Table of Contents

AI Doorbell Market Overview

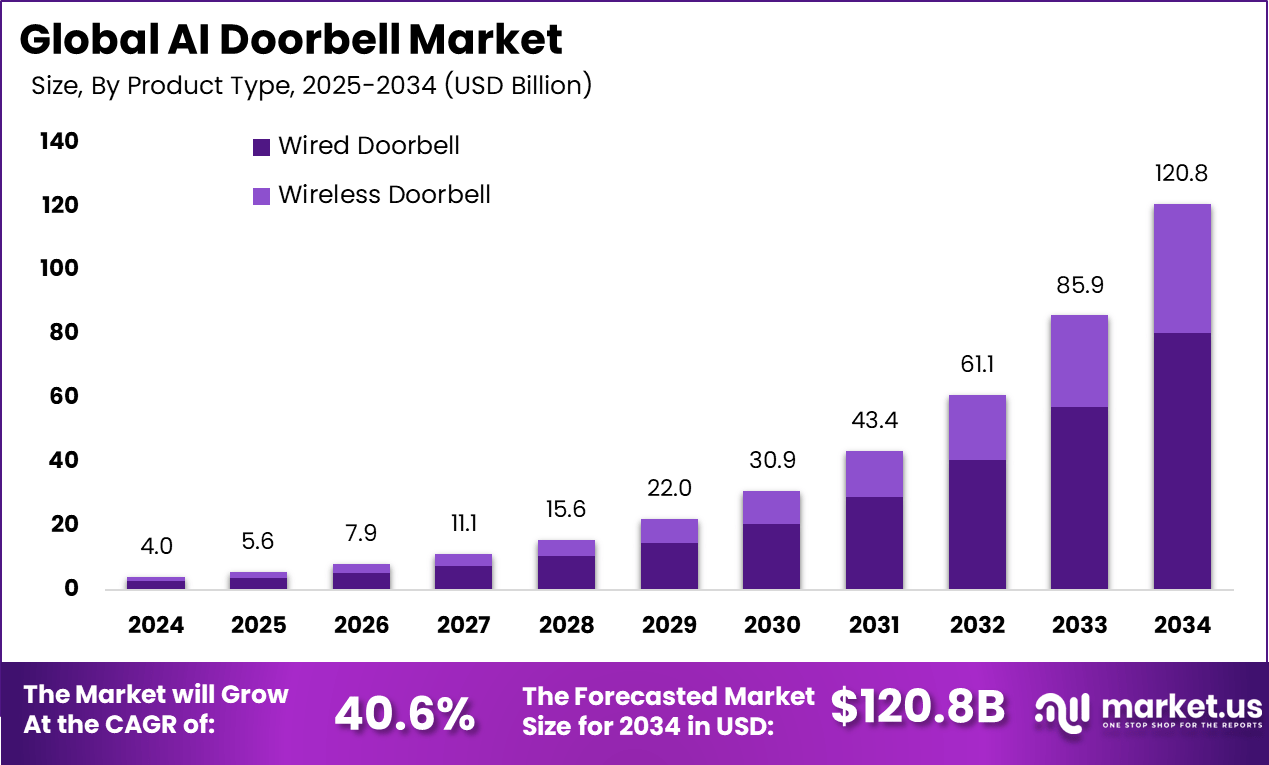

The Global AI Doorbell Market represents a high-growth investment opportunity, driven by rapid adoption of smart home security solutions and advances in AI-powered video analytics. With market value projected to surge from USD 4.0 billion in 2024 to USD 120.8 billion by 2034, the sector demonstrates exceptional scalability and long-term revenue potential. North America’s early adoption leadership, combined with rising consumer demand for connected security devices, positions the market favorably for sustained capital inflows and strategic investments.

The AI doorbell market is composed of smart doorbell devices that use artificial intelligence to enhance home and property access monitoring. These devices typically combine video cameras, motion sensors, microphones, and connectivity to offer users visibility and interaction with visitors through a mobile phone or connected home system. The integration of AI allows for advanced functions such as intelligent motion detection and differentiated alerts for people versus animals. The evolution of this segment is driven by growing security concerns and the trend toward connected living environments where devices work together for convenience and safety.

Consumer demand for AI-enabled doorbells is part of the broader smart doorbell ecosystem that emphasizes remote monitoring and automated analytics. The deployment of AI in these products is increasing the perceived value of these devices compared to traditional doorbells, making them an essential part of modern security systems. By providing real-time alerts and the ability to verify visitors remotely, AI doorbells are meeting core consumer needs for both safety and convenience.

Key Takeaways

- In 2024, wired doorbells accounted for 66.7% of the market, supported by consumer preference for consistent power supply and dependable operation.

- The residential segment held 60.4% share, reflecting increased adoption of smart home systems and heightened attention to home security.

- Natural language processing represented 40.4%, showing wider use of voice based interaction and intelligent control features.

- The offline segment captured 55.6%, indicating continued interest in systems that function locally without reliance on cloud services.

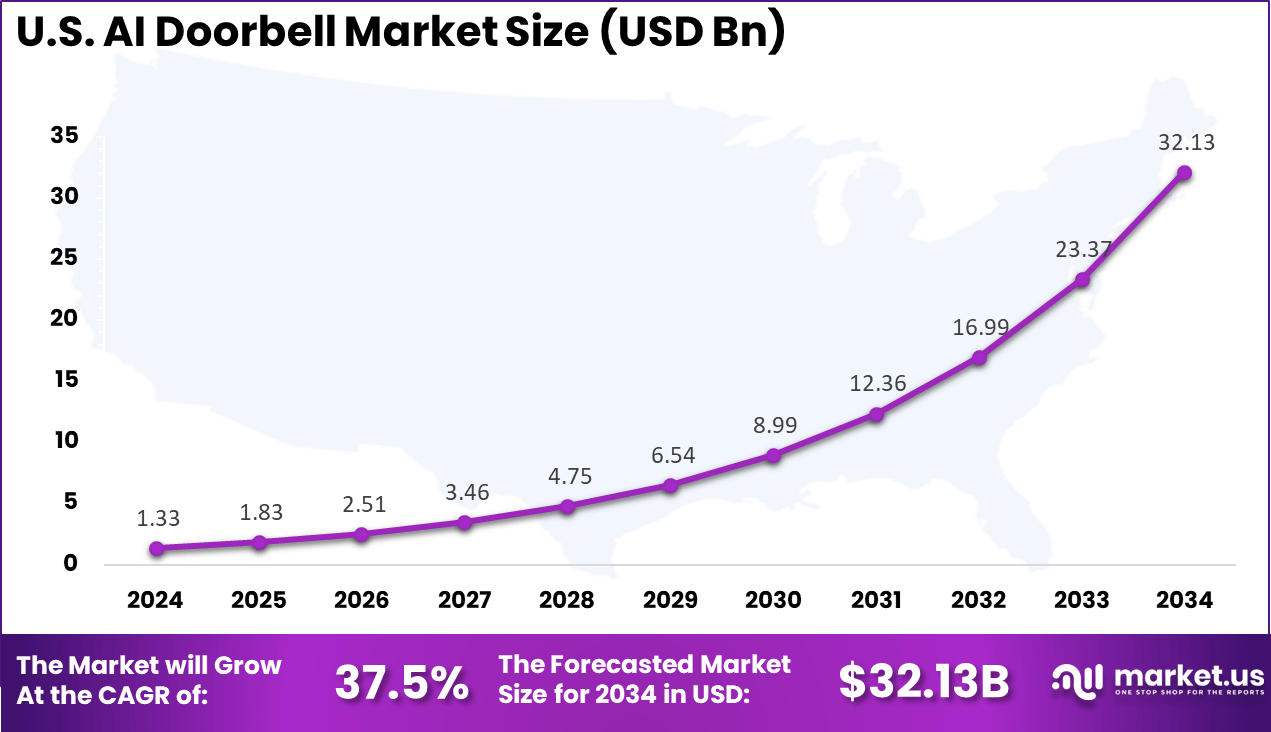

- The US market reached USD 1.33 billion in 2024 and is expanding at a 37.5% CAGR, driven by rapid uptake of connected home technologies.

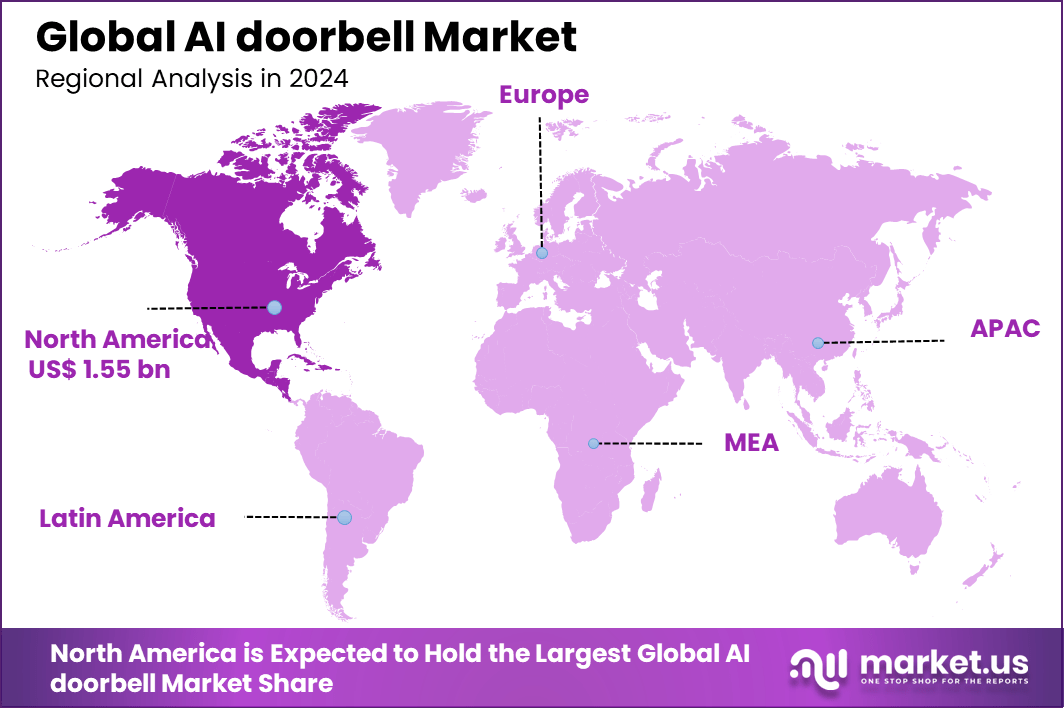

- North America accounted for more than 38.9% of global demand, supported by mature IoT infrastructure and growing consumer safety awareness.

Consumer Adoption and Feature Trends

- In 2023, more than 60% of new smart doorbells included AI based motion or person detection capabilities.

- By 2024, advanced features such as facial recognition and two way audio represented over 35% of new product sales.

- About 61% of consumers identified video doorbells as the most important smart home device in recent surveys.

- Around 45% of US households used a video doorbell in 2024, up from 42% in 2023, showing steady year over year growth.

- Ongoing concerns around package theft and household security continue to drive interest in AI enabled smart doorbell solutions.

Growth Driver Impact Analysis

| Key Growth Driver | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| Rising adoption of smart home security solutions | +9.2 | North America, Europe | Short to medium term |

| Increasing use of AI based facial recognition and motion analytics | +8.1 | North America, developed Asia Pacific | Medium term |

| Growth in residential video surveillance and remote monitoring | +7.4 | Global | Short term |

| Expansion of cloud and edge AI integration in consumer devices | +6.3 | North America, Asia Pacific | Medium to long term |

| Rising urbanization and demand for connected home ecosystems | +5.1 | Asia Pacific, Middle East | Long term |

Restraints Impact Analysis

| Key Restraint | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| High device and subscription costs for AI enabled features | -3.4 | Price sensitive markets | Short to medium term |

| Privacy and data protection concerns related to video analytics | -3.0 | Europe, North America | Medium term |

| Dependence on stable internet connectivity | -2.6 | Emerging markets | Medium term |

| Integration challenges with legacy home security systems | -2.1 | Global | Medium to long term |

| Regulatory scrutiny on biometric data usage | -1.7 | Europe, North America | Long term |

Investment Opportunities

Investment opportunities in the AI doorbell segment are emerging from technology integration and product diversification. As AI capabilities improve, companies are exploring more sophisticated analytics such as facial recognition and behaviour prediction. Ongoing enhancements to hardware and software create pathways for differentiated offerings in the broader security market.

Commercial applications also offer investment potential, as businesses seek cost-effective ways to manage access control and visitor logging. AI doorbell systems that integrate with enterprise security networks can provide value beyond residential use. These opportunities indicate that investments in product development and ecosystem partnerships may yield sustained interest from both consumer and commercial segments.

Business Benefits

The adoption of AI doorbells can improve operational efficiency for security service providers by automating surveillance tasks. AI-driven alerts reduce the need for manual monitoring, enabling providers to offer scalable solutions with lower overhead. Enhanced analytics also support subscription-based service models that can generate recurring revenue.

For end users, business benefits include improved perception of safety and control over access to property. The ability to receive detailed information about visitors in real time enhances peace of mind and contributes to a sense of personal security. These benefits make AI doorbells a compelling addition to contemporary home and property security strategies.

Investor Type Impact Matrix

| Investor Type | Strategic Objective | Risk Tolerance | Market Influence |

|---|---|---|---|

| Smart home device manufacturers | Expansion of AI enabled product portfolios | Medium | High |

| Consumer electronics brands | Entry into connected security ecosystems | Medium | Medium to High |

| Venture capital firms | High growth AI driven consumer IoT platforms | High | Medium |

| Private equity investors | Scalable recurring revenue from smart devices | Medium | Medium |

| Real estate technology investors | Value addition through smart home features | Low to Medium | Medium |

Technology Enablement Analysis

| Technology Enabler | Functional Role | Impact on Adoption | Adoption Timeline |

|---|---|---|---|

| Edge AI video processing | Real time recognition with reduced latency | Very High | Short term |

| Facial recognition and object detection models | Accurate visitor identification and alerts | High | Short to medium term |

| Cloud based video storage and analytics | Remote access and advanced insights | High | Medium term |

| Wireless connectivity and IoT protocols | Seamless device integration | Very High | Short term |

| AI driven anomaly and behavior detection | Proactive threat identification | Medium | Medium to long term |

U.S. AI Doorbell Market Size

The U.S. market for AI powered doorbells is expanding rapidly and is currently valued at USD 1.33 billion. The market is projected to grow at a strong CAGR of 37.5%, driven by rising adoption of smart home security solutions and increasing consumer demand for AI enabled monitoring features.

In 2024, North America held a dominant position in the global AI doorbell market, accounting for more than 38.9% of total market share. The region generated approximately USD 1.55 billion in revenue, supported by high adoption of smart home security solutions and strong consumer demand for AI enabled surveillance technologies.

Key Market Segments

By Product Type

- Wired Doorbell

- Wireless Doorbell

By End-User

- Residential

- Commercial

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing (NLP)

- Machine Vision

- Generative AI

By Distribution

- Offline

- Online

Top Key Players in the Market

- Ring Inc.

- Vivint, Inc.

- Smartwares Group

- Intelligent Technology Co. Ltd.

- Sky Bell Technologies Inc.

- Aeotec Technology (Shenzhen) Co., Ltd.

- Arlo Technologies Inc.

- August Home Inc.

- Eques Inc.

- iseeBell Inc.

- Other Major Players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.0 Bn |

| Forecast Revenue (2034) | USD 120.8 Bn |

| CAGR(2025-2034) | 40.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)