Table of Contents

- Bank Connectivity Platform Market Introduction

- How Growth is Impacting the Economy

- Impact on Global Businesses

- Strategies for Businesses

- Key Takeaways

- Analyst Viewpoint

- Use Case and Growth Factors

- Regional Analysis

- Business Opportunities

- Key Segmentation Overview

- Key Player Analysis

- Recent Developments

- Conclusion

Bank Connectivity Platform Market Introduction

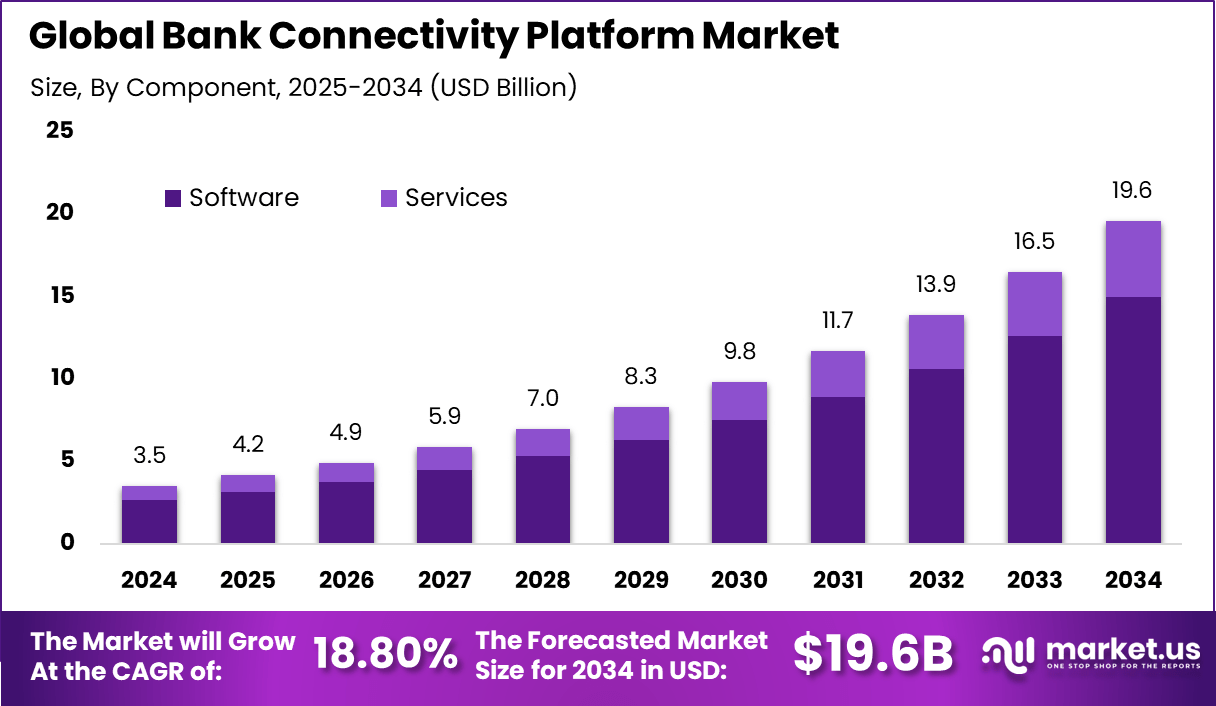

The global bank connectivity platform market is expanding rapidly as financial institutions accelerate digital transformation and open banking adoption. The market generated USD 3.5 billion in 2024 and is projected to grow from USD 4.2 billion in 2025 to about USD 19.6 billion by 2034, registering a CAGR of 18.80% during the forecast period. Bank connectivity platforms enable secure data exchange between banks, fintechs, and third-party applications through APIs and standardized interfaces. North America dominated the market in 2024 with over 37% share and USD 1.29 billion in revenue, supported by advanced digital banking ecosystems and regulatory readiness.

How Growth is Impacting the Economy

The growth of bank connectivity platforms is strengthening digital financial infrastructure and improving economic efficiency. Seamless data sharing enables faster payments, improved credit access, and real-time financial services, supporting consumer spending and business activity. Banks benefit from reduced operational costs and improved process automation, while fintech innovation accelerates service diversification. Governments gain from increased financial transparency and better monitoring of financial flows. The market’s expansion is also generating demand for software engineers, cybersecurity specialists, and data professionals. Over time, improved banking connectivity supports financial inclusion, enhances SME access to digital finance, and strengthens overall economic resilience.

➤ Year-End Sale: Hurry, Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=169643

Impact on Global Businesses

Rising Costs and Supply Chain Shifts

Financial institutions face higher upfront investments in API management, cybersecurity, and compliance frameworks. However, supply chains are shifting toward platform-based banking models that reduce manual processing and long-term operational expenses.

Sector-Specific Impacts

Retail and corporate banking benefit from faster onboarding and real-time payments. Fintech companies gain streamlined access to bank data. E-commerce and digital platforms leverage embedded finance capabilities. Government and public sector organizations improve digital payment and treasury operations through secure connectivity.

Strategies for Businesses

Banks and enterprises are prioritizing API first architectures to enable scalable connectivity. Strong data security and consent management frameworks are being implemented to meet regulatory requirements. Partnerships with fintechs and technology providers are accelerating innovation. Businesses are also investing in analytics to monetize data insights and improve customer experience while maintaining compliance and trust.

Key Takeaways

- Bank connectivity platforms are central to open banking ecosystems

- Market growth is supported by an 18.80% CAGR through 2034

- North America leads due to digital maturity and regulatory readiness

- Platforms enable faster payments and embedded finance models

- Long-term demand is driven by data-driven financial services

➤ Unlock growth! Get your sample now! @ https://market.us/report/bank-connectivity-platform-market/free-sample/

Analyst Viewpoint

Currently, bank connectivity platforms are moving from integration tools to strategic digital infrastructure. Adoption is strongest in regions with mature open banking regulations and advanced fintech ecosystems. Looking ahead, the outlook remains positive as real-time payments, embedded finance, and cross-border data sharing expand. Future platforms are expected to integrate AI-driven analytics and enhanced security layers. Over the forecast period, bank connectivity platforms are anticipated to become foundational to digital financial services worldwide.

Use Case and Growth Factors

| Use Case | Description | Key Growth Factors |

|---|---|---|

| Open banking integration | Secure API based data sharing | Regulatory mandates and open banking adoption |

| Real time payments | Instant fund transfers and settlement | Rising demand for faster payment systems |

| Embedded finance | Financial services within non bank platforms | Growth of digital commerce and platforms |

| Account aggregation | Unified view of customer financial data | Demand for personalized financial services |

| Cross border connectivity | International banking data exchange | Globalization of financial services |

Regional Analysis

North America dominates the bank connectivity platform market with more than 37% share, driven by strong fintech adoption and advanced banking infrastructure. Europe follows closely with established open banking frameworks and PSD regulations. Asia Pacific is emerging as a high-growth region due to rapid digital banking adoption and government-backed financial modernization initiatives. Other regions are gradually expanding connectivity as digital finance ecosystems mature.

➤ Explore Huge Library Here –

- Self-Reconfigurable Robots Market

- Bank Statement Aggregation Market

- Partyline Intercom Systems Market

- Smart Glasses Microdisplay Market

Business Opportunities

Significant opportunities exist in cloud native bank connectivity platforms that support scalability and interoperability. Demand is growing for solutions focused on compliance automation and data security. Small and medium enterprises represent an expanding customer base through embedded finance offerings. Cross-border payment connectivity and data analytics services offer additional revenue streams. Providers offering flexible and compliant platforms are well positioned for long term growth.

Key Segmentation Overview

The market is segmented by component into software and services, with software platforms leading adoption. By deployment mode, cloud-based solutions are growing faster than on-premises systems. Application segments include payments, account management, lending, and compliance, with payments representing a major share. End users include banks, fintech companies, enterprises, and government organizations, with banks remaining the primary adopters.

Key Player Analysis

Market participants focus on secure API management, scalability, and regulatory compliance. Competitive differentiation is driven by platform reliability, integration speed, and data security capabilities. Continuous investment in cybersecurity, analytics, and cloud technologies strengthens market positioning. Long-term competitiveness depends on adaptability to evolving regulations and the ability to support diverse financial ecosystems.

- Finastra

- FIS (Fidelity National Information Services)

- ACI Worldwide

- Bottomline Technologies

- SAP SE

- Oracle Corporation

- Tata Consultancy Services (TCS)

- Infosys

- Temenos

- Intellect Design Arena

- Volante Technologies

- Kyriba

- Serrala

- Cashfac

- Nexi

- Sopra Banking Software

- Fiserv Incorporation

- EBICS (Deutsche Bank, Société Générale, BNP Paribas)

- SWIFT

- Banking Circle

- Others

Recent Developments

- Expansion of API based open banking platforms

- Increased adoption of real time payment connectivity

- Integration of advanced cybersecurity and fraud detection tools

- Growing partnerships between banks and fintech ecosystems

- Enhanced support for cross-border banking connectivity

Conclusion

Bank connectivity platforms are transforming digital finance infrastructure. Strong growth, led by North America, reflects rising demand for secure data exchange and real-time financial services, positioning these platforms as essential enablers of future banking ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)