Table of Contents

Introduction

The global Automotive NFC market is expanding rapidly as vehicle digitalization accelerates. Automakers increasingly adopt NFC technology to enhance secure access, personalization, and in-car connectivity. This transformation supports a shift toward intuitive, contactless vehicle experiences that align with modern consumer expectations.

Additionally, rising integration of digital key systems strengthens NFC demand across connected and electric vehicles. These advancements simplify entry, authentication, and pairing processes. Moreover, automakers prioritize seamless smartphone interaction, encouraging widespread adoption of advanced NFC modules within evolving vehicle architectures.

Furthermore, regulatory focus on cybersecurity and secure communication frameworks boosts NFC integration across global automotive ecosystems. Governments emphasize encrypted data exchange and digital identity protection. Consequently, OEMs accelerate development of compliant, high-performance NFC solutions that enhance safety while improving user convenience.

Meanwhile, expanding shared mobility and fleet management models continue shaping NFC market growth. NFC enables reliable, traceable access control suitable for rental, car-sharing, and subscription-based services. As transportation ecosystems modernize, NFC-driven authentication becomes vital for efficient and secure operational workflows.

Finally, rising EV adoption intensifies the need for smart charging authentication and seamless user-vehicle interaction. NFC facilitates secure payments, personalized cabin settings, and instant device pairing. Therefore, the market prepares for robust expansion as vehicles transition toward fully connected, software-defined platforms.

Key Takeaways

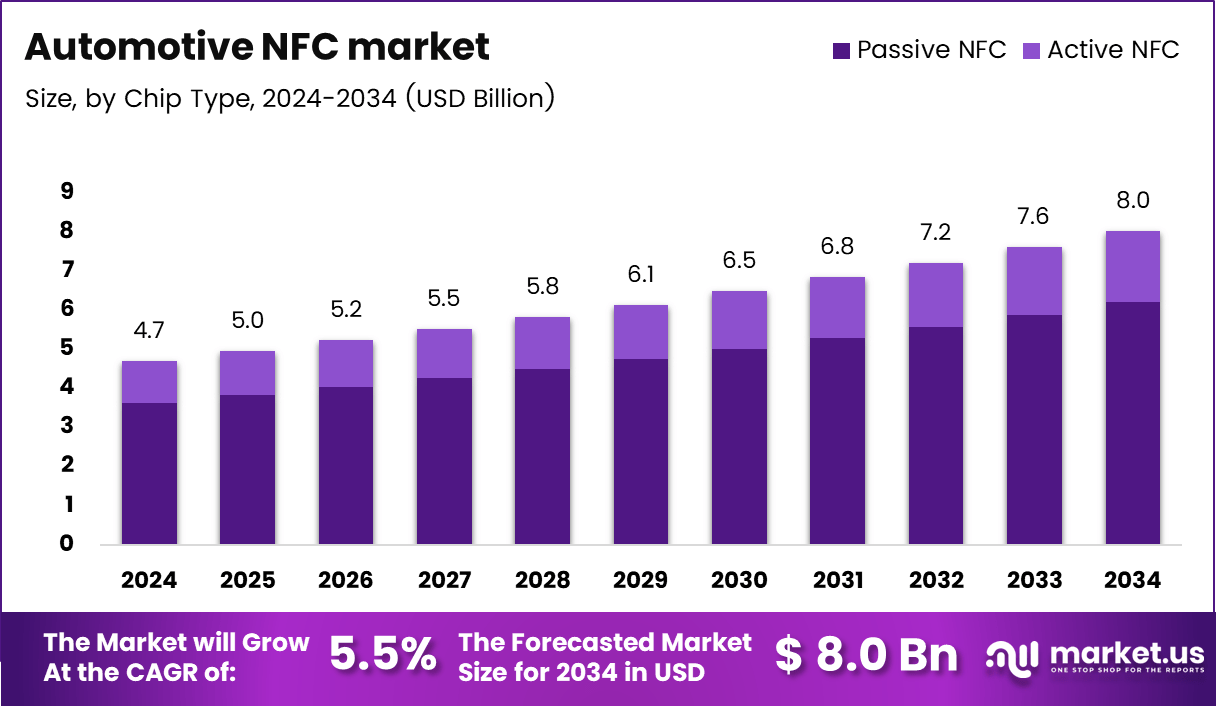

- The global Automotive NFC market reached USD 4.7 billion in 2024 and is projected to hit USD 8.0 billion by 2034.

- The market expands at a 5.5% CAGR from 2025–2034, driven by rising adoption of digital key systems.

- 106 Kbit/S emerged as the leading Type segment with a 44.2% share in 2024.

- Semi-Autonomous vehicles dominated with a 67.9% contribution.

- Mid-range vehicles led with a 55.7% share.

- Passive NFC remained the leading Chip Type with a 77.3% market share.

- Interior applications accounted for 66.6% of the market.

- North America dominated with a 43.8% share, valued at USD 2.0 billion in 2024.

Market Segmentation Overview

By Type

The 106 Kbit/S segment dominated due to its strong compatibility with standard automotive NFC functions. It supports secure authentication and vehicle pairing, making it ideal for mainstream models. Moreover, its stability positions it as the preferred choice for widely adopted NFC applications.

The 212 Kbit/S and 424 Kbit/S segments continued gaining traction as automakers pursued higher-speed communication. These protocols enhance responsiveness and data exchange, benefiting premium vehicles. Additionally, demand grows as digital cockpit systems require faster, more secure NFC-enabled interaction.

By Level of Autonomy

Semi-Autonomous vehicles retained dominance as NFC enhances driver authentication and system activation. These models rely on secure verification before enabling advanced features. Additionally, rising ADAS adoption accelerates NFC integration for safe, intuitive user access.

Autonomous vehicles displayed emerging interest, supported by fleet-based mobility models. NFC assists with secure passenger identification and personalized cabin setup. Moreover, rising investments in autonomous mobility drive research into advanced NFC systems for streamlined operations.

By Vehicle Type

Mid-range vehicles led the segment as OEMs expanded connected features across affordable models. NFC enables digital keys, personalization, and easy smartphone pairing. Additionally, growing consumer demand for smart features strengthens NFC adoption in this category.

High-end vehicles continued deep integration of advanced NFC modules. Luxury buyers favor multi-layer authentication and seamless connectivity. Meanwhile, low-end vehicles show gradual adoption as affordable NFC components enter cost-sensitive markets.

By Chip Type

Passive NFC dominated due to its low power requirement and compatibility with multiple vehicle systems. It supports locking mechanisms, driver authentication, and component tagging. Furthermore, its cost efficiency promotes widespread OEM adoption.

Active NFC gained slow but steady adoption as premium vehicles required long-range communication. These chips support high-speed data exchange, improving user experience. Moreover, demand rises as connected vehicles adopt richer infotainment ecosystems.

By Application

Interior applications held the largest share as NFC supports seat adjustments, digital keys, and infotainment pairing. Drivers expect frictionless personalization, enhancing NFC’s value. Additionally, interior digitalization trends continue pushing this segment forward.

Exterior applications grew with expanding EV charging authentication and secure entry solutions. Shared mobility platforms increasingly rely on NFC for fast, trackable access. Moreover, rising EV sales accelerate exterior NFC adoption.

Drivers

Rising Integration of Digital Keys: NFC-based digital key systems streamline vehicle access, reduce reliance on physical keys, and boost convenience. As EV adoption increases, digital access becomes essential, driving widespread integration across vehicle categories.

Growth of Personalization Features: NFC enables users to load personalized cabin settings instantly. This enhances driver comfort, especially in shared mobility and multi-user households. OEMs leverage personalization to differentiate their connected vehicle offerings.

Use Cases

Fleet Management: NFC supports precise driver authentication, improving accountability in commercial fleets. Rental and ride-hailing services benefit from traceable vehicle access, reducing unauthorized usage and operational risks.

In-Vehicle Payments: NFC powers secure transactions for charging, tolling, and parking. As mobility ecosystems digitalize, drivers increasingly prefer seamless, cardless payment experiences integrated directly into the vehicle.

Major Challenges

High Implementation Costs: Automotive-grade NFC modules require robust security and durability, raising manufacturing expenses. This challenge limits adoption across low-cost vehicle segments and emerging markets.

Interoperability Issues: Variations among smartphone brands and operating systems create inconsistent user experiences. Ensuring universal compatibility remains a barrier for OEMs seeking broad-scale implementation.

Business Opportunities

Smart City Integration: As cities adopt digital mobility infrastructure, NFC-enabled parking, EV charging, and transit systems become key growth drivers. Automakers can align vehicles with seamless urban connectivity.

Aftermarket Upgrades: Growing interest in retrofitting older vehicles with NFC modules and digital key add-ons expands the aftermarket. This creates new revenue streams for suppliers and service providers.

Regional Analysis

North America: With a 43.8% market share, the region leads due to strong adoption of connected vehicles and digital keys. High EV penetration and advanced mobility infrastructure continue supporting growth.

Asia Pacific: Rapid smartphone adoption and expanding automotive manufacturing propel NFC integration. China, Japan, and South Korea lead the regional push toward digital access and connected mobility ecosystems.

Recent Developments

- In November 2024, PREMO S.A. launched advanced NFC coil antennas for exterior car-access applications.

- In April 2025, Sony Corporation upgraded its NFC sensors to enhance multi-device pairing for connected-car interfaces.

Conclusion

The Automotive NFC market is poised for strong expansion as digitalization reshapes mobility. Rising adoption of digital keys, personalization technologies, and secure communication systems underscores NFC’s strategic importance. As connected and electric vehicles continue accelerating globally, NFC will remain a foundational technology enabling safe, intuitive, and modern driving experiences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)