Table of Contents

- Introduction

- Editor’s Choice

- Global Advanced Analytics Market Overview

- Significant Areas of Technology Innovation for Companies Investing in Data and Analytics Technology

- Global Spending on the Internet of Things (IoT)

- Use of Big Data Analytics Across Institutions

- Adoption of Key Analytical Technologies

- Deployment of Advanced Analytics in Corporate Arena

- Current Use of Advanced Analytics and Future Predictions

Introduction

According to Advanced Analytics Statistics, Advanced analytics has become indispensable for businesses, providing crucial insights from intricate datasets. Technological progressions like machine learning and big data analytics allow companies to forecast future results, streamline operations, and tailor customer experiences.

By examining past data and using algorithms, businesses can predict customer behavior, mitigate risks, and improve operational effectiveness. Advanced analytics is applied in various sectors, including customer segmentation and supply chain enhancement, empowering informed decision-making and fostering a competitive edge.

As technology advances, the significance of advanced analytics only amplifies, influencing the trajectory of business strategies globally.

Editor’s Choice

- By 2033, the global advanced analytics market revenue is expected to exceed 473 billion USD.

- In the landscape of the advanced analytics market, large enterprises hold a dominant position, capturing a substantial market share of 64.3%.

- In the global landscape of advanced analytics and data science technologies in 2023, MATLAB emerged as the leading player, with a substantial market share of 14.58%.

- Cloud computing, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), stands out as the leading area, capturing 48% of the data and analytics investment.

- In 2023, global spending on Internet of Things (IoT) technology reached 805 billion U.S. dollars, marking an increase from the previous year. However, the growth was lower than initially anticipated due to the impact of the global coronavirus pandemic.

- According to a survey, several technologies are poised for significant adoption over the next five years, with digital platforms and apps ranking highest, with 86.4% of organizations expressing a likelihood or increased likelihood of adoption.

- IT departments have the highest adoption rate of sophisticated advanced analytics at 41%, indicating a greater propensity for leveraging advanced techniques in this domain.

Global Advanced Analytics Market Overview

Global Advanced Analytics Market Size

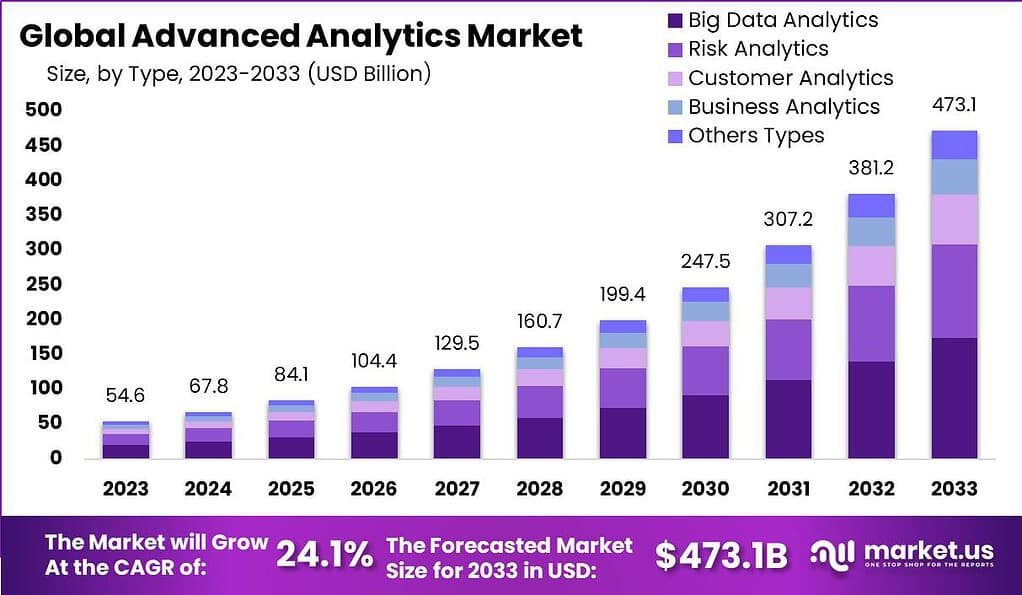

- According to recent data, the global advanced analytics market revenue is projected to experience substantial growth over the next decade at a CAGR of 24.1%.

- Starting at 54.6 billion USD in 2023, the market is anticipated to expand significantly, reaching 67.8 billion USD in 2024 and further climbing to 84.1 billion USD in 2025.

- The momentum continues into the early 2030s, with revenue projections climbing to 307.2 billion USD in 2031 and further rising to 381.2 billion USD in 2032.

- By 2033, the global advanced analytics market is expected to exceed 473 billion USD, reflecting sustained and robust growth in adopting advanced analytics solutions across various industries worldwide.

Advanced Analytics Market Share- By Organization Size

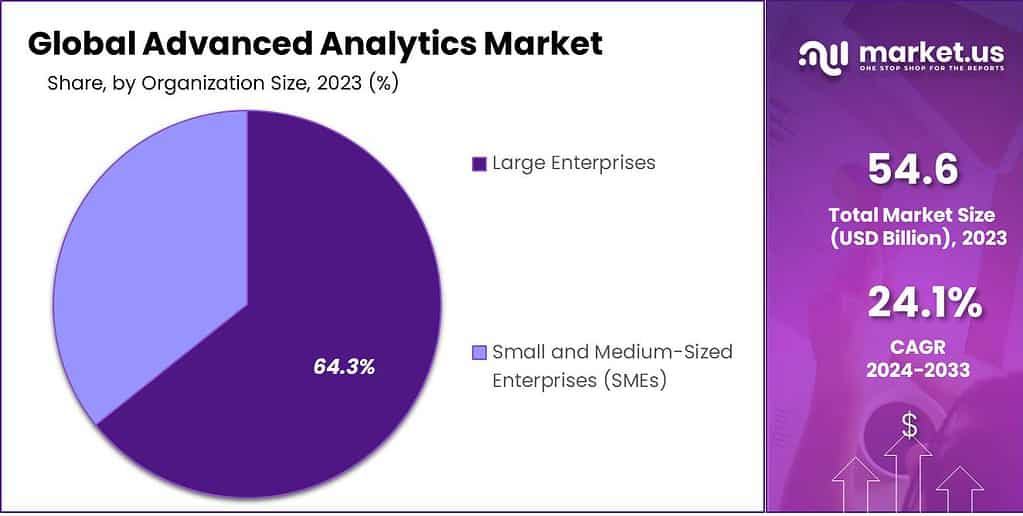

- In the landscape of the advanced analytics market, large enterprises hold a dominant position, capturing a substantial market share of 64.3%.

- However, small and medium-sized enterprises (SMEs) also contribute significantly, accounting for 35.7% of the market share.

- This distribution reflects the varied participation of organizations of different sizes in leveraging advanced analytics solutions to drive business growth and competitive advantage.

Market Share of Advanced Analytics and Data Science Technologies

- In the global landscape of advanced analytics and data science technologies in 2023, MATLAB emerged as the leading player, with a substantial market share of 14.58%.

- Following MATLAB, Altery secures a significant portion of the market with a share of 10.82%, while HubS follows closely with 6.51%.

- Tibco Spotfire Datascience and Stata also make notable contributions, holding respective shares of 4.98% and 4.79%, respectively.

- However, a considerable portion of the market remains fragmented among various other players, collectively accounting for 58.32% of the market share.

Significant Areas of Technology Innovation for Companies Investing in Data and Analytics Technology

- Several significant areas of technology innovation have emerged for companies investing in data and analytics technology.

- Cloud computing, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), stands out as the leading area, capturing 48% of the investment.

- Artificial intelligence follows closely behind, with 35% of companies focusing on AI technologies.

- Software development and deployment also remain a key focus, with 32% of companies investing in this area.

- Additionally, the Internet of Things (IoT) and technology and business services, including IT services, each hold a share of 15% in technology innovation investments.

- Security, communications, storage, and computer infrastructure hardware each attract the attention of 11%, 10%, and 10% of companies, respectively.

Global Spending on the Internet of Things (IoT)

- In 2023, global spending on Internet of Things (IoT) technology reached 805 billion U.S. dollars, marking an increase from the previous year. However, the growth was lower than initially anticipated due to the impact of the global coronavirus pandemic.

- The initial forecast for worldwide IoT spending by 2023, estimated in 2019, was 1.1 trillion U.S. dollars.

- The Asia Pacific region held the largest share of the IoT market, followed by North America and Europe, the Middle East, and Africa.

- Security has emerged as a primary concern for businesses, with many European IoT adopters citing security improvement as their primary reason for adoption.

- In 2019, global spending on IT security exceeded 120 billion U.S. dollars. Other key motivations for IoT adoption include reducing operational costs and enhancing efficiency.

Use of Big Data Analytics Across Institutions

- Big Data Analytics has seen significant adoption and exploration across EU institutions, with noticeable trends between 2018 and 2019.

- In 2018, 60% of institutions reported implementing or launching Big Data Analytics initiatives, which increased to 64% by 2019.

- Pilot testing, however, experienced a slight decline from 11% in 2018 to 6% in 2019, indicating a shift from experimental phases to more mature stages of implementation.

- Similarly, the percentage of initiatives under development decreased slightly from 19% to 17% over the same period.

- Conversely, discussions surrounding the implementation of Big Data Analytics increased, rising from 8% in 2018 to 11% in 2019, suggesting a growing interest and deliberation within EU institutions regarding such technologies’ potential applications and benefits.

- Despite these fluctuations, the percentage of institutions reporting no activity in Big Data Analytics remained constant at 2% between 2018 and 2019.

Adoption of Key Analytical Technologies

- According to a survey, several technologies are poised for significant adoption over the next five years, with digital platforms and apps ranking highest, with 86.4% of organizations expressing a likelihood or increased likelihood of adoption.

- Education and workforce development technologies are closely behind at 80.9%, and big-data analytics at 80%.

- IoT and connected devices are also anticipated to see widespread adoption, with 76.8% of organizations considering adoption likely.

- Cloud computing and encryption/cybersecurity technologies are similarly high on the list, with 76.6% and 75.6% likelihood of adoption, respectively.

- E-commerce and digital trade, artificial intelligence, and environmental management technologies are also expected to see significant uptake, with adoption likelihood ranging from 74.9% to 75.3%.

Deployment of Advanced Analytics in Corporate Arena

- Legal services exhibit the lowest adoption of sophisticated advanced analytics, with only 10% of organizations utilizing these advanced techniques, while 90% resort to less sophisticated methods.

- Similarly, marketing departments have a relatively low adoption rate of sophisticated analytics at 18%, with 82% employing less advanced approaches.

- Human resources (HR) and finance sectors show a moderate adoption rate of sophisticated analytics, with 26% and 31%, respectively, while most organizations rely on less sophisticated methods.

- Real estate and procurement sectors mirror the adoption rates in finance, with 31% of organizations using sophisticated analytics.

- In contrast, IT departments have the highest adoption rate of sophisticated advanced analytics at 41%, indicating a greater propensity for leveraging advanced techniques in this domain.

Current Use of Advanced Analytics and Future Predictions

- In the current landscape, advanced analytics is employed in various capacities across industries, with differing levels of integration and adoption.

- Approximately 20% of organizations have embraced advanced analytics extensively, implementing it company-wide to inform decision-making and drive innovation.

- Another 41% selectively utilize advanced analytics, targeting specific areas or initiatives where its application is most beneficial.

- Moreover, 33% of organizations do not utilize advanced analytics but recognize its potential value and plan to incorporate it into their operations.

- However, a small percentage, accounting for 3% of respondents, do not intend to adopt advanced analytics or foresee its use in their future strategies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)