Table of Contents

Introduction

The global automatic gearbox valves market is entering a new era of technological transformation. Moreover, rising regulatory pressures and efficiency goals continue to reshape component design, manufacturing, and deployment. Consequently, manufacturers worldwide are accelerating innovation to meet growing performance demands.

Additionally, the market’s strong momentum reflects expanding vehicle production and widespread automatic transmission adoption. Furthermore, emerging hybrid and electric vehicle platforms are generating fresh opportunities for advanced valve integration. As a result, suppliers are diversifying product portfolios to accommodate next-generation transmission architectures.

At the same time, OEMs are reinforcing partnerships with valve manufacturers to secure reliable, high-precision hydraulic control solutions. Likewise, the expansion of mechatronic systems is driving development of electronically governed, ultra-responsive valve technologies. Thus, the industry is experiencing a shift toward smarter, sensor-enabled components.

Meanwhile, global supply chain evolution plays a pivotal role in shaping cost structures and regional competitiveness. In addition, localized manufacturing incentives are influencing production footprints across major automotive hubs. Therefore, strategic investments in capacity expansion and material innovation remain vital to sustaining growth.

Overall, the automatic gearbox valves market is positioned for accelerated expansion, supported by continuous innovation and heightened adoption of modern transmission systems. Consequently, stakeholders across the value chain anticipate significant advancements in durability, precision, and energy efficiency throughout the forecast period.

Key Takeaways

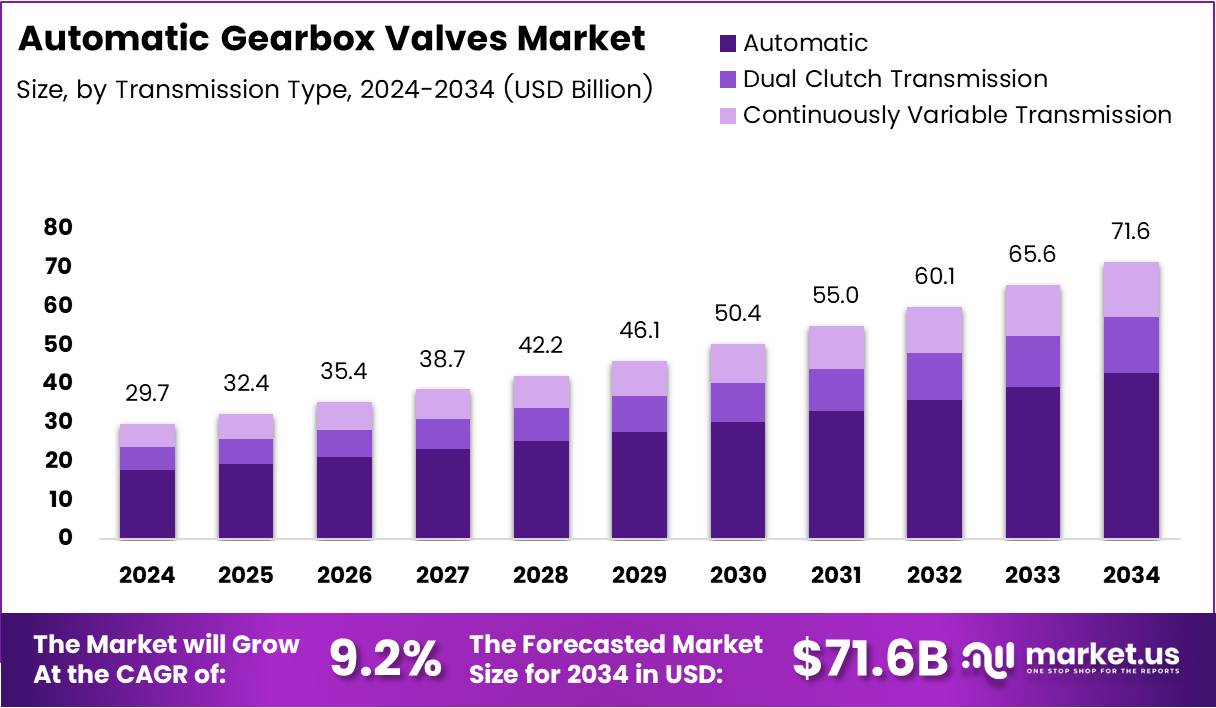

- Global Automatic Gearbox Valves Market projected to reach USD 71.6 Billion by 2034, up from USD 29.7 Billion in 2024.

- Market grows at a CAGR of 9.2% during 2025–2034.

- Asia Pacific leads with 44.8% share valued at USD 13.3 Billion in 2024.

- Automatic transmission segment dominates with 56.3% share in 2024.

- Passenger Cars lead the vehicle type segment with 61.7% share in 2024.

- Solenoid Valves dominate product type with 34.9% share in 2024.

- First Fit (OEM) channel holds 73.2% share in 2024.

Market Segmentation Overview

By Transmission Type

Automatic transmissions maintain dominance due to their widespread acceptance globally. Moreover, manufacturers continue refining hydraulic valve systems to support emerging high-speed gearboxes. As adoption accelerates, demand for sophisticated valve assemblies grows significantly.

Meanwhile, dual-clutch and CVT systems expand steadily across performance and fuel-efficient vehicle segments. Additionally, these architectures require specialized control valves engineered for precision and durability. Therefore, suppliers intensify R&D efforts to meet evolving transmission system requirements.

By Vehicle Type

Passenger cars hold the leading share as global production volumes rise continuously. Furthermore, advancements in driving comfort and automation reinforce the shift toward automatic transmissions. Consequently, OEM demand for high-quality valve components remains strong.

Light and heavy commercial vehicles increasingly transition to automated gear solutions. Moreover, commercial fleets seek enhanced driver comfort and operational efficiency. Thus, robust valve assemblies capable of sustaining intense duty cycles gain traction.

By Product Type

Solenoid valves dominate due to their electronic responsiveness and integration with advanced control units. Additionally, OEMs prioritize these components for achieving smoother, more efficient gear transitions. As a result, solenoid valve innovation remains a top industry focus.

Other critical valve types—including shift, pressure regulator, accumulator, clutch, and pulley control valves—support diverse transmission architectures. Moreover, each category plays a specialized role in managing hydraulic flow and pressure. Therefore, precision engineering remains essential across the entire product landscape.

By Sales Channel

First Fit installations continue leading the market, supported by robust OEM manufacturing activities. Additionally, long-term supplier partnerships ensure consistent quality and large-scale production capability. Consequently, OEM channels account for the majority of global demand.

The aftermarket also expands due to aging vehicle fleets and recurring service requirements. Moreover, consumers increasingly prefer OEM-standard replacement components for reliability. Thus, aftermarket distributors experience sustained growth aligned with repair and maintenance trends.

Drivers

Stringent emission standards and localization incentives significantly accelerate adoption of advanced valve technologies. Regulatory frameworks such as the EU’s evolving emission norms compel automakers to redesign hydraulic systems for efficiency and precision. Consequently, suppliers invest in next-generation mechatronic modules to ensure compliance and competitiveness.

Additionally, improving semiconductor availability and cost reductions in transmission control electronics drive broader integration of smart valve systems. As microcontrollers become more affordable, OEMs expand electronic actuation and onboard diagnostics. This trend enables better shift quality, optimized fuel efficiency, and revised engineering strategies across transmission platforms.

Use Cases

Automatic gearbox valves are essential in ensuring smooth, responsive gear shifting within passenger and commercial vehicles. By regulating fluid pressure across hydraulic circuits, these valves enhance driving performance and fuel economy. As transmission designs evolve, their role becomes increasingly central to vehicle drivability.

Moreover, advanced valve systems support hybrid and multi-speed EV transmissions, enabling seamless coordination between electric motors and mechanical powertrains. They facilitate precise control of clutch packs and torque paths, improving energy efficiency and component durability. Thus, valves remain indispensable to next-generation electric mobility solutions.

Major Challenges

Raw material cost volatility—particularly for copper, nickel, and specialty alloys—poses persistent challenges for valve manufacturers. These fluctuations disrupt pricing strategies and increase production uncertainty. Smaller suppliers face higher risk exposure, intensifying competitive pressures across the market.

Additionally, tightening global PFAS restrictions complicate component engineering for high-temperature valve systems. Replacing fluoropolymer-based seals requires extensive revalidation to maintain performance under extreme conditions. This regulatory landscape adds complexity, cost, and development delays for industry stakeholders.

Business Opportunities

Sensor-integrated valves enabling predictive maintenance and real-time diagnostics open new revenue avenues in smart mobility ecosystems. As OEMs deploy connected vehicle platforms, demand grows for components capable of generating actionable data. Suppliers who innovate in this direction gain significant competitive advantage.

Furthermore, expanding automotive industrialization across the Middle East and Asia unlocks opportunities for localized casting and machining operations. Government-backed EV clusters stimulate demand for transmission components, encouraging suppliers to establish regional manufacturing hubs. This shift enhances cost efficiency and market accessibility.

Regional Analysis

Asia Pacific leads the global landscape due to large-scale manufacturing capabilities and high vehicle output. Strong government support and rapid technology adoption further contribute to its commanding market share. Consequently, the region remains a primary hub for transmission component sourcing.

Meanwhile, North America and Europe maintain strong growth momentum driven by advanced transmission technologies and premium vehicle production. Localization incentives in the U.S. and stringent emission standards in Europe reinforce demand for high-performance valve systems. These regions continue to shape global innovation trajectories.

Recent Developments

- In June 2025, Allison Transmission acquired Dana Inc.’s off-highway unit for USD 2.7 Billion, expanding its heavy-duty capabilities.

- In June 2025, Latham & Watkins advised Allison Transmission on regulatory processes for the Dana acquisition.

- In March 2024, Take-Two acquired Gearbox from Embracer for USD 460 Million, marking significant activity in adjacent tech sectors.

Conclusion

The automatic gearbox valves market is poised for sustained expansion, driven by regulatory evolution, digital integration, and global manufacturing growth. As automotive powertrain technologies advance, demand for precise, durable, and intelligent hydraulic control components will intensify. Ultimately, companies that prioritize innovation, regional alignment, and technological collaboration will secure long-term competitive advantage.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)