Table of Contents

Introduction

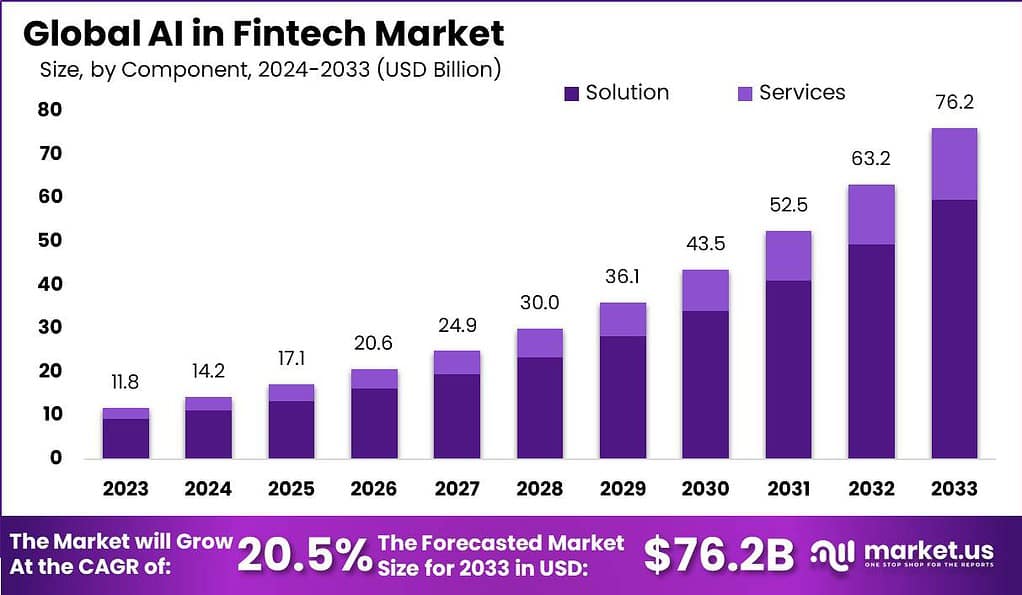

The global market for AI in Fintech is expected to grow significantly, from USD 11.8 billion in 2023 to approximately USD 76.2 billion by 2033. This growth is projected to occur at a CAGR of 20.5% during the forecast period from 2024 to 2033. This remarkable expansion is driven by several key factors, challenges, and recent developments that are shaping the industry landscape.

The AI in Fintech market is being propelled by the increasing adoption of cloud-based solutions, which offer cost-effective, scalable, and flexible infrastructure for deploying AI applications. These solutions enable financial institutions to easily adjust their AI capabilities according to demand, facilitating real-time global collaboration and compliance with stringent security measures. Furthermore, the utilization of AI in applications such as virtual assistants (chatbots), credit scoring, quantitative and asset management, and fraud detection is driving market growth. These applications leverage AI’s ability to process and analyze large datasets, improving operational efficiency, customer service, and decision-making processes in the financial sector.

Recent developments in the AI in Fintech sector highlight significant trends, partnerships, and investments that shape the future of financial technologies. For example, Zest AI and Equifax collaborated in August 2022 to enhance credit access through better scoring, marking Zest AI’s first major distribution deal with a National Consumer Reporting Agency. Additionally, Versapay acquired DadeSystems in April 2022, expanding its accounts receivable automation solutions and AI capabilities.

The U.S. government significantly increased its spending on AI contracts, reaching USD 3.3 billion in the fiscal year 2022, showcasing the growing investment in AI technologies.

Baiduri Bank partnered with Finbots.ai in February 2023 to modernize its credit risk management using AI, aiming to enhance financial inclusion for underserved markets. Scotiabank introduced Scotia Smart Investor, an AI-powered tool, to offer personalized investment advice.

Key Takeaways

- The AI in Fintech market is projected to witness robust growth, with an estimated CAGR of 20.5% from 2024 to 2033.

- By 2033, the AI in Fintech market is anticipated to reach a substantial valuation of USD 76.2 billion, indicating significant market expansion.

- In 2023, the global AI in Fintech market was valued at USD 11.8 billion, showcasing a strong foundation for future growth.

- According to industry sources, investments in AI-focused fintech companies exceeded USD 10 billion in 2023 alone, reflecting high market confidence and support for AI technologies.

- The Solution segment emerged as the dominant player in 2023, capturing a notable market share of over 78.3%.

- Similarly, the Cloud-Based deployment mode established a dominant market position in 2023, accounting for a significant share of over 62.9%.

- The Analytics & Reporting segment emerged as the leading application category in 2023, capturing a substantial market share of over 30.7%.

- North America led the global AI in Fintech market in 2023, capturing over 41.5% of the market share, indicating regional dominance.

- Among key regions, North America witnessed demand worth USD 4.9 billion for AI in Fintech in 2023, showcasing a strong market presence.

- Several prominent companies are leading the AI in Fintech market, including IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services Inc., and Nuance Communications Inc.

AI In Fintech Statistics

- 90% of fintech companies are leveraging artificial intelligence to enhance their services.

- 80% of these fintech firms are utilizing machine learning technologies.

- Advanced analytics stands out as the most popular machine learning use case in fintech.

- 80% of fintech companies identify access to quality data as a major challenge in implementing AI.

- By 2030, AI adoption in fintech is projected to increase employment in the finance industry by 20%.

- Fintech companies predominantly create and market AI-powered solutions, relying on autonomous decision-making systems and cloud-based offerings.

- The top three specific AI use cases in fintech are AI-enabled data analytics, fraud/anomaly detection and surveillance, and AI-enabled customer communication channels.

- Over 75% of fintech firms have integrated at least one machine learning, deep learning, or high-performance computing use case.

- Natural language processing (NLP) and large language models (LLMs) are employed by 26% of fintech companies, followed by recommender AI systems/next-best action (23%).

- Task automation is the primary motivator for adopting AI, cited by 20% of respondents in a Netguru study.

- Fintech companies leverage automation for various tasks, including data processing, payments, lending, investing, and portfolio management.

- 80% of fintech companies leverage machine learning, with advanced analytics, forecasting, and fraud detection as the top three use cases.

- ML is applied in process optimization, underwriting, predictive analysis, trading, investment, and fraud detection.

- NLP assists in advanced sentiment analysis, customer service via chatbots, document classification, and topic clustering.

- 36% of fintech companies have adopted computer vision technology, with biometric authentication, facial recognition, and document verification as primary applications.

- Mastercard employs AI across its operations, focusing on financial security and HR recruitment.

- Chime utilizes machine learning to drive insights for product decisions and marketing strategies.

- SoFi leverages AI for efficient credit underwriting and wealth management services.

- Stripe enhances customer experience and fraud management with AI, incorporating GPT-4 technology.

- Affirm uses AI-powered underwriting systems to democratize financing and minimize risk.

- 44% of fintech companies report significant cost savings through AI implementation.

- AI enables innovative solutions, leading to better customer experiences and higher satisfaction.

- Enhanced customer experiences through AI-driven chatbots and virtual assistants drive customer loyalty.

- Regulatory complexities hinder AI implementation in 40% of fintech firms.

- AI adoption is expected to reduce operating costs by 22% in the financial services industry by 2030.

Use Cases

- Fraud Detection and Management: With global fraud losses projected to reach $44 billion by 2025, AI-based solutions are increasingly crucial for detecting fraudulent activities and managing compliance. AI’s ability to analyze user behavior and identify anomalies plays a pivotal role in enhancing the security and integrity of financial transactions.

- Financial Advisory Services: AI-driven financial advisory services are on the rise, aiming to democratize access to personalized financial advice. By analyzing vast amounts of data, AI can provide tailored investment recommendations and strategies, catering to the needs of individuals lacking the time or expertise to manage their finances effectively. The anticipated user base for AI in asset management is expected to surge to 478.89 million by 2025, underscoring the growing reliance on AI for financial planning and decision-making.

- Credit Decisions: AI’s precision in analyzing diverse data points for credit assessments allows for quicker and more accurate credit decisions. This technological advancement not only streamlines the loan approval process but also enhances financial inclusion by evaluating creditworthiness using alternative data sources.

- Personalized Banking Experience: AI’s role in personalizing the banking experience is becoming increasingly important, with technologies like AI-powered chatbots offering customized financial advice and services. This personalized approach, leveraging data from various sources, significantly enhances customer engagement and satisfaction.

- Process Automation: In financial services, process automation through AI is eliminating the need for manual intervention in tasks such as market data analysis and investment management. This not only increases operational efficiency but also allows for more strategic resource allocation.

Recent Developments

- Advancements in Algorithmic Trading and Risk Assessment: AI’s role in developing new trading algorithms and strategies is expected to grow, including capabilities for trading in multiple markets and adapting to real-time market conditions. Similarly, AI is revolutionizing risk assessment in FinTech, enabling more accurate credit scoring and faster loan approvals by leveraging a wider range of data points.

- Increased Focus on Fraud Detection and Prevention: Machine learning algorithms are enhancing the ability to detect unusual transaction patterns and potential fraudulent activities in real-time. This shift towards AI-based security measures is crucial for increasing user confidence and securing FinTech applications against cyber threats.

- Enhancement of Customer Service through AI-powered Chatbots: The integration of AI-powered chatbots in FinTech solutions is set to become a standard, providing 24/7 customer support, handling inquiries, and managing basic tasks while personalizing interactions based on individual customer preferences.

- Personalized Financial Recommendations: AI is enabling the delivery of personalized recommendations for saving, investing, and budgeting by analyzing users’ financial behaviors. This trend towards personalization is expected to make financial services more accessible and tailored to individual needs.

- Regulatory Compliance and Streamlined Operations: AI is aiding FinTech companies in staying compliant with evolving financial regulations by automating compliance checks and reporting. Moreover, AI’s application in streamlining operations, such as loan processing and KYC checks, is anticipated to improve efficiency and reduce operational costs.

- Growth in Open Banking and Decentralized Finance (DeFi): The expansion of open banking and DeFi is set to redefine the financial services landscape. Open banking, facilitated by APIs, is enhancing customer experiences and creating new revenue streams, while DeFi, powered by blockchain, is driving a significant shift towards decentralized financial services.

- Behavioral Biometric Authentication Advances: With the rise in cyber threats, FinTech is increasingly adopting biometric authentication methods, including fingerprints and facial recognition, to secure access to applications and sensitive information.

- Moody’s 2024 AI Outlook: Moody’s Investors Service forecasts increased funding in AI, focusing on model improvement and edge computing, despite challenges such as the global shortage of GPUs. The growth in AI applications is particularly significant for the banking, financial services, and insurance sectors, with AI expected to be widely adopted market-wide by 2026.

Key Players Analysis

IBM Corporation

IBM is making significant progress in the AI in FinTech sector by leveraging AI and cloud computing technologies. Their approach focuses on improving financial services delivery through personalized solutions, improved risk and performance analysis, and innovative technologies such as AI and cloud. IBM’s initiatives like MySocialPulse and Yayzy illustrate their commitment to using AI and cloud for monitoring financial trends on social media and developing sustainable banking solutions, respectively. By prioritizing security, compliance, and a security-first mindset, IBM aims to drive innovation and digital transformation within the financial services industry, making it more resilient and agile.

Microsoft Corporation

Microsoft is working to improve financial inclusion in Latin America through AI and fintech innovations. By collaborating with fintech companies like Finvero, N5, and ClearSale, Microsoft leverages its cloud and AI technologies to help bridge the financial gap for millions of unbanked or underbanked individuals. These collaborations focus on providing real-time, AI-driven solutions for consumer lending, legacy system digital transformation, and fraud prevention, significantly contributing to the region’s digital economy expansion.

Google LLC

Google is enhancing the fintech sector through its advanced AI technologies. By integrating AI to automate and optimize various financial processes, from fraud detection to customer service, through its cloud services, Google is driving innovation and efficiency in financial services. Its investments and partnerships in AI-driven fintech startups further demonstrate its commitment to transforming the financial landscape by making financial services more accessible, secure, and user-friendly.

Amazon Web Services, Inc.

AWS is playing a crucial role in the transformation of financial services through AI and machine learning. By offering a broad and deep set of AI and ML services, AWS enables financial institutions to innovate at a rapid pace. These technologies are being used to automate and personalize customer experiences, enhance analytics, and improve efficiency on a secure, scalable, and resilient cloud platform.

Salesforce, Inc.

Salesforce has launched Einstein GPT, marking a significant advancement in CRM by introducing generative AI technology. This innovation aims to enhance customer interactions across sales, service, marketing, commerce, and IT by generating AI-created content, making every customer experience better and every employee more productive. With its integration with OpenAI, Salesforce offers customers out-of-the-box generative AI capabilities, further transforming customer engagement through personalized content generation.

Mastercard Inc.

Mastercard has launched Decision Intelligence Pro (DI Pro), a Gen AI-powered tool designed to enhance consumer protection by evaluating transaction risk. This advanced tool, building on the capabilities of its predecessor, DI, scans a trillion data points in real time to predict transaction authenticity, significantly boosting fraud detection rates and reducing false positives by over 85%.

Conclusion

The combination of AI and FinTech is leading the way for creative solutions that not only improve operational efficiency and customer experience, but also promote financial inclusion and market stability. As the industry keeps advancing, the strategic use of AI technologies will continue to be a significant factor for growth and change within the FinTech industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)