Table of Contents

Introduction

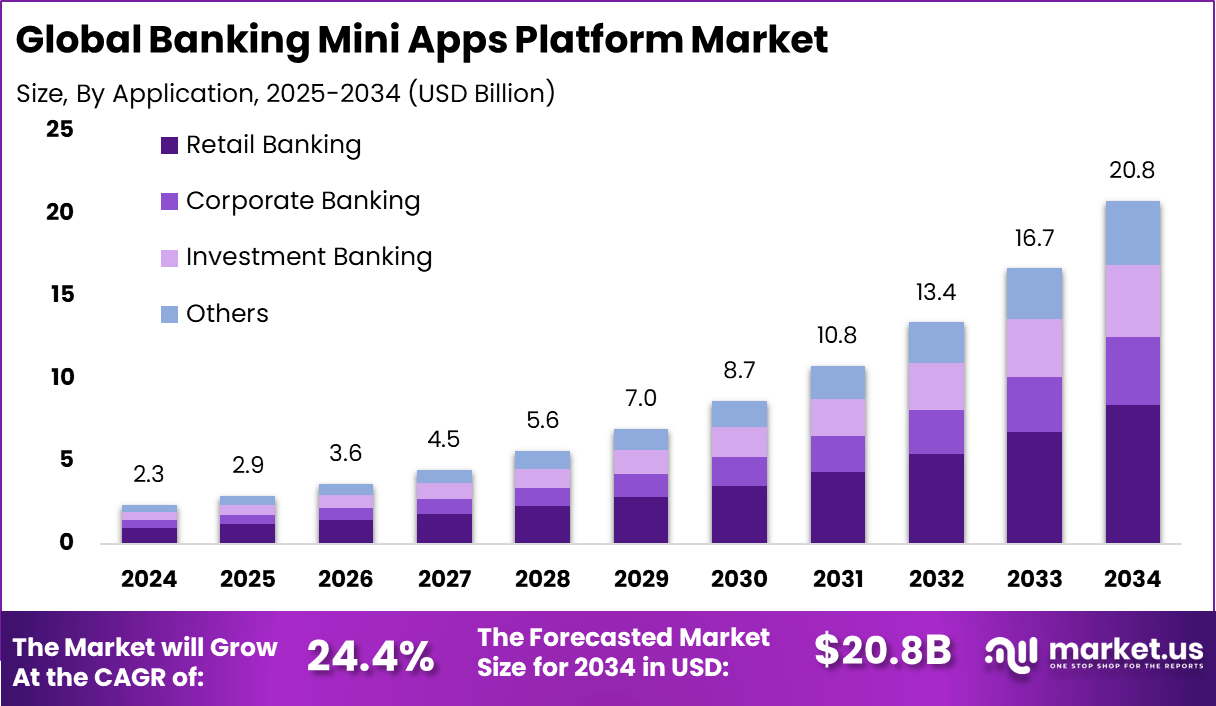

The Global Banking Mini Apps Platform Market is expected to experience robust growth, rising from USD 2.3 billion in 2024 to USD 20.8 billion by 2034. This represents a compound annual growth rate (CAGR) of 24.4%. North America is anticipated to dominate in 2024, holding a 35.3% market share and generating USD 0.8 billion in revenue.

This surge is attributed to the increasing demand for innovative digital banking solutions, the rise of mobile-first banking, and the growing adoption of mini apps in financial services. The market’s expansion reflects a broader trend towards the digitalization of financial services, offering opportunities for growth across multiple regions and sectors.

How Growth is Impacting the Economy

The exponential growth of the Banking Mini Apps Platform Market is having a profound impact on the global economy. The integration of mini apps into banking platforms provides more convenient, secure, and cost-effective solutions for consumers and businesses. This shift is contributing to the economic acceleration, particularly in emerging markets where digital banking is increasingly embraced.

As the banking sector evolves, there is a notable shift in financial inclusion, with new opportunities for underserved populations. Furthermore, this growth is boosting the fintech ecosystem, creating new employment opportunities, and driving technological innovation in the financial sector. The platform’s growth also contributes to broader digital transformation trends, accelerating GDP growth in tech-driven economies.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/banking-mini-apps-platform-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts:

As the market for banking mini apps expands, businesses are facing rising operational costs due to increased demand for advanced technologies and infrastructure. This shift in demand is also influencing supply chain dynamics, especially in software development, cloud computing, and app deployment services. Companies will need to adapt to these changes, focusing on optimizing their supply chains and reducing costs while ensuring high service standards.

Sector-Specific Impacts:

In the financial sector, mini apps allow banks to provide more customized services, streamlining processes like payments, loans, and wealth management. For tech companies, it presents opportunities to enhance cloud storage and application management services. Retail businesses leveraging banking platforms for e-commerce will experience improved customer engagement and simplified payment processing.

Strategies for Businesses

- Focus on partnerships with fintech companies for deeper integration into the banking ecosystem.

- Invest in R&D to stay ahead of tech innovations, offering enhanced app functionalities.

- Streamline operations by outsourcing non-core activities to improve cost efficiency.

- Embrace cloud infrastructure for scalability, ensuring seamless app deployment and management.

- Leverage data analytics to provide personalized financial services, improving customer retention.

Key Takeaways

- The market is projected to grow from USD 2.3 billion in 2024 to USD 20.8 billion by 2034.

- North America holds a dominant market share of 35.3% in 2024.

- The CAGR is expected to be 24.4% during the forecast period.

- Increasing adoption of mobile banking and digital-first platforms will drive market growth.

- Businesses in the financial and tech sectors stand to gain the most from this trend.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=168800

Analyst Viewpoint

Presently, the banking mini apps platform market is poised for rapid expansion due to the rising adoption of mobile-first banking and digital payment systems. In the future, the market is expected to continue flourishing, driven by advancements in fintech, evolving consumer preferences, and increased internet penetration globally. The demand for mini apps will play a pivotal role in reshaping the financial services landscape.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Mobile Banking Solutions | Increased smartphone penetration globally |

| Digital Payments | Rising demand for cashless transactions |

| Wealth Management Apps | Consumer shift towards digital financial advisory |

| Loan Management Platforms | Growth in demand for instant, digital loan approvals |

| Payment Processing Systems | Increased e-commerce activity and contactless payments |

Regional Analysis

The North American region is expected to continue leading the global market, holding a significant revenue share. The region’s dominance is driven by high adoption rates of mobile banking apps and the robust fintech infrastructure. Europe follows closely, with rapid growth in digital banking and payments, while the Asia-Pacific market is anticipated to exhibit the fastest growth, thanks to rising smartphone penetration and favorable government policies encouraging digital financial services.

➤ Want more market wisdom? Browse reports –

- Business Interruption Insurance Market

- AI Pet Camera Market

- Store Fulfillment App Market

- Credit Monitoring Services Market

Business Opportunities

The growing adoption of mini apps presents numerous business opportunities in areas such as mobile payment solutions, app development services, and cloud infrastructure. Financial institutions can also explore white-label solutions to enter new markets without large upfront investments. For tech startups, this is a chance to innovate and disrupt traditional banking models, offering unique services that align with evolving customer demands.

Key Segmentation

- By Application: Mobile Payments, Digital Loans, Wealth Management, Insurance Services, Other Financial Services

- By End-User: Financial Institutions, Tech Companies, Retailers, Third-Party Service Providers

- By Region: North America, Europe, Asia-Pacific, Middle East & Africa, Latin America

- By Deployment Type: Cloud-Based, On-Premise

Key Player Analysis

The market is characterized by a variety of key players, including financial institutions, fintech companies, and app developers. These players focus on innovation, scalability, and security to attract consumers and businesses. They are leveraging strategic partnerships and investments in R&D to enhance user experience and integrate new features into their platforms. Collaboration with tech companies and mobile carriers is essential for market expansion.

- HSBC

- JPMorgan Chase

- Bank of America

- Wells Fargo

- Citibank

- Barclays

- Deutsche Bank

- BNP Paribas

- Santander

- UBS

- ING Group

- Standard Chartered

- Goldman Sachs

- Morgan Stanley

- Royal Bank of Canada

- TD Bank Group

- BBVA

- Societe Generale

- ICICI Bank

- DBS Bank

- Others

Recent Developments

- January 2024: A leading fintech company launched a new digital wallet mini app with integrated savings tools.

- March 2024: A major bank introduced a mini app for small businesses, enabling streamlined payment and invoicing features.

- June 2024: Cloud service providers enhanced their offerings for banking platforms, focusing on increased scalability.

- August 2024: A mobile payment solution company raised funds to expand its mini app services in emerging markets.

- November 2024: A global bank partnered with a tech firm to launch an AI-powered wealth management mini app.

Conclusion

The Banking Mini Apps Platform Market is set to continue its rapid growth, driven by technological advancements and a shift towards mobile-first solutions. Businesses that innovate and invest in this space will find ample growth opportunities. With increasing demand for convenience, security, and digital-first solutions, the future of banking is digital, and the growth trajectory of this market is exceptionally promising.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)