Table of Contents

Introduction

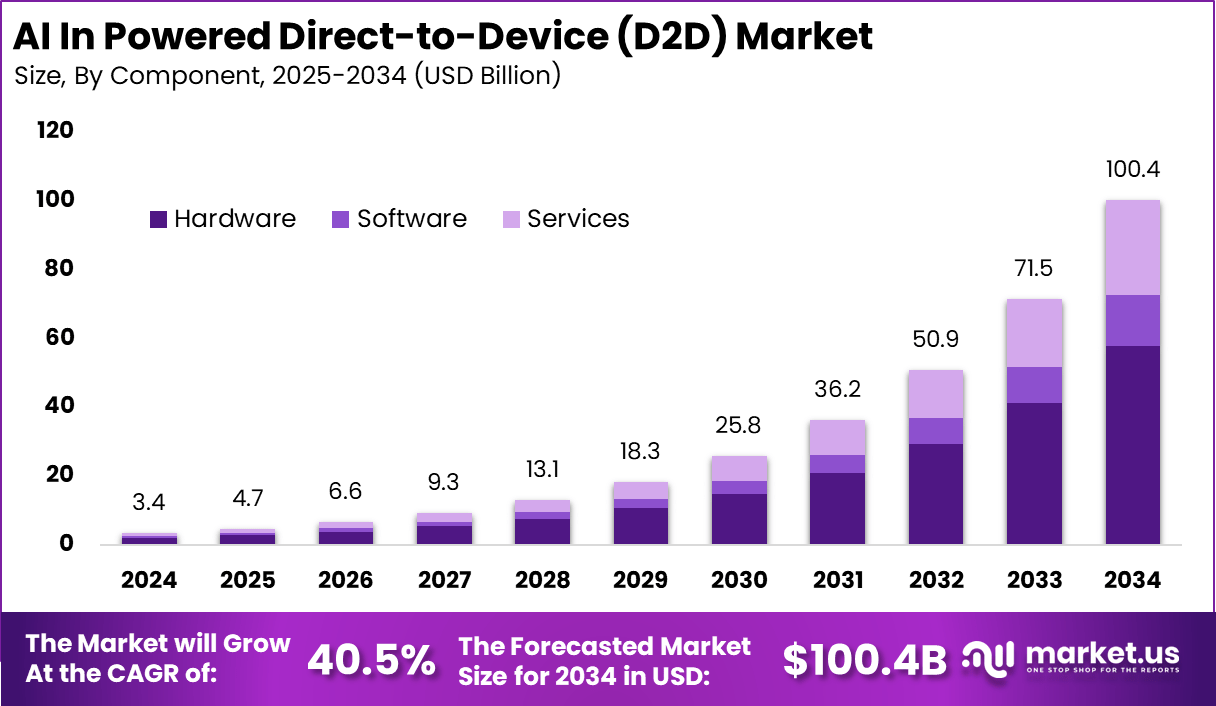

The Global AI-Powered Direct-to-Device (D2D) Market generated USD 3.4 billion in 2024 and is projected to grow from USD 4.7 billion in 2025 to nearly USD 100.4 billion by 2034, achieving an impressive CAGR of 40.5%. Growth is propelled by rising adoption of edge AI, on-device processing, real-time analytics, and privacy-centric applications across smartphones, wearables, IoT devices, and consumer electronics. North America dominated the sector in 2024 with a 36.6% revenue share amounting to USD 1.2 billion, fueled by advanced device ecosystems, strong AI investments, and rapid 5G integration.

How Growth is Impacting the Economy

The global rise of AI-powered D2D technology is significantly strengthening economic productivity by reducing reliance on cloud infrastructure, lowering data transfer costs, and enhancing real-time performance across sectors.

On-device AI supports faster decision-making, drives industrial automation, and boosts innovation across consumer electronics, automotive, healthcare, and enterprise mobility solutions. The technology supports economic resilience by enabling new digital services, reducing latency-dependent risks in critical applications, and unlocking new revenue channels for device manufacturers and app developers.

The market’s rapid expansion encourages investments in semiconductor fabrication, neural processing units, AI chipsets, and connectivity modules. Job creation is rising in embedded engineering, edge AI model optimization, and device security development. Countries developing strong D2D ecosystems experience enhanced competitiveness, domestic manufacturing growth, and greater digital independence. Overall, the economic impact is substantial as D2D AI becomes central to next-generation smart devices and connected technologies.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/ai-in-powered-direct-to-device-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses face higher costs related to AI chipset manufacturing, specialized NPUs, firmware optimization, and enhanced device security. Supply chains are pivoting toward localized chip production, diversified semiconductor sourcing, and partnerships with edge-AI hardware suppliers to mitigate global shortages and geopolitical risks.

Sector-Specific Impacts

Consumer electronics benefit from faster, more private, on-device intelligence. Automotive companies use D2D AI for in-car assistants, ADAS features, and predictive diagnostics. Healthcare applications leverage real-time biometric analytics and remote monitoring. Industrial players deploy edge AI in robotics, automation, and predictive maintenance systems.

Strategies for Businesses

Companies are prioritizing edge-optimized AI models, investing in custom chip design, and integrating low-latency AI capabilities into next-gen devices. Strengthening cybersecurity, partnering with telcos for 5G/6G-enabled D2D capabilities, and adopting privacy-by-design frameworks remain critical. Businesses are also developing hybrid AI models that balance edge processing with cloud scalability.

Key Takeaways

- Market expected to reach USD 100.4 billion by 2034

- Strong CAGR of 40.5% from 2025–2034

- North America leads with 36.6% market share

- Rising demand for on-device AI, edge analytics, and privacy-centric processing

- Semiconductor advancements driving D2D adoption

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165810

Analyst Viewpoint

The current market momentum is driven by the shift toward ultra-fast, secure, and low-latency device intelligence. Increasing smartphone and wearables penetration, combined with growth in IoT and automotive sectors, positions D2D AI as a core future technology. Over the next decade, innovations in neural engines, sensor fusion, and multimodal AI models are expected to unlock new capabilities. The long-term outlook remains highly positive, with D2D applications poised to become standard across global device ecosystems.

Use Case & Growth Factors Table

| Use Case | Description | Growth Factors |

|---|---|---|

| On-Device Assistants | Real-time voice, text, and gesture AI | Demand for faster and offline intelligence |

| Smart Wearables | Health & fitness analytics processed locally | Rising adoption of biometric monitoring |

| Automotive Edge AI | ADAS, in-car assistance, predictive safety | Growth of connected and autonomous vehicles |

| IoT Device Intelligence | Sensors processing data on the edge | Expansion of smart homes and industries |

| Enterprise Mobility | Secure on-device AI for workforce apps | Privacy requirements and reduced data transfer |

Regional Analysis

North America leads due to strong semiconductor ecosystems, early adoption of device-level AI, and large consumer electronics markets. Europe follows with growing demand for privacy-focused edge AI and automotive innovation. Asia-Pacific shows the fastest expansion driven by massive smartphone manufacturing, rising IoT deployments, and large-scale investments in AI-enabled chipset fabrication. Latin America and the Middle East are adopting D2D AI across telecom, retail, and industrial sectors, supported by digital transformation programs.

➤ Want more market wisdom? Browse reports –

Business Opportunities

Large-scale opportunities exist in edge AI chipsets, embedded neural processors, privacy-centric mobile apps, wearable AI analytics, smart home ecosystems, and industrial IoT automation. Device makers can differentiate through on-device generative AI, hybrid edge-cloud intelligence, and power-efficient AI processors. Additional opportunities arise in healthcare monitoring, connected vehicles, AR/VR devices, and secure enterprise mobility tools.

Key Segmentation

The market includes product categories such as AI-powered smartphones, wearables, embedded devices, automotive systems, and industrial IoT hardware. Key applications span voice assistants, predictive analytics, biometric processing, navigation systems, automation tools, and consumer personalization. End users include consumers, enterprises, automotive OEMs, healthcare providers, telecom operators, and industrial manufacturers adopting intelligence-at-the-edge for improved performance and security.

Key Player Analysis

Leading players focus on enhancing neural processing capabilities, improving on-device inference efficiency, and integrating multimodal intelligence into consumer and industrial devices. Strategies include developing custom AI chip architectures, optimizing AI models for low power consumption, expanding partnerships with device manufacturers, and building hybrid edge-cloud ecosystems. Companies emphasize security, firmware innovation, and regulatory compliance to expand market reach across global device industries.

- Apple Inc.

- MediaTek Inc.

- Nvidia Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- AST & Science, LLC

- Lynk Global

- Starlink

- Arm Limited

- Synaptics, Inc.

- Edgeimpulse, Inc.

- BrainChip

- Syntiant Corp.

- Other

Recent Developments

- February 2025: Launch of a next-generation neural processor designed for ultra-low-latency on-device AI.

- December 2024: Introduction of an upgraded D2D platform enabling fully offline generative AI functions.

- October 2024: Expansion of edge-AI partnerships with global smartphone and wearable manufacturers.

- August 2024: Release of real-time on-device vision models for AR/VR applications.

- June 2024: Deployment of an automotive-grade D2D AI engine for in-car safety systems.

Conclusion

AI-powered D2D technology is reshaping device intelligence through faster processing, enhanced privacy, and reduced cloud reliance. With rising demand across consumer electronics, automotive, and IoT ecosystems, the market is set for sustained long-term expansion and innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)