Table of Contents

Introduction

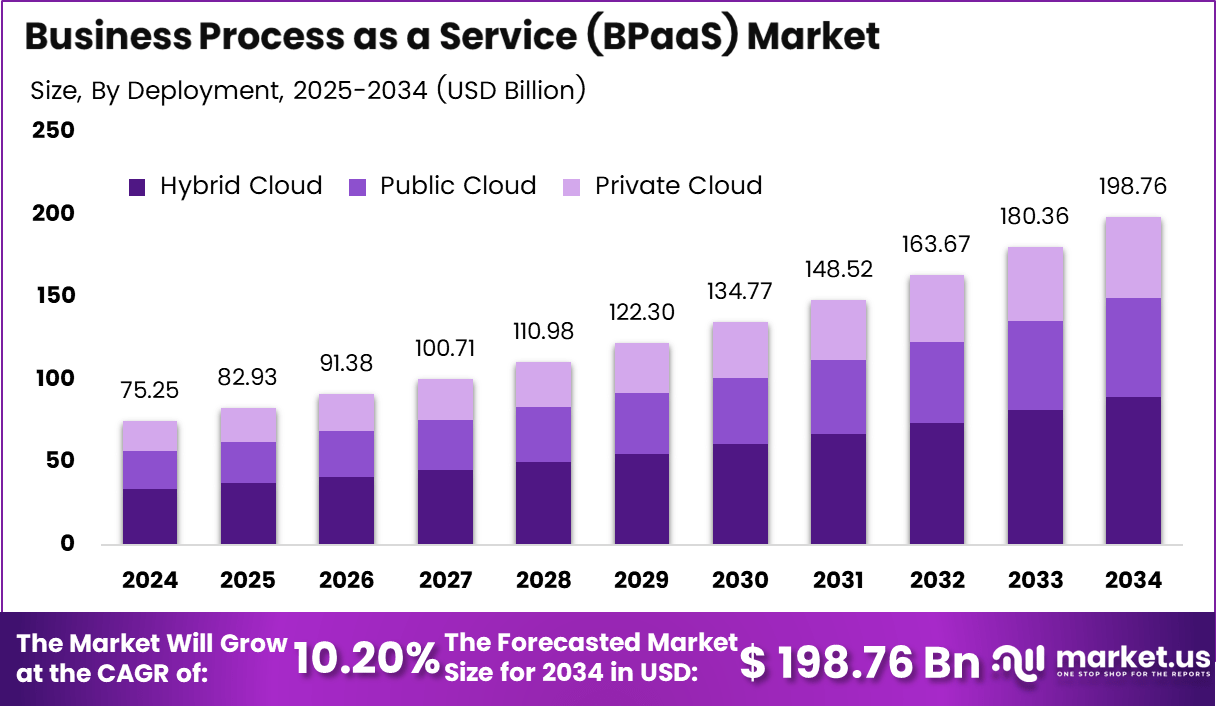

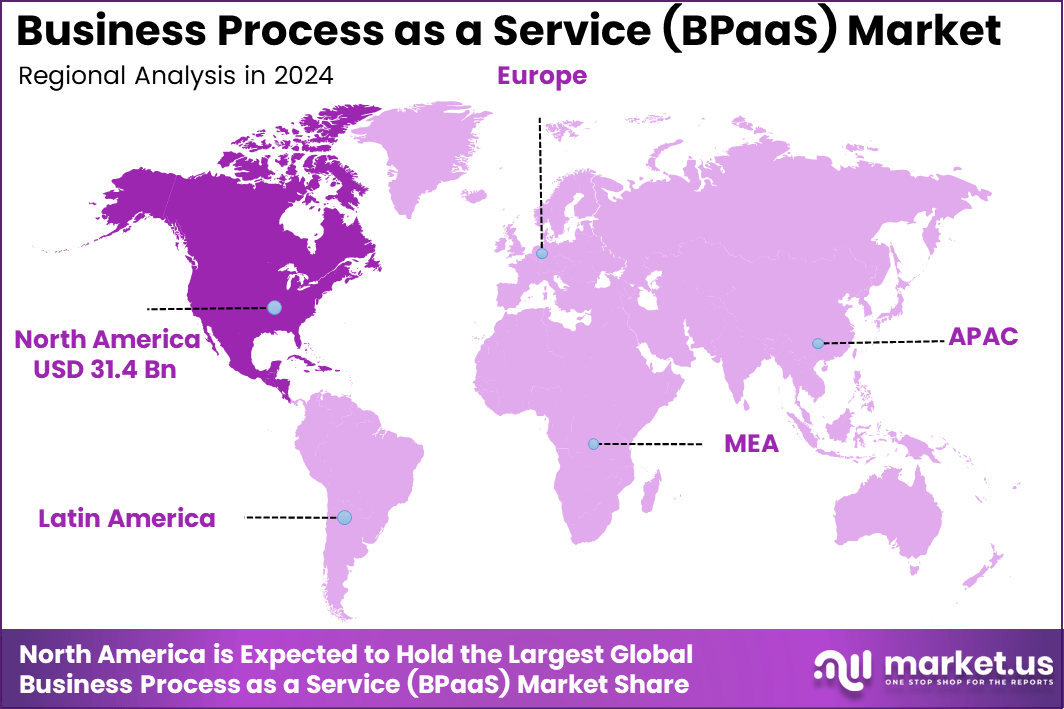

The global Business Process as a Service market was valued at USD 75.25 billion in 2024 and is projected to reach approximately USD 198.76 billion by 2034, expanding at a CAGR of 10.2%. Growth is supported by rising integration of automation, artificial intelligence, and analytics into business processes, which is reshaping service delivery across industries. North America dominated the market in 2024 with revenue of around USD 31.4 billion, driven by early cloud adoption and a strong presence of leading BPaaS providers.

Buy this research report now and save up to 60% in the Christmas Sale@ https://market.us/purchase-report/?report_id=162368

Business Process as a Service refers to the delivery of standardized and automated business processes through cloud based platforms. These services allow organizations to outsource functions such as finance and accounting, human resources, procurement, customer support, and supply chain operations without investing in on premise infrastructure. The market has gained strong traction among enterprises seeking flexibility, scalability, and faster process execution. Adoption is supported by the broader shift toward digital transformation and cloud first strategies across industries.

Key Insights Summary

- Human Resource Management (HRM) led with 25.6%, driven by rising use of automated payroll, hiring, and employee management platforms.

- Hybrid cloud deployment captured 45.2%, as organizations balance scalability with data security and compliance needs.

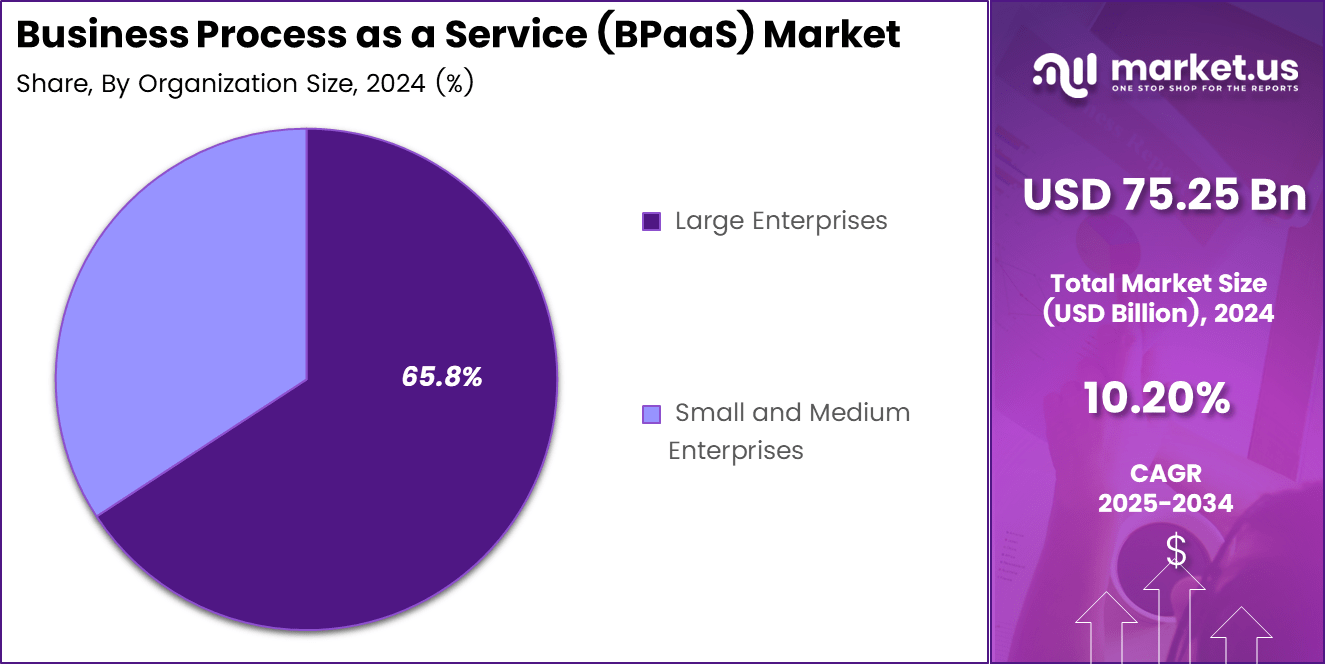

- Large enterprises dominated with 65.8%, reflecting strong BPaaS adoption for cost control and digital transformation.

- The BFSI sector held 28.3%, relying on BPaaS for regulatory compliance, process automation, and service efficiency.

- North America accounted for 41.8% of global demand, supported by mature cloud infrastructure and high outsourcing adoption.

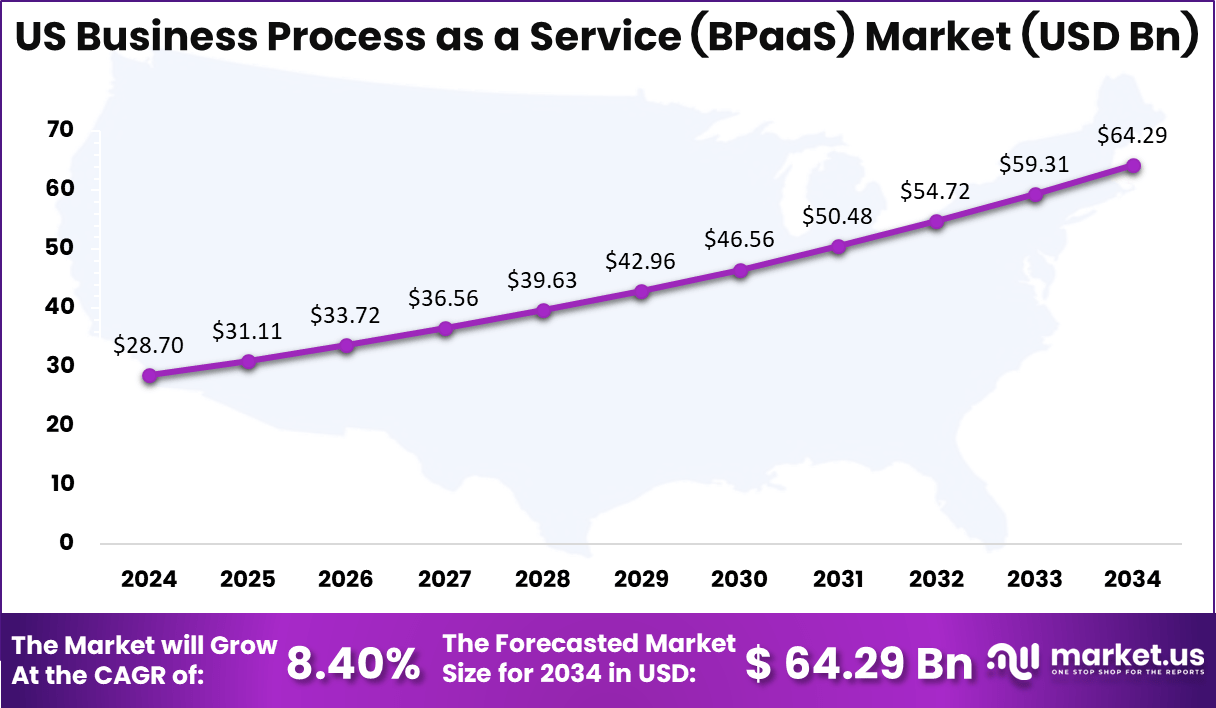

- The U.S. market reached USD 28.7 billion in 2024, growing at a steady 8.4% CAGR due to deeper integration of AI and analytics in outsourced business processes.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 75.25 Bn |

| Forecast Revenue (2034) | USD 198.76 Bn |

| CAGR(2025-2034) | 10.20% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Top Driving Factors

Growth of the BPaaS market is driven by increasing pressure on organizations to reduce operating costs and improve process efficiency. Companies are moving away from manual and fragmented workflows toward integrated service models that offer predictable performance and service level agreements. Rising adoption of cloud computing and automation tools has made BPaaS more reliable and easier to deploy. Demand is also supported by the need for rapid business continuity and remote process management, especially among small and mid sized enterprises.

Demand for BPaaS solutions is expanding steadily across sectors such as banking, healthcare, retail, manufacturing, and telecom. Organizations are adopting these services to standardize processes, improve compliance, and gain real time visibility into operations. Interest is particularly strong among companies undergoing rapid growth or restructuring, where internal process management becomes complex. As enterprises continue to focus on agility and digital efficiency, demand for BPaaS offerings is expected to remain strong over the long term.

By Business Process

The Human Resource Management segment led with 25.6%, showing strong demand for BPaaS solutions that support payroll processing, recruitment workflows, and employee lifecycle management. Organizations increasingly rely on digital HR platforms to standardize processes and reduce manual effort.

Growth in this segment is supported by rising workforce complexity and remote work adoption. Automated HR services help improve accuracy, ensure policy compliance, and enhance employee experience while lowering administrative costs.

By Deployment

Hybrid cloud deployment accounted for 45.2%, reflecting its ability to balance flexibility and control. Organizations use hybrid models to keep sensitive data on private systems while leveraging public cloud platforms for scalability and efficiency. This deployment approach is favored by enterprises with strict data governance needs. Hybrid cloud BPaaS allows smooth integration with legacy systems while supporting gradual cloud migration strategies.

By Organization Size

Large enterprises dominated with 65.8%, driven by their need to manage complex business processes across multiple regions and departments. These organizations adopt BPaaS to streamline operations and improve process consistency. Cost optimization and digital transformation initiatives continue to support adoption among large enterprises. BPaaS helps reduce infrastructure burden and enables faster deployment of standardized business services.

By Application

The BFSI sector held 28.3%, highlighting strong reliance on BPaaS for compliance management and transaction processing. Financial institutions use BPaaS platforms to automate workflows and improve operational efficiency. Adoption is further supported by the need for accurate reporting and improved customer service. BPaaS solutions help BFSI organizations respond faster to regulatory changes and market demands.

By Region

North America

North America captured 41.8% of the global market, underpinned by mature cloud infrastructure and strong enterprise outsourcing adoption. Organizations in the region show early acceptance of cloud-based process automation. High investment in digital transformation and advanced analytics continues to support market growth. Enterprises across North America increasingly view BPaaS as a strategic tool rather than a support function.

United States

The US market reached USD 28.7 Billion in 2024, recording a steady CAGR of 8.4%. Growth is driven by increasing integration of AI and analytics into business process outsourcing models. US enterprises focus on data-driven decision making and process intelligence. BPaaS platforms enable real-time insights, improved performance tracking, and better alignment with business goals.

Key Market Segment

By Business Process

- Human Resource Management (HRM)

- Accounting and Finance

- Sales & Marketing

- Customer Service and Support

- Procurement & Supply Chain Management

- Operations

- Others (Legal and R&D)

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Application

- BFSI

- Telecom & IT

- Manufacturing

- E-commerce & Retail

- Healthcare

- Government & Public Sector

- Others

Top Key Players

- Accenture plc

- IBM Corporation

- Tata Consultancy Services (TCS)

- Cognizant Technology Solutions

- Wipro Limited

- HCL Technologies

- Capgemini SE

- Infosys Limited

- Genpact Ltd.

- Fujitsu Ltd.

- Oracle Corporation

- SAP SE

- Deloitte Touche Tohmatsu Limited

- NTT DATA

- CGI Inc.

- DXC Technology

- Tech Mahindra

- EXL Service Holdings

- ADP Inc.

- Alight Solutions

- Paychex Inc.

- UKG (Ultimate Kronos Group)

- TriNet Group

- Ceridian HCM

- WNS Global Services

- Sutherland Global Services

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)