Table of Contents

Introduction

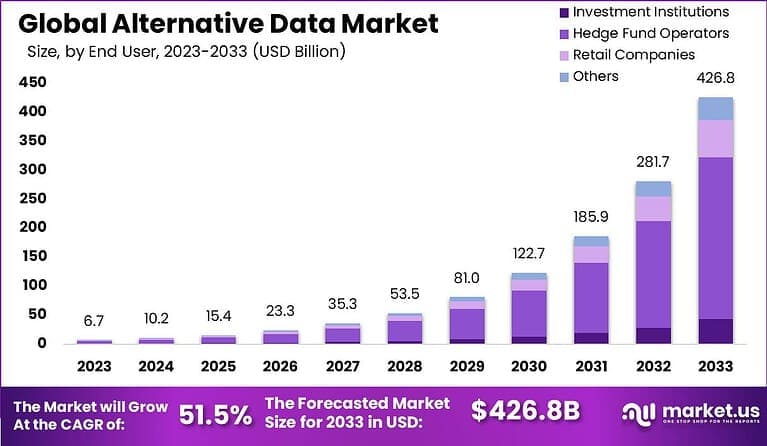

The Global Alternative Data Market is poised for remarkable growth, expected to rise from USD 6.7 billion in 2023 to USD 426.8 billion by 2033, growing at an impressive CAGR of 51.50% during the forecast period from 2024 to 2033. Alternative data, which includes non-traditional data sources such as social media, satellite imagery, and transaction data, is gaining traction as companies seek new ways to gain insights into market trends and consumer behavior.

In 2023, North America was the dominant region, capturing 52.7% of the market share with USD 3.5 billion in revenue. As the need for data-driven decision-making continues to rise, the demand for alternative data solutions is expected to surge, impacting multiple industries across the globe.

How Growth is Impacting the Economy

The rapid growth of the alternative data market is having a significant impact on the global economy by driving innovation across industries such as finance, retail, real estate, and healthcare. Businesses are increasingly using alternative data to make more informed decisions, improve predictive modeling, and uncover hidden trends.

For example, financial institutions are leveraging alternative data for investment strategies, risk assessments, and market forecasting, while retailers are using it to optimize inventory and customer engagement. This data-driven transformation is improving operational efficiency and unlocking new revenue streams for businesses. Moreover, the explosion of alternative data is fueling the growth of data analytics firms, driving job creation and technological advancements. As the demand for alternative data rises, businesses in AI, machine learning, and big data analytics are expanding, contributing to broader economic growth by offering innovative solutions that make data actionable and valuable.

➤ Unlock growth! Get your sample now! – https://market.us/report/alternative-data-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

As the alternative data market expands, businesses are encountering rising costs associated with data acquisition, storage, and processing. Collecting and managing large volumes of non-traditional data require significant investments in infrastructure, advanced analytics tools, and skilled personnel. However, these costs are often outweighed by the benefits of using alternative data to improve market intelligence, reduce risks, and make more strategic decisions.

Companies in sectors such as finance and retail are increasingly incorporating alternative data into their operations to optimize their supply chains, identify new opportunities, and better serve customers. The integration of alternative data into supply chain management is improving real-time visibility, enhancing forecasting, and enabling more efficient decision-making.

Sector-Specific Impacts

In the financial services industry, alternative data is transforming investment strategies, enabling firms to make more informed decisions based on real-time insights from unconventional data sources. In retail, companies are using alternative data to personalize marketing efforts and enhance customer experience. The real estate sector is leveraging alternative data, such as satellite imagery and location-based data, to assess property values and trends. Additionally, healthcare companies are adopting alternative data to improve patient outcomes by analyzing diverse sources, including social media and wearables, to predict health trends and behaviors.

Strategies for Businesses

To capitalize on the growth of the alternative data market, businesses should consider the following strategies:

- Invest in data infrastructure and analytics tools to handle and process large volumes of alternative data efficiently.

- Leverage partnerships with data providers to gain access to valuable, diverse data sources.

- Develop AI and machine learning models that can extract actionable insights from alternative data to make better business decisions.

- Focus on data privacy and security by implementing robust measures to ensure compliance with regulations and protect sensitive data.

- Expand into emerging markets by offering alternative data solutions tailored to regional needs and challenges.

Key Takeaways

- The alternative data market is expected to grow from USD 6.7 billion in 2023 to USD 426.8 billion by 2033, at a CAGR of 51.50%.

- North America holds a dominant position, capturing 52.7% of the market share, generating USD 3.5 billion in revenue in 2023.

- Financial services, retail, real estate, and healthcare are major sectors driving market growth.

- Investing in data infrastructure, AI analytics, and data privacy will be key to business success.

- The rise of alternative data is fostering innovation, efficiency, and market intelligence across industries.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=131732

Analyst Viewpoint

Present View:

The alternative data market is experiencing rapid growth, driven by increasing demand for actionable insights and data-driven decision-making. North America remains the leader in market share, but other regions are expected to see significant growth as businesses recognize the potential of alternative data to enhance their operations.

Future Positive View:

Looking ahead, the alternative data market is set for sustained expansion, fueled by technological advancements in AI and data analytics. As businesses across various sectors continue to adopt alternative data solutions, the market will diversify, offering innovative applications that will further drive economic growth and operational efficiency.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Financial Services | Use of alternative data for market analysis, investment strategies, and risk assessment |

| Retail | Personalization of marketing campaigns and inventory management |

| Real Estate | Property valuation and trend prediction using satellite and location data |

| Healthcare | Predicting patient behavior and improving treatment outcomes |

| Logistics & Supply Chain | Enhancing real-time visibility and optimizing inventory management |

Regional Analysis

North America holds a dominant position in the alternative data market, capturing 52.7% of the market share and generating USD 3.5 billion in revenue in 2023. This growth is driven by strong demand from the financial services and e-commerce sectors. Europe is witnessing growing adoption, particularly in the retail and real estate sectors, where alternative data is being integrated to improve business intelligence. Asia-Pacific (APAC) is also becoming a key market, fueled by the rise of e-commerce and financial technology. Latin America and the Middle East & Africa (MEA) are emerging markets, where businesses are starting to adopt alternative data solutions for improved market insights and operations.

Business Opportunities

The rapid growth of the alternative data market presents numerous business opportunities for companies in data analytics, AI, finance, retail, and technology sectors. Firms can focus on building partnerships with data providers to gain access to diverse data sources, such as satellite imagery, social media, and transaction data, to deliver value-added services. Companies can also create AI-powered solutions to extract actionable insights from alternative data and tailor these solutions to different industries, such as healthcare, real estate, and logistics. There are also opportunities to expand into emerging markets where businesses are just beginning to recognize the benefits of alternative data.

Key Segmentation

The alternative data market is segmented by:

- Application: Financial Services, Retail, Real Estate, Healthcare, Logistics, Others.

- End-User: Data Providers, Data Analytics Firms, Financial Institutions, Retailers, Healthcare Providers, Technology Companies.

- Technology: AI & Machine Learning, Cloud Computing, Big Data Analytics, Satellite Imagery, Social Media Data.

- Region: North America, Europe, APAC, Latin America, Middle East & Africa.

These segments highlight the diverse industries and applications that are leveraging alternative data, providing businesses with ample opportunities for growth and innovation.

Key Player Analysis

Key players in the alternative data market are focusing on AI and machine learning innovations to improve data analytics and create actionable insights. Many companies are developing cloud-based platforms to handle vast amounts of alternative data and ensure its scalability. Partnerships with financial institutions, technology providers, and data suppliers are essential to gaining access to valuable data sources and enhancing product offerings. As data privacy and security become critical issues, companies are also prioritizing compliance with regulatory requirements to ensure their solutions are trusted by users across industries.

- Nasdaq, Inc.

- YipitData

- RavenPack

- Earnest Analytics

- Bloomberg Second Measure LLC

- Thinknum Alternative Data

- M Science LLC

- Advan Research Corporation

- Alphasense Inc.

- Other Key Players

Recent Developments

- Launch of AI-powered analytics platforms to process and derive insights from large datasets.

- Strategic partnerships with financial institutions to offer customized alternative data solutions.

- Expansion of cloud computing infrastructure to handle large volumes of alternative data securely.

- Development of satellite imagery solutions for real estate and agriculture market analysis.

- Increased focus on data privacy regulations and ensuring compliance with GDPR and other standards.

Conclusion

The alternative data market is on a robust growth trajectory, expected to reach USD 22.9 billion by 2033. As businesses increasingly rely on data-driven insights to improve decision-making, companies that invest in AI technologies, data analytics, and sustainable data practices will be well-positioned to thrive in this rapidly expanding market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)