Table of Contents

- AI Soundbar Market Size

- Product Type Analysis

- Connectivity Analysis

- Technology Analysis

- Installation Type Analysis

- Speaker Wattage Analysis

- Price Range Analysis

- Size Analysis

- Application Analysis

- Distribution Channel Analysis

- United States Market Size

- Key Market Segments

- Top Key Players in the Market

- Report Scope

AI Soundbar Market Size

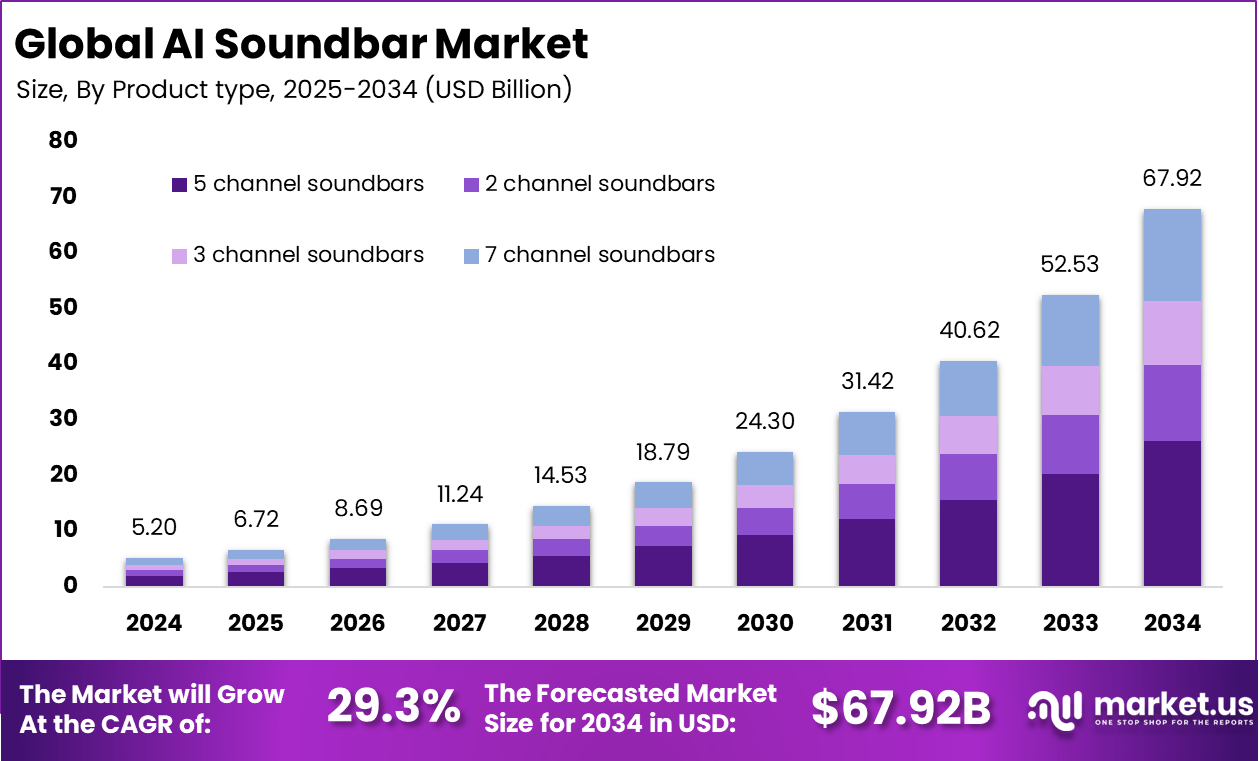

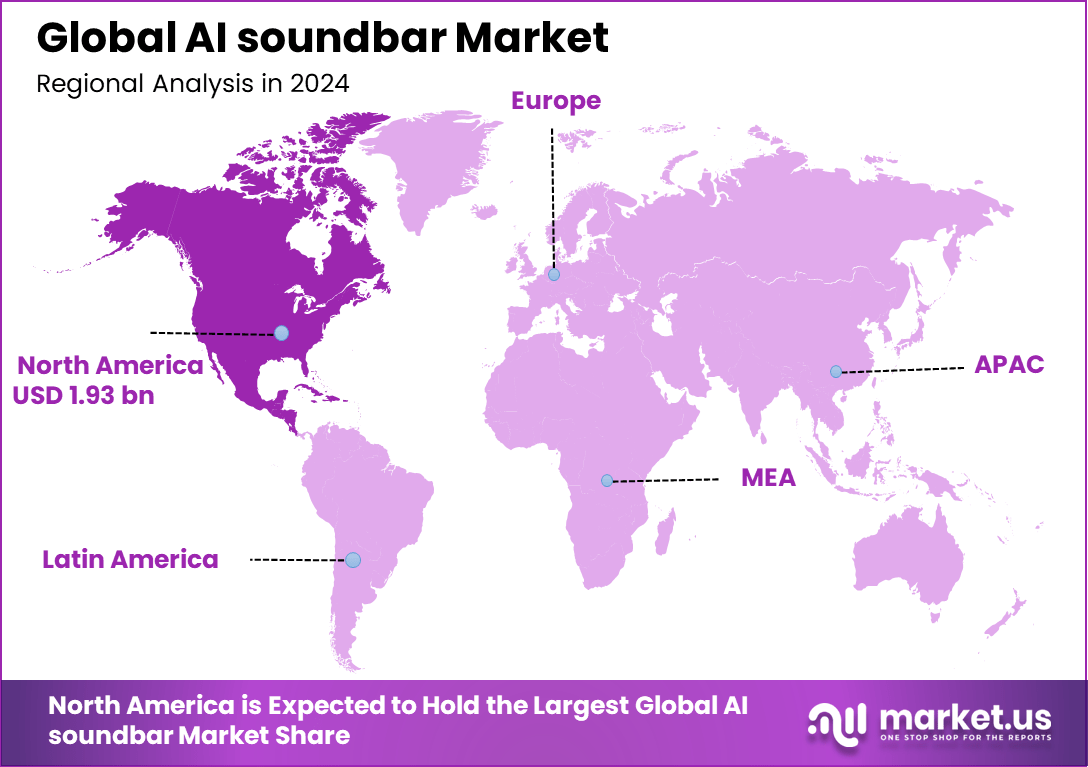

The global AI soundbar market was valued at USD 5.20 billion in 2024 and is projected to reach approximately USD 67.92 billion by 2034, expanding at a CAGR of 29.3% during the forecast period from 2025 to 2034. In 2024, North America dominated the market with more than 37.2% share, generating around USD 1.93 billion in revenue, supported by high adoption of smart home entertainment and AI enabled audio technologies.

The AI soundbar market refers to audio systems integrated with artificial intelligence to enhance sound quality, user interaction, and content personalization. These soundbars use AI algorithms to analyze room acoustics, adjust audio output automatically, and optimize sound based on content type such as movies, music, or gaming. Adoption has increased as consumers seek immersive home entertainment experiences without complex audio setups. The market benefits from the wider use of smart home ecosystems, where soundbars act as both entertainment devices and voice enabled control hubs.

Growth in this market is driven by rising demand for premium home audio experiences and the rapid adoption of smart televisions. Consumers are increasingly replacing traditional speaker systems with compact soundbars that offer advanced features and ease of use. Integration of voice assistants and compatibility with connected home devices have further supported demand. Improvements in AI based sound processing and declining hardware costs have made these products more accessible to a broader consumer base.

Enjoy up to 60% discount on this research report in our Christmas Sale (2025–2034) @ https://market.us/purchase-report/?report_id=162138

Demand for AI soundbars is growing steadily across residential users, particularly in urban households with limited space. Interest is strong among users who stream content regularly and value adaptive sound quality without manual adjustment. The market is also supported by gaming and sports viewing trends, where immersive audio enhances user experience. As smart home adoption continues to expand, demand for AI enabled soundbars is expected to remain favorable in the coming years.

Product Type Analysis

5-channel soundbars led with 38.7%, reflecting strong demand for immersive audio experiences in both residential and commercial settings. These soundbars provide enhanced surround sound compared to basic stereo systems, making them suitable for movies, gaming, and live content playback. Their popularity is supported by growing consumer interest in theater-like audio without complex speaker setups. 5-channel configurations offer a balance between performance and ease of installation, which continues to drive adoption across homes, offices, and entertainment venues.

Connectivity Analysis

Bluetooth connectivity dominated with 42.7%, highlighting user preference for wireless audio solutions and easy device pairing. Bluetooth-enabled soundbars allow seamless connection with smartphones, tablets, and smart TVs, improving user convenience. This segment benefits from rising use of mobile devices for content streaming. Wireless connectivity reduces cable clutter and supports flexible placement, which aligns well with modern living and working environments.

Technology Analysis

NLP-enabled features captured 40.6%, indicating growing adoption of voice control and AI-based interaction. These features allow users to control volume, playback, and content selection through voice commands. The growth of this segment is supported by increasing integration of AI assistants into home entertainment systems. NLP improves accessibility and user engagement, especially in smart home environments where hands-free control is preferred.

Installation Type Analysis

Wall-mounted soundbars held 46.6%, supported by modern interior design trends and space-saving requirements. These soundbars integrate smoothly with wall-mounted televisions, creating a clean and organized appearance. Demand is rising in urban homes and commercial spaces where floor space is limited. Wall-mounted designs also improve sound projection and viewing aesthetics, which enhances overall user experience.

Speaker Wattage Analysis

Soundbars with output up to 200 Watts accounted for 47.7%, appealing to users seeking balanced sound performance without excessive power consumption. These models deliver clear audio suitable for small to medium-sized rooms. This segment is driven by consumers looking for energy-efficient audio solutions with consistent sound quality. Moderate power output meets everyday entertainment needs while keeping operating costs under control.

Price Range Analysis

Medium-sized soundbars represented 55.5%, indicating strong acceptance of mid-range audio solutions. These models fit well in standard living rooms, offices, and commercial areas without requiring complex installation. Their popularity is supported by versatility and affordability. Medium-sized soundbars offer a good mix of performance, design, and pricing, which makes them suitable for a wide range of users.

Size Analysis

Units designed for 30 to 60 inch displays secured 52.6%, aligning with the most common television sizes used in homes and offices. These soundbars are optimized to match screen width and audio coverage. The segment benefits from widespread adoption of mid-sized TVs in residential and professional environments. Proper size matching improves sound distribution and visual balance, enhancing the overall viewing experience.

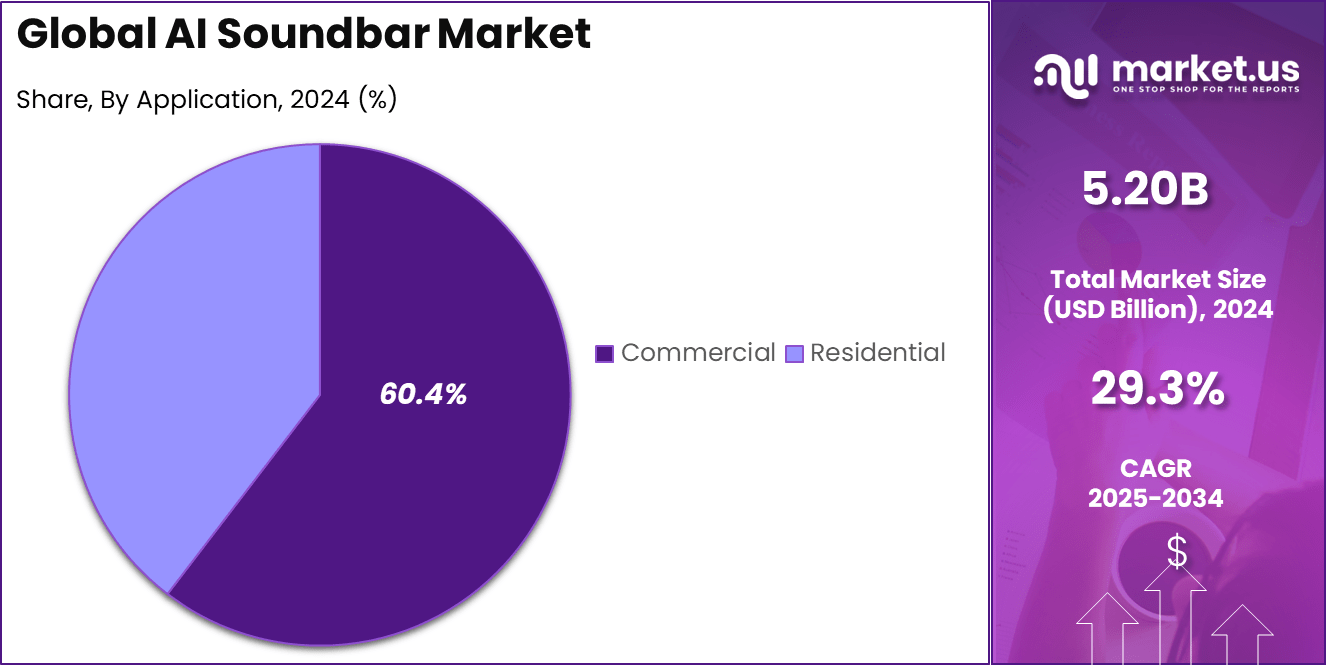

Application Analysis

Commercial applications led with 60.4%, driven by rising use of soundbars in retail stores, hotels, restaurants, and corporate spaces. These environments require clear audio for announcements, background music, and presentations. Businesses prefer AI-enabled soundbars due to ease of control, compact design, and consistent performance. Commercial adoption is further supported by growing focus on customer experience and smart facility management.

Distribution Channel Analysis

Offline sales channels contributed 65.7%, reflecting consumer preference for in-store testing and live demonstrations. Sound quality is a key purchase factor, and physical stores allow customers to experience audio performance before buying. Retail stores also provide expert guidance, installation advice, and immediate product availability. These factors continue to support offline sales, especially for premium and AI-enabled audio products.

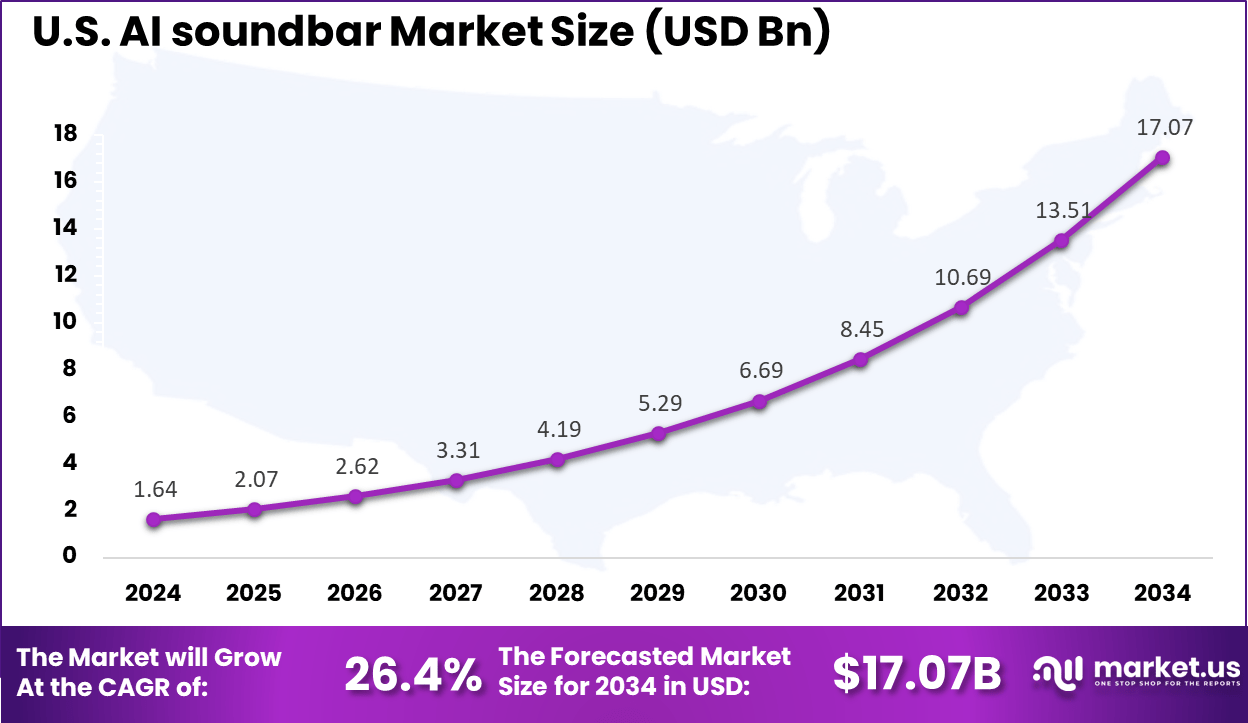

United States Market Size

The U.S. market reached USD 1.64 billion in 2024 and is growing at a strong CAGR of 26.4%. Growth is driven by rising smart home adoption, increased spending on home entertainment, and strong demand for AI-powered devices. Consumers in the U.S. are quick to adopt advanced audio technologies that integrate with voice assistants and smart ecosystems. This supports continuous upgrades and replacement demand for AI soundbars.

North America dominated globally with 37.2% share, supported by high consumer spending and advanced AI entertainment ecosystems. The region benefits from early adoption of smart devices and strong retail infrastructure. Growth is further supported by widespread availability of high-speed internet and connected home platforms. These factors continue to strengthen demand for AI-enabled soundbars across residential and commercial markets.

Key Market Segments

By Product Type

- 2 channel soundbars

- 3 channel soundbars

- 5 channel soundbars

- 7 channel soundbars

By Connectivity

- Bluetooth

- Auxiliary

- Wi-Fi

- Others (HDMI, optical, USB, NFC, etc.)

By Technology

- Natural Language Processing (NLP)

- Machine Learning

- Computer Vision

- Others

By Installation Type

- Wall mounted

- Tabletop

- Free standing

By Speaker Wattage

- Up to 200 Watts

- Between 200-800 Watts

- Above 800 Watts

By Price Range

- Low

- Medium

- High

By Size

- Under 30 inches

- 30-60 inches

- Above 60 inches

By Application

- Residential

- Commercial

- Hospitality (hotels, restaurants)

- Retail stores

- Offices/conference rooms

- Educational institutions

- Entertainment venues (cinemas, theaters)

- Others

By Distribution Channel

- Online

- E-commerce

- Company websites

- Offline

- Hypermarkets/supermarkets

- Specialty stores

- Brand outlets

- Other retail stores (e.g., department stores, local electronics shops)

Top Key Players in the Market

- Bose

- Bowers and Wilkins

- Denon

- Devialet

- Harman International

- Klipsch

- LG Electronics

- Onkyo

- Panasonic

- Philips

- Pioneer

- Polk Audio

- Samsung Electronics

- Sharp

- Sonos

- Sony

- TCL

- Vizio

- Xiaomi

- Yamaha

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.20 Bn |

| Forecast Revenue (2034) | USD 67.9 Bn |

| CAGR(2025-2034) | 29.3% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)