Table of Contents

Introduction

According to Automotive Sensors Statistics, Automotive sensors are miniature yet powerful devices that drive the evolution of the modern automotive industry. They serve as the vehicle’s sensory organs, constantly collecting and transmitting data to optimize performance, safety, and efficiency. These sensors are strategically positioned throughout the vehicle, measuring parameters like temperature, pressure, speed, and emissions, and are integral to the functioning of critical systems.

From enhancing engine performance and emissions control to enabling advanced driver-assistance features, automotive sensors are at the heart of innovation in the automotive sector. They are pivotal in achieving goals such as increased fuel efficiency, reduced emissions, and enhanced safety, making them indispensable components in creating smarter and more connected vehicles.

Editor’s Choice

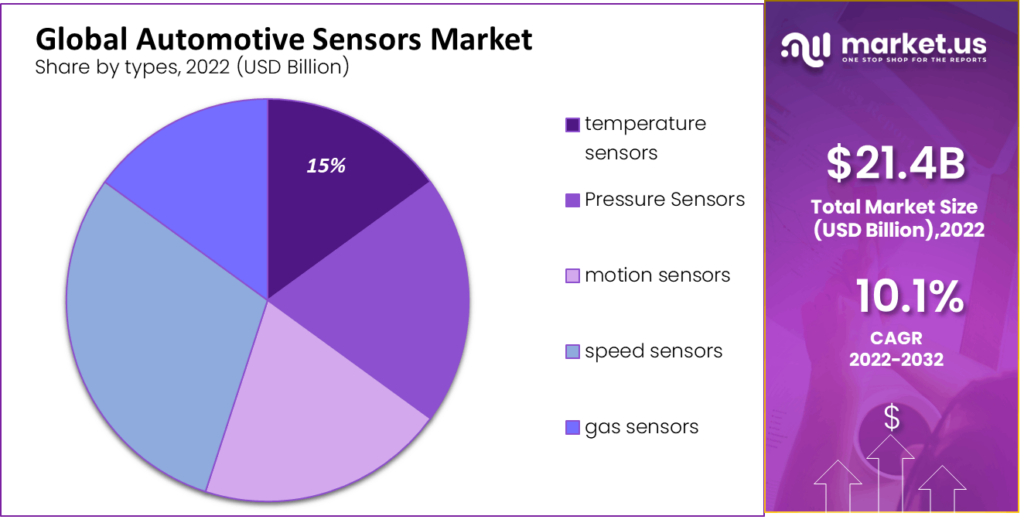

- The automotive sensors market has demonstrated robust growth at a CAGR of 10.1%.

- The automotive sensors market accounted for $21.0 billion in 2022.

- The Asia-Pacific (APAC) region stands out prominently, commanding the largest market share at 46.80%, reflecting its robust presence and growth potential.

- Robert Bosch GmbH leads the pack with a significant market share of 16%, followed closely by DENSO Corporation, holding a substantial share of 14%.

- With the increasing amount of time spent at home, there’s an escalating demand for smart devices, and the IoT sector is on an upward trajectory, with expectations of IoT device sensors reaching $43 billion by 2025.

- In 2023, the world witnessed a 16% rise in the quantity of interconnected IoT (Internet of Things) devices, reaching a total of 16.7 billion devices.

- The McKinsey Institute anticipates robust annual growth of around 30% in Level 2 advanced driver assistance systems (ADAS) until 2025, primarily due to regulatory mandates mandating the inclusion of these sensors in new vehicles.

- The anticipated evolution of proximity sensors in vehicles is substantial, with an increase from four types in a vehicle to nine by the year 2040.

Types of Automotive Sensors

Temperature Sensors

- From 2016 to 2022, the temperature sensors market has seen consistent revenue growth.

- In 2016, the market generated approximately $5.13 billion, which gradually increased over the years.

- By 2017, revenue reached $5.4 billion, followed by $5.6 billion in 2018, $5.9 billion in 2019, and $6.2 billion in 2020.

- The momentum continued into 2021, with revenue reaching $6.5 billion and further expanded to $6.79 billion in 2022.

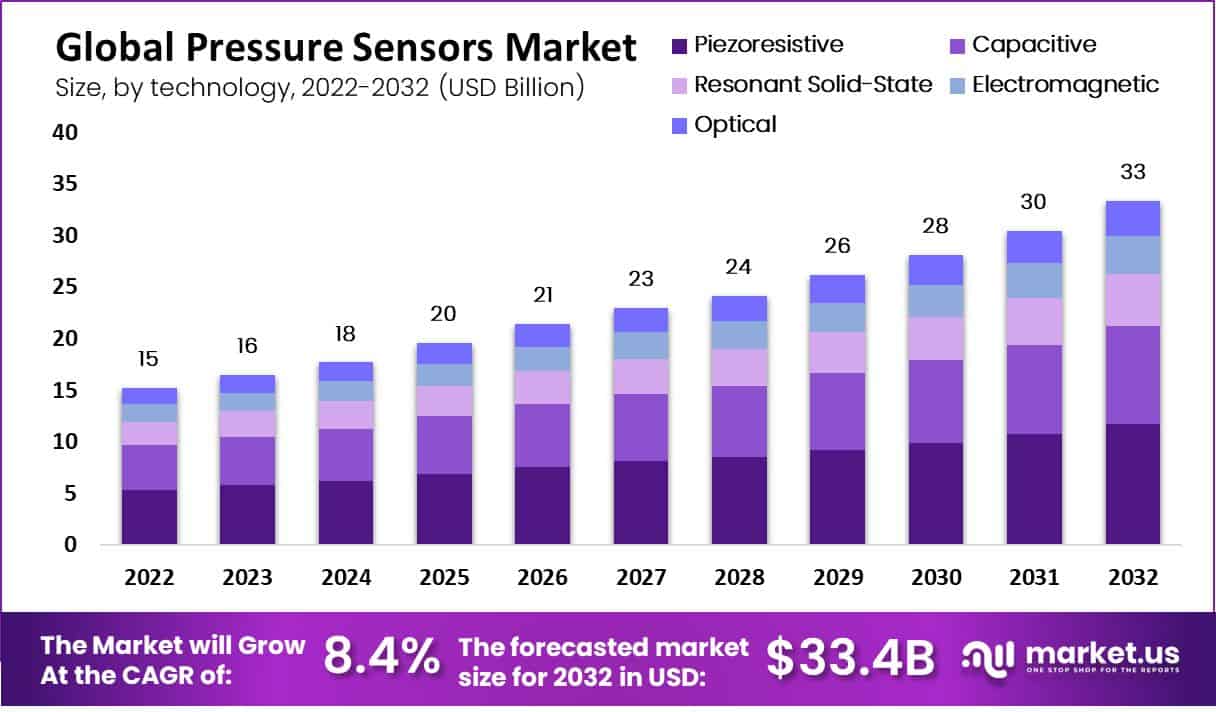

Pressure Sensors

- The revenue generated by the pressure sensors market is on a continuous upward trajectory, demonstrating substantial growth at a CAGR of 8.4%.

- In 2022, the market’s revenue was $15 billion, projected to climb to $16 billion in 2023.

- The market’s expansion further accelerates in the subsequent years, with revenue reaching $18 billion in 2024, $20 billion in 2025, and $21 billion in 2026.

- The trend of steady growth continues throughout the forecast period, with revenue estimates reaching $23 billion in 2027, $24 billion in 2028, $26 billion in 2029, $28 billion in 2030, $30 billion in 2031, and $33 billion in 2032.

Speed Sensors

- The global market for speed sensors grew, increasing from $8.72 billion in 2022 to $9.41 billion in 2023, with a growth rate of 7.9%.

- Nevertheless, the ongoing conflict between Russia and Ukraine has disrupted hopes for a rapid global economic rebound from the COVID-19 pandemic.

- This conflict has led to economic sanctions, surging commodity prices, supply chain disruptions, and inflation, affecting global markets.

- Projections indicate that the speed sensor market is set to achieve $12.53 billion in 2027, driven by a compound annual growth rate of 7.4%.

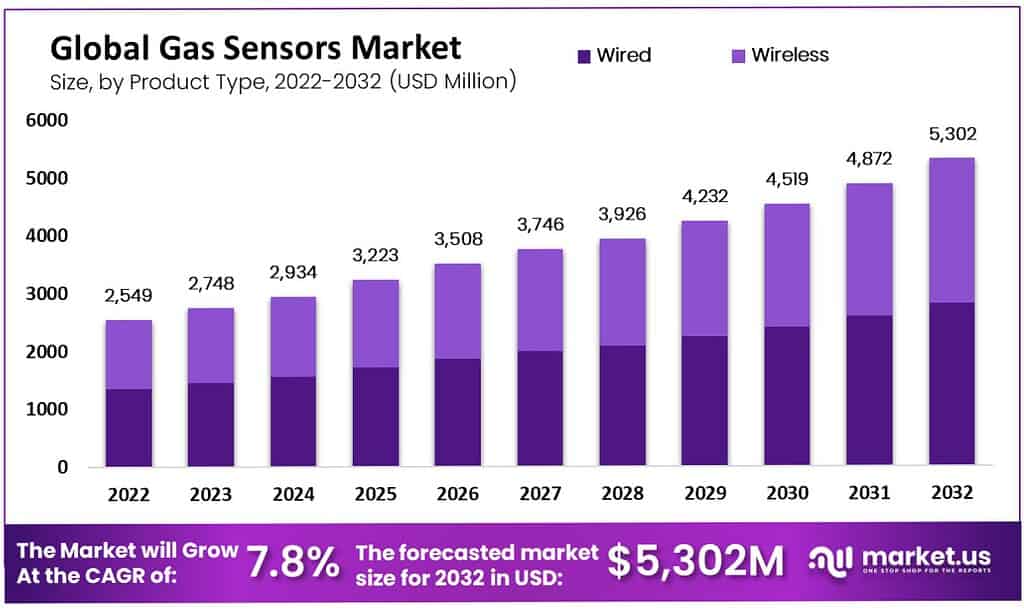

Gas Sensors

- The revenue of the gas sensors market has demonstrated a consistent upward trend, starting at $2,549 million in 2022 and increasing annually.

- In 2023 the market revenue climbed to $2,748 million, followed by $2,934 million in 2024.

- The growth trajectory continued with revenue figures of $3,223 million in 2025, $3,508 million in 2026, and $3,746 million in 2027.

- The upward momentum persisted, with revenue reaching $3,926 million in 2028, $4,232 million in 2029, and $4,519 million in 2030.

- The market is projected to expand, with revenue anticipated to reach $4,872 million in 2031 and $5,302 million in 2032.

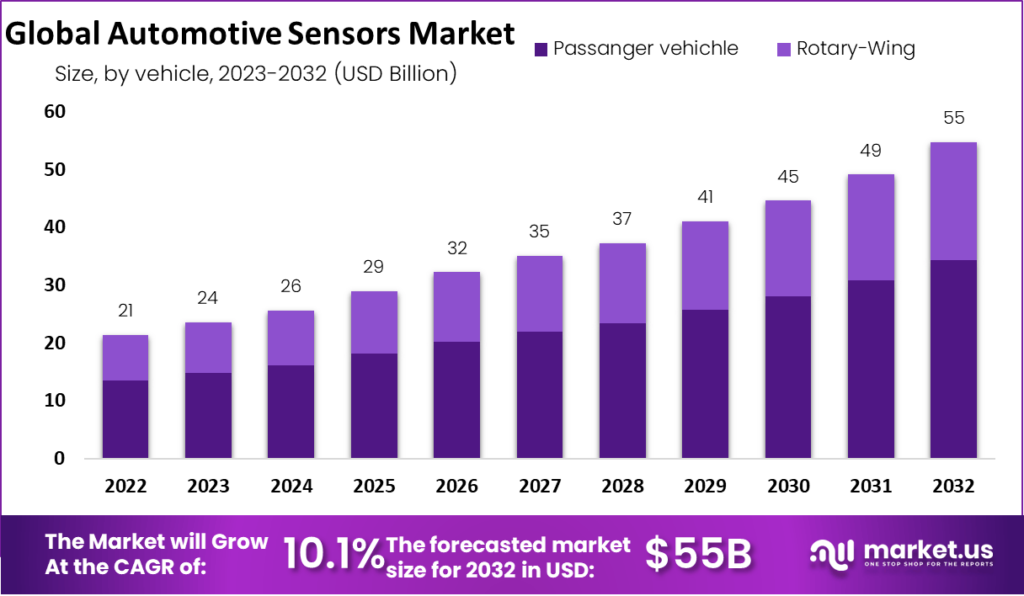

Global Automotive Sensors Market Size

- The automotive sensors market has demonstrated robust growth at a CAGR of 10.1%.

- Commencing at $21.0 billion in 2022, the market consistently advanced year by year.

- By 2023, market revenue had surged to $24.0 billion, followed by $26.0 billion in 2024.

- The momentum persisted, with revenues of $29.0 billion in 2025, $32.0 billion in 2026, and $35.0 billion in 2027.

- This upward trajectory continued, reaching $37.0 billion in 2028, $41.0 billion in 2029, and $45.0 billion in 2030.

- The market is expected to maintain its expansion, projecting revenues of $49.0 billion in 2031 and $55.0 billion in 2032.

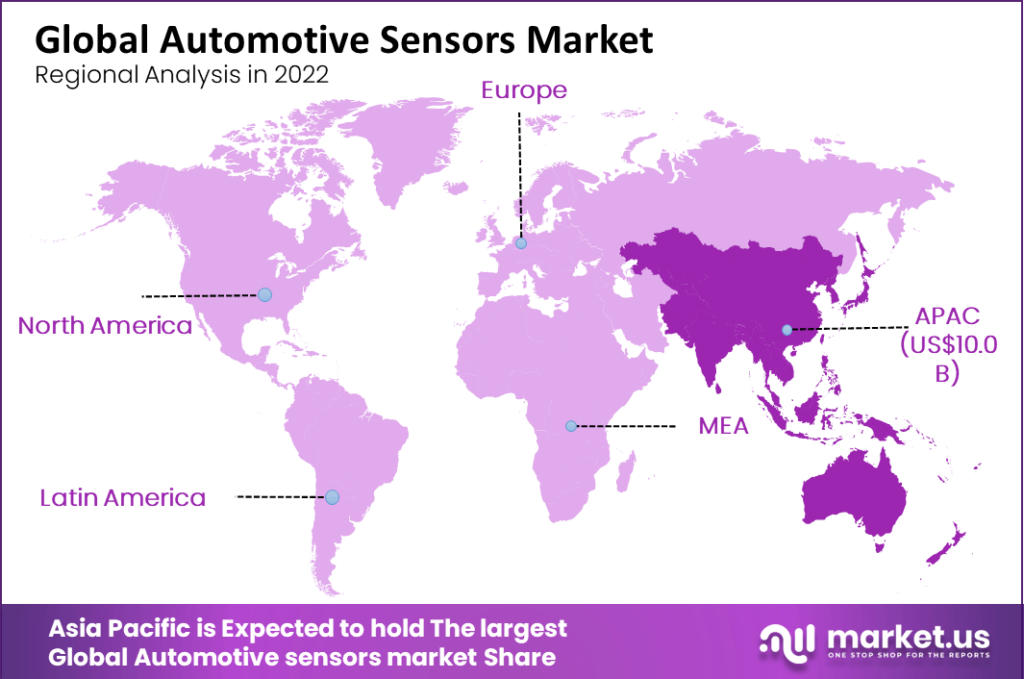

Regional Analysis of Automotive Sensors Market

- The regional analysis of the automotive sensors market reveals a diverse market share distribution across different regions.

- It accounts for approximately 17.80% of the market in North America, signifying a significant presence in this region. Europe follows closely, holding a substantial share of 24.40%.

- However, the Asia-Pacific (APAC) region stands out prominently, commanding the largest market share at 46.80%, reflecting its robust presence and growth potential.

- Latin America holds a smaller yet notable portion of the market at 6.86%, while the Middle East and Africa (MEA) region contributes 4.10% to the market share.

Key Players in the Automotive Sensors Market

- A diverse array of key players marks the automotive sensors market, each contributing to its dynamic landscape.

- Robert Bosch GmbH leads the pack with a significant market share of 16%, followed closely by DENSO Corporation, holding a substantial share of 14%.

- Infineon Technologies AG and NXP Semiconductor contribute 7% and 10% of the market, underlining their noteworthy positions.

- ST Microelectronics and Valeo each account for 9% of the market share, while Continental AG shares 8% of the market with Valeo.

- Sensata Technologies also plays a prominent role, with a 9% market share.

- Additionally, other key players collectively make up 19% of the market, indicating the presence of a range of significant players shaping the industry.

Technological Advancements

Adoption of MEMS Sensors

- The MEMS sensor market is projected to achieve a value of $75 billion from 2022 to 2032.

- The growing prevalence of electronic devices, coupled with the lightweight and energy-efficient nature of MEMS sensors, has made them a favored choice among consumers.

- Moreover, integrating MEMS sensors into the Internet of Things (IoT) ecosystem is streamlining and simplifying our daily lives.

- With the increasing amount of time spent at home, there’s an escalating demand for smart devices, and the IoT sector is on an upward trajectory, with expectations of IoT device sensors reaching $43 billion by 2025.

- MEMS sensors come in various types, including mechanical, optical, and chemical & biological sensors.

- Optical sensors, particularly those aligned with the expanding use of fiber optics, have gained substantial popularity.

IoT Connections

- In 2023, the world witnessed a 16% rise in the quantity of interconnected IoT (Internet of Things) devices, reaching a total of 16.7 billion devices.

- This upward trend is anticipated to persist, with forecasts indicating that by 2027, the global count of IoT connections will exceed 29 billion.

- China has emerged as a prominent contender in the IoT device market, with substantial expansion in cellular IoT connections.

- Among all IoT connections, Wi-Fi constitutes 31%, with the incorporation of advanced Wi-Fi 6 and Wi-Fi 6E technologies leading to more effective communication among IoT devices, particularly in smart homes, buildings, and healthcare.

Advanced Driver Assistance Systems (ADAS)

Global Advanced Driver Assistance Systems (ADAS) Market Size

- The market revenue for Advanced Driver Assistance Systems Market (ADAS) has demonstrated a remarkable and consistent upward trajectory over the years at a CAGR of 14.00%.

- In 2022, it stood at $33 billion, steadily increasing yearly.

- By 2023, the market revenue had surged to $38 billion, followed by $42 billion in 2024.

- The market is anticipated to maintain its robust expansion, projecting revenues of $102 billion in 2031 and $118 billion in 2032.

Adoption of Advanced Driver Assistance Systems (ADAS)

- The McKinsey Institute anticipates robust annual growth of around 30% in Level 2 advanced driver assistance systems (ADAS) until 2025, primarily due to regulatory mandates mandating the inclusion of these sensors in new vehicles.

- Looking ahead to 2030, the institute estimates suggest that 12% of vehicles will come equipped with Levels 3 and 4 AD capabilities, a substantial increase from the 1% reported in 2025.

Energy Use Implications

- The anticipated evolution of proximity sensors in vehicles is substantial, with an increase from four types in a vehicle to nine by the year 2040.

- This expansion translates to a rise in the number of sensors from 17 in 2015 to 32.

- Assuming that the “Types of Proximity Sensor” aligns with the number of sensor systems, and considering the ultrasonic backup sensor system as a representative of advanced driver assistance systems (ADAS), solely the manufacturing and operational energy consumption of ADAS systems contributes 4.0 gigajoules (GJ) to the total energy usage over the lifespan of a 2015 vehicle.

- This figure could potentially increase to 8.9 GJ or even more for a 2040 vehicle, as the number of sensors is expected to grow independently from the types of sensors employed.

- Projected for 2024, automotive sensor sales are set to reach 11 billion units, marking a substantial increase from the 7.5 billion units recorded in 2017.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)