Table of Contents

Chipless RFID Market Overview

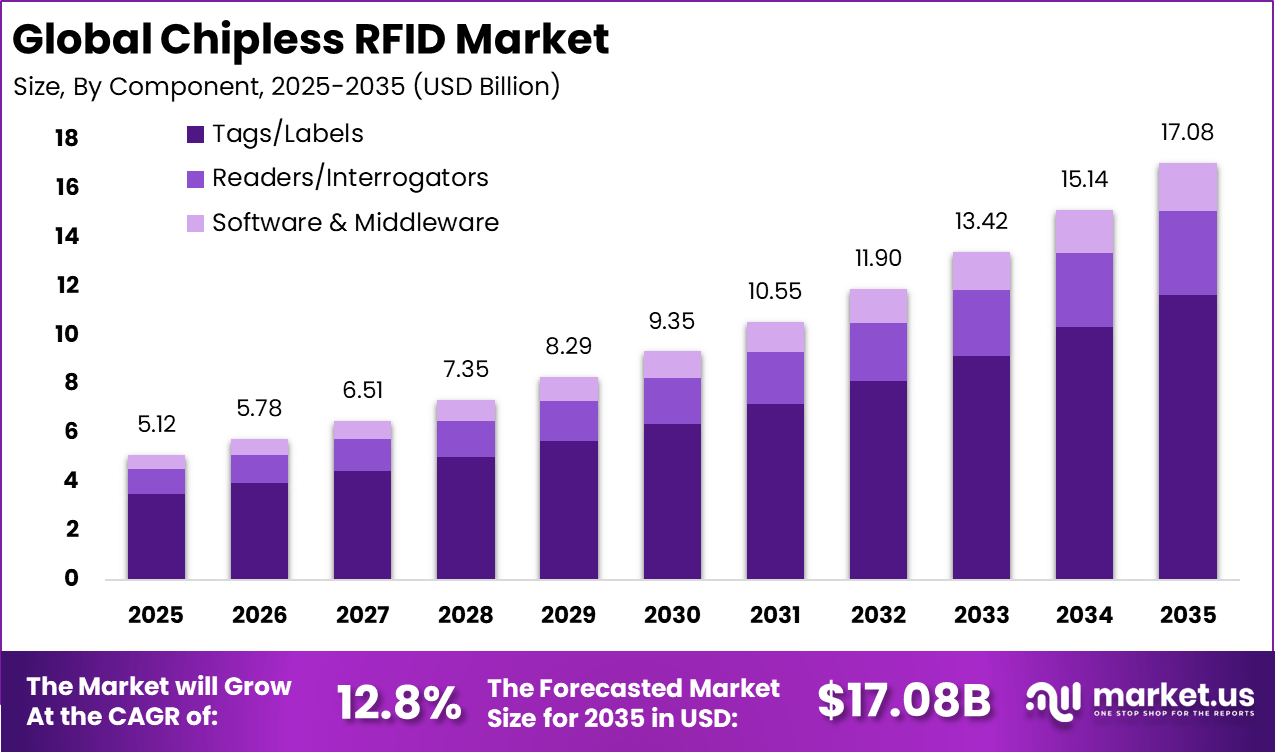

The Global Chipless RFID Market reached a valuation of USD 5.12 billion in 2025 and is anticipated to grow to nearly USD 17.08 billion by 2035. This expansion reflects a steady compound annual growth rate of 12.8% during the forecast period. The upward trajectory is supported by increasing demand for cost-efficient identification and tracking solutions across multiple end-use industries.

In 2025, North America held a leading position in the market, accounting for more than 32.6% of total revenue, equivalent to approximately USD 1.66 billion. The regional dominance can be attributed to the strong adoption of scalable and low-cost RFID technologies across retail supply chains, logistics networks, and industrial operations. Growing emphasis on inventory visibility, anti-counterfeiting measures, and operational automation has further strengthened market penetration across the region.

The chipless RFID market refers to technologies and solutions that enable object identification and tracking without the use of semiconductor chips. Unlike traditional RFID systems which rely on an integrated circuit to store and transmit data, chipless systems encode information through physical features such as material patterns or electromagnetic signatures. These solutions are developed to reduce cost and complexity in large-scale tagging applications where chip based tags may be impractical. Adoption supports tracking, authentication, and data capture across supply chains and asset management environments.

Chipless RFID systems generally consist of readers and specially designed tags that respond to radio frequency signals in a unique manner. The use of encoded physical signatures allows information to be detected and interpreted by readers without the need for silicon chips. This makes production of chipless tags more economical and suitable for disposable or low-cost applications. The market includes hardware manufacturers, software integrators, and service providers focused on deploying identification systems.

Key Takeaways

- Tags and Labels led the market with 68.4% share in 2025. Demand is driven by inventory tracking and product identification.

- Ultra High Frequency (UHF) technology held 72.8% share. Growth is supported by longer read range and better data capture efficiency.

- Retail and Supply Chain Management accounted for 38.7% of total demand. Real time visibility and shrinkage control are key drivers.

- Retail and E commerce led by end use with 41.5% share. Accurate stock tracking and faster order fulfillment support adoption.

- The United States market was valued at USD 298.7 Billion in 2025. It is expanding at a CAGR of 29.6%.

- North America captured more than 32.6% of global revenue. Early technology adoption and strong retail infrastructure support growth.

Adoption Trends by Sector

- Retail and Apparel hold around 28.5% to 30% market share during 2025 to 2026. RFID penetration in apparel has reached nearly 40% of the addressable market. Over 31 billion tags are expected to be deployed in 2025.

- Logistics and Transport are projected to be the fastest growing sectors through 2032. Growth is supported by real time asset tracking and parcel monitoring.

- Healthcare is expanding at a 29.0% CAGR through 2031. Cold chain monitoring for vaccines and biologics supports adoption.

- In European urban markets, chipless RFID represents over 18% of new loader sales. Adoption reflects growing demand for silicon free identification technologies.

Usage and Performance Insights

- RFID deployment reduces cycle count labor by up to 70%. Inventory errors decline by around 25%. Retail sales increase by an average of 10% after implementation.

- Identification accuracy ranges between 95% and 99.9%. Shipping and picking accuracy improves by nearly 80% in manufacturing environments.

- Cost efficiency remains a core advantage. Removing the silicon chip lowers tag prices and supports high volume applications.

- Tags accounted for 70.4% of total revenue in 2025. Middleware software is the fastest growing segment, expanding at a CAGR of 26%.

Top Driving Factors

One of the primary factors driving the chipless RFID market is the increasing need for cost-effective tracking solutions across supply chains. Traditional RFID tags include semiconductor chips which contribute to higher unit costs, especially when applied in large volumes. Chipless alternatives offer a reduced cost per tag through simpler manufacturing techniques. Organisations with extensive tagging requirements find financial advantage in lower cost identification media.

Another key factor is the expansion of industries requiring high volume object identification. Sectors such as logistics, retail, and packaging generate vast quantities of items that require tracking or authentication. Chipless RFID systems provide a method to mark large populations of assets without incurring prohibitive tag expenses. The scalability of chipless tags aligns with environments where millions of items must be monitored.

Environmental sustainability considerations also contribute to market interest. Chipless RFID tags often use fewer materials and simpler designs, which can reduce environmental impact associated with production and disposal. This supports organisational initiatives to minimise waste and adopt greener technologies. As companies place greater emphasis on sustainability reporting and responsible procurement, chipless RFID becomes a consideration.

Demand Analysis

Demand for chipless RFID solutions is increasing as organisations seek alternatives to traditional identification technologies. Enterprises that manage complex inventory and asset networks view affordable tagging as a means to enhance visibility and reduce loss. The ability to track items without costly chips supports wider deployment across operational nodes. This enhances real-time data capture and improves decision support.

Industries such as retail and logistics show particular interest due to the high volume of items that move through their networks daily. Retailers look to track goods from manufacturing through to point of sale to improve inventory accuracy. Logistic firms seek to monitor shipments and containers to reduce misplacement and delays. Chipless RFID offers a potential method to extend tracking coverage at scale.

Demand is also supported by broader interest in automated identification technologies within manufacturing and warehousing. Organisations implementing automation benefit from identification systems that enable machines and software to recognise and respond to tagged items. Chipless RFID supports these efforts without adding significant per unit cost. As automation expands, the need for cost-effective identification systems increases.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Demand for low cost identification | Replacement of barcodes and traditional RFID | ~3.6% | Global | Short Term |

| Growth of retail automation | Inventory accuracy and shrinkage reduction | ~3.0% | North America, Europe | Short Term |

| Expansion of logistics and warehousing | High volume asset tracking requirements | ~2.4% | Global | Mid Term |

| Industrial digitalization | Traceability and process optimization | ~2.1% | Global | Mid Term |

| Rising adoption in smart packaging | Anti counterfeiting and tracking | ~1.7% | Global | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| Read range limitations | Lower performance compared to chipped RFID | ~2.9% | Global | Short Term |

| Interference issues | Sensitivity to environmental conditions | ~2.3% | Industrial environments | Mid Term |

| Standardization gaps | Lack of uniform global protocols | ~1.9% | Global | Mid Term |

| Technology awareness gaps | Limited understanding among end users | ~1.5% | Emerging Markets | Long Term |

| Competition from alternative technologies | Optical and sensor based tracking | ~1.2% | Global | Long Term |

Emerging Trend Analysis

A key emerging trend in the chipless RFID market is the increasing integration of printed conductive materials and advanced decoding methods that enhance tag readability and data handling without a silicon chip. Innovations in printing technology are enabling chipless RFID tags to be produced at lower cost while maintaining compatibility with existing scanning systems, thereby expanding practical deployment across high-volume applications such as packaging and inventory tracking.

As material science advances, these printed chipless tags are also being embedded into smart packaging and Internet of Things ecosystems, supporting automated identification and real-time operational insights. The trend toward scalable, printable chipless RFID solutions reflects a shift in industry focus from traditional microchip-based RFID to more cost-efficient, high-volume alternatives that can be integrated into everyday products.

Furthermore, the integration of artificial intelligence-enabled analytics with chipless RFID systems is gaining attention as a means to improve real-time data interpretation and anomaly detection. AI-driven processing enhances the ability of chipless systems to handle large data flows generated in dynamic environments, such as logistics or healthcare, thereby improving accuracy and operational value. This alignment of AI with low-cost identification technologies supports faster processing and better decision-making based on RFID-generated data streams.

Opportunity Analysis

An important opportunity in the chipless RFID market lies in expanding applications within smart packaging and the Internet of Things (IoT) ecosystem. As consumer goods industries and supply chain operators adopt IoT frameworks to improve efficiency, chipless RFID can serve as a low-cost means of embedding identification directly into products and packaging materials. This enables seamless integration with sensor networks, mobile scanning devices, and cloud-based analytics, creating richer data sets for inventory tracking, quality assurance, and consumer interaction monitoring. Increasing synergy between chipless RFID and IoT platforms can unlock new value propositions for automated asset visibility.

Additionally, opportunities exist in emerging sectors such as anti-counterfeiting and brand protection, where chipless RFID offers an affordable alternative to costly microchip-based authentication systems. With appropriate enhancements in security protocols and tag design, chipless solutions can support verification of genuine products at scale, particularly in industries where margin pressures limit the use of expensive technologies. Growth in these domains could be accelerated by regulatory requirements for traceability and consumer demand for transparent supply chains.

Key Market Segments

By Component

- Tags/Labels

- Readers/Interrogators

- Software & Middleware

By Frequency Band

- Ultra-High Frequency (UHF)

- Microwave Frequency

- Millimeter Wave

By Application

- Retail & Supply Chain Management

- Aerospace & Defense

- Healthcare & Pharmaceuticals

- Logistics & Transportation

- Smart Cards & Ticketing

- Others

By End-User Industry

- Retail & E-commerce

- Aerospace & Defense

- Healthcare

- Automotive

- Others

Top Key Players in the Market

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Alien Technology, LLC

- Impinj, Inc.

- NXP Semiconductors N.V.

- Honeywell International, Inc.

- Invengo Information Technology Co., Ltd.

- GAO RFID, Inc.

- HID Global Corporation

- Smartrac Technology Group

- Tageos

- Checkpoint Systems, Inc.

- SATO Holdings Corporation

- Ascend ID Solutions, LLC

- Datalogic S.p.A.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 5.1 Bn |

| Forecast Revenue (2035) | USD 17.0 Bn |

| CAGR(2026-2035) | 12.8% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)