Table of Contents

Introduction

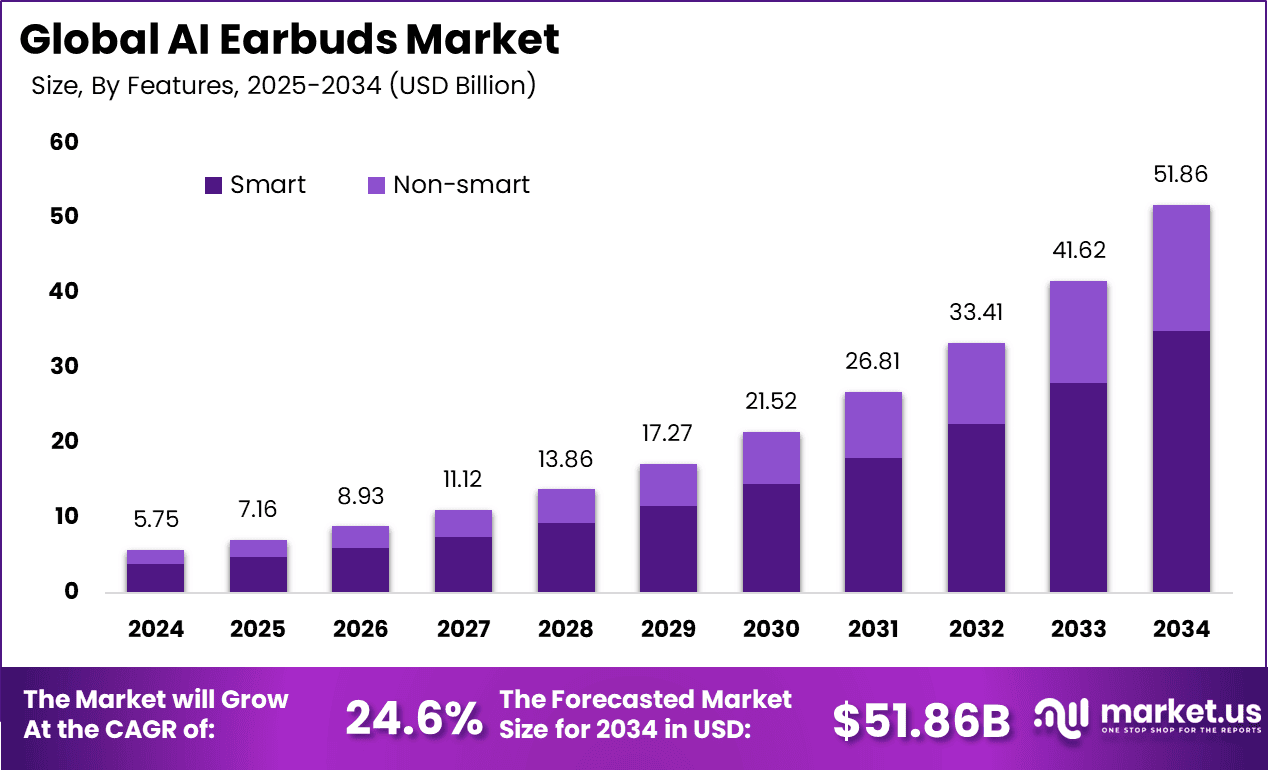

The global AI earbuds market is projected to reach USD 51.86 billion by 2034, rising from USD 5.75 billion in 2024 at a robust 24.6% CAGR from 2025 to 2034. In 2024, North America held a leading position with more than 36.4% market share, accounting for about USD 2.09 billion in revenue, reflecting strong early adoption of intelligent audio devices. This momentum is supported by a rapidly expanding user base, with around 4.88 billion smartphone users worldwide in 2024, representing roughly 60.4% of the global population and creating a large addressable market for AI-enabled hearables.

At the same time, music streaming applications generated approximately USD 53.7 Billion in revenue in 2024, a year on year increase of 12.5%, while paid music subscriptions reached nearly 818 million users globally, indicating a sizable pool of consumers who already rely on connected audio ecosystems and are likely to upgrade to AI powered earbuds that offer personalized sound, adaptive noise control, and real time voice assistance.

Key Takeaways

- Smart earbuds captured 67.5% of the market, which shows that users strongly prefer models with voice assistance, gesture control, and smarter audio functions.

- Deep learning based features accounted for 44.6%, indicating that buyers clearly value adaptive sound, personalized listening, and better noise control in their earbuds.

- The mid-range price band of USD 50–USD 150 held 55.6%, suggesting that most consumers want advanced AI features but still look for affordable pricing.

- Multi-brand electronic stores accounted for 45.7% of sales, suggesting that many buyers still prefer to compare brands in person before deciding to purchase.

- Fitness and gym users accounted for 40.6% of the customer base, reflecting strong interest in health tracking, biometric feedback, and workout-focused personalisation via AI earbuds.

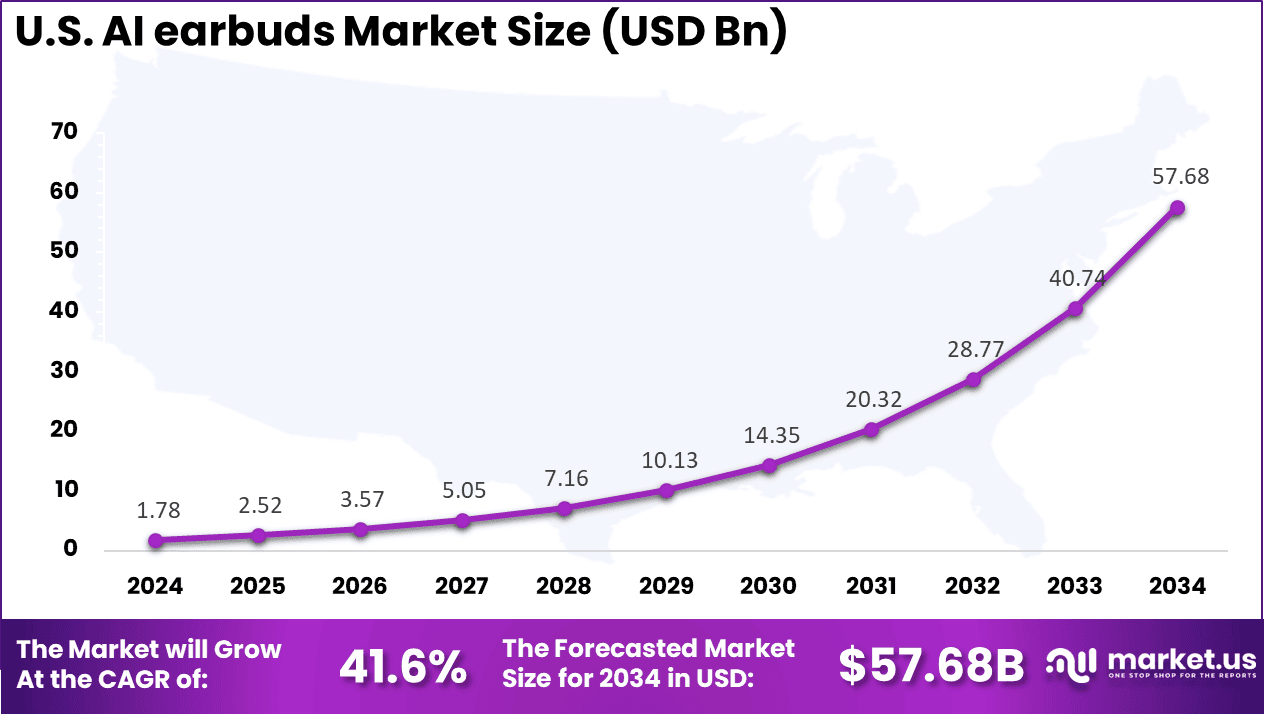

- The United States market reached USD 1.78 billion, supported by a high 41.6% CAGR, underscoring how quickly AI-based audio products are being adopted in one of the most mature consumer tech markets.

- North America accounted for 36.4% of global revenue, indicating that higher spending power and early integration of AI in wearables keep this region in a leadership position.

- In June 2025, OPPO introduced its Enco Buds3 true wireless AI earbuds, which offer up to 48 hours of total listening time with the charging case and around 9.5 hours of use per earbud on a single charge, showing how long battery life is becoming a key selling point.

- A quick 10-minute charge supports about 3 hours of playback, and the battery retains over 80% of its capacity after 1,000 charging cycles, signalling a strong move toward durability and lower replacement needs.

- Real time noise cancellation and smooth shifting between devices such as smartphones, tablets, and laptops are highly valued, as users increasingly expect uninterrupted and consistent audio across their daily ecosystem.

- The steady rise of online sales channels is making AI earbuds easier to access, which is helping overall shipment volumes grow as customers combine online research with fast delivery.

- Professional and enterprise use, including multilingual communication and virtual collaboration, is adding a new layer of demand, showing that AI earbuds are moving beyond personal entertainment into work and productivity use cases.

Request Sample Report Before Purchasing: https://market.us/report/ai-earbuds-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.75 Bn |

| Forecast Revenue (2034) | USD 51.86 Bn |

| CAGR(2025-2034) | 24.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Features (Smart, Non-smart), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Price Range (Premium Range (Greater than $150), Mid-Range ($50 – $150), Low Range (Less than $50), By Distribution Channel (Multi-Brand Electronic Stores, Hypermarket/Supermarket Stores, Online Stores, Others), By Application (Fitness & Gymming, Gaming, Music & Entertainment, Others) |

| Regional Analysis | North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA |

| Competitive Landscape | Hong Kong Future Intelligent Technology Co., Ltd., Laxis, Inc., Samsung, timekettle, Motorola Mobility LLC, Sony Corporation, Bose Corporation, Jabra, Google, Sennheiser, Xiaomi, Langogo, Translators Club, WeTalk, Pocketalk, Zytra, Others |

Consumer Trends

- In India, a 2024 JBL survey found that more than 54% of Gen Z and millennials already use AI powered audio devices, showing that younger, tech familiar consumers are driving early adoption and are ready to spend more in USD terms for smarter sound products.

- Around 33% of consumers say they prefer personalized sound that adjusts to their listening habits, which indicates that AI based audio tuning is becoming a key factor in how people choose devices, even when product prices are compared in USD.

- Nearly 30% of buyers place higher value on better voice recognition for smooth voice commands and calls, and this preference is guiding brands to improve microphones and AI algorithms to justify higher USD price points.

- About 20% of users look for more interactive listening experiences through AI features such as smart recommendations and contextual sound, which suggests that simple playback is no longer enough for many buyers in both INR and USD markets.

- Adaptive Active Noise Cancellation that changes automatically with the surrounding environment is now seen as a clear premium feature, and many consumers accept paying extra in USD for models that provide stronger isolation and comfort in daily use.

- At present, premium AI audio devices lead overall adoption, but it is observed that brands are steadily adding these advanced AI functions into more affordable models so they can reach wider income groups, defend market share, and compete better on value when prices are compared globally in USD.

U.S. AI Earbuds Market Size

- The U.S. AI earbuds market is expanding quickly and is currently valued at USD 1.78 Billion, showing strong momentum across the country.

- A projected growth rate of 41.6% indicates that demand is rising as consumers look for smarter and more convenient audio devices.

- Growth has been supported by the shift toward earbuds that improve daily tasks through AI features such as real time assistance and personalized sound.

- Consumer preference is moving toward devices that make communication easier and more productive, which is strengthening market adoption.

- In January 2025, at CES, Laxis introduced its AI powered OSO earbuds in the U.S., and this highlighted how the country continues to lead innovation in AI based audio devices.

- These earbuds offer real time meeting transcription, AI generated summaries, and instant question answering, which shows how productivity focused features are shaping market growth.

- North America was observed to lead the Global AI Earbuds Market in 2024, as it captured more than 36.4% of the total share and generated USD 2.09 million in revenue.

- This leadership was attributed to the region’s strong technology infrastructure that supports faster adoption of AI features in consumer electronics.

- High ownership of smart devices across the US and Canada further increased the willingness of consumers to upgrade to AI-enabled earbuds, strengthening the region’s overall market influence.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Segmentation Analysis

- In 2024, the Smart segment held a dominant position in the Global AI Earbuds Market, capturing 67.5% share. This segment is growing because users now expect more than simple audio playback from their devices. Smart earbuds with voice assistants, adaptive noise cancellation, and real-time language translation are preferred, as these features support busy, multitasking lifestyles. These capabilities help users stay connected and productive without needing to handle their phones all the time.

- In 2024, the Deep Learning segment held a leading role in the technology landscape of AI earbuds, accounting for 44.6% of the market. This technology enables better speech recognition, stronger noise suppression, and smarter audio adjustments based on the surrounding environment. Deep learning models analyze ambient sounds and user behavior to deliver more accurate and personalized audio, which improves responsiveness and ease of use in changing conditions.

- In 2024, the Mid Range price band between USD 50 and USD 150 captured a dominant 55.6% share of the Global AI Earbuds Market. This range is favored because it offers a strong balance between cost and features. Consumers in this bracket typically gain access to noise cancellation, voice assistant integration, and reliable battery life at an accessible price, which makes these products attractive for value conscious buyers who still expect solid performance.

- In 2024, Multi-Brand Electronic Stores held a leading 45.7% share in the distribution of AI earbuds worldwide. The strength of this channel is explained by the importance of hands on experience for buyers of advanced audio devices. Consumers prefer to test sound quality, comfort, and fit in person and often rely on in store experts before making a purchase decision, especially when evaluating AI enabled functions that are difficult to judge online.

- In 2024, the Fitness and Gymming application segment accounted for a dominant 40.6% share of AI earbuds usage. Health oriented users are increasingly choosing earbuds that provide sweat resistance, secure and comfortable fit, and basic health tracking such as heart rate and activity monitoring. The demand is rising for devices that combine strong audio performance with fitness and wellness features, reflecting the broader shift toward active and health conscious lifestyles.

Key Market Segments

By Features

- Smart

- Non-smart

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Others

By Price Range

- Premium Range (Greater than $150)

- Mid-Range ($50 – $150)

- Low Range (Less than $50)

By Distribution Channel

- Multi-Brand Electronic Stores

- Hypermarket/Supermarket Stores

- Online Stores

- Others

By Application

- Fitness & Gymming

- Gaming

- Music & Entertainment

- Others

Top Key Players in the Market

- Hong Kong Future Intelligent Technology Co., Ltd.

- Laxis, Inc.

- Samsung

- timekettle

- Motorola Mobility LLC

- Sony Corporation

- Bose Corporation

- Jabra

- Sennheiser

- Xiaomi

- Langogo

- Translators Club

- WeTalk

- Pocketalk

- Zytra

- Others

Role of AI Impact

- Generative AI is strengthening personalization in AI earbuds, as shown by a JBL survey in India where 54% of users have already adopted AI-enabled audio devices, 43% say they appreciate intelligent playlist curation and automatic audio optimization, and 83% want AI-powered, emotionally driven music experiences, which positions generative recommendation and sound-scoring models as a core differentiator for future earbuds.

- AI is becoming central to sound-quality optimization in earbuds because Qualcomm’s State of Sound research, based on 7,000 smartphone users, reports that 73% of listeners say they ensure sound quality improves with every device purchase and 69% list lossless audio as a likely purchase driver, which encourages vendors to embed AI codecs, upscalers, and adaptive EQ engines directly into AI earbuds.

- AI-driven hearing personalization is turning earbuds into quasi-hearing-assistance devices, since one analysis of the same Qualcomm study notes that 60% of consumers see a one-time hearing test and personalized audio as a likely purchase driver and this interest rises to more than 80% in China and India, so AI models that tune frequency response to each ear are becoming a key role for AI earbuds rather than a niche feature.

- AI algorithms are being used to handle difficult listening environments, because survey data indicate that 61% of respondents report trouble hearing clearly in noisy workplaces or lecture halls and 29% already use earbuds to reduce background noise, which supports investment in AI-based adaptive noise cancellation and scene detection that constantly adjusts ANC strength and transparency levels.

- Deep learning models are improving call clarity in AI earbuds, as shown by the VibOmni system for earables that achieves up to 21% improvement in Perceptual Evaluation of Speech Quality, 26% gain in signal-to-noise ratio and about 40% reduction in word error rate, with 87% of 35 test users preferring it over baselines, which demonstrates how AI speech enhancement directly raises the performance benchmark for premium AI earbuds.

- Real-time neural networks are enabling AI earbuds to offer advanced binaural speech enhancement on consumer hardware, illustrated by the ClearBuds prototype where the AI model runs in about 21.4 milliseconds on a mobile phone, keeps synchronization error below 64 microseconds between the two earbuds, and is validated through 37 participants who rated 1,041 real-world audio samples over 15.4 hours, which proves that AI processing can fit into the power and latency limits of commercial earbuds.

- Generative and large-model AI is expanding the role of earbuds into real-time language tools, since a spatial speech translation prototype for hearables reaches a BLEU score of up to 22.01 when translating between languages in noisy multi-speaker environments, showing that AI earbuds can evolve into in-ear translators that preserve each speaker’s direction and voice characteristics while generating translated speech.

- AI is also reshaping everyday usage patterns for earbuds, with commentary on Qualcomm’s State of Sound study indicating that daily earbud use has risen to around 58% of respondents compared with 26% earlier, while 68% say they would like to use the same earbuds or headphones for music, gaming and calls, which makes AI assistants, conversational interfaces, and generative-AI features more commercially important because a single device must serve many contexts.

- AI features are becoming a driver for immersive and spatial listening experiences in AI earbuds, as earlier State of Sound work on spatial audio reports that about 73% of consumers are aware of spatial audio, 41% would pay more to have it in their next true wireless earbuds and 56% say its presence would influence purchase decisions, so AI models that generate or optimize head-tracked spatial scenes and room corrections now play a visible role in product positioning.

- Generative AI assistants are beginning to be embedded directly into earbuds, illustrated by recent headphone updates that integrate a conversational AI assistant and support for Bluetooth LE Audio sharing, allowing one phone to stream to two headsets at once, and this kind of integration means AI earbuds are shifting from passive audio endpoints to interactive, context-aware companions that can summarize content, manage notifications and support productivity while users are mobile.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)