Table of Contents

- Bank Statement Aggregation Market Introduction

- How Growth is Impacting the Economy

- Impact on Global Businesses

- Strategies for Businesses

- Key Takeaways

- Analyst Viewpoint

- Use Case and Growth Factors

- Regional Analysis

- Business Opportunities

- Key Segmentation Overview

- Key Player Analysis

- Recent Developments

- Conclusion

Bank Statement Aggregation Market Introduction

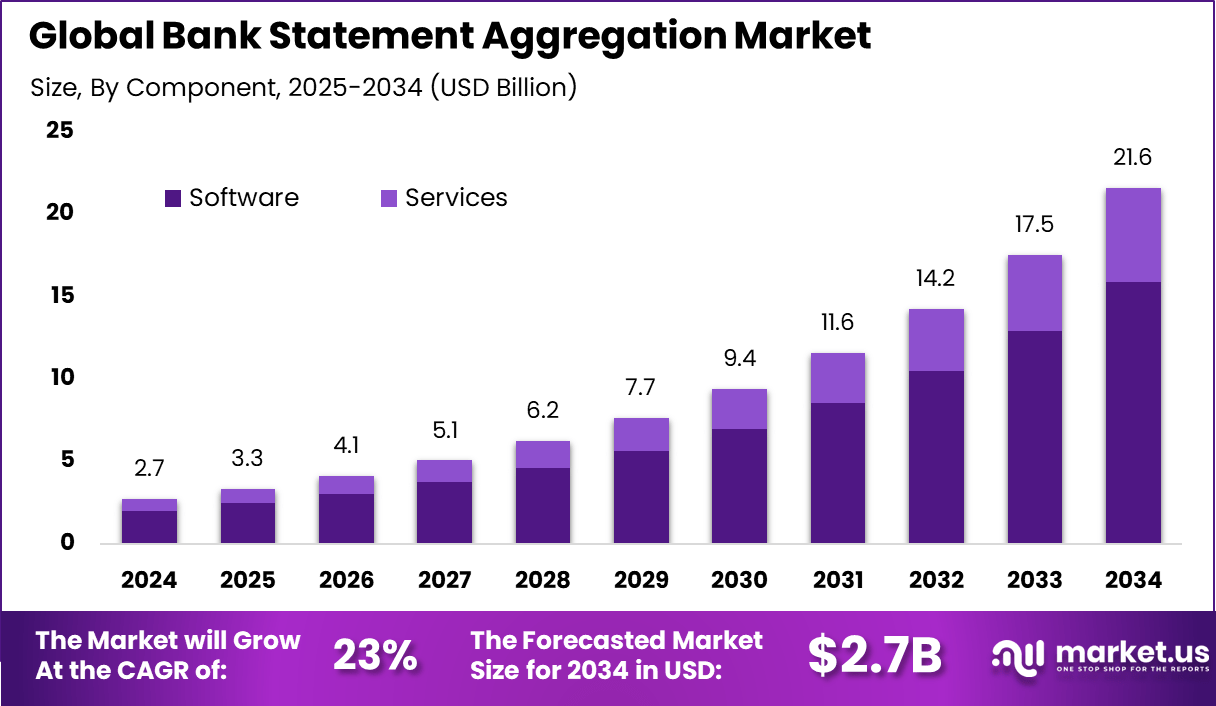

The global bank statement aggregation market is expanding rapidly as financial institutions and enterprises prioritize real-time financial visibility and open banking capabilities. The market generated USD 2.7 billion in 2024 and is projected to grow from USD 3.3 billion in 2025 to about USD 21.6 billion by 2034, registering a CAGR of 23% during the forecast period.

Bank statement aggregation enables secure consolidation of transaction data across multiple accounts and banks through APIs and data connectors. North America dominated in 2024 with more than 36.4% share and USD 0.99 billion revenue, supported by advanced digital banking ecosystems and strong fintech adoption.

How Growth is Impacting the Economy

Growth in bank statement aggregation is strengthening digital financial infrastructure and improving capital efficiency across economies. Automated access to consolidated banking data reduces manual reconciliation, accelerates credit assessments, and enhances cash flow management for businesses. This improves liquidity utilization and supports SME growth. Financial institutions benefit from reduced processing costs and improved risk assessment, while governments gain better financial transparency and reporting accuracy.

The market’s expansion is also creating demand for software engineers, data analysts, and cybersecurity professionals. Over time, seamless data aggregation supports financial inclusion by enabling faster lending decisions and personalized financial services, contributing to more resilient and digitally connected economies.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=169796

Impact on Global Businesses

Rising Costs and Supply Chain Shifts

Businesses face higher initial investments in secure API integration, compliance frameworks, and data governance. However, financial operations supply chains are shifting toward automated, platform driven models that reduce long term operational costs and dependency on manual workflows.

Sector-Specific Impacts

Banking and fintech sectors benefit from faster onboarding and real time financial insights. Accounting and enterprise software providers integrate aggregation to enhance analytics. E-commerce and marketplaces use aggregated data for embedded finance. Government and public sector entities improve auditing and financial monitoring efficiency.

Strategies for Businesses

Organizations are adopting API first architectures to enable scalable and secure data aggregation. Strong consent management and encryption frameworks are being implemented to comply with data protection regulations. Partnerships with fintech platforms are accelerating deployment and innovation. Businesses are also leveraging aggregated data analytics to improve forecasting, risk management, and customer experience while maintaining trust and regulatory compliance.

Key Takeaways

- Bank statement aggregation enables real-time financial visibility

- Market growth is supported by a strong 23% CAGR through 2034

- North America leads due to mature open banking ecosystems

- Automation reduces reconciliation costs and credit decision timelines

- Long term demand is driven by data-driven financial services

➤ Unlock growth! Get your sample now! @ https://market.us/report/bank-statement-aggregation-market/free-sample/

Analyst Viewpoint

Currently, bank statement aggregation is evolving from a convenience feature to a core financial infrastructure. Adoption is strongest in regions with advanced open banking regulations and fintech ecosystems. Looking ahead, the outlook remains highly positive as real-time lending, embedded finance, and AI driven analytics expand. Aggregation platforms are expected to integrate deeper analytics and cross border data capabilities. Over the forecast period, bank statement aggregation is anticipated to become a foundational layer for digital finance and enterprise financial management.

Use Case and Growth Factors

| Use Case | Description | Key Growth Factors |

|---|---|---|

| Credit assessment and lending | Automated analysis of borrower transaction history | Growth in digital lending and alternative credit models |

| Cash flow management | Real time visibility into multi account balances | Demand for improved liquidity planning |

| Financial reconciliation | Automated matching of bank statements | Need to reduce manual accounting processes |

| Embedded finance | Financial services integrated into platforms | Expansion of digital commerce ecosystems |

| Regulatory reporting | Accurate and timely financial data access | Increasing compliance and reporting requirements |

Regional Analysis

North America dominates the bank statement aggregation market with more than 36.4% share, driven by advanced digital banking infrastructure and widespread API adoption. Europe follows with strong growth supported by open banking regulations and standardized data frameworks. Asia Pacific is emerging as a high-growth region due to rapid fintech expansion and increasing digital payment adoption. Other regions are gradually adopting aggregation solutions as financial digitization accelerates.

➤ Explore Huge Library Here –

- Autonomous Charging Robots Market

- Autonomous Underwater Drones Market

- Construction Cybersecurity Market

- Mixed Reality Capture Card Market

Business Opportunities

Strong opportunities exist in cloud native aggregation platforms that offer scalability and interoperability. Demand is increasing for solutions tailored to small and medium enterprises seeking simplified financial management. Cross-border aggregation and multi-currency analytics present additional growth avenues. Integration with AI-driven financial insights and risk scoring tools enhances value creation. Providers offering secure, compliant, and flexible solutions are well-positioned for sustained market expansion.

Key Segmentation Overview

The market is segmented by component into software platforms and services, with software accounting for a major share. By deployment mode, cloud-based solutions are growing faster than on-premises implementations. Application segments include lending, accounting, cash management, and compliance, with lending and cash management leading adoption. End users include banks, fintech companies, enterprises, and government organizations, with banks and fintechs representing primary demand drivers.

Key Player Analysis

Market participants focus on secure data connectivity, accuracy, and regulatory compliance. Competitive differentiation is driven by API reliability, data normalization capabilities, and consent management frameworks. Continuous investment in cybersecurity and analytics strengthens platform trust. Long term competitiveness depends on adaptability to evolving regulations, cross-border interoperability, and the ability to support complex financial ecosystems.

- Plaid

- Yodlee (Envestnet)

- Finicity (Mastercard)

- Tink (Visa)

- Salt Edge

- TrueLayer

- MX Technologies

- Flinks

- Bankin’

- Nordigen (GoCardless)

- Bud Financial

- Basiq

- Kontomatik

- Figo (Finleap Connect)

- Bankable

- Quovo (Plaid)

- Belvo

- Codat

- Moneyhub

- Crealogix

- Others

Recent Developments

- Expansion of API based bank data aggregation platforms

- Increased integration with digital lending and accounting software

- Enhanced security and consent management capabilities

- Growing adoption of real-time aggregation services

- Rising partnerships between banks and fintech platforms

Conclusion

Bank statement aggregation is becoming essential to modern digital finance. Strong growth, led by North America, reflects rising demand for real-time financial data, positioning aggregation platforms as critical enablers of efficient, transparent, and data-driven financial ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)