Table of Contents

Market Overview

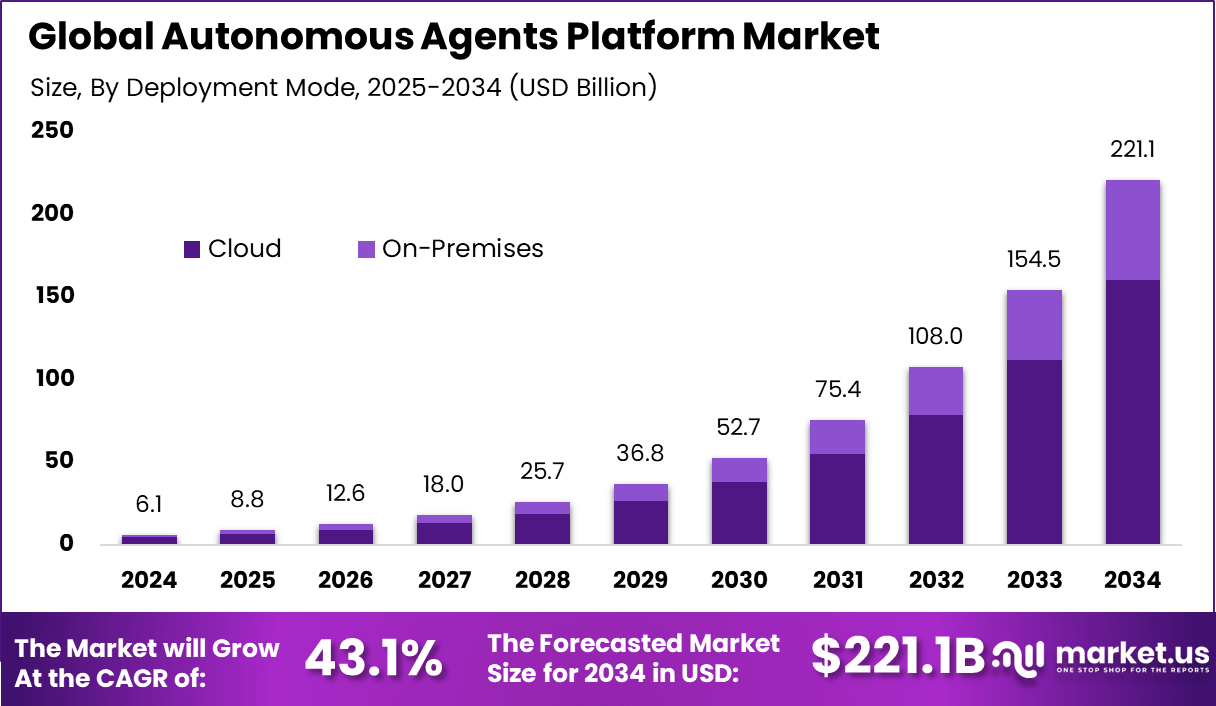

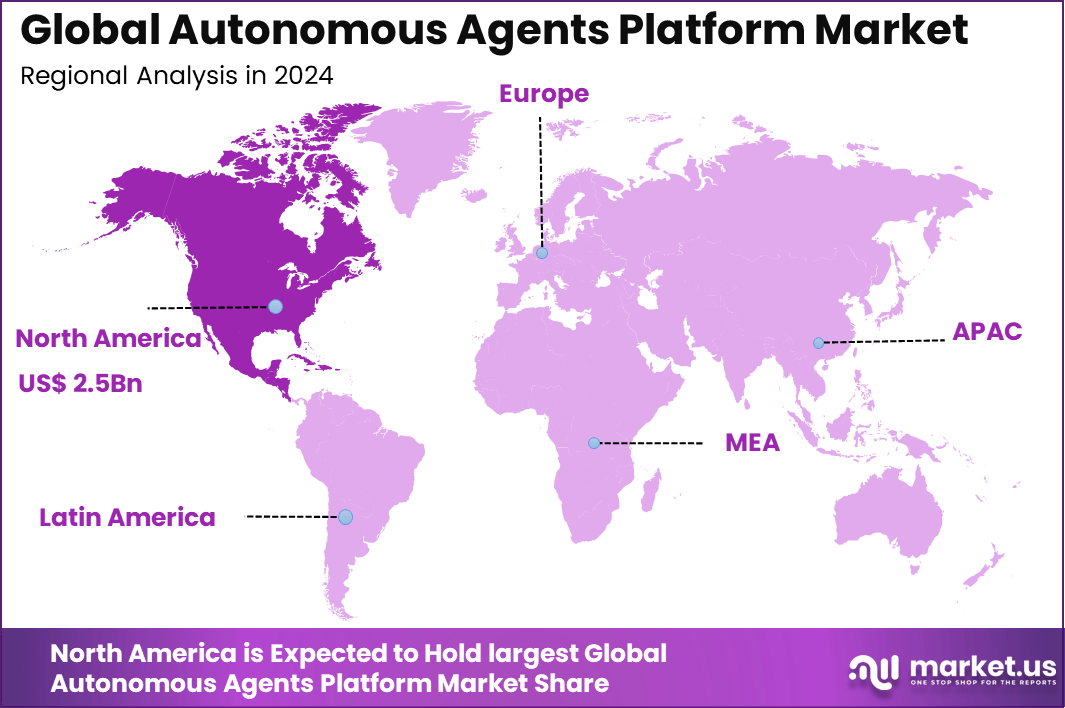

The global autonomous agents platform market generated USD 6.1 billion in 2024 and is projected to grow from USD 8.8 billion in 2025 to approximately USD 221.1 billion by 2034, registering a CAGR of 43.1% over the forecast period. In 2024, North America held a dominant position with more than 41.2% market share, accounting for around USD 2.5 billion in revenue, supported by early adoption of autonomous AI systems and strong enterprise investment.

The autonomous agents platform market focuses on software platforms that enable intelligent agents to operate independently with minimal human input. These platforms allow agents to perceive information, make decisions, and execute tasks across digital environments. Autonomous agents are designed to handle complex workflows and continuous operations. The market is emerging as organizations seek advanced automation solutions.

Autonomous agents platforms are used across enterprise IT, business operations, customer service, research, and software development. They combine decision logic, memory, and action execution within a unified system. Organizations adopt these platforms to move beyond task-based automation. The market is evolving as autonomy becomes a strategic capability.

Quick Market Facts

- Platform and solution offerings dominate with 69.7%, driven by demand for end-to-end autonomous agent orchestration and workflow automation.

- Cloud-based deployment leads with 72.6%, reflecting preference for scalability, rapid rollout, and flexible system integration.

- Large enterprises account for 78.1%, as autonomous agents are used to manage complex, high-volume operations and improve efficiency.

- Customer service and support represent 33.1%, supported by adoption of agents for real-time interaction, ticket resolution, and self-service.

- IT and telecommunications hold 21.7%, indicating strong use in network automation, service assurance, and digital operations.

- North America leads with 41.2%, backed by advanced AI adoption and strong enterprise investment.

- The U.S. market reached USD 2.28 billion and is expanding at a 38.6% CAGR, reflecting rapid deployment of autonomous agent platforms.

Enterprise Adoption and Benefits

- About 79% of organizations already use AI agents in operational workflows.

- Nearly 88% of U.S. enterprises plan to increase AI spending within the next year.

- Companies deploying AI agents report roughly 55% improvement in operational efficiency.

- Average cost reductions of around 35% are achieved after agent deployment.

- In software development, AI agents have reduced cycle times and cut production errors by 50% or more in some large retail environments.

- Key use cases include research and summarization (58%), customer service (45.8%), and personal productivity and workflow automation (53.5%).

Consumer Perception

- About 54% of consumers prioritize faster problem resolution over human interaction.

- Nearly 39% are comfortable with AI agents scheduling appointments.

- Around 24% are comfortable allowing AI agents to make purchases on their behalf.

Demand Analysis

Demand surges from enterprises seeking to automate complex, multi-step processes amid talent shortages and rising operational costs. Adoption accelerates in IT and telecom for network management, with North America capturing over 40% share due to mature AI ecosystems. Global projections show growth from USD 6.1 billion in 2024 to over USD 200 billion by 2034, driven by productivity needs.

End-user focus on finance and healthcare reflects needs for real-time decision-making and compliance, fueled by advancements in generative AI. Over 50% of firms prioritize these platforms for gen AI initiatives, with cloud deployments easing scalability. Sustained expansion ties to proven ROI in reducing manual interventions.

Regional Analysis

North America holds a dominant 41.2% share of the global autonomous agents platform market in 2025. This leadership is driven by strong investments in AI, advanced digital infrastructure, and a high concentration of tech innovators.

Emerging Trends

In the autonomous agents platform market, a key trend is the integration of artificial intelligence and machine learning to enable adaptive behaviour. Platforms are increasingly incorporating advanced models that allow agents to learn from interactions, predict needs, and make decisions autonomously without constant human input. This capability supports more refined task execution and improves responsiveness across dynamic environments.

Another emerging trend is the fusion of multi-agent coordination capabilities that allow autonomous agents to work collaboratively toward shared objectives. Instead of operating as isolated units, agents can communicate, negotiate, and allocate tasks within a system. This collective behaviour enhances efficiency and supports complex use cases such as coordinated logistics, automated workflow orchestration, and real-time optimisation.

Growth Factors

A principal growth factor in the autonomous agents platform market is the rising demand for automation across industries. Organisations are deploying agents to handle repetitive tasks, manage large data streams, and support 24/7 operations. Autonomous platforms enable these capabilities by reducing manual intervention and allowing human resources to focus on strategic and high-value activities.

Another important factor supporting growth is the expansion of digital ecosystems and connected devices. The proliferation of Internet of Things (IoT) infrastructure, distributed computing, and networked services creates environments where autonomous agents can perform monitoring, coordination, and decision-making tasks efficiently. This connectivity supports broader adoption of agent-based automation across diverse operational contexts.

Driver

A central driver of the autonomous agents platform market is the need for improved operational efficiency and scalability. Organisations are under pressure to deliver services faster and with fewer errors. Autonomous agents that can execute predefined processes, handle exceptions, and adapt to changing conditions help reduce latency and improve throughput in areas such as customer support, workflow automation, and system monitoring.

Another driver is the increasing complexity of digital processes that surpass manual management capabilities. As enterprises adopt composite systems involving multiple applications, data sources, and user interactions, autonomous agents provide a way to manage this complexity by executing rule-based and predictive actions across systems. This capability supports smoother integration and more reliable execution of end-to-end workflows.

Restraint

A notable restraint in this market is the challenge of ensuring trust, transparency, and explainability in autonomous decision-making. As agents operate with increasing autonomy, organisations must understand how and why decisions are made to ensure accountability. Limited visibility into agent logic can inhibit adoption where regulatory and governance standards require auditability and traceability.

Another restraint relates to integration complexity with existing enterprise infrastructure. Autonomous platforms must connect with legacy systems, varied data sources, and diverse operational contexts. Achieving seamless interoperability without disrupting ongoing processes requires careful planning and technical expertise, which can slow deployment timelines.

Opportunity

A strong opportunity exists in the development of domain-specific autonomous agent solutions tailored to sectors such as healthcare operations, supply chain management, smart manufacturing, and customer engagement. Platforms designed with specialised capabilities for these verticals can deliver more immediate value by aligning with industry workflows and performance expectations.

Another opportunity lies in augmenting human-agent collaboration frameworks that allow agents to assist rather than replace human decision-makers. Platforms that support intuitive oversight, user-friendly controls, and contextual recommendations can improve trust and adoption by enabling humans to guide agent behaviour while benefiting from automation efficiency.

Challenge

One of the main challenges for the autonomous agents platform market is balancing autonomy with ethical and regulatory compliance. Autonomous agents that interact with sensitive data, critical decision paths, or customer-facing systems must operate within ethical boundaries and legal standards. Designing systems that ensure compliance without stifling intelligent behaviour remains complex.

Another challenge involves the continuous improvement and adaptation of agent models in response to evolving operational conditions and user expectations. Agents must be maintained, retrained, and updated to reflect new rules, environments, or objectives. Sustaining this level of evolution requires robust governance, monitoring, and feedback mechanisms to maintain performance and relevance.

Key Market Segments

By Component

- Platform/Solutions

- Agent Development Frameworks

- Orchestration & Management Hubs

- Others

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Customer Service & Support

- Sales & Marketing

- Data Analysis & Business Intelligence

- Software Development & IT Operations (DevOps & AIOps)

- Personal Assistant Agents

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing & Logistics

- Media & Entertainment

- Government & Public Sector

- Others

Top Key Players in the Market

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation (IBM)

- Amazon.com, Inc.

- Salesforce, Inc.

- ServiceNow, Inc.

- Oracle Corporation

- SAP SE

- OpenAI, L.L.C.

- Meta Platforms, Inc.

- Appian Corporation

- UiPath Inc.

- Automation Anywhere, Inc.

- Cognizant Technology Solutions Corporation

- Accenture plc

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.1 Bn |

| Forecast Revenue (2034) | USD 221.1 Bn |

| CAGR(2025-2034) | 43.1% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)