Table of Contents

Automotive AI Processor Market Size

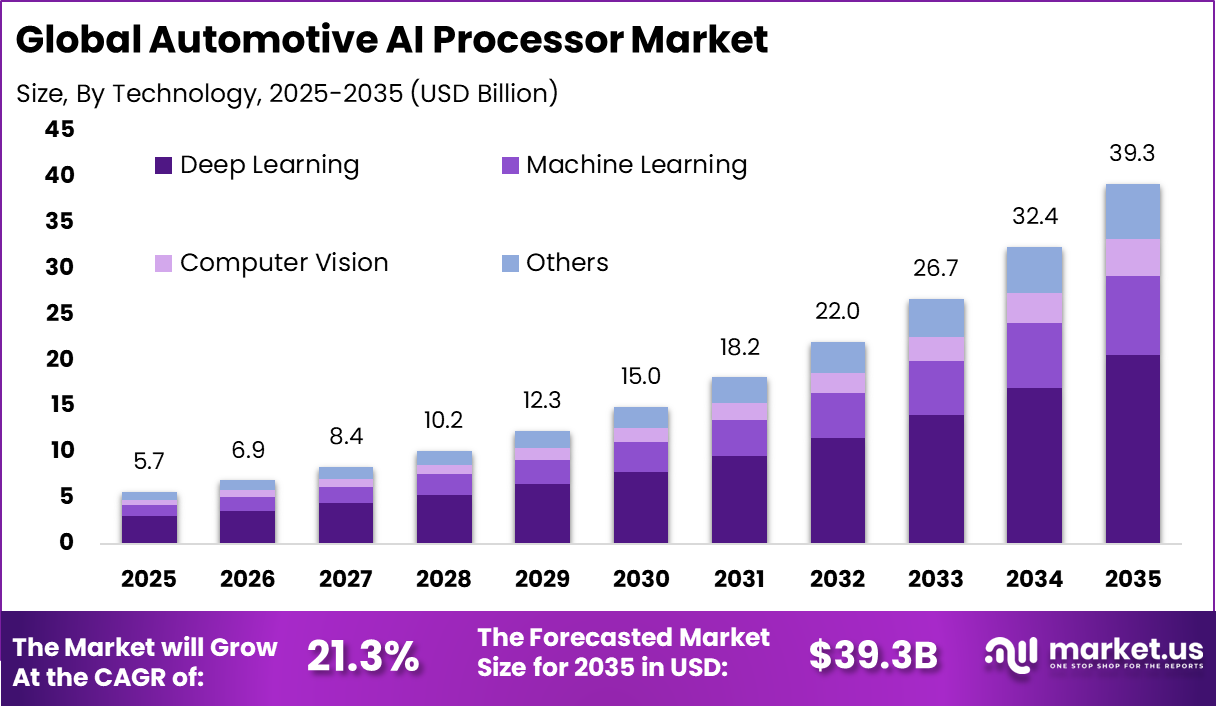

The Global Automotive AI Processor Market is entering a high-growth phase, projected to expand from USD 5.7 billion in 2025 to approximately USD 39.3 billion by 2035, registering a strong CAGR of 21.3% during the forecast period. Asia-Pacific led the market, capturing more than 42.6% share and generating USD 2.4 billion in revenue, underscoring the region’s dominance in automotive manufacturing, EV adoption, and AI-driven mobility innovation.

The Automotive AI Processor Market involves specialized chips designed for AI tasks in vehicles, such as processing data from sensors for safety and automation features. These processors power advanced driver assistance systems (ADAS), autonomous driving, and infotainment by handling machine learning workloads efficiently. Rising demand for autonomous vehicles pushes the need for powerful AI processors that manage real-time sensor data like cameras and radar.

Automakers integrate these chips to enable features from basic assistance to full self-driving capabilities. Electric vehicle growth adds to this, as AI optimizes battery use and energy efficiency. Advancements in deep learning and machine learning require high-performance computing in cars for quick decisions. Consumer expectations for safer, connected rides fuel investment in these technologies. Regulatory pushes for better safety standards worldwide also accelerate adoption.

Top Market Takeaways

- System on Chip (SoC) processors led the automotive AI processor market with a 40.7% share, reflecting demand for integrated computing, memory, and AI acceleration in vehicles.

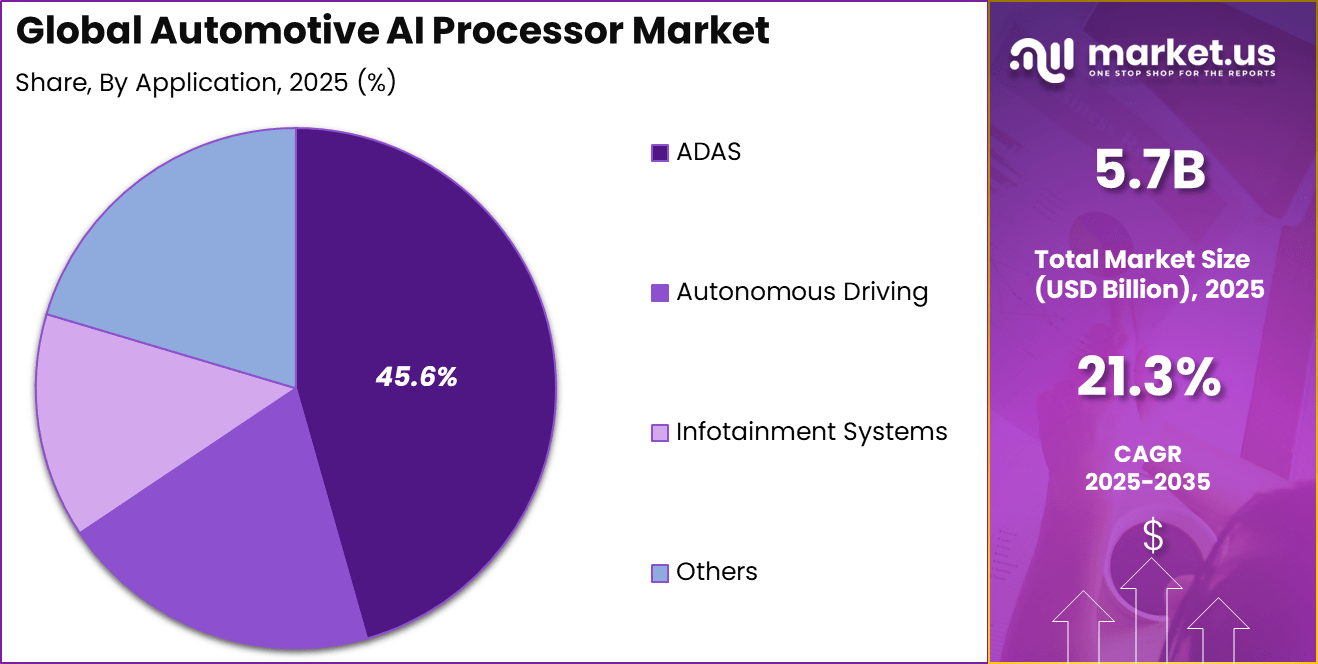

- Advanced Driver Assistance Systems (ADAS) accounted for 45.6%, driven by rising adoption of safety and driver support features.

- Passenger cars dominated vehicle type adoption with 70.3%, supported by higher production volumes and faster integration of AI features.

- Deep learning technology led with a 52.5% share, enabling advanced perception, decision making, and pattern recognition in automotive systems.

- OEMs were the primary end users, accounting for 95.2%, as AI processors are increasingly embedded during vehicle design and manufacturing.

- Asia Pacific held 42.6% of the market, with China contributing USD 0.73 billion and growing at a 18.2% CAGR.

Key Insight Summary

- OEM implementation: By 2026, around 43% of OEMs are implementing AI at scale or selectively across operations.

- SDV prioritization: About 45% of automotive OEMs and suppliers identify the shift to software defined vehicles as their top strategic priority for 2026.

- ADAS dominance: ADAS applications such as automatic braking and lane keeping hold the largest share at around 58.7% to 59%.

- Telematics growth: Telematics is the fastest growing application segment, with a projected 33.8% CAGR.

- Autonomy levels:

- Level 2 autonomy remains the most widely adopted, especially in mid range and premium vehicles.

- Level 3 autonomy is expected to be the fastest growing segment between 2025 and 2030.

- Manufacturing efficiency: OEMs using AI for quality assurance and predictive maintenance report up to 50% improvement in first time right production yields.

Drivers Impact Analysis

| Key Driver | Impact on CAGR Forecast (~%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rapid adoption of ADAS and autonomous driving features | +5.4% | North America, Europe, Asia Pacific | Short to medium term |

| Increasing integration of AI in infotainment and cockpit systems | +4.2% | Global | Medium term |

| Rising demand for real-time vehicle perception and decision making | +4.0% | North America, Asia Pacific | Medium term |

| Growth of electric vehicles with software-defined architectures | +3.6% | Europe, China, North America | Medium to long term |

| OEM focus on in-vehicle AI computing and edge processing | +2.9% | Global | Long term |

The combined driver impact strongly supports the ~21.3% CAGR, with ADAS and autonomous capabilities acting as the primary growth engines.

Restraints Impact Analysis

| Key Restraint | Impact on CAGR Forecast (~%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High cost of advanced automotive-grade AI processors | −3.1% | Global | Short to medium term |

| Complex integration with vehicle electronic architectures | −2.6% | Global | Medium term |

| Semiconductor supply chain volatility | −2.2% | Global | Short to medium term |

| Thermal and power consumption constraints in vehicles | −1.9% | Global | Medium term |

| Long automotive qualification and certification cycles | −1.5% | Global | Long term |

Restraints are technology- and cost-driven, but are expected to ease as volumes scale and architectures standardize.

Processor Type Analysis

System on Chip processors account for 40.7% of total demand, reflecting their central role in integrating multiple computing functions within a single unit. These processors are widely adopted due to their ability to combine processing, memory, and connectivity, which supports real time decision making in automotive environments. Their compact design also helps reduce power consumption and hardware complexity.

The growing preference for System on Chip architecture is closely linked to the rising use of software driven vehicle functions. As vehicles rely more on embedded intelligence, these processors enable faster data handling and improved system reliability. This structural advantage continues to support their leading position within the processor segment.

Application Analysis

Advanced Driver Assistance Systems account for 45.6% of application demand, making it the most dominant use case. This leadership is driven by the widespread integration of safety features such as lane assistance, collision avoidance, and adaptive cruise control. These functions require continuous data processing from multiple sensors, increasing reliance on advanced computing platforms.

Regulatory pressure and consumer safety expectations further strengthen demand for ADAS focused solutions. Automakers are prioritizing these systems to improve vehicle safety ratings and compliance. As a result, application demand remains heavily concentrated around ADAS deployment.

Vehicle Type Analysis

Passenger cars represent 70.3% of overall market demand, reflecting their higher production volumes and faster adoption of intelligent vehicle technologies. Consumer demand for comfort, safety, and connected features has accelerated the integration of advanced processing systems in this vehicle category.

Passenger vehicles also serve as early adopters for new automotive technologies. The dominance of passenger cars is reinforced by competitive differentiation among manufacturers. Advanced computing capabilities are increasingly used to enhance driving experience and brand positioning. This trend sustains strong demand from the passenger vehicle segment.

Technology Analysis

Deep learning accounts for 52.5% of technology adoption, highlighting its importance in processing complex driving data. This technology enables systems to learn from large datasets and improve performance over time. Applications such as object detection, path prediction, and decision support rely heavily on deep learning models. The adoption of deep learning is further supported by improvements in computing efficiency and algorithm optimization. These advances allow real time inference within vehicle systems. As automation levels increase, deep learning remains a core technology foundation.

End User Analysis

Original Equipment Manufacturers represent 95.2% of total end user demand, indicating strong concentration at the production level. OEMs integrate advanced processing solutions directly into vehicle platforms during manufacturing. This approach ensures system compatibility, performance optimization, and regulatory compliance.

The high share of OEM demand reflects their control over vehicle architecture and technology selection. Long term partnerships with technology providers also influence adoption patterns. As vehicles become more software defined, OEM driven integration continues to dominate end user demand.

Investor Type Impact Matrix

| Investor Type | Growth Sensitivity | Risk Exposure | Geographic Focus | Investment Outlook |

|---|---|---|---|---|

| Automotive semiconductor manufacturers | Very High | Medium | Asia Pacific, North America | Strong long-term demand from OEMs |

| Automotive OEM and Tier-1 suppliers | High | Medium | Global | Strategic vertical integration opportunity |

| AI accelerator and chip design firms | Very High | High | North America | Innovation-led growth with premium valuation |

| Private equity firms | Medium | Medium | Europe, North America | Platform expansion and consolidation |

| Venture capital investors | Very High | Very High | North America | Early-stage disruptive chip architectures |

Investor interest is strongest where automotive AI processors enable differentiation in safety, autonomy, and user experience.

Technology Enablement Analysis

| Technology Enabler | Impact on CAGR Forecast (~%) | Primary Function | Geographic Relevance | Adoption Timeline |

|---|---|---|---|---|

| Dedicated AI accelerators for ADAS and autonomy | +5.6% | High-speed perception and inference | Global | Short to medium term |

| Advanced node semiconductor manufacturing | +4.3% | Higher performance per watt | Asia Pacific | Medium term |

| Edge AI processing architectures | +3.9% | Low-latency decision making | Global | Medium term |

| Heterogeneous computing combining CPU, GPU, and NPU | +3.4% | Flexible AI workloads | North America, Europe | Medium to long term |

| Automotive-grade safety and redundancy features | +2.8% | Functional safety compliance | Global | Long term |

Key Market Segments

By Processor Type

- Graphics Processing Unit (GPU)

- Central Processing Unit (CPU)

- Application-specific Integrated Circuit (ASIC)

- Field Programmable Gate Array (FPGA)

- System on Chip (SoC)

- Others

By Application

- ADAS

- Autonomous Driving

- Infotainment Systems

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

By Technology

- Deep Learning

- Machine Learning

- Computer Vision

- Others

By End-User

- OEMs

- Aftermarket

Top Key Players in the Market

- Aptiv

- Baidu

- Continental

- Horizon Robotics

- Huawei Technologies

- Mobileye (Intel)

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Robert Bosch

- Tesla Inc.

- Intel Corporation

- Renesas Electronics Corporation

- NXP Semiconductors

- Texas Instruments Inc.

- Advanced Micro Devices Inc.

- Arm Holdings Plc

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 5.7 Bn |

| Forecast Revenue (2035) | USD 39.3 Bn |

| CAGR(2026-2035) | 21.3% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)