Table of Contents

Introduction

The Global Automotive Powertrain Sensors Market continues to evolve as automotive manufacturers accelerate the integration of intelligent sensing systems. These sensors enable real-time monitoring of fuel efficiency, engine performance, and emission output, supporting a new era of connected, electrified, and environmentally responsible vehicles. The market’s trajectory signals significant technological transformation.

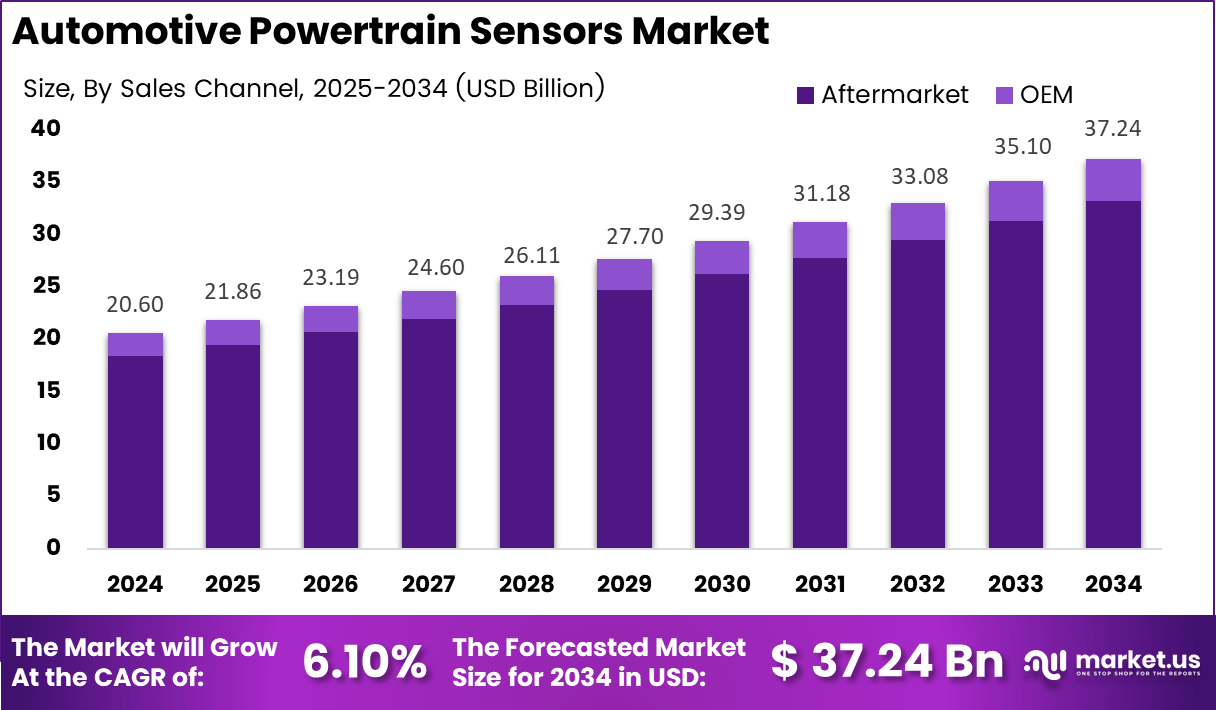

Valued at USD 20.6 billion in 2024, the market is projected to reach USD 37.24 billion by 2034, growing at a CAGR of 6.1% from 2025 to 2034. This steady growth reflects automakers’ strong focus on electrification, precision control, and sustainability, as global emission regulations intensify and fuel economy standards tighten across regions.

Technological advancements continue to drive innovation across sensor categories, enabling better combustion management, battery safety, and energy optimization. The automotive industry’s transition toward smart, software-defined vehicles further boosts demand for robust sensing platforms that integrate seamlessly into electronic control systems, improving reliability and operational efficiency in real time.

Moreover, the growing adoption of hybrid and electric vehicles (EVs) worldwide expands the scope of advanced powertrain sensing solutions. As automakers pursue reduced emissions and enhanced drivability, next-generation sensors provide a vital foundation for adaptive power distribution, battery thermal management, and predictive maintenance, ensuring efficiency and performance in evolving mobility landscapes.

Increasing investments in semiconductor miniaturization, artificial intelligence (AI), and solid-state technologies are reshaping sensor capabilities. These innovations allow for faster data acquisition and enhanced precision, empowering manufacturers to meet the rising demand for cleaner, safer, and smarter mobility solutions while maintaining compliance with global environmental directives.

As governments strengthen emission policies and incentivize electric mobility, automotive OEMs are prioritizing sensor-driven intelligence for energy-efficient powertrain systems. This transition highlights the market’s pivotal role in achieving sustainability targets and underpins its importance in future automotive engineering and manufacturing strategies.

Key Takeaways

- The Automotive Powertrain Sensors Market reached USD 20.6 billion in 2024 and is projected to hit USD 37.24 billion by 2034.

- The market grows at a steady CAGR of 6.1% from 2025 to 2034, driven by rising vehicle electrification.

- North America leads the global market with a dominant share of 43.8%, valued at USD 9.0 billion in 2024.

- Pressure Sensors dominate the sensor type segment with a market share of 34.9% in 2024.

- Internal Combustion Engine Vehicles remain the leading propulsion type, accounting for 72.3% of total market demand.

- Passenger Cars represent the dominant vehicle category, contributing 59.2% to total sensor adoption.

- The OEM channel accounts for a major share of 89.2%, reflecting high reliance on factory-installed sensing systems.

Market Segmentation Overview

By Sensor Type, Pressure Sensors dominate with a 34.9% share in 2024. Their crucial role in optimizing combustion and maintaining turbocharger efficiency solidifies their leadership. Temperature and Position Sensors follow closely, as advanced vehicles demand more precise thermal and positional control for enhanced fuel economy and performance.

By Propulsion Type, Internal Combustion Engine (ICE) Vehicles lead with a 72.3% share due to widespread adoption and established infrastructure. However, Electric Vehicles (EVs) are rapidly gaining ground as governments push electrification. Their dependence on sensors for battery, motor, and inverter monitoring ensures significant long-term growth potential.

By Vehicle Type, Passenger Cars hold the largest share at 59.2%, driven by high production volumes and rapid technological adoption. Light and Heavy Commercial Vehicles follow, using sensors for load management and emission optimization. Two-wheelers are also seeing increased sensor integration for performance and safety improvements.

By Sales Channel, OEMs dominate with a commanding 89.2% market share as automakers prefer integrated, factory-installed systems. The aftermarket contributes moderately, primarily driven by replacement needs and performance upgrades among aging vehicle fleets, particularly in emerging economies with expanding automotive bases.

Drivers

1. Increasing Integration of Advanced Monitoring Systems: Automakers are increasingly adopting smart powertrain sensors in hybrid and electric vehicles to ensure safety, efficiency, and real-time control. These sensors monitor temperature, voltage, and torque to improve battery life and optimize energy distribution, driving sustained global demand.

2. Stricter Global Emission Standards: Tightening emission norms across North America, Europe, and Asia have intensified the use of precision pressure and temperature sensors. These technologies help maintain cleaner combustion and fuel efficiency, enabling automakers to meet compliance targets while ensuring reliable powertrain operations.

Use Cases

1. Electric Vehicle Thermal Management: Advanced thermal sensors are deployed in EVs to monitor battery temperature and prevent overheating. By ensuring optimal heat regulation, these systems enhance battery performance, prolong lifespan, and support consistent vehicle operation under varying environmental conditions.

2. Predictive Powertrain Diagnostics: Integrated sensor networks allow for real-time vehicle health tracking. Data-driven diagnostics support preventive maintenance and improve operational efficiency. Fleet operators and OEMs use these capabilities to reduce downtime and enhance overall powertrain reliability across diverse vehicle categories.

Major Challenges

1. High Development and Integration Costs: Implementing advanced multi-sensor systems requires significant investment in research, calibration, and electronics integration. Smaller manufacturers often face cost constraints, limiting large-scale deployment of sophisticated sensor technologies in mass-market vehicles.

2. Complex Sensor Calibration and Compatibility: Integrating multiple sensor types across hybrid and EV platforms presents calibration and interoperability challenges. Variations in environmental conditions and communication protocols can affect performance accuracy and delay product development cycles.

Business Opportunities

1. Growth in Smart and Self-Diagnosing Sensors: Automakers are investing in self-monitoring sensors that predict component failures before they occur. This evolution toward intelligent sensing systems creates vast opportunities for suppliers specializing in data analytics and sensor fusion technologies.

2. Expansion of EV Battery Sensing Systems: As EV adoption rises, the need for battery temperature, voltage, and current monitoring grows exponentially. Companies that develop specialized sensors for harsh operating environments are poised to capture significant market share in this high-growth segment.

Regional Analysis

1. North America: North America dominates the global market with a 43.8% share, valued at USD 9.0 billion in 2024. The region benefits from strong EV adoption, stringent emission standards, and advanced manufacturing capabilities. Investments in connected powertrain technologies further reinforce its leadership position.

2. Asia Pacific: Asia Pacific emerges as the fastest-growing region due to expanding automotive production in China, Japan, and India. Rising government incentives for EVs, local sensor manufacturing initiatives, and growing demand for efficient vehicles accelerate large-scale market development across the region.

Recent Developments

- In September 2024, a leading power electronics manufacturer acquired a specialized sensing technologies firm to enhance EV inverter-integrated sensor capabilities, strengthening its multi-sensor fusion portfolio.

- In December 2025, a major chipmaker introduced advanced motor-control sensor ICs for next-generation 800-V EV architectures, improving switching efficiency, heat tolerance, and real-time current measurement accuracy.

Conclusion

The Global Automotive Powertrain Sensors Market is set for substantial growth as automakers pursue cleaner, smarter, and electrified mobility solutions. Advancements in solid-state, miniaturized, and AI-driven sensors redefine performance standards and accelerate sustainability across all vehicle types. With leading players like Robert Bosch GmbH, Continental AG, DENSO Corporation, and Infineon Technologies AG driving innovation, the industry’s future will be defined by efficiency, precision, and integration. As the world transitions toward connected and zero-emission mobility, powertrain sensors will remain at the heart of automotive transformation, enabling superior control, compliance, and competitive advantage across global markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)