Table of Contents

Introduction

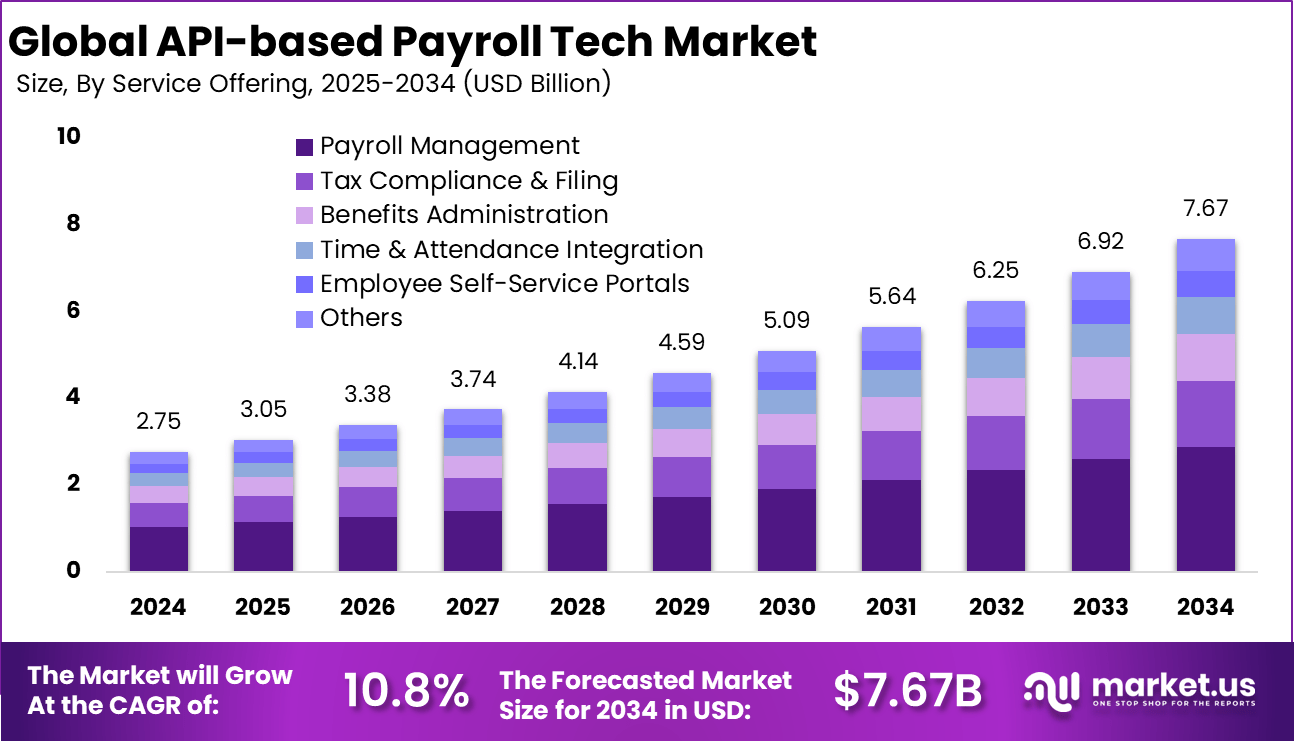

The Global API-based Payroll Tech Market reached USD 2.75 billion in 2024 and is projected to grow to USD 7.67 billion by 2034, registering a strong CAGR of 10.8%. This growth is driven by rising digital payroll adoption, automation of HR workflows, expanding gig workforce needs, and increasing demand for real-time compliance updates. North America dominated the market in 2024 with a 38.4% share and USD 1.05 billion revenue, supported by mature cloud ecosystems and rapid enterprise digital transformation.

How Growth Is Impacting the Economy

The expansion of API-based payroll technologies is improving global economic efficiency by streamlining salary disbursement, tax processing, compliance management, and workforce data integration. Automated payroll reduces administrative burden for businesses, enabling them to redirect resources toward innovation and productivity. Governments benefit from improved tax transparency and faster compliance reporting, strengthening fiscal stability.

The technology also supports the gig and remote employment economy by enabling flexible, cross-border payroll operations. As SMEs increasingly adopt API-driven payroll systems, digital financial inclusion expands, generating new opportunities for fintech and HR tech industries. Ultimately, the market supports consistent economic resilience through reduced payroll errors, enhanced workforce satisfaction, and improved business operational continuity.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/api-based-payroll-tech-market/free-sample/

Impact on Global Businesses

Rising labor costs, evolving tax regulations, and complex cross-border payroll workflows are pushing global businesses toward API-enabled payroll automation. Supply chain shifts, especially the rise of remote teams and distributed operations, require unified payroll systems capable of real-time updates.

Sector-specific impacts include:

• Technology: Automated payroll for large remote engineering teams.

• Retail: High-volume workforce scheduling and instant payouts.

• BFSI: Regulatory compliance and audit-ready reporting.

• Healthcare: Shift-based payroll with real-time adjustments.

• Gig economy: On-demand, API-triggered payments.

Strategies for Businesses

Businesses should integrate payroll APIs with HRIS, attendance systems, and financial tools to create unified data ecosystems. Enhancing cybersecurity protocols, including encryption and tokenization, ensures secure payroll data transfer. Companies must adopt compliance-ready APIs to manage evolving labor regulations. Investing in analytics-driven payroll insights helps optimize staff planning, while embedding real-time payment solutions improves employee satisfaction. Collaborating with fintech partners ensures scalable and compliant payroll operations across global markets.

Key Takeaways

- Market projected to reach USD 7.67 billion by 2034.

- Strong 10.8% CAGR driven by payroll automation.

- North America leads with 38.4% share.

- Growth aligned with gig economy expansion and digital workforce requirements.

- API integrations enhance compliance, accuracy, and operational efficiency.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=166076

Analyst Viewpoint

The API-based payroll tech market is gaining strong momentum as businesses prioritize automation, accuracy, and seamless integration across HR and financial systems. Currently, demand is driven by remote work, rising global workforce mobility, and stricter payroll compliance requirements. In the future, AI-driven payroll insights, embedded finance capabilities, and real-time global tax engines will further elevate market adoption. With growing dependence on digital payroll infrastructure, the long-term outlook remains strongly positive, especially in emerging economies, accelerating fintech innovation.

Use Cases & Growth Factors

| Category | Details |

|---|---|

| Use Cases | Automated salary processing, tax filing APIs, cross-border payroll, on-demand payouts, attendance-linked payroll |

| Growth Factors | Remote work expansion, rising gig workforce, need for compliance automation, fintech–HR tech integrations, cloud adoption |

Regional Analysis

North America dominates due to advanced HR automation, API-driven fintech expansion, and strong compliance infrastructure. Europe shows significant growth driven by cross-border workforce management, GDPR-focused payroll security, and rising adoption among SMEs. Asia Pacific emerges as the fastest-growing region due to rapid startup expansion, large gig workforce, and rising digital payroll penetration. Latin America gains traction with fintech partnership models, while the Middle East & Africa adopt payroll APIs to modernize workforce systems and support economic diversification.

➤ Want more market wisdom? Browse reports –

Business Opportunities

Growing opportunities exist in embedded payroll APIs for super-apps, AI-driven compliance engines, on-demand wage access solutions, and fintech-powered global payroll platforms. Innovations in cross-border payment APIs and decentralized workforce onboarding tools open new avenues. SMEs increasingly require affordable plug-and-play payroll API modules, while enterprise clients seek deeper integrations with ERP, banking, and HR analytics platforms. The rise of gig work and flexible employment models further expands monetizable API-driven payroll infrastructure.

Key Segmentation

Key market segments include by component (solutions, services), by deployment (cloud, on-premise), by application (tax automation, payment processing, HR integration), by enterprise size (SMEs, large enterprises), and by end user (IT, BFSI, retail, healthcare, gig platforms, manufacturing). Cloud-based solutions dominate due to scalability and low infrastructure cost, while gig platforms and IT companies represent the fastest-growing user groups due to dynamic payroll requirements.

Key Player Analysis

Leading participants focus on developing secure, scalable payroll APIs that integrate seamlessly with HR, banking, and ERP platforms. They invest in compliance automation, AI-driven payroll analytics, and real-time payment capabilities. Vendors expand offerings through partnerships with fintechs and workforce platforms, enhancing global payroll coverage. Strategic initiatives include upgrading tax engines, improving API documentation for developers, and adding modular features tailored to SMEs, enterprises, and gig-focused businesses.

- Merge

- Gusto Inc.

- Kombo

- udPay Inc.

- Razorpay Software Limited

- Klamp

- Knit

- Check Technologies, Inc.

- KeyPay

- Remote Technology, Inc.

- Others

Recent Developments

- Introduction of real-time payroll APIs supporting instant payments.

- Launch of compliance automation engines for multi-country regulations.

- Expansion of developer-friendly API marketplaces in payroll tech.

- Integration of payroll APIs with embedded finance platforms.

- New onboarding APIs enabling seamless contractor and gig-worker payroll setup.

Conclusion

The API-based payroll tech market is accelerating rapidly, driven by digital HR transformation, compliance automation, and global workforce decentralization. Its strong long-term outlook ensures ongoing innovation, broader enterprise adoption, and increasing relevance in modern payroll ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)