing in technology focused professional liability. As insurtech adoption grows, demand for tailored coverage increases. Providers with deep understanding of digital risk gain competitive advantage. This specialization supports premium growth. There are also opportunities in data driven underwriting platforms.

Tools that assess algorithmic risk and automation exposure improve pricing accuracy. Investors favor solutions that reduce uncertainty in emerging risk categories. This innovation attracts sustained interest. Another investment area is bundled coverage models. Combining E&O with cyber and technology liability offers comprehensive protection. Integrated products simplify purchasing for insurtech firms. This approach supports higher retention and value.

For insurtech firms, E&O insurance provides financial protection against professional liability claims. Coverage safeguards balance sheets and investor confidence. This protection supports uninterrupted operations during disputes. Business stability improves significantly.From a strategic perspective, insurance coverage enhances credibility.

Partners, regulators, and customers view insured firms as more reliable. E&O insurance supports trust building in digital insurance models. This trust is essential for scaling. Financially, coverage reduces the impact of litigation and settlement costs. Predictable risk transfer improves financial planning. Over time, this stability supports sustainable growth and innovation.

Key Market Segments

By Coverage Type

- Technology Service Providers

- Digital Brokers

- Insurtech Startups

- Others

By Application

- Small and Medium Enterprises

- Large Enterprises

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Online Platforms

- Others

By End-User

- Insurance Companies

- Insurtech Firms

- Third-party Administrators

- Others

Top Key Players in the Market

- AXA XL

- Chubb

- AIG (American International Group)

- Zurich Insurance Group

- Hiscox

- Beazley

- Liberty Mutual

- Travelers

- Markel Corporation

- Allianz Global Corporate & Specialty

- Sompo International

- Berkshire Hathaway Specialty Insurance

- CNA Financial

- Tokio Marine HCC

- Arch Insurance Group

- Munich Re

- QBE Insurance Group

- AmTrust Financial Services

- Swiss Re

- The Hartford

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)