Table of Contents

Report Overview

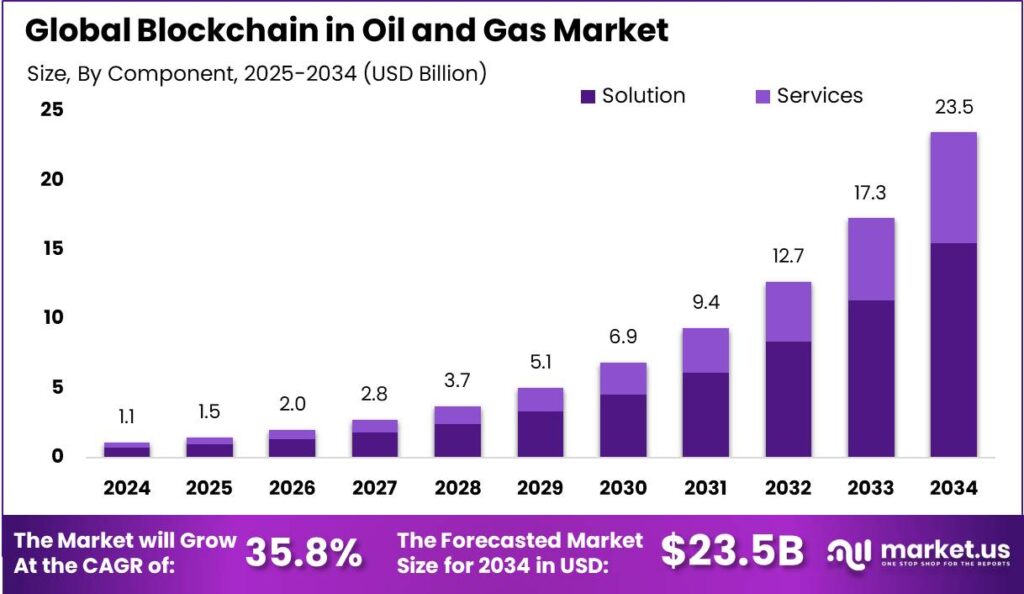

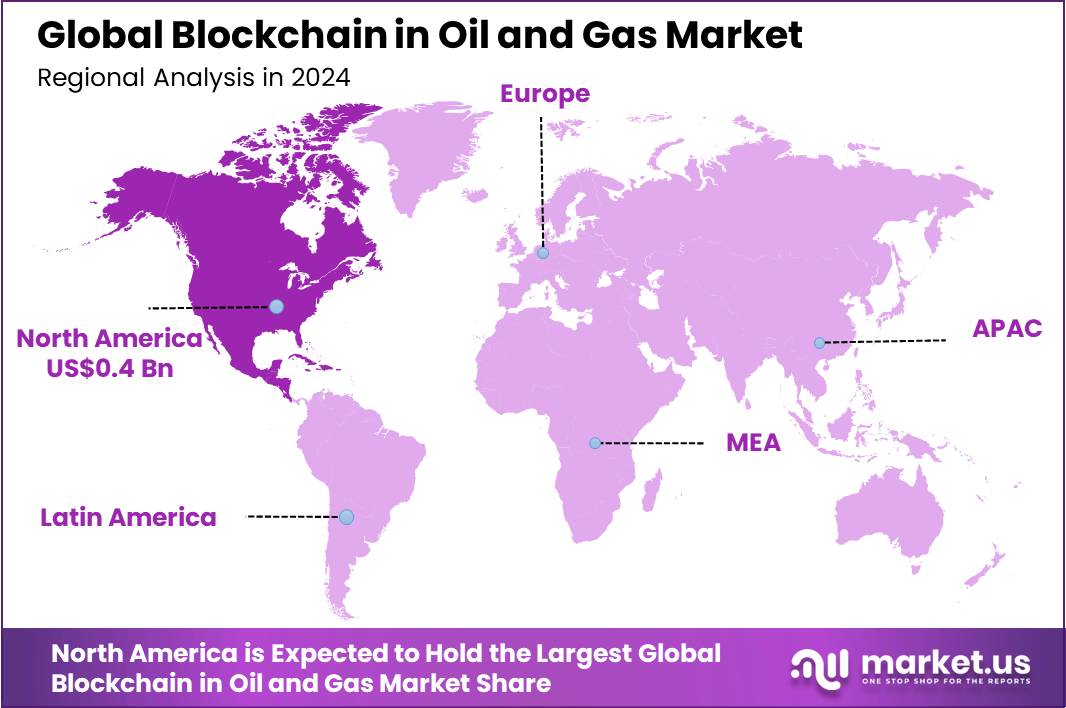

The Global Blockchain in Oil and Gas Market is projected to soar from USD 1.1 Billion in 2024 to an impressive USD 23.5 Billion by 2034, reflecting a robust CAGR of 35.80% throughout the forecast period from 2025 to 2034. In 2024, North America led the market, securing a dominant 37.4% share, with revenues reaching USD 0.4 billion. This rapid growth highlights the transformative potential of blockchain technology in the oil and gas industry.

Blockchain technology has emerged as a transformative force across various industries, and its application within the oil and gas sector is gaining increasing attention. The oil and gas industry, traditionally reliant on complex supply chains, regulatory frameworks, and large-scale data management, stands to benefit significantly from the adoption of blockchain. By leveraging blockchain’s decentralized, transparent, and secure nature, companies in the sector can streamline operations, reduce costs, enhance traceability, and improve overall efficiency.

One of the primary drivers of blockchain adoption in the oil and gas industry is the increasing need for transparency and traceability. As the sector becomes more complex with its supply chains and international operations, ensuring the accuracy and visibility of transactions is critical.Another significant factor is the industry’s ongoing push toward improving operational efficiency. Blockchain’s ability to automate and streamline transactions between multiple parties can significantly reduce costs associated with intermediaries, paperwork, and errors.

Key applications of blockchain in the oil and gas sector include supply chain management, asset tracking, contract management, and payment systems. Blockchain enhances transparency, traceability, and efficiency, while smart contracts automate agreements, manage leases, and ensure regulatory compliance. It also enables peer-to-peer energy trading, reducing costs and improving energy distribution, and supports the integration of renewable energy into the grid.

Widespread blockchain adoption in the oil and gas sector faces challenges such as reliance on legacy systems, which requires significant investment to integrate with new technology, a barrier for smaller companies. Additionally, the lack of standardized protocols for blockchain implementation leads to inconsistent practices across the industry, making collaboration difficult and slowing down sector-wide adoption.

Technological innovations from blockchain in oil and gas include smart contracts, which automate processes like procurement and payments, enhancing efficiency and reducing fraud. Blockchain also improves data management by securely storing and sharing vast amounts of industry data, ensuring real-time, tamper-proof access for better decision-making. Additionally, blockchain-based platforms are revolutionizing carbon credit tracking and trading, helping companies meet environmental regulations by providing transparent and verifiable emission data.

Companies are increasingly exploring blockchain as a way to gain a competitive edge, particularly in regions with high levels of oil and gas production such as the Middle East, North America, and Russia. The drive for efficiency, cost reduction, and enhanced transparency is motivating oil and gas firms to experiment with blockchain technology in various facets of their operations. Industry giants are expected to collaborate with tech providers to create tailored blockchain solutions, driving broader adoption and eventually leading to global standardization.

Key Takeaways

- In 2024, the Solution segment dominated the blockchain-driven oil and gas market, securing over 65.9% of the total market share.

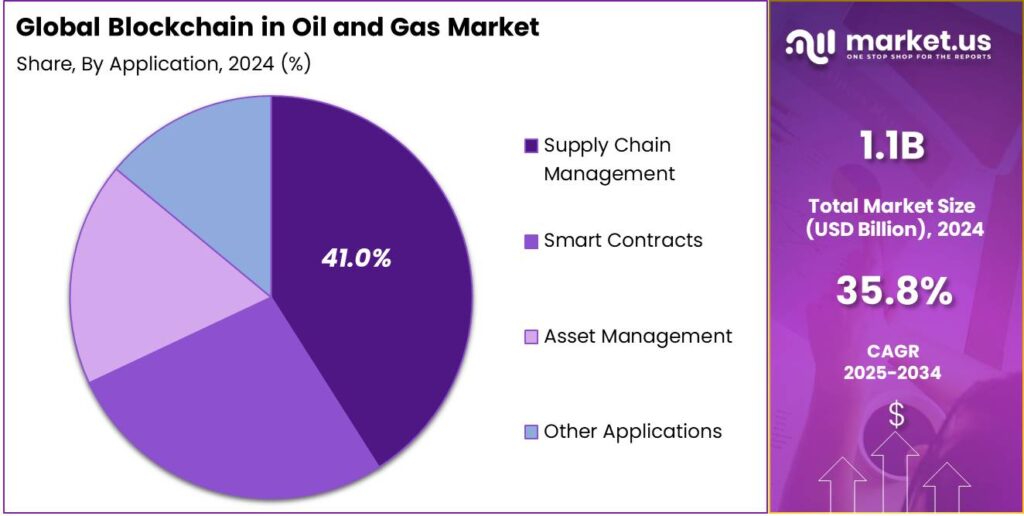

- The Supply Chain Management segment led the industry, accounting for more than 41.0% of the market share within the blockchain oil and gas sector.

- North America emerged as the regional leader, capturing over 37.4% of the market share, with total revenues reaching USD 0.4 billion.

- Within North America, the U.S. stood at the forefront, contributing USD 0.3 billion in revenues to the blockchain oil and gas market.

Impact Of AI

- Enhanced Data Security and Transparency: AI-powered systems enhance blockchain security by monitoring networks in real time, detecting unusual activities, and preventing cyberattacks or fraud. Blockchain ensures data immutability, providing a transparent, secure record of transactions, boosting trust in data handling and exchange in oil and gas operations.

- Optimized Supply Chain Management: Blockchain provides a decentralized and transparent view of the supply chain, while AI enhances this by analyzing patterns and predicting possible disruptions. Together, they can optimize the movement of resources, reduce downtime, and improve inventory management. This ensures smoother operations and better planning in exploration, extraction, and distribution phases.

- Improved Asset Management: AI and blockchain can work together to improve the management of physical assets such as oil rigs, pipelines, and machinery. AI algorithms predict when equipment will need maintenance, and blockchain ensures transparent tracking of maintenance records. This reduces costly breakdowns and ensures operational efficiency.

- Streamlined Contract Management with Smart Contracts: Blockchain enables the use of smart contracts, which are self-executing contracts with predefined terms. AI can enhance these contracts by analyzing vast amounts of historical data to provide accurate predictions. This reduces the need for intermediaries and speeds up the process of contract execution, minimizing risks of human error and delays.

- Improved Decision Making with Predictive Analytics: AI algorithms can analyze large volumes of data collected through blockchain systems to predict market trends, operational risks, or opportunities. In the oil and gas industry, this helps in making informed, data-driven decisions regarding exploration, production, and even investment strategies.

Regional Analysis

North America has solidified its position as the dominant regional player in the blockchain technology market for the oil and gas industry, commanding over 37.4% of the total market share. The region’s total revenues amounted to USD 0.4 billion, showcasing significant growth and adoption of blockchain solutions within the sector. This strong market presence reflects North America’s advanced infrastructure, highly developed oil and gas industry, and the increasing demand for enhanced operational efficiency, transparency, and data security that blockchain offers.

Among the North American countries, the United States has emerged as the leading force, contributing USD 0.3 billion to the overall revenue of the blockchain oil and gas market. This dominance is driven by the U.S.’s robust energy sector, substantial investments in technological innovations, and the government’s increasing focus on advancing energy solutions. U.S.-based oil and gas companies are increasingly exploring blockchain applications to streamline processes, reduce costs, and enhance regulatory compliance. As a result, the U.S. remains at the forefront of blockchain adoption in the oil and gas industry, capitalizing on its technological infrastructure and industry expertise to drive the transformation of traditional energy systems into more efficient, transparent, and secure systems.

Market Segmentation

Component Analysis

In 2024, the Solution segment of the blockchain market in the oil and gas industry played a pivotal role, capturing a dominant market share of over 65.9%. This dominance can be attributed to the growing adoption of blockchain technologies to address critical challenges within the sector, such as transparency, efficiency, and security. Blockchain solutions enable seamless data sharing, better traceability of assets, and enhanced collaboration across stakeholders. Companies in oil and gas are increasingly investing in blockchain to streamline operations, reduce costs, and improve the integrity of transactional data. This widespread utilization has significantly contributed to the growth of the Solution segment, cementing its position as the leader in the market.

Application Analysis

The Supply Chain Management (SCM) segment emerged as a major force in the blockchain oil and gas industry in 2024, accounting for more than 41.0% of the market share. Blockchain’s ability to provide real-time visibility, traceability, and secure documentation has made it an invaluable tool in managing the complex supply chains inherent to the oil and gas industry. By leveraging distributed ledger technology, organizations can ensure that every transaction, from procurement to final delivery, is transparent and immutable, reducing fraud and errors. This increased efficiency and reliability in managing supply chains have driven significant investments in blockchain within this segment, making it the top application area in the sector for 2024.

Market Opportunities for Key Players

- Supply Chain Transparency and Efficiency: Blockchain can improve transparency in the oil and gas supply chain by providing real-time tracking of products from producers to retailers. Every transaction is recorded on an immutable ledger, reducing fraud, errors, and delays. This enhances operational efficiency, reduces costs, fosters trust among partners, and ensures better regulatory compliance and audit trails.

- Smart Contracts for Automated Operations: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the oil and gas industry, these can automate processes such as procurement, payment processing, and joint ventures.Oil and gas companies can reduce administrative overheads, minimize disputes, and improve efficiency by automating contractual processes. Smart contracts can also expedite transactions, ensuring that payments and deliveries are made promptly and without human intervention.

- Secure Data Sharing and Collaboration: Blockchain enables secure data sharing in the oil and gas sector, allowing operators, regulators, and partners to collaborate while ensuring data integrity and restricted access to authorized parties. By adopting blockchain, companies can securely share sensitive operational data, reducing data breach risks and improving the efficiency of joint ventures.

- Improved Payment Systems and Cross-Border Transactions: Blockchain can streamline cross-border transactions in the oil and gas industry by reducing reliance on intermediaries, using cryptocurrencies or tokenized assets to make payments faster, cheaper, and more secure. This improves international payments, particularly for companies operating across regions with different currencies, while lowering transaction costs and delays.

- Carbon Emissions Tracking and Sustainability Reporting: As regulators and stakeholders push for sustainability, oil and gas companies are focusing on tracking and reporting carbon emissions. Blockchain offers a trusted platform to measure and report environmental impact, supporting compliance with regulations and enhancing corporate social responsibility (CSR) efforts.

Emerging Trends

- Decentralization and Enhanced Security: The oil and gas industry is increasingly adopting blockchain to safeguard against cyberattacks and data breaches. The technology’s decentralized and cryptographic nature makes data manipulation and unauthorized access challenging, providing a more secure environment for sensitive information.

- Regulatory Compliance and Auditing: Blockchain technology simplifies compliance with environmental and safety regulations by providing an immutable, transparent ledger for tracking and verifying emissions, waste disposal, and other compliance metrics. This real-time capability facilitates audits and reduces the risk of regulatory violations.

- Supply Chain Optimization: Blockchain is set to transform supply chain management within the industry by enabling real-time data sharing and monitoring across multiple stakeholders. This capability not only enhances forecasting and inventory management but also improves the overall efficiency of the supply chain.

- Smart Contracts and Transaction Efficiency: The application of smart contracts in blockchain allows for automated and error-free transaction management, reducing reliance on intermediaries and enhancing overall transaction speed and reliability.

- Transparency and Traceability: The use of blockchain increases transparency in the oil and gas sector by providing a clear and unalterable record of transactions, from exploration and production to distribution. This traceability is crucial for maintaining compliance, ensuring quality, and verifying the ethical sourcing of materials.

Top Use Cases

- Trading Platforms: Blockchain enables the creation of secure and transparent trading platforms for oil and gas commodities, reducing fraud risks and enhancing trading efficiency. These platforms allow direct transactions between parties, reducing the need for intermediaries and associated costs.

- Digitalization of Crude Oil Transactions: Leveraging blockchain for crude oil transactions minimizes inefficiencies and vulnerabilities by reducing contract duplication and the need for third-party validation, thus cutting administrative costs and enhancing security.

- Enhanced Data Management: By utilizing blockchain, oil and gas companies can streamline the management and storage of vast amounts of data generated from operations, enhancing accessibility and reliability of data across the value chain.

- Environmental Impact Monitoring: Blockchain aids in the monitoring and reporting of environmental impact, helping companies to meet sustainability goals. Real-time tracking of emissions and waste management enabled by blockchain supports adherence to environmental standards and promotes sustainable practices.

- Automation of Back-Office Processes: The integration of blockchain can automate various back-office operations such as accounting, contract management, and compliance documentation. This automation not only reduces operational costs but also increases efficiency and accuracy in these critical processes.

Major Challenges

- Integration with Existing Systems: Integrating blockchain technology into the existing IT infrastructure of oil and gas companies poses significant challenges. The complexity of legacy systems and the need for seamless integration without disrupting ongoing operations can be daunting.

- Regulatory Uncertainty: The regulatory landscape for blockchain is still evolving, with varying standards and regulations across different countries. This uncertainty can hinder the adoption of blockchain, as companies must navigate a complex web of legal frameworks while trying to deploy new technologies.

- High Implementation Costs: Initial costs for implementing blockchain technology can be substantial. These costs include not only technological investment but also expenses related to training staff and modifying existing processes to accommodate the new system.

- Scalability Concerns: As blockchain solutions are deployed on a larger scale within the oil and gas industry, issues related to scalability arise. Ensuring that blockchain networks can handle large volumes of transactions without compromising speed or security is a significant challenge.

- Cultural and Organizational Resistance: There can be resistance within organizations due to a lack of understanding of blockchain technology. Changing the corporate culture to embrace new technologies and convincing stakeholders of its benefits requires substantial effort and strong change management strategies.

Attractive Opportunities

- Enhanced Operational Efficiency: By automating and digitizing processes, blockchain can significantly enhance operational efficiency in the oil and gas industry. This includes everything from crude oil transactions to supply chain management, potentially leading to reduced costs and faster operations.

- Improved Security and Compliance: Blockchain’s inherent security features, such as encryption and decentralization, can help mitigate risks associated with cyber threats and ensure compliance with regulatory requirements through transparent and auditable records.

- Supply Chain Optimization: Blockchain offers tremendous opportunities for optimizing supply chains by providing real-time tracking and verification of goods and materials as they move through various stages of the supply chain. This can lead to improved logistics, reduced losses, and enhanced collaboration among stakeholders.

- Data Management and Transparency: The ability to store and manage large volumes of data securely and transparently can transform data handling in the oil and gas industry. Blockchain facilitates better data accuracy, accessibility, and integrity, which are crucial for decision-making and operational efficiency.

- New Business Models and Revenue Streams: Blockchain opens up new business models and revenue streams in the oil and gas sector, such as peer-to-peer energy trading, tokenization of assets, and new forms of partnerships and collaborations that were not possible before due to technological constraints.

Top Market Players

IBM Corporation stands as a key player in the blockchain landscape for oil and gas. With its IBM Blockchain platform, the company provides an enterprise-grade solution that enhances supply chain transparency and trust. IBM has collaborated with several oil and gas firms to develop blockchain-based solutions, ensuring secure, real-time data exchanges and reducing fraud. Their blockchain offering enables companies to track product movements, improve payments, and streamline contract management, delivering significant cost reductions and operational efficiencies.

SAP SE is another major player integrating blockchain with oil and gas operations. SAP’s blockchain platform is part of their SAP Leonardo suite, which facilitates seamless integration with existing enterprise resource planning (ERP) systems. With a focus on integrating blockchain with broader business processes, SAP helps oil and gas companies gain better control over their operations while enhancing data accuracy and security.

Wipro is positioning itself as a blockchain leader in the oil and gas industry, offering custom solutions designed to optimize energy trading, supply chain management, and contract management. Wipro’s expertise lies in the application of blockchain for process automation, helping oil and gas companies minimize paperwork and human error, thus enabling faster, more accurate decision-making.

VAKT Global Ltd is one of the prominent players dedicated exclusively to blockchain solutions in the oil and gas sector. Their platform, which is built on blockchain technology, digitizes trade finance and logistics processes, specifically for the energy market. By enabling secure, real-time, and paperless transactions, VAKT reduces operational risks and costs associated with traditional methods.

Recent Developments

March 2024: SAP launched new blockchain features integrated into its supply chain management solutions, designed to enhance transparency and traceability of oil and gas transactions. This development aims to streamline operations and reduce costs associated with supply chain complexities.

Conclusion

In summary, the integration of blockchain technology into the oil and gas industry is transforming key operational areas, including supply chain management, asset tracking, and transaction transparency. Blockchain’s decentralized nature enhances security and efficiency by allowing real-time data sharing, reducing fraud, and ensuring the integrity of transactions. By automating and simplifying processes, it also lowers operational costs and improves decision-making. Blockchain applications, such as smart contracts and tokenized assets, have proven to be particularly valuable for streamlining complex processes in exploration, production, and distribution.

The adoption of blockchain in the oil and gas market holds the potential to reshape the industry’s future by driving greater accountability and reducing inefficiencies. As the technology continues to mature, its impact will likely expand across various facets of operations, enabling companies to foster collaboration, boost operational performance, and mitigate risks. The move toward blockchain also signals a broader shift toward digital transformation, ensuring the industry’s competitive edge in an increasingly data-driven world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)