Table of Contents

Introduction

A semiconductor is a material with electrical conductivity between that of a conductor and an insulator. It enables controlled flow of electrical current, which makes it a critical component in modern electronic devices such as computers, smartphones, and other digital systems. Semiconductors form the foundation of integrated circuits and microchips used in various technology applications. The semiconductor industry plays a pivotal role in supporting advancements in fields like artificial intelligence, electric vehicles, wireless communication, and data storage.

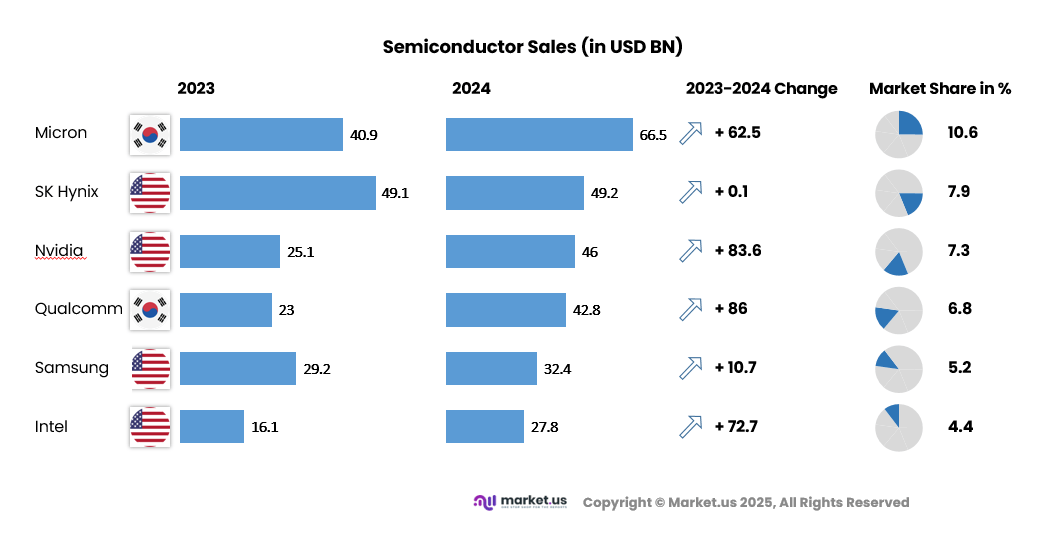

In recent years, growth has been driven particularly by demand for chips used in generative AI and data center infrastructure. For example, semiconductor sales grew by about 19% in 2024, with AI-related chips accounting for over 20% of total chip sales that year. Overall, nearly a trillion chips were sold in 2023 with an average price of around 61 cents per chip. Specialized chips for AI workloads and automotive applications are gaining prominence over general-purpose chips.

Statistics highlight the semiconductor sector’s significance to technology growth. For instance, the AI chip market alone was worth over $125 billion in 2024 and is projected to grow substantially. About 70% of semiconductor industry growth is concentrated in automotive, wireless communication, and computation/storage industries, reflecting broad technology adoption across sectors.

Semiconductor Market Size

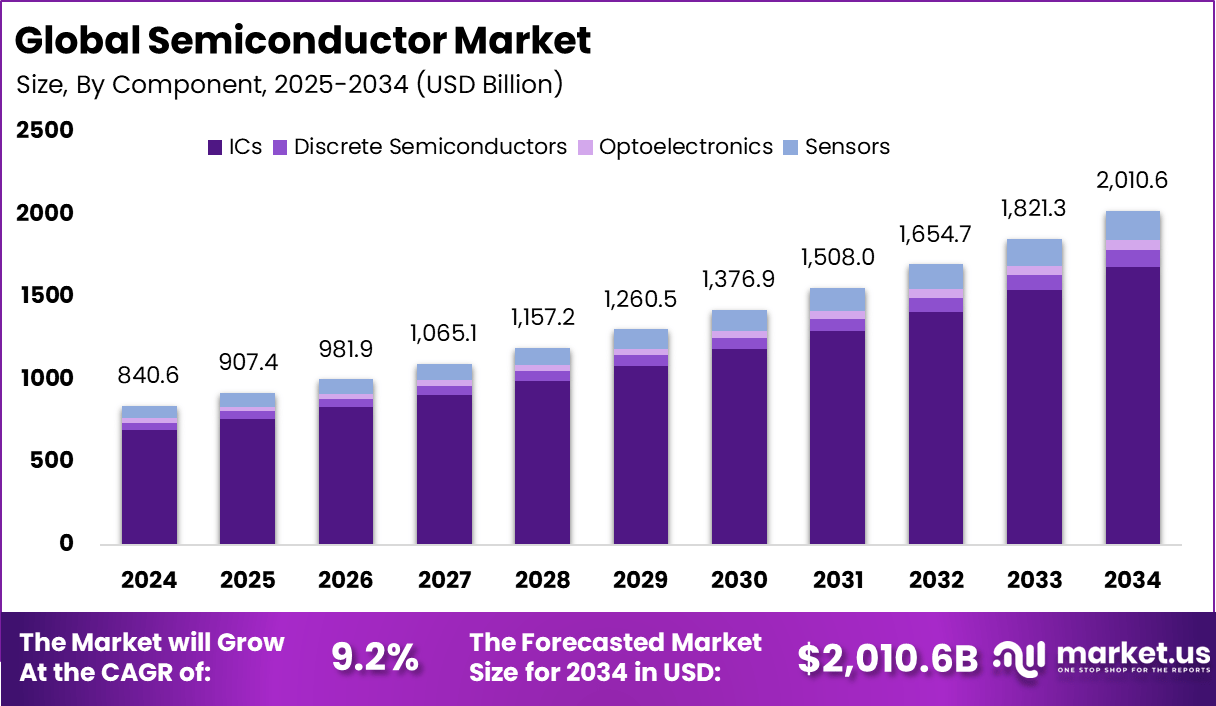

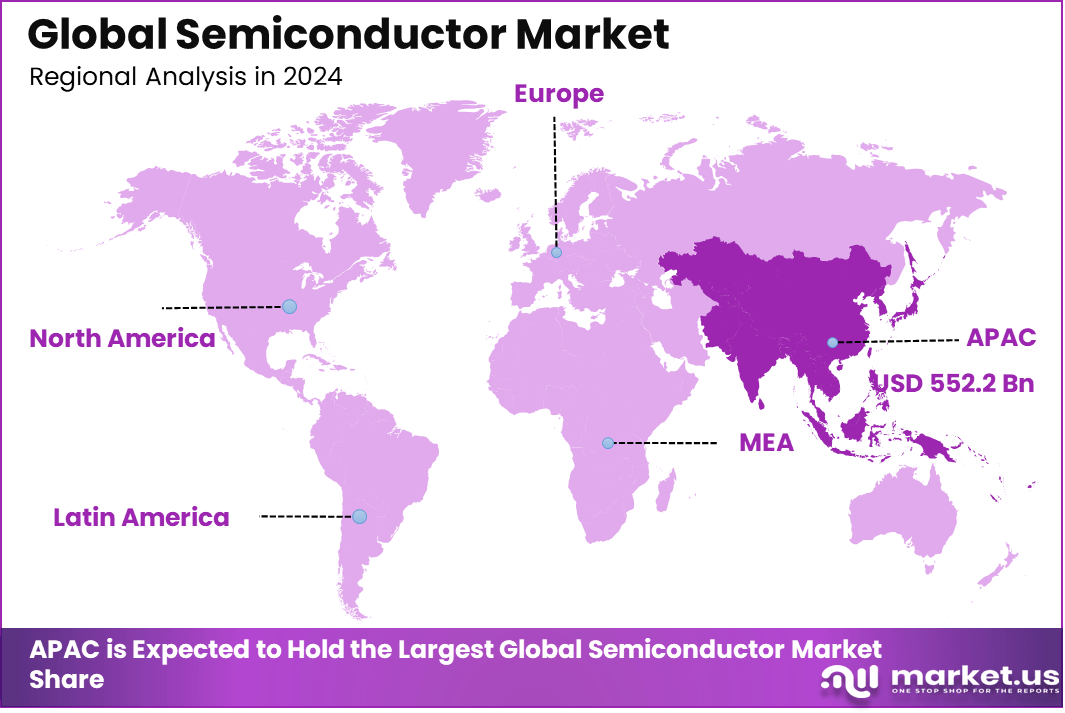

The global semiconductor market was valued at USD 840.60 billion in 2024 and is expected to rise from USD 907.4 billion in 2025 to about USD 2,010.6 billion by 2034, reflecting a CAGR of 9.20% from 2025 to 2034. The Asia Pacific region led the market in 2024 with more than 65.7% share, generating nearly USD 552.2 billion in revenue due to its strong manufacturing ecosystem and expanding fabrication capacity.

According to the Semiconductor Industry Association, global semiconductor sales reached USD 208.4 billion in the third quarter of 2025, marking a 15.8% increase over Q2. Monthly sales for September 2025 totaled USD 69.5 billion, up 25.1% from USD 55.5 billion in September 2024 and 7.0% above August 2025. Sales data is compiled by the World Semiconductor Trade Statistics and reflects a three month moving average.

Top Market Takeaways

- In 2024, the ICs segment led the market with a commanding 83.1% share, reflecting the central role of integrated circuits in electronics, automation, and digital infrastructure.

- Networking and communications dominated by application with 37.8% share, driven by rising demand for high-speed connectivity, data center expansion, and 5G deployments.

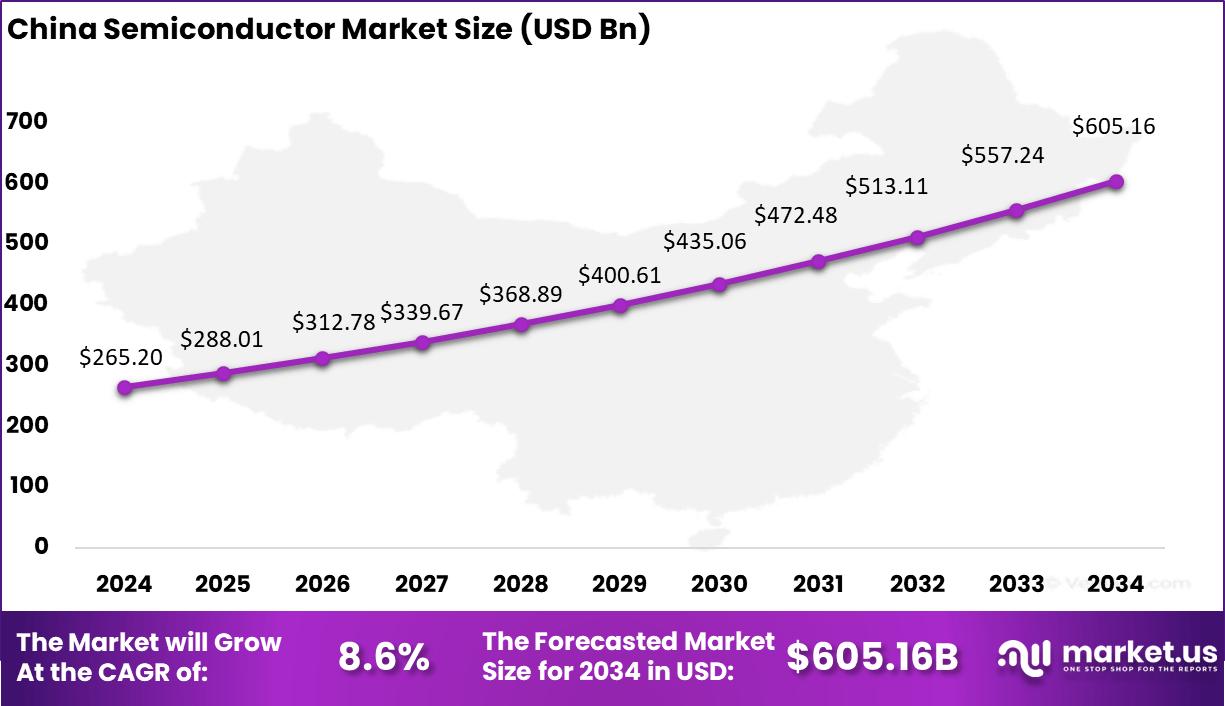

- The China semiconductor market reached USD 265.2 billion in 2024 and is expanding at a strong CAGR of 8.6%, supported by manufacturing capacity, domestic demand, and government-backed innovation initiatives.

- Asia Pacific maintained a dominant global position with over 65.7% share, driven by large-scale manufacturing hubs, strong consumer electronics production, and continued investment in advanced semiconductor technologies.

AI Impact Analysis on Semiconductor Industry

AI integration into the semiconductor industry enhances design processes, manufacturing efficiency, and supply chain management. It enables faster chip development, better defect detection, and predictive maintenance, addressing key challenges in producing complex, high-performance components. These advancements position the sector for greater innovation amid rising demand for advanced technologies.

Chip Design Optimization

AI streamlines the transition from high-level logic to physical chip layouts by analyzing design patterns and optimizing logic structures. Algorithms identify efficient pathways, balance power usage with performance needs, and reduce timing issues proactively. This reduces manual iterations and accelerates development timelines while improving overall chip reliability.

Neural networks and genetic algorithms further refine designs by recognizing complex patterns and evolving optimal configurations from vast datasets. These tools automate layout generation, minimize human error, and explore innovative solutions beyond traditional methods. As a result, designers achieve higher precision in areas like low-power synthesis and place-and-route stages.

Manufacturing and Yield Improvement

In production, AI analyzes sensor data to detect wafer defects early, boosting output quality and reducing waste. Predictive models forecast equipment failures, enabling timely maintenance that cuts downtime and optimizes resource use. Real-time adjustments in processes like lithography and etching ensure consistent performance across fabrication runs.

AI also enhances quality control through automated optical inspection and defect classification on wafers and devices. By learning from historical data, systems predict yield variations and refine parameters for better throughput. This leads to more efficient silicon utilization and lower operational costs in high-volume environments.

Verification and Testing Enhancements

AI-powered tools excel at identifying design weaknesses through pattern recognition trained on extensive simulation data. They simulate real-world conditions more accurately, closing gaps between virtual tests and actual performance. Early flaw detection allows corrections before production, enhancing chip dependability.

Machine learning automates test scenario generation, covering edge cases that manual methods often miss. This speeds up validation cycles and improves prediction of issues like timing violations. Overall, verification becomes more adaptive, supporting complex nodes in modern semiconductor architectures.

Supply Chain and Demand Management

AI forecasts demand by processing market trends and historical sales data, aiding inventory planning. It mitigates risks from disruptions by modeling scenarios and suggesting resource reallocations. This builds resilience, especially in volatile global supply networks. Dynamic analytics optimize material flows and production scheduling in real time. Manufacturers adjust to shifts like regional expansions or trade pressures more effectively. Enhanced visibility reduces shortages and supports scalable operations across segments.

Research and Material Innovation

AI accelerates discovery of new materials and processes through simulations that test architectures rapidly. Predictive models cut trial-and-error phases, enabling exploration of energy-efficient designs for edge computing and specialized workloads. This fosters breakthroughs in chip capabilities tailored to emerging needs.

In R&D, AI handles massive datasets to propose novel configurations, shortening development cycles. It supports customization for applications like data centers and telecommunications, where real-time processing demands evolve quickly. Innovation gains pace, aligning with industry shifts toward specialized semiconductors.

Key Challenges in Adoption

Data quality poses hurdles, as AI requires clean, comprehensive datasets for reliable outcomes; gaps lead to biased results. Complex algorithms struggle with unpredictable design variations, demanding ongoing refinement. Interpretability remains an issue, with “black box” decisions eroding trust among engineers. Tool integration into existing workflows creates compatibility barriers, slowing deployment. High computational needs and skill gaps further complicate scaling. Addressing these requires collaborative efforts to embed AI seamlessly without disrupting established processes.

Strategic Implications for the Sector

Value creation concentrates among top performers leveraging AI for AI-specific components, while others face margin pressures. Expanding Chinese market players intensify competition, squeezing non-AI segments. Firms must explore adjacencies, consolidate, and deploy AI internally for productivity. Geopolitical tensions and talent shortages amplify needs for resilient models. AI enables rewiring operations, from sales to sustainability, unlocking efficiencies. Long-term, it drives a shift toward solution-oriented plays beyond core manufacturing.

Regional Insights

In 2024, APAC held a dominant market position in the global Semiconductor Market, capturing more than a 65.7% share. This substantial market share can primarily be attributed to the region’s robust manufacturing capabilities and the heavy concentration of semiconductor fabrication plants, particularly in countries such as Taiwan, South Korea, and China.

China Semiconductor Market Size

Semiconductor Market Share by country (%), 2020-2024

| By Country | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| China | 49.8% | 49.3% | 48.9% | 48.5% | 48.0% |

| Japan | 15.1% | 15.2% | 15.2% | 15.3% | 15.3% |

| South Korea | 8.8% | 8.7% | 8.7% | 8.7% | 8.6% |

| India | 9.8% | 10.2% | 10.5% | 10.9% | 11.2% |

| Australia | 3.8% | 3.7% | 3.7% | 3.7% | 3.6% |

| Singapore | 3.9% | 4.0% | 4.1% | 4.2% | 4.3% |

| Thailand | 2.3% | 2.4% | 2.4% | 2.4% | 2.4% |

| Vietnam | 2.9% | 3.2% | 3.4% | 3.2% | 3.1% |

| Rest of Asia Pacific | 3.6% | 3.6% | 3.5% | 3.4% | 3.4% |

Emerging Trends in Semiconductor Industry

One major emerging trend is the expansion of AI compute and custom silicon, where cloud and enterprise spending is sharply increasing on AI-specific chips. For example, AI semiconductor revenues have shown year-over-year growth rates near 70%, reflecting strong market adoption. Another key trend involves advanced packaging technologies like chiplets and 3D ICs, which are being rapidly expanded to meet performance and power demands.

High bandwidth memory (HBM) is also gaining importance, contributing 20% of DRAM revenue and rising due to AI and computing needs. Regulations mandating safety features in automotive chips are prompting growth in the automotive semiconductor segment, where silicon content per vehicle is increasing significantly. Supply chain geography is shifting as geopolitics and re-shoring fragment the market into multi-region footprints, while sustainability concerns are becoming cost factors in manufacturing.

The semiconductor industry is also focusing on edge AI, photonics, and power backbones like SiC and GaN for electric vehicle charging and data centers. These trends illustrate a diversification in semiconductor applications combined with a deepening focus on energy-efficient, high-performance components.

Growth Factors

A key growth driver remains the rising global demand for AI, IoT, and 5G technologies, which expands the need for faster, more powerful semiconductors. Data center growth fueled by cloud computing and e-commerce platforms further raises semiconductor consumption, especially in logic and memory chips, which have seen revenue increases over 20% year-over-year in some categories.

Additionally, the electrification of vehicles is boosting demand for automotive semiconductors, particularly those related to advanced driver assistance systems and electric powertrains. Memory semiconductor devices show solid growth, driven by data infrastructure needs and expanding digital economies.

Government investments and corporate strategies aimed at reducing dependency on imports and strengthening domestic manufacturing capacity also support industry expansion. As performance and efficiency requirements grow more complex, innovation in semiconductor materials, chip design, and manufacturing processes helps the industry maintain pace. The continuous push for energy-efficient computing and renewable energy solutions further propels semiconductor development to meet future technology demands.

Semiconductor Market Companies

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

- Samsung

- NVIDIA

- Intel Corp.

- Broadcom Inc.

- Qualcomm Inc.

- SK Hynix

- Applied Materials, Inc.

- Advanced Micro Devices (AMD)

- Micron

- Other key players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 840.6 Bn |

| Forecast Revenue (2034) | USD 2,010.6 Bn |

| CAGR (2025-2034) | 9.2% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Explore More Reports

- North America Semiconductor Market

- Aerospace Semiconductor Market

- Space Semiconductor Market

- Power Semiconductor Market

- Wide Bandgap (WBG) Semiconductor Market

- Compound Semiconductor Market

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)