Table of Contents

Overview

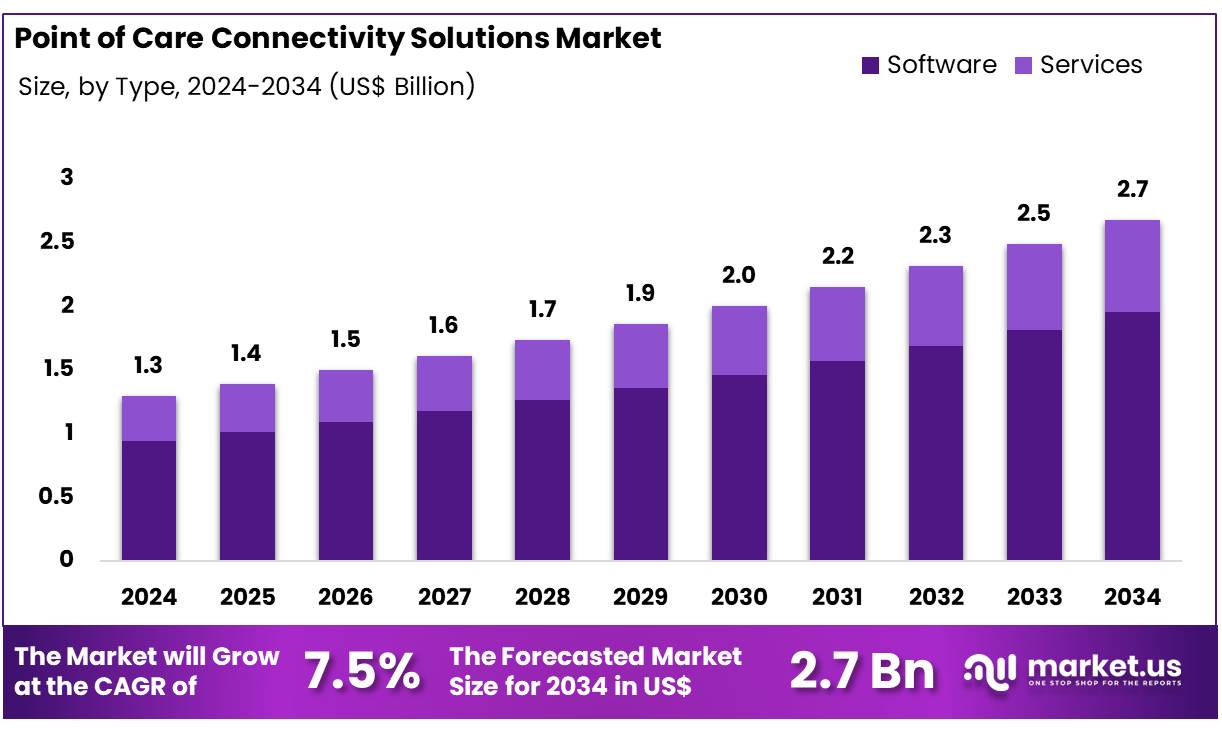

New York, NY – Feb 13, 2026 – Global Point of Care Connectivity Solutions Market size is expected to be worth around US$ 2.7 Billion by 2034 from US$ 1.3 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2024 to 2034. In 2023, North America led the market, achieving over 31% share with a revenue of US$ 0.4 Billion.

The global Point of Care Connectivity Solutions market is witnessing steady expansion, driven by the increasing need for seamless data exchange across healthcare systems. These solutions enable the integration of diagnostic devices with hospital information systems, laboratory information systems, and electronic medical records, ensuring accurate and real-time patient data management. The growing emphasis on reducing medical errors and enhancing clinical workflow efficiency has significantly supported market adoption.

The market growth can be attributed to the rising digital transformation in healthcare infrastructure, along with increased investments in advanced diagnostic technologies. Hospitals and diagnostic laboratories are actively deploying interoperable connectivity platforms to streamline operations and improve patient outcomes. Furthermore, regulatory focus on data accuracy, patient safety, and standardized reporting systems is reinforcing the demand for reliable connectivity frameworks.

Technological advancements such as cloud-based deployment models, cybersecurity enhancements, and remote device management capabilities are further accelerating industry development. North America is currently leading the market due to well-established healthcare IT infrastructure, while emerging economies are demonstrating notable potential owing to expanding healthcare access and modernization initiatives.

Key Takeaways

- The global Point of Care Connectivity Solutions market was valued at USD 1.3 billion in 2024 and is projected to reach USD 2.7 billion by 2034, expanding at a CAGR of 7.5% during the forecast period.

- In 2024, the software segment dominated the market, accounting for approximately 73% of the overall revenue share.

- The hospitals and clinics segment emerged as the leading end-user category, contributing 32% of the total market revenue in 2024.

- By application, the glucose monitoring segment held the highest share, representing 17% of the global revenue in 2024.

- North America retained its dominant position in the market, capturing over 31% of the total revenue share in 2024.

Regional Analysis

North America accounted for a considerable share of the Point of Care (PoC) connectivity solutions market, supported by a highly developed healthcare infrastructure and strong penetration of digital health technologies. Significant healthcare expenditure across the region has facilitated the adoption of advanced connectivity systems aimed at improving clinical efficiency and patient data management. The United States represents a major contributor, supported by an established healthcare framework that emphasizes innovation, quality of care, and streamlined operations.

Efforts to control healthcare costs and enhance patient outcomes have further strengthened the demand for PoC connectivity platforms. The increasing integration of cloud-based services within healthcare facilities has also supported market expansion. Favorable reimbursement structures and a well-defined regulatory environment continue to reinforce regional growth.

The rising deployment of public cloud platforms illustrates this transition. According to data reported by HIPAA Journal, healthcare organizations used an average of 19 public cloud services in 2019, increasing to 24 services by 2022, indicating a growing dependence on secure cloud-enabled data management systems.

Emerging trends in Point of Care (POC) Connectivity Solutions

- POC connectivity is being driven by near-universal EHR use

- Connectivity is increasingly being designed to “write directly” into the EHR (device → EHR documentation), because most care settings already run on certified EHR systems.

- Numeric signal: 96% of U.S. non-federal acute care hospitals had adopted a certified EHR (2021).

- Interoperability requirements are pushing more standard APIs (USCDI / FHIR direction)

- More POC solutions are being built around standard data elements and exchange expectations (so that device results, vitals, and orders can move across systems with less custom work).

- Numeric signal: ONC released USCDI Version 5 on July 18, 2024, expanding the “core” data foundation used for nationwide exchange (a key enabler for connected point-of-care data flows).

- Medication workflows are being connected end-to-end (barcode + eMAR + smart pumps + EHR)

- POC connectivity is increasingly being used to reduce manual steps at the bedside (scan → verify → document → infuse), because manual entry is where many errors start.

- Numeric signal: AHRQ Patient Safety Network reported 56% reduction in medication errors after bar-code–assisted medication administration (BCMA) implementation in one study.

- Numeric signal: Smart pump–EHR interoperability studies have reported large reductions in programming errors for high-alert drugs (example: 84% → 16% after auto-programming in one pre/post study summary).

- Connected POCT is being expanded to speed decisions in emergency and acute care

- More hospitals are connecting point-of-care testing (POCT) devices to LIS/EHR to reduce delays and avoid lost/mis-charted results (results can be available fast and captured automatically).

- Numeric signal: A 2024 clinical review described POCT turnaround as “only a few minutes” compared with central lab workflows, which supports faster decision-making in ED settings.

- Home and hybrid care are increasing demand for “outside-the-hospital” connectivity

- POC connectivity is being extended beyond hospital walls (telehealth + remote monitoring + home testing), so that patient-generated data can be routed into clinical workflows.

- Numeric signal: U.S. adult telemedicine use was 30.1% in 2022 (down from 37.0% in 2021), showing telehealth remains a large channel that benefits from connected devices and data capture.

High-impact use cases for POC Connectivity Solutions

- Auto-posting POCT results into LIS/EHR (glucose, blood gases, cardiac markers, infectious tests)

- Results are transmitted directly from the bedside analyzer into the patient chart to reduce manual transcription and speed treatment decisions.

- Numeric anchor: POCT turnaround is often described as a few minutes, which supports time-sensitive ED workflows when results are connected and immediately available in the record.

- Barcode medication administration connected to eMAR/EHR

- Patient wristband + medication barcode scanning is linked to the eMAR so that “right patient / right drug / right time” checks are enforced and documentation is captured automatically.

- Numeric anchor: Medication errors were reduced by 56% after BCMA implementation in an AHRQ PSNet-highlighted study.

- Smart infusion pump interoperability with EHR (auto-programming + auto-documentation)

- Infusion orders are sent from the EHR to the pump to reduce manual programming and improve documentation consistency.

- Numeric anchor: Reported programming errors for high-alert drugs fell from 84% to 16% in a pre/post implementation study described in a 2025 review.

- Telehealth + connected home devices feeding clinical review (BP cuffs, pulse oximeters, glucometers)

- Patient readings are captured remotely and routed into clinician workflows to support chronic disease follow-up and post-discharge monitoring.

- Numeric anchor: 30.1% of U.S. adults used telemedicine in 2022, supporting ongoing need for connected, reliable patient data flows.

- Quality control (QC) + operator compliance monitoring for POCT programs

- Connectivity is used to ensure devices are used by trained operators, QC is completed, and exceptions are flagged early (supporting lab oversight and audit readiness).

- Numeric anchor: Practical POCT governance focuses on avoiding process failures (for example, training/certification gaps), and structured QA oversight has been documented as important for reducing POCT errors.

Conclusion

The global Point of Care Connectivity Solutions market is positioned for sustained growth, supported by accelerating healthcare digitalization and strong regulatory emphasis on data accuracy and patient safety. Expanding EHR adoption, interoperability standards, and cloud-based integration frameworks are reinforcing seamless device-to-record connectivity.

Demonstrated reductions in medication and programming errors, alongside faster POCT turnaround times, highlight measurable clinical value. North America remains a key revenue contributor, while emerging markets present scalable opportunities driven by infrastructure modernization. As telehealth and remote monitoring expand, demand for secure, interoperable, and workflow-integrated connectivity platforms is expected to strengthen steadily through 20

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)