Table of Contents

Introduction

Autonomous Mobile Robots Statistics: Autonomous Mobile Robots (AMRs) are robotic systems that can move and navigate on their own, without the need for human control. They use sensors to understand their surroundings, create maps, and make decisions autonomously.

AMRs are applied in diverse fields, such as manufacturing, healthcare, retail, agriculture, and construction. Bringing benefits like enhanced efficiency, safety, accuracy, and the potential for cost reduction.

However, introducing AMRs into operations requires an initial financial investment and smooth integration with existing systems. Despite these obstacles, continual technological progress points to a promising future for AMRs.

Editor’s Choice

- The autonomous mobile robots market has been witnessing remarkable growth in recent years at a CAGR of 18.1%, with its revenue steadily increasing.

- In 2022, the market revenue stood at USD 3.6 billion, and it continued to expand significantly in the subsequent years.

- In 2022, the total market revenue stood at USD 3.6 billion, with hardware contributing USD 2.3 billion. Software contributed USD 1.0 billion, and services accounted for USD 0.3 billion.

- According to the type of AMR, goods-to-person picking robots dominate with a significant market share of 47%.

- In 2018, the global shipment of autonomous mobile robots (AMRs) exceeded 20,000 units. More than doubling the figure from the previous year, according to a quarterly report by Interact Analysis.

- Despite robust demand in the supply chain and e-commerce sectors for AMRs, revenue growth was limited to 10%, with Dematic leading as the primary supplier.

- According to recent data, logistic robots occupy a substantial share, accounting for 31% of service robot utilization. These robots play a crucial role in optimizing and streamlining logistics operations.

Autonomous Mobile Robots Market Statistics

Global Autonomous Mobile Robots Market Size Statistics

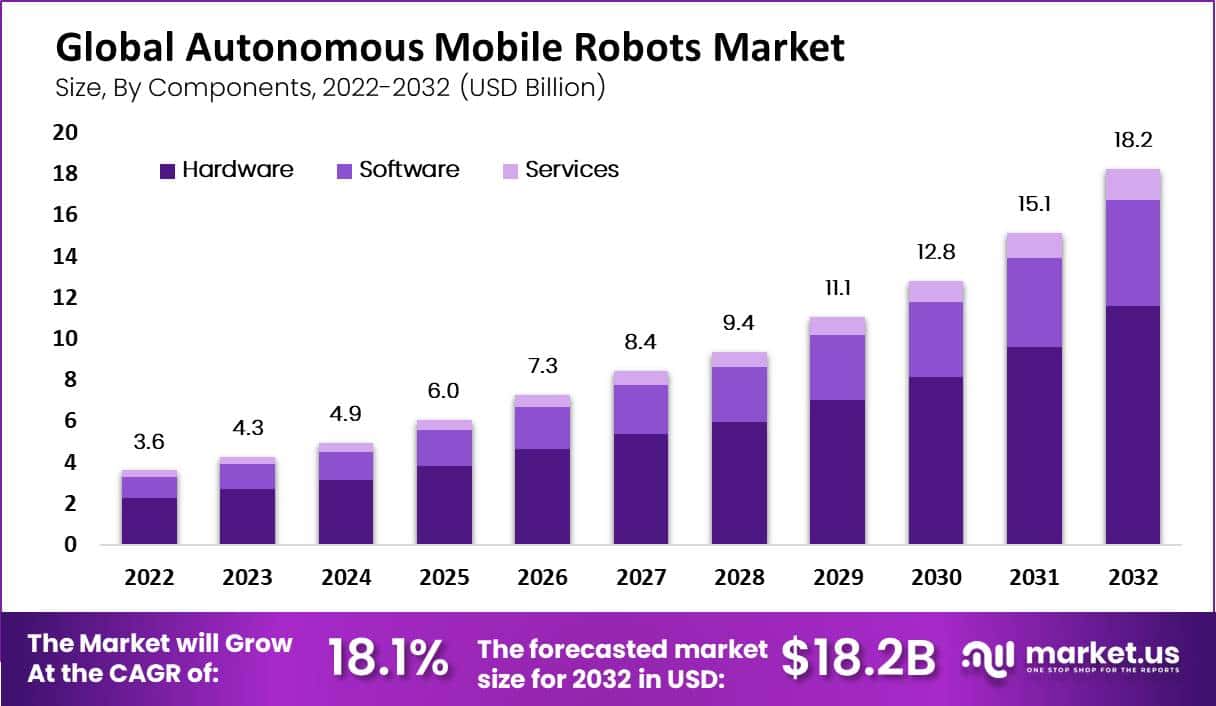

- The autonomous mobile robots market has been witnessing remarkable growth in recent years at a CAGR of 18.1%, with its revenue steadily increasing.

- In 2022, the market revenue stood at USD 3.6 billion, and it continued to expand significantly in the subsequent years.

- In 2023, the revenue reached USD 4.3 billion, followed by a substantial rise to USD 4.9 billion in 2024.

- This positive trajectory is expected to continue in the coming years, with projections of USD 6.0 billion in 2025, USD 7.3 billion in 2026, and USD 8.4 billion in 2027.

- The market is anticipated to maintain its upward trend, reaching USD 9.4 billion in 2028, USD 11.1 billion in 2029, and USD 12.8 billion in 2030.

- Looking further ahead, the autonomous mobile robots market is predicted to see even more substantial growth. With revenues projected to reach USD 15.1 billion in 2031 and a remarkable USD 18.2 billion in 2032.

- These impressive figures signify the market’s robust potential and the increasing adoption of autonomous mobile robots across various industries.

(Source: Market.us)

Autonomous Mobile Robots Market Share – By Components Statistics

- The global autonomous mobile robots market’s growth can be analyzed by breaking down its components. Including hardware, software, and services, along with the total market revenue of USD billion.

- In 2022, the total market revenue stood at USD 3.6 billion, with hardware contributing USD 2.3 billion. Software contributed USD 1.0 billion, and services accounted for USD 0.3 billion.

- As we progress into the future, these components continue to exhibit substantial growth. By 2023, the total market revenue will increase to USD 4.3 billion, with hardware, software, and services revenues rising to USD 2.7 billion, USD 1.2 billion, and USD 0.3 billion, respectively.

- In 2024, the market further expands to reach USD 4.9 billion, with hardware, software, and services revenues of USD 3.1 billion, USD 1.4 billion, and USD 0.4 billion, respectively.

- This trend continues throughout the forecast period, with the market projected to achieve USD 18.2 billion in 2032.

- Hardware, software, and services are expected to contribute significantly. With revenues of USD 11.6 billion, USD 5.2 billion, and USD 1.5 billion, respectively.

- These figures illustrate the growth and importance of each component in the global autonomous mobile robots market.

(Source: Market.us)

Global Autonomous Mobile Robots Market Share – By Type Statistics

- The global autonomous mobile robots market is diversified across various types of robots, each with its share of the market.

- In this landscape, goods-to-person picking robots dominate with a significant market share of 47%. These robots are instrumental in optimizing warehouse operations by efficiently retrieving items for order fulfillment.

- Self-driving forklifts follow closely behind, commanding a 24% market share. These autonomous forklifts play a vital role in material handling and logistics.

- Autonomous inventory robots hold a substantial 16% market share, offering innovative solutions for inventory management and tracking.

- Lastly, unmanned aerial vehicles (UAVs) carve out a niche with a 13% market share, serving applications ranging from surveillance to delivery services.

- This distribution of market share highlights the diverse and evolving nature of the global autonomous mobile robots market, with each type catering to specific industry needs and driving technological advancements in their respective domains.

(Source: Market.us)

Autonomous Mobile Robots Shipment Statistics

- In 2018, the global shipment of autonomous mobile robots (AMRs) exceeded 20,000 units, more than doubling the figure from the previous year, according to a quarterly report by Interact Analysis.

- This growth was witnessed across all regions, with Asia and notably China playing a significant role as primary drivers of this expansion.

- It’s worth noting that Amazon alone had already deployed over 200,000 AMRs by that time.

- Concurrently, the Robotic Industries Association (RIA) reported record-breaking robot shipments in North America, with 35,880 robots sent out in 2018, marking a 7% rise from the previous year.

- The RIA also highlighted a 41% surge in shipments to non-automotive companies, particularly in sectors like food, consumer goods, plastics, rubber, life sciences, and electronics.

- Despite robust demand in the supply chain and e-commerce sectors for AMRs, revenue growth was limited to 10%, with Dematic leading as the primary supplier.

- Additionally, there was a strong demand for larger deck-load and forklift robots.

(Source: Interact Analysis, Robotic Industries Association (RIA))

Service Robots for Professional Use

- Service robots designed for professional use are making a significant impact across various application types.

- According to recent data, logistic robots occupy a substantial share, accounting for 31% of service robot utilization. These robots play a crucial role in optimizing and streamlining logistics operations.

- Additionally, robots designed for public environments hold a considerable share at 39%, contributing to enhanced efficiency and convenience in public spaces.

- Professional cleaning robots, with a usage rate of 41%, are revolutionizing the cleaning industry by offering automated and efficient solutions.

- Furthermore, medical robots, with a utilization rate of 30%, are increasingly being adopted in healthcare settings, assisting with various tasks and procedures.

- These statistics underscore the growing importance and versatility of service robots in professional applications, shaping diverse industries for improved productivity and functionality.

(Source: International Federation of Robotics)

Installations of Industrial Robots

- In 2020, the global installation of industrial robots saw varying degrees of activity across different industries.

- The electrical and electronics industry led the way with the highest number of installations, totaling 109,000 units.

- This reflects the sector’s continuous reliance on automation and robotics for manufacturing processes.

- The unspecified and other industries accounted for 86,000 installations, showing a broad application of industrial robots across diverse sectors.

- Meanwhile, the automotive industry, a long-time proponent of automation, recorded 80,000 installations, emphasizing its commitment to efficient production.

- Metal and machinery industries followed with 41,000 installations, further illustrating the widespread use of robotics in heavy manufacturing.

- Additionally, the plastic and chemical products industry saw 19,000 installations, while the food industry embraced automation with 12,000 new robot installations.

- These figures highlight the integral role industrial robots play in various sectors, driving efficiency and productivity in manufacturing and production processes worldwide.

(Source: Statista)

Trends in Industrial and Autonomous Robots

Business Operations

- Regarding expansion plans for the upcoming year, 79% of respondents expressed their intention to expand their operations, marking a 3% increase compared to the previous year.

- Capital expenditure (capex) remained robust, with an average projected expenditure of approximately $1.27 million for the next year, which closely resembled last year’s figures.

- Although the average respondent represented a smaller operation this year, 9% indicated plans to invest $10 million or more.

- The primary industry concern continued to be the difficulty in attracting and retaining a qualified hourly workforce, cited by 50% of respondents, although this figure slightly decreased from the previous year.

- Interestingly, the challenge of finding good supervisors experienced a notable increase, rising from 26% last year to 35% this year.

- Responses regarding technology utilization showed a growing willingness to adopt automation and software, with 23% mentioning the addition of automation to control distribution center costs, up from 15% in the previous year.

(Source: Warehouse/DC Operations Survey)

Operations and E-commerce

- The impact of e-commerce is clear in the shifts observed in both outbound and inbound operations among survey participants. In outbound operations, there was a 3% decrease in those exclusively handling split cases, while 22% now handle both cases and split cases, a significant increase from 13% the previous year.

- This means that a quarter of respondents are now engaged in shipping both case and split case items, or exclusively split case, up from 18% the prior year. Full pallet outbound operations remained constant at 10%.

- On the inbound side, there was a notable increase from 10% to 19% in operations dealing exclusively with full pallets.

- This change might be due to fluctuations in the response base, but it could also be attributed to factors like tariffs and global trade uncertainty, potentially leading more operations to opt for larger import quantities.

- While wholesale had traditionally been the dominant channel served in recent years, there was a 6% increase in those catering to retailers, making retail the primary channel served at 60%, closely followed by wholesale at 58%.

- E-commerce also exhibited growth, with 42% of respondents now servicing this channel, compared to 40% in the previous year.

- Additionally, 20% mentioned their involvement in omni-channel operations, marking a slight 1% decrease from the prior year.

- This underscores that over 60% of respondents are actively engaged in either e-commerce or omni-channel services, indicating the profound impact of the expanding e-commerce sector.

(Source: Warehouse/DC Operations Survey)

Technology and Automation

- In the realm of materials handling systems, manual methods still play a significant role, with 72% of survey participants preferring manual picking, a slight decrease from the 76% reported last year.

- Conversely, automated replenishment methods saw a 7% uptick, and the use of automated storage and retrieval systems (ASRS) increased from 12% to 15% this year.

- Additionally, the adoption of robotic/articulating arms rose from 3% to 4%.

- Concerning specific picking technologies, paper-based approaches saw a 7% increase compared to the previous year.

- Notably, there was a significant doubling in the utilization of parts-to-person automation, surging from 7% to 14%. Voice-assisted solutions also experienced growth, increasing from 12% to 14% this year.

- The implementation of Warehouse Management Systems (WMS) remained robust at 85%, despite a decrease from the previous year’s 93%, which is in line with usage levels observed in 2017 and 2016.

- The prevailing WMS approaches continued to be the integration of warehouse management as an enterprise resource planning (ERP) system module or the use of a legacy/homegrown system.

- The adoption of best-of-breed WMS remained steady at 18%, just 1% less than the previous year. Similarly, the utilization of Warehouse Execution Systems (WES) stayed consistent at 6%.

- In a somewhat unexpected development, 58% of respondents indicated the use of manual data collection this year, up from 53% in the previous year.

(Source: Warehouse/DC Operations Survey)

Recent Developments

Acquisitions and Mergers:

- Amazon acquires Zoox: In 2023, Amazon announced the acquisition of Zoox, a startup focused on developing fully autonomous vehicles. This acquisition aims to enhance Amazon’s logistics capabilities and integrate autonomous mobile robots into its delivery systems.

- Siemens merges with Varian: Siemens completed a merger with Varian, focusing on health technology and automation, in early 2024. This merger allows Siemens to enhance its offerings in medical robotics and automated solutions for healthcare, which include autonomous mobile robots for hospital settings.

New Product Launches:

- Boston Dynamics launches Stretch: In 2023, Boston Dynamics launched Stretch, an autonomous mobile robot designed for warehouse logistics. Stretch features advanced AI and machine learning capabilities, enabling it to handle boxes of varying sizes and weights with precision.

- KUKA unveils KMR iiwa: In 2024, KUKA introduced the KMR iiwa, a collaborative mobile robot designed to work alongside humans in industrial environments. It combines mobility with advanced robotic arms, making it suitable for complex assembly tasks.

Funding:

- Fetch Robotics secures $46 million in Series C funding: In mid-2023, Fetch Robotics raised $46 million to expand its fleet of autonomous mobile robots for warehouse automation. The funding will be used to enhance R&D and expand operations in North America and Europe.

- Miso Robotics raises $25 million: In early 2024, Miso Robotics is known for its AI-driven kitchen automation. Secured $25 million to develop autonomous mobile robots for food service. This funding will help improve efficiency in fast-food and restaurant environments.

Technological Advancements:

- AI Integration: By 2025, over 50% of autonomous mobile robots are expected to integrate advanced AI technologies to improve navigation and operational efficiency. Enabling better interaction with human workers and surrounding environments.

- Increased connectivity with IoT: Autonomous mobile robots are increasingly being equipped with IoT capabilities. Allowing real-time data sharing and communication with other systems. By 2026, 70% of mobile robots in logistics and manufacturing are projected to utilize IoT technology for enhanced performance.

Conclusion

Autonomous Mobile Robots Statistics – In summary, Autonomous Mobile Robots (AMRs) show great potential as a transformative technology.

Recent statistics indicate a steady rise in the AMR market, with widespread applications across industries, offering improved efficiency and safety.

While challenges like initial investment and integration persist, ongoing technological advancements are driving AMR adoption.

Furthermore, the global impact of AMRs is influenced by the changing landscape of e-commerce, prompting the use of various picking technologies and warehouse management systems to adapt to evolving demands. Overall, AMRs are set to play a significant role in the future of automation across industries.

FAQs

AMRs are robotic systems capable of independent navigation and operation without human intervention. They use sensors and advanced software to perceive their surroundings, make decisions, and move autonomously.

AMRs have diverse applications across industries such as manufacturing, healthcare, logistics, retail, and agriculture. They are employed for tasks like material handling, transportation, and inventory management.

AMRs offer several advantages, including increased efficiency, safety, accuracy, and potential cost savings. They can also handle repetitive and labor-intensive tasks, freeing up human workers for more complex jobs.

AMRs rely on a combination of sensors, including LiDAR, cameras, and proximity sensors, to create maps of their surroundings. Advanced algorithms process this data to make real-time navigation decisions.

Integration of AMRs can vary depending on the specific application and existing infrastructure. Customization may be required to ensure seamless integration with a company’s operations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)