Table of Contents

- Market Overview

- Top Market Takeaways

- Key Insights Summary

- Growth Driver Impact Analysis

- Restraints Impact Analysis

- Increasing Adoption Technologies

- Investment Opportunities

- Business Benefits

- Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trend Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Report Scope

Market Overview

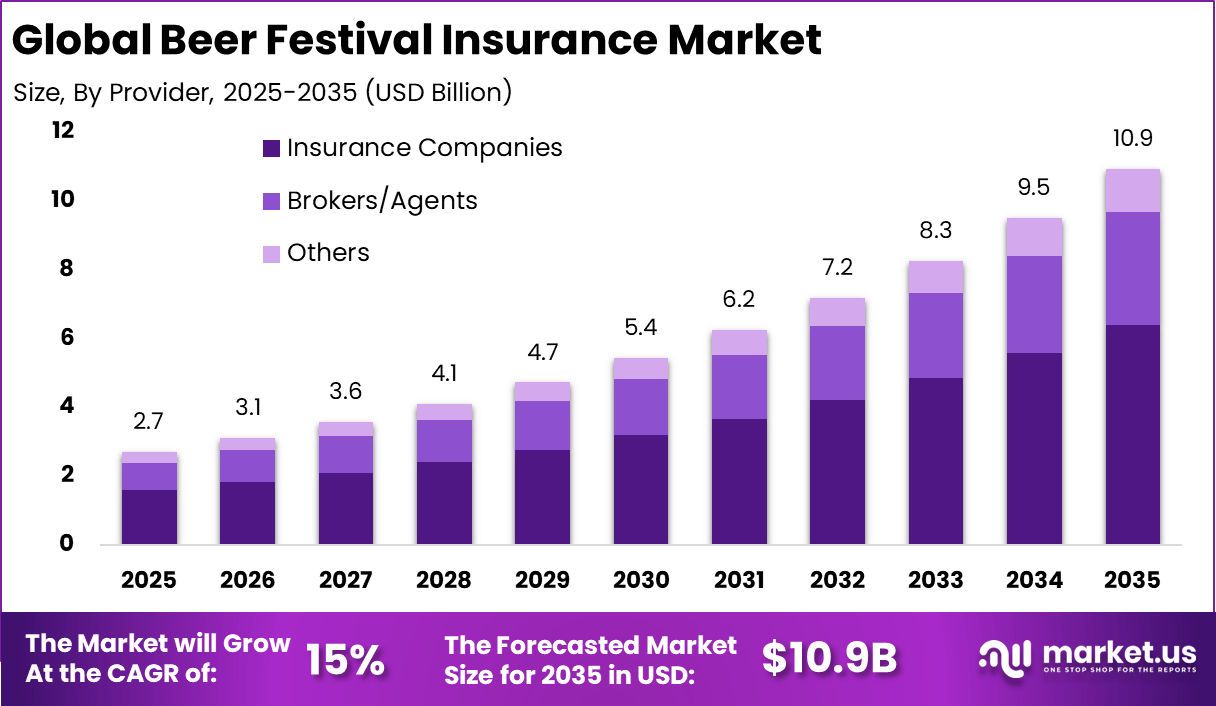

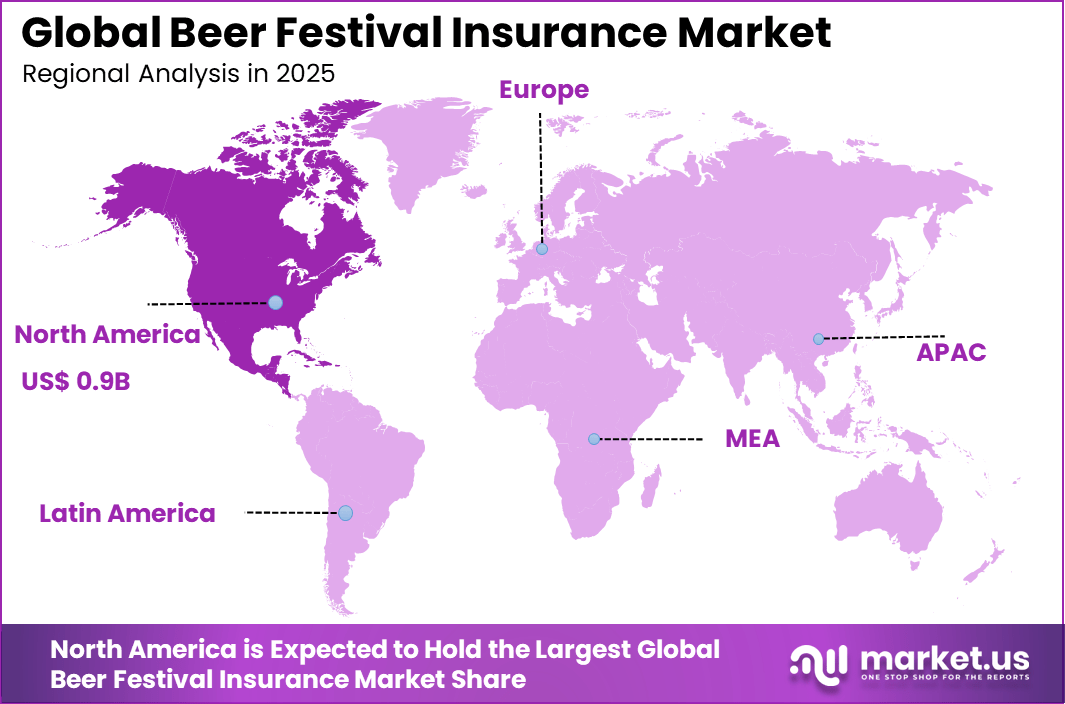

New York, NY – Jan. 2026 – According to Market.us, With revenues of USD 2.7 billion in 2025, the Global Beer Festival Insurance Market is on a strong upward trajectory, projected to expand to approximately USD 10.9 billion by 2035 at a CAGR of 15%. North America led the market in 2025, accounting for more than 35.8% share and USD 0.9 billion in revenue, demonstrating accelerating adoption and favorable risk-return characteristics for investors in the event insurance ecosystem.

The Beer Festival Insurance market refers to specialized insurance solutions designed to protect organisers, vendors, and stakeholders involved in beer-focused public events from financial loss due to unforeseen circumstances. These policies typically include covers such as general liability, property damage, event cancellation, and alcohol-related incident protection, which are tailored to the distinct risks associated with beer festivals. Beer festivals usually attract large crowds to temporary venues where alcohol consumption is central, creating exposure to a range of potential liabilities that standard insurance may not fully address.

In many jurisdictions, local authorities and venue contracts require proof of adequate insurance as part of regulatory and contractual compliance before issuing permits for festivals that serve alcohol publicly. This market includes products aimed at short-term, event-specific coverage as well as extensions that can be tailored for specific features of beer festivals, such as tastings or competitions. As craft beer culture and community-oriented beer events grow in popularity, these insurance solutions are increasingly viewed as essential risk management tools rather than optional extras.

One of the foremost drivers of the Beer Festival Insurance market is the elevated liability risk associated with large gatherings where alcohol is consumed. Alcohol-related incidents, such as injuries caused by falls, fights, or traffic accidents involving intoxicated attendees, can result in costly legal claims and compensation demands against event organisers. Without appropriate insurance, these liabilities can impose substantial financial burdens. Insurance coverage thus provides a financial safeguard that helps protect event organisers and sponsors from the legal and monetary consequences of such incidents.

Top Market Takeaways

- General liability insurance holds 36.8% share, reflecting the need to cover injury, property damage, and alcohol related risks at large public events.

- Insurance companies account for 58.6% of providers, supported by strong underwriting capacity and regulatory compliance.

- Event organizers represent 45.7% of end users, as they are responsible for crowd safety, vendor management, and liability control.

- Direct distribution channels capture 58.9%, showing preference for faster policy issuance and clearer coverage terms.

- North America holds 35.8% of the global market, driven by a high concentration of beer festivals and established insurance practices.

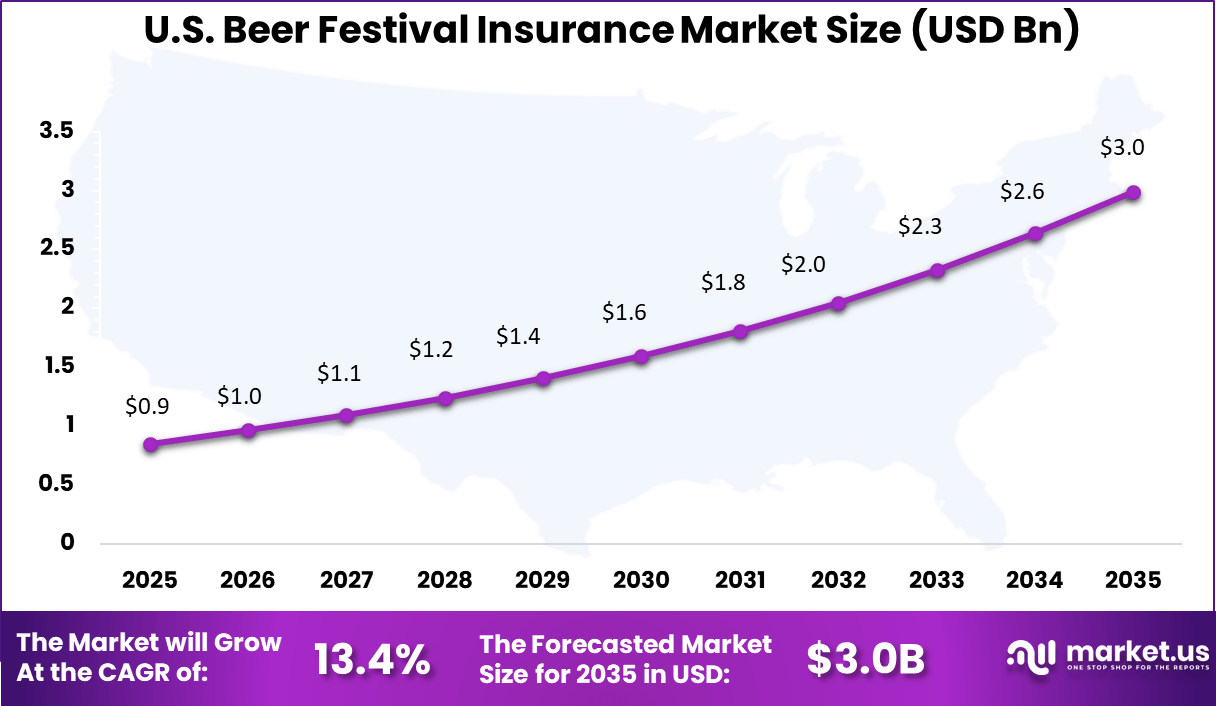

- The US market reached USD 0.85 billion and is growing at a 13.4% CAGR, supported by rising event activity and regulatory requirements.

Key Insights Summary

- Event cancellation insurance typically costs 1% to 1.5% of total festival budgets for large beer and music events.

- Small breweries and micro festivals usually pay USD 77 to USD 109 per month for general liability coverage with USD 1 million / USD 2 million limits.

- Festival insurance costs are rising in emerging markets, with premiums increasing more than three times in some regions due to higher risk exposure.

- Liquor liability coverage remains essential and is often required for operating permits.

- Lost property incidents are common, with more than 4,500 items recorded in lost and found inventories during major festivals in 2025.

- Theft risk remains high, with around 116,000 attempted beer stein thefts reported at large festivals in 2025.

- Equipment breakdown poses financial risk, with claims reaching up to USD 138,000 in lost business income from a single incident.

Growth Driver Impact Analysis

| Key Growth Driver | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| Rising number of large scale beer festivals and craft brew events | +5.1 | North America, Europe | Short to medium term |

| Increasing regulatory requirements for event liability coverage | +4.4 | North America, Europe | Medium term |

| Growth in experiential tourism and destination based festivals | +3.8 | Europe, Asia Pacific | Medium to long term |

| Higher awareness of public safety and alcohol related risks | +3.2 | Global | Short term |

| Expansion of private sponsorships and commercial partnerships | +2.6 | North America, developed Asia Pacific | Long term |

Restraints Impact Analysis

| Key Restraint | Influence on Projected Growth (~)% | Geographical Significance | Expected Timeframe of Impact |

|---|---|---|---|

| High premium costs for large scale public events | -2.9 | Emerging markets | Short to medium term |

| Limited insurance awareness among small event organizers | -2.3 | Asia Pacific, Latin America | Medium term |

| Weather related uncertainty affecting festival planning | -1.9 | Europe, North America | Medium term |

| Complexity of underwriting alcohol related liabilities | -1.6 | Global | Medium to long term |

| Dependence on discretionary consumer spending | -1.3 | Global | Long term |

Increasing Adoption Technologies

Technology is contributing to the efficiency and accessibility of beer festival insurance products, particularly through online policy platforms that enable quick quotation, purchase, and issuance of coverage certificates. Digital applications streamline risk assessment by collecting event details and automatically generating tailored policy options based on venue size, expected attendance, and alcohol service practices. This reduces administrative friction for organisers and facilitates rapid procurement of insurance, even for short-term or last-minute events. Digital platforms also support efficient documentation and proof of coverage for regulatory compliance.

Another technological trend is the integration of risk analytics tools that help insurers evaluate potential exposures more precisely. By analysing historical incident data, weather patterns, and attendee profiles, insurers can tailor risk ratings and coverage terms for specific beer festival profiles. Such analytics contribute to more nuanced underwriting and may help organisers understand risk drivers and cost implications more clearly. These advancements support both insurers and festival planners in aligning coverage with actual risk scenarios.

Investment Opportunities

Investment opportunities in the beer festival insurance market are supported by the continuing growth of craft beverage festivals and experiential cultural events that attract broad audiences. As event organisers seek flexible, event-specific risk solutions, there is scope for innovation in modular insurance products that combine liability, cancellation, and liquor liability coverage in a single package. Investors may find potential in platforms that offer streamlined digital policy issuance and integration with event management systems, reducing cost and friction for buyers.

Additional opportunities exist in expanding coverage options to include ancillary services such as weather cancellation protection and equipment loss coverage. These extensions provide comprehensive risk mitigation for organisers who face multiple sources of potential financial pressure, from adverse weather conditions to logistical failures. Products that can bundle such protections with core liability coverage may gain traction among organisers seeking simplicity and cost predictability.

Business Benefits

Beer festival insurance delivers significant business benefits by safeguarding the financial stability of events that might otherwise be vulnerable to disruption or liability claims. With proper coverage in place, organisers can manage unforeseen costs arising from accidents, property damage, or legal claims without diverting funds from core event activities. This financial protection helps sustain ongoing operations and supports confidence among sponsors, vendors, and attendees that the festival is responsibly managed.

Another benefit lies in supporting compliance with venue and regulatory requirements, which enhances an organiser’s reputation and reduces barriers to hosting events. When insurance certificates are readily available, relationships with venues and local authorities tend to be smoother, lowering the risk of last-minute permit denials or contractual disputes. Additionally, clear insurance arrangements contribute to better contingency planning, enabling organisers to respond effectively to unexpected challenges and preserve the festival’s long-term viability.

Regional Analysis

North America holds a dominant position in the Beer Festival Insurance market, accounting for 35.8% of total market share. This leadership is supported by a high concentration of large scale beer festivals, strong event insurance awareness, and well established regulatory frameworks for public events. Organizers in the region increasingly rely on specialized insurance coverage to manage risks related to crowd safety, alcohol liability, and event cancellations.

Regional Driver Comparison

| Region | Core Demand Driver | Growth Influence Level | Market Maturity |

|---|---|---|---|

| North America | Strong festival culture and strict liability norms | Very High | Mature |

| Europe | Dense calendar of cultural and beer festivals | High | Mature |

| Asia Pacific | Growing urban festivals and tourism promotion | Medium to High | Developing |

| Middle East | Limited alcohol events with controlled environments | Low to Medium | Early stage |

| Latin America | Expanding music and beer festival formats | Medium | Developing |

| Africa | Emerging tourism driven events | Low | Early stage |

Within North America, the United States represents a key contributor, with market revenue of approximately USD 0.85 billion. The market in the country is expanding at a CAGR of 13.4%, driven by the growing number of craft beer festivals and rising demand for comprehensive event risk protection. Strong participation from insurers and increasing compliance requirements continue to support market growth in the U.S.

Within North America, the United States represents a key contributor, with market revenue of approximately USD 0.85 billion. The market in the country is expanding at a CAGR of 13.4%, driven by the growing number of craft beer festivals and rising demand for comprehensive event risk protection. Strong participation from insurers and increasing compliance requirements continue to support market growth in the U.S.

Investor Type Impact Matrix

| Investor Type | Strategic Objective | Risk Tolerance | Market Influence |

|---|---|---|---|

| Specialty insurance providers | Expansion of event and liability portfolios | Medium | High |

| Reinsurance firms | Risk diversification across event categories | Medium | Medium to High |

| Event management companies | Risk mitigation and compliance assurance | Low to Medium | Medium |

| Private equity investors | Scalable specialty insurance platforms | Medium | Medium |

| Tourism and hospitality investors | Protection of event driven revenue streams | Low | Medium |

Technology Enablement Analysis

| Technology Enabler | Functional Role | Impact on Adoption | Adoption Timeline |

|---|---|---|---|

| Digital policy issuance platforms | Faster coverage activation for short term events | High | Short term |

| AI based risk assessment tools | Improved pricing for crowd and alcohol risks | High | Short to medium term |

| Event data analytics and modeling | Better forecasting of incident probability | Medium to High | Medium term |

| Mobile claim reporting systems | Faster incident documentation and settlement | Medium | Medium term |

| Integrated compliance and permit tracking tools | Simplified regulatory adherence | Medium | Medium to long term |

Emerging Trend Analysis

A clear emerging trend in the Beer Festival Insurance market is the adoption of digital and insurtech driven policy platforms that simplify how organisers obtain and manage coverage. These digital platforms are enabling real time quoting, personalised risk assessments, and instant policy issuance, which reduce administrative friction and improve access for smaller and mid sized events.

The use of advanced analytics and automated underwriting supports more precise evaluation of festival specific risks, including liability and cancellation exposures. This trend is influencing how insurance products are structured and sold to event organisers and related stakeholders. Another aspect of this trend is the integration of online tools that support streamlined claims management and risk monitoring before, during, and after events.

Insurtech innovations are enabling faster responses to claims and greater transparency in coverage details, which enhances organiser confidence. As a result, event managers are more willing to seek comprehensive insurance solutions that align with the complex logistics of beer festivals. This digital shift is expected to improve overall market efficiency and broaden the appeal of specialised insurance offerings beyond traditional brokerage models.

Opportunity Analysis

An important opportunity in the Beer Festival Insurance market exists in expanding specialised coverage options that address a wider range of risks. Beyond basic liability and liquor liability, there is increasing interest in property insurance, event cancellation protection, and vendor specific policies that reflect the diverse risk landscape of modern festivals. Tailored products can better align with the unique needs of organisers, venues, and vendors, encouraging more comprehensive insurance adoption. This product diversification can attract a broader customer base and enhance overall market engagement.

Growth opportunities also stem from emerging markets where craft beer culture and festival participation are expanding. Regions such as Asia Pacific are witnessing a rise in beer festival activity, creating demand for insurance solutions adapted to local regulatory environments and risk profiles. As awareness of risk management grows alongside festival popularity, insurers can offer locally relevant products and educational support to organisers. This regional expansion presents a meaningful avenue for future market development.

Challenge Analysis

A key challenge in the Beer Festival Insurance market is managing the unpredictability of the events industry. Factors such as weather disruptions, sudden changes in attendance, and last minute cancellations create volatile risk profiles that are difficult to price accurately. Insurers must invest in robust risk modelling and dynamic pricing mechanisms to maintain sustainable coverage options while protecting profitability. This unpredictability requires sophisticated actuarial approaches and continuous refinement of underwriting practices.

Another challenge involves balancing comprehensive coverage with clear communication of policy terms. Festival organisers and vendors must understand what is covered and what is excluded to avoid costly surprises after a claim arises. Complex policy language and varied conditions across different insurers can lead to misinterpretation and disputes during claims processing. Ensuring clarity and consistency in policy documentation remains a significant operational challenge for market participants.

Key Market Segments

By Coverage Type

- General Liability

- Liquor Liability

- Property Insurance

- Equipment Insurance

- Event Cancellation

- Others

By Provider

- Insurance Companies

- Brokers/Agents

- Others

By End-User

- Event Organizers

- Breweries

- Vendors

- Others

By Distribution Channel

- Direct

- Indirect

Top Key Players in the Market

- Allianz SE

- Aon plc

- Marsh & McLennan Companies

- Chubb Limited

- AXA XL

- Zurich Insurance Group

- Willis Towers Watson

- Hiscox Ltd

- Lloyd’s of London

- Event Insurance Services Ltd

- Markel Corporation

- Intact Insurance

- Gallagher (Arthur J. Gallagher & Co.)

- Tokio Marine HCC

- Beazley Group

- Munich Re

- Travelers Companies, Inc.

- American International Group (AIG)

- Aviva plc

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 2.7 Bn |

| Forecast Revenue (2035) | USD 10.9 Bn |

| CAGR(2026-2035) | 15% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Coverage Type (General Liability, Liquor Liability, Property Insurance, Equipment Insurance, Event Cancellation, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User (Event Organizers, Breweries, Vendors, Others), By Distribution Channel (Direct, Indirect) |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)