Table of Contents

- AI-powered Digital Humans Market Size

- Key Industry Highlights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Table

- Regional Driver Comparison

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Regional Analysis

- Key Market Segments

- Report Scope

AI-powered Digital Humans Market Size

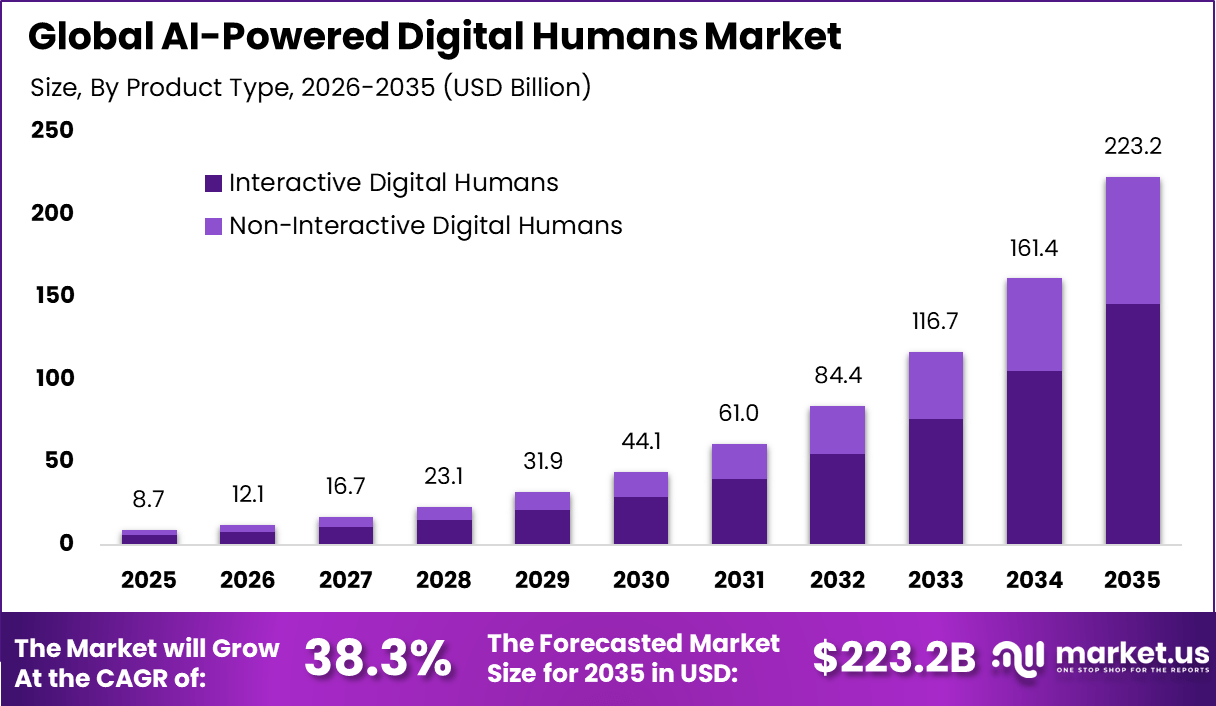

The global AI powered Digital Humans market was valued at USD 8.7 billion in 2025 and is expected to expand rapidly over the forecast period. The market is projected to reach approximately USD 223.2 billion by 2035, growing at a strong CAGR of 38.3% from 2026 to 2035. This growth is driven by rising adoption of AI driven virtual assistants, digital avatars, and human like interfaces across customer service, media, healthcare, and education. Advancements in natural language processing, computer vision, and generative AI are further accelerating market development.

The AI powered digital humans market refers to virtual human-like entities created using artificial intelligence, computer graphics, and speech technologies. These digital humans simulate realistic facial expressions, voice, gestures, and conversational behavior. They are used in customer service, marketing, education, healthcare, gaming, and virtual assistance applications. AI powered digital humans interact with users in real time through text, voice, and visual interfaces. Adoption supports more engaging and human-like digital interactions.

Market development has been influenced by the growing need for scalable and interactive digital communication. Traditional chatbots and avatars often lack emotional depth and realism. AI powered digital humans provide more natural and intuitive engagement. Improved realism enhances user trust and experience. As digital interaction increases, demand for human-like interfaces grows.

Key Industry Highlights

- Interactive digital humans led by product type with 65.4%, driven by rising use of real-time conversational avatars for customer engagement and support.

- Hardware modules accounted for 53.6%, supported by strong demand for sensors, cameras, and processing units enabling realistic avatar performance.

- Cloud-based deployment dominated with 64.8%, reflecting scalability, centralized updates, and smooth integration with AI and enterprise systems.

- Retail and e-commerce represented 32.2% of adoption, fueled by virtual assistants, digital brand ambassadors, and personalized shopping tools.

- Generative AI–based digital humans captured 48.5%, highlighting reliance on advanced language models, facial animation, and adaptive interaction.

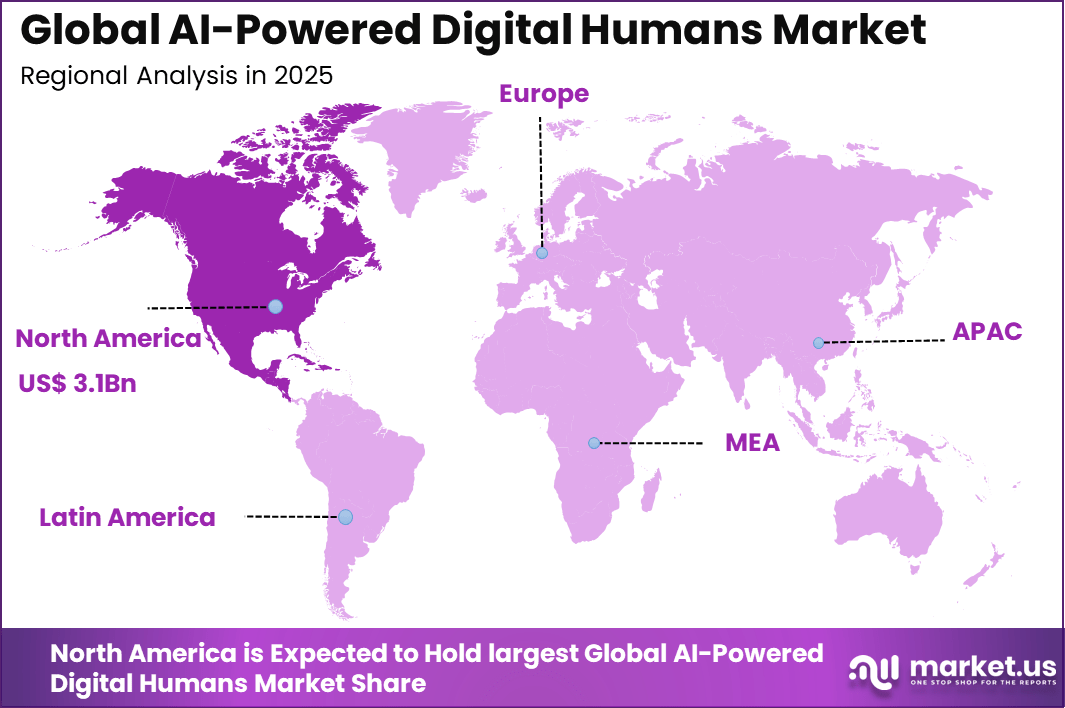

- North America held 36.3% share, supported by early AI adoption and strong enterprise investment.

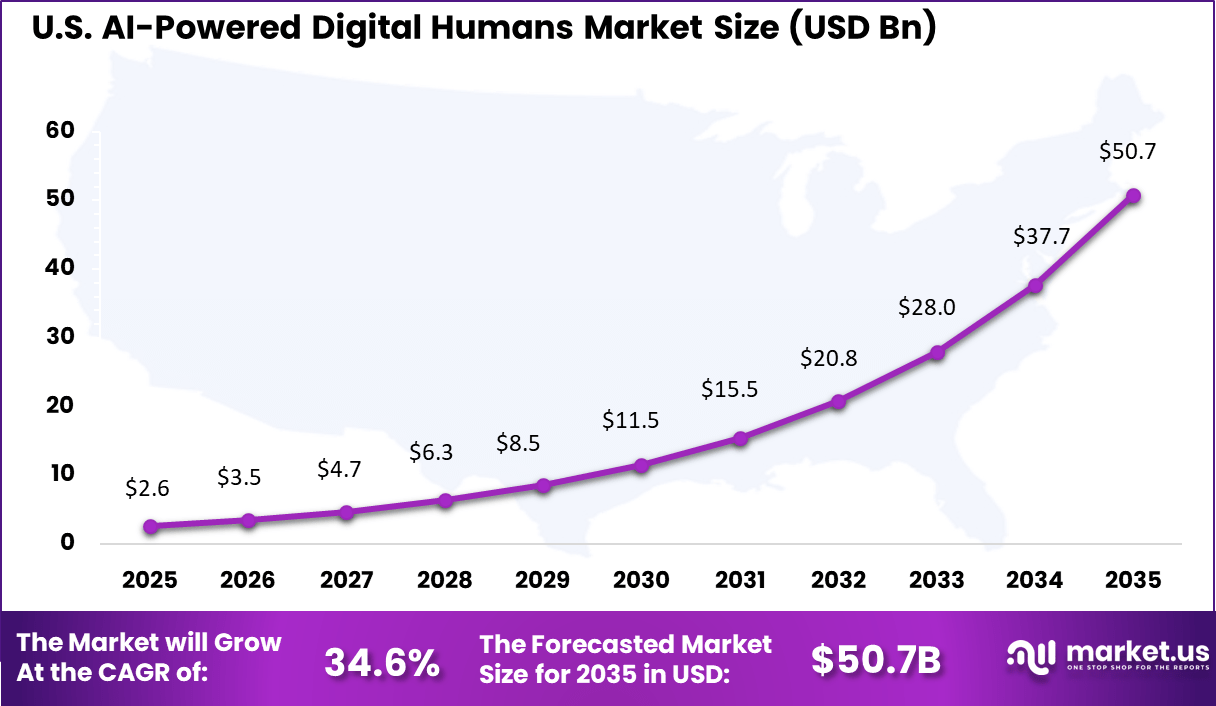

- The U.S. market reached USD 2.69 billion in 2024 and is growing at a 34.6% CAGR, driven by rapid commercialization of AI-powered avatars.

Quick Market Facts

- 88% of organizations now use AI in at least one business function, up from 78% in 2024.

- The global AI avatar market is projected to reach USD 63.5 billion by 2034, expanding at a 38.2% CAGR from 2025 to 2034.

- In 2024, North America captured over 39.2% share, generating USD 0.9 billion in revenue.

- By the end of 2025, nearly 95% of customer interactions are expected to involve AI technologies.

- About 62% of organizations are experimenting with autonomous AI agents for multi-step workflows.

Industry Usage Statistics (2025)

- Gaming and entertainment account for 37.4% of adoption due to real-time avatar use.

- Around 80% of retail leaders plan to adopt AI automation by 2025.

- Virtual try-ons and digital shopping assistants are used by 32.6% of leading retailers.

- Nearly 70% of healthcare organizations have implemented or are pursuing generative AI.

- Patient engagement represents 62% of healthcare AI use, while administrative efficiency accounts for 60%.

- More than 92% of U.S. banks have deployed AI in some form.

- Digital assistants are a priority for 80% of finance leaders.

Consumer Engagement and Sentiment

- 54% of consumers are willing to use AI assistants in retail environments.

- 60% prefer voice interaction over typing on mobile devices.

- 75% are comfortable using bots for simple queries.

- Only 33% trust bots for complex or sensitive issues.

- Businesses using conversational agents report open rates of 85%.

- Average click-through rates reach 40%.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Growth of conversational AI | Human like digital interactions at scale | ~9.2% | Global | Short Term |

| Expansion of virtual customer service | Automation of front line engagement | ~8.1% | North America, Europe | Short Term |

| Advances in generative AI models | Realistic speech, emotion, and behavior | ~7.4% | Global | Mid Term |

| Rising demand for immersive experiences | Digital humans in media and branding | ~6.5% | Global | Mid Term |

| Cost optimization initiatives | Reduction in human support costs | ~4.3% | Global | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| Ethical and trust concerns | Perception of AI impersonation | ~6.2% | Global | Short Term |

| Data privacy and consent issues | Use of voice and likeness data | ~5.1% | North America, Europe | Short Term |

| High development complexity | Advanced AI and rendering pipelines | ~4.3% | Global | Mid Term |

| Cultural acceptance barriers | Human interaction replacement concerns | ~3.5% | Global | Mid Term |

| Regulatory uncertainty | Governance of synthetic identities | ~2.7% | Global | Long Term |

Restraint Impact Table

| Restraint Factor | Restraint Description | Impact on Market Expansion (%) | Most Affected Regions | Duration of Impact |

|---|---|---|---|---|

| High implementation cost | AI model training and avatar creation | ~6.8% | Emerging Markets | Short to Mid Term |

| Limited standardization | Inconsistent avatar platforms | ~5.4% | Global | Mid Term |

| Skill shortages | Need for AI and 3D expertise | ~4.1% | Global | Mid Term |

| Integration challenges | Alignment with enterprise systems | ~3.2% | Global | Long Term |

| ROI measurement difficulty | Qualitative engagement benefits | ~2.5% | Global | Long Term |

Regional Driver Comparison

| Region | Primary Growth Driver | Regional Share (%) | Regional Value (USD Bn, 2025) | Adoption Maturity |

|---|---|---|---|---|

| North America | Enterprise adoption of AI engagement tools | 36.3% | USD 3.1 Bn | Advanced |

| Europe | Digital customer experience innovation | 28.4% | USD 2.47 Bn | Advanced |

| Asia Pacific | Large scale digital population engagement | 24.1% | USD 2.10 Bn | Developing to Advanced |

| Latin America | Growth of virtual brand interaction | 6.2% | USD 0.54 Bn | Developing |

| Middle East and Africa | Early smart service deployments | 5.0% | USD 0.43 Bn | Early |

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Enterprises | Very High | ~41.6% | Customer engagement efficiency | Platform wide deployment |

| Media and entertainment firms | High | ~21% | Virtual characters and content | Project based investment |

| Technology vendors | High | ~18% | Platform and ecosystem expansion | R&D intensive |

| Marketing agencies | Moderate | ~12% | Brand differentiation | Campaign based adoption |

| Educational institutions | Low | ~8% | Digital learning assistants | Pilot deployments |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| Generative AI models | Speech, behavior, and personality creation | ~8.6% | Growing |

| Natural language processing | Contextual conversation handling | ~7.4% | Mature |

| Real time rendering engines | Visual realism and animation | ~6.1% | Growing |

| Cloud AI infrastructure | Scalable digital human deployment | ~5.0% | Mature |

| Emotion and sentiment analysis | Human like interaction depth | ~3.9% | Developing |

Driver Analysis

The AI-powered digital humans market is being driven by the increasing demand for more natural, engaging, and scalable human-machine interactions across enterprise, entertainment, healthcare, and customer engagement environments. Digital humans integrate artificial intelligence, natural language processing, facial animation, and behavioural modelling to create interactive representations that can converse, respond, and adapt to user inputs in near real-time.

Organisations are adopting these solutions to enhance customer support, deliver personalised experiences, and reduce operational burden by automating routine interactions without sacrificing perceived human empathy. As digital engagement channels proliferate, the value of lifelike, AI-enabled interfaces continues to strengthen across digital transformation strategies.

Restraint Analysis

A significant restraint in the AI-powered digital humans market relates to ethical considerations and concerns about authenticity and misrepresentation. Digital humans that interact with users must balance realism with clear disclosure of their artificial nature to avoid confusion, deception, or misuse.

Organisations deploying digital human solutions face scrutiny over data privacy, consent, and the potential for deepfake-style misuse if models are repurposed without appropriate safeguards. These ethical, regulatory, and brand trust considerations can slow adoption, particularly in highly-regulated sectors or where consumer trust is paramount.

Opportunity Analysis

Emerging opportunities in the AI-powered digital humans market are linked to expanding applications that extend beyond conventional chatbot or avatar roles into immersive education, personalised coaching, virtual events, and digital companions for wellness and mental health support. Digital humans can be tailored to represent brand personas, subject matter experts, or culturally relevant guides that improve engagement and retention.

There is also potential for integration with broader metaverse and mixed-reality experiences, where lifelike avatars serve as intuitive interfaces between users and digital ecosystems. As generative AI, expressive animation, and contextual understanding improve, digital humans can offer differentiated value in complex, conversational, and empathy-driven use cases.

Challenge Analysis

A central challenge confronting this market involves managing technical complexity, interoperability, and model reliability across diverse interaction contexts. AI-powered digital humans require extensive training on language, behaviour, and visual expression datasets to respond appropriately and consistently.

Ensuring that digital human responses remain accurate, culturally sensitive, unbiased, and compliant with organisational policies demands ongoing validation and governance. Integrating digital humans with backend systems, knowledge bases, and real-time data feeds also introduces architectural and operational complexity that organisations must plan and resource effectively.

Emerging Trends

Emerging trends in the AI-powered digital humans landscape include the use of multi-modal understanding that combines speech, text, gesture, and facial cues to create more intuitive and expressive interactions. Developers are also exploring adaptive learning where digital humans personalise their communication style based on user preferences and historical interactions.

Another trend is the integration of emotional recognition and response adjustment, enabling digital humans to tailor tone and content to the user’s emotional state. These advancements aim to enhance perceived empathy and engagement while maintaining safety and appropriateness in responses.

Growth Factors

Growth in the AI-powered digital humans market is supported by advances in generative AI, neural rendering, and conversational modelling that enable more realistic and contextually relevant interactions. Organisations across customer service, healthcare triage, education, and entertainment are prioritising digital engagement solutions that reduce friction and improve accessibility.

As demand for continuous, scalable, and personalised experiences grows, digital humans provide a strategic avenue to augment human resources while improving user satisfaction and operational efficiency. Improvements in real-time processing, graphical fidelity, and cloud-based deployment further enhance scalability and adoption across varied industries, reinforcing the role of digital humans in future digital engagement strategies.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 36.3% of total revenue. The region generated around USD 3.1 billion, supported by early adoption of immersive AI technologies and strong investment in digital experience platforms. High presence of technology developers and enterprise adoption of virtual human solutions strengthened regional leadership. As a result, North America continues to shape innovation and commercialization trends in the AI powered digital humans market.

The United States reached USD 2.69 Billion with a CAGR of 34.6%, reflecting rapid market expansion. Growth is driven by retail innovation and digital transformation initiatives. Enterprises adopt digital humans to improve scalability and engagement. High investment in AI supports long-term growth. The market shows strong momentum.

Key Market Segments

By Product Type

- Interactive Digital Humans

- Non-Interactive Digital Humans

By Component

- Software Platforms

- Services

- Hardware Modules

By Deployment Mode

- Cloud-based

- On-premises

By End-user Industry

- Retail and E-commerce

- Gaming and Entertainment

- BFSI

- Education and E-learning

- Automotive

- Healthcare and Life Sciences

- Travel and Hospitality

- Telecom and Media

- Other Industries

By Technology

- Generative-AI Digital Humans

- Rule-based / NLP-driven Digital Humans

- Real-time Rendering Engine Digital Humans

- Others

Top Key Players in the Market

- Microsoft Corporation

- Nvidia Corporation

- Meta Platforms, Inc.

- Samsung Electronics Co., Ltd.

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

- Epic Games, Inc.

- Soul Machines Ltd.

- UneeQ Ltd.

- Didimo Inc.

- Reallusion Inc.

- Inworld AI, Inc.

- Synthesia Ltd.

- iFLYTEK Co., Ltd.

- ObEN, Inc.

- Pinscreen, Inc.

- Digital Domain Holdings Ltd.

- Virti Ltd.

- Hour One AI Ltd.

- DeepBrain AI

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 8.7 Bn |

| Forecast Revenue (2035) | USD 223.2 Bn |

| CAGR(2026-2035) | 38.3% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)