Table of Contents

Introduction

The global camshaft lifters market is entering a pivotal growth phase as manufacturers adopt advanced valvetrain engineering to enhance efficiency and durability. Moreover, rising consumer expectations for smoother engine performance continue to push OEMs toward precision lifter technologies that improve reliability across diverse driving conditions.

Additionally, the market gains momentum as stricter emission standards compel automakers to optimize combustion efficiency. Consequently, camshaft lifters are increasingly adopted to support cleaner, more fuel-efficient engines worldwide. Furthermore, heightened interest in long-life engine components reinforces demand across both OEM and aftermarket channels.

At the same time, expanding industrial, logistics, and construction activities amplify demand for heavy-duty engines with stable valvetrain systems. As a result, advanced hydraulic and roller lifters are seeing wider deployment. Similarly, aftermarket growth accelerates as aging vehicle fleets require frequent maintenance and cost-effective replacements.

Furthermore, innovations in lightweight materials, precision machining, and advanced coatings propel lifter performance to new levels. In return, automakers gain access to reduced friction, enhanced heat resistance, and extended component life. Ultimately, these advancements position camshaft lifters as essential components in next-generation internal combustion and hybrid engines.

Key Takeaways

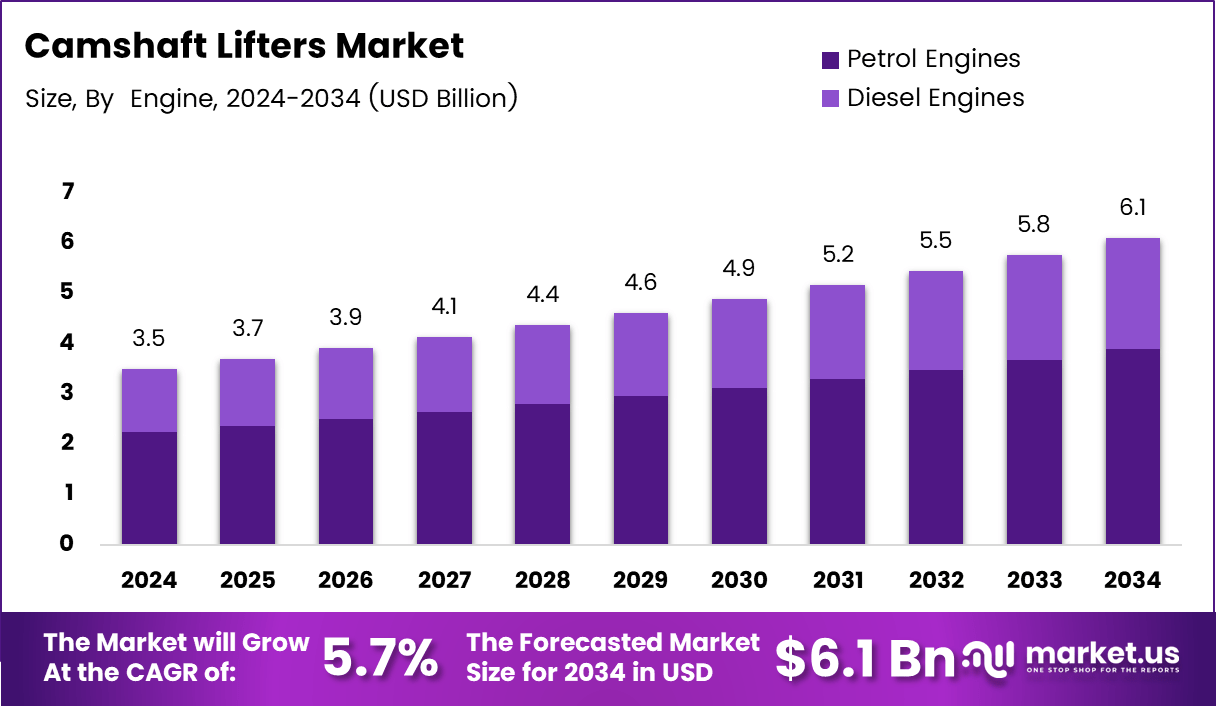

- The Global Camshaft Lifters Market is projected to reach USD 6.1 billion by 2034 from USD 3.5 billion in 2024.

- The market expands at a stable CAGR of 5.7% from 2025 to 2034.

- Hydraulic Lifters dominate the By Type segment with a leading share of 48.3% in 2024.

- Petrol Engines lead the By Engine segment with a significant 63.9% share in 2024.

- Passenger Cars hold the largest share By Vehicle Type at 69.5% in 2024.

- OEMs dominate the By Sales Channel segment with 77.2% share in 2024.

- North America leads the regional landscape with a 44.9% share, valued at USD 1.5 billion in 2024.

Market Segmentation Overview

By Type

Hydraulic Lifters dominate with 48.3%, driven by their low-maintenance characteristics and smoother valve operation. Additionally, automakers increasingly adopt these systems to achieve quieter engines and enhanced consumer satisfaction across mass-market vehicle platforms.

Mechanical (Solid) Lifters maintain demand due to their performance advantages and higher RPM stability. Moreover, motorsport enthusiasts and aftermarket engine builders favor these components for precision tuning and improved responsiveness in competitive or modified vehicle settings.

Roller Lifters continue expanding as manufacturers integrate friction-reducing technologies. As a result, better fuel efficiency and reduced wear support their adoption across modern platforms. Furthermore, hybrid engines also benefit from these lifters’ optimized contact profiles.

Flat Tappet Lifters remain relevant for budget engines and legacy platforms. Additionally, they serve critical roles in older vehicle rebuilds and restoration projects, sustaining long-term aftermarket activity among cost-conscious consumers.

By Engine

Petrol Engines lead with a 63.9% share as global gasoline vehicle adoption remains strong. Moreover, smoother combustion characteristics and evolving lightweight engine designs further support their dominance in passenger mobility markets.

Diesel Engines maintain a substantial presence due to heavy-duty applications requiring long-life components. Additionally, sectors such as agriculture, logistics, and construction continue relying on diesel-driven torque for intensive workloads.

By Vehicle Type

Passenger Cars dominate with 69.5%, supported by global car ownership growth and ongoing advancements in engine technology. Furthermore, automakers focus on improving fuel efficiency through precision valvetrain systems tailored to evolving mobility needs.

Light Commercial Vehicles witness increasing adoption as e-commerce and small logistics fleets expand. Additionally, frequent operational cycles and load-bearing requirements demand durable lifter systems for consistent performance.

Heavy Commercial Vehicles continue generating steady demand due to their dependence on engines designed for extended operation. Moreover, infrastructure projects and freight movement sustain consumption of robust valvetrain components.

By Sales Channel

OEMs hold 77.2% as automakers integrate advanced lifters to meet emission standards and performance expectations. Additionally, large-scale vehicle production ensures consistent, high-volume component sourcing.

The Aftermarket remains vital due to aging vehicle fleets and continuous maintenance needs. Furthermore, performance upgrades and engine rebuilds keep specialty shops and parts distributors active in the segment.

Drivers

Growing Demand for Fuel-Efficient Engines: The push toward cleaner, more efficient combustion continues to propel adoption of optimized valve timing systems. As automakers pursue improved fuel economy, camshaft lifters enable smoother engine cycles and enhanced overall performance, supporting regulatory compliance worldwide.

Increasing Production of High-Performance Vehicles: Turbocharged and high-output engines rely on advanced lifters capable of handling greater thermal and mechanical loads. This technological shift accelerates lifter innovation and expands market uptake across premium and performance vehicle categories.

Use Cases

Passenger Vehicle Efficiency Enhancement: Modern sedans and SUVs integrate hydraulic and roller lifters to reduce friction and noise while improving fuel efficiency. This application supports customer demands for quieter, smoother rides across urban and suburban environments.

Commercial Fleet Reliability: Long-haul trucks and delivery vehicles require durable lifters to withstand continuous engine operation. Reliable valvetrain components help fleet operators minimize maintenance downtime and extend engine service life, reducing operational costs.

Major Challenges

High Repair and Replacement Costs: Hydraulic lifter failures often require complex and expensive repairs. This discourages some consumers and fleet managers and may slow adoption in price-sensitive markets where cost outweighs performance benefits.

Raw Material Price Volatility: Fluctuations in steel, alloys, and specialty coatings increase production costs. Manufacturers face difficulty maintaining price stability, affecting profit margins and supply chain predictability.

Business Opportunities

Development of Lightweight, Low-Friction Lifters: Innovations in materials and coatings offer significant potential for efficiency improvements. Manufacturers can capitalize on demand for components that reduce internal resistance and extend engine lifespan.

Growth in Aftermarket Replacement Demand: Aging vehicles in developing regions present strong opportunities for affordable, durable lifter solutions. Companies offering reliable replacement parts can gain substantial market share in these expanding automotive repair ecosystems.

Regional Analysis

North America: With a 44.9% share, North America dominates due to strong vehicle production and widespread adoption of advanced engine systems. Additionally, a mature aftermarket and continued investments in performance engines reinforce sustained demand.

Europe and Asia Pacific: Europe benefits from regulatory pressure and engineering innovation, while Asia Pacific grows rapidly through expanding passenger vehicle production. Both regions maintain rising demand for optimized valvetrain components supporting fuel-efficient mobility advancements.

Recent Developments

- In January 2024, Aisin Seiki introduced an upgraded hydraulic lifter with enhanced oil-flow stability for high-temperature environments.

- In September 2025, Tenneco launched an advanced lifter solution featuring reduced-noise operation for next-generation engine systems.

Conclusion

The global camshaft lifters market is poised for robust long-term expansion as automakers prioritize efficiency, durability, and emission compliance. Supported by innovations in materials, machining, and aftermarket growth, lifters remain essential components across both internal combustion and hybrid powertrain architectures. As new technologies emerge, the market will continue evolving to meet the demands of modern mobility.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)