Table of Contents

Introduction

Cloud Gaming Statistics: Cloud gaming, game streaming, or cloud-based gaming. It represents a transformative shift in the gaming industry. They are utilizing cloud computing infrastructure to deliver video games directly to players via the internet.

Unlike traditional gaming, where games are locally processed, cloud gaming leverages remote data centers. Executing games on powerful servers and streaming video and audio outputs to players’ devices in real-time.

With advancements in infrastructure, streaming technology, and input methods. Cloud gaming has evolved from early experiments to mainstream adoption, attracting tech giants like Google and Microsoft.

It offers increased accessibility, cross-platform play, and scalability. Fundamentally reshaping how we engage with and access video games while impacting the broader gaming landscape.

Editor’s Choice

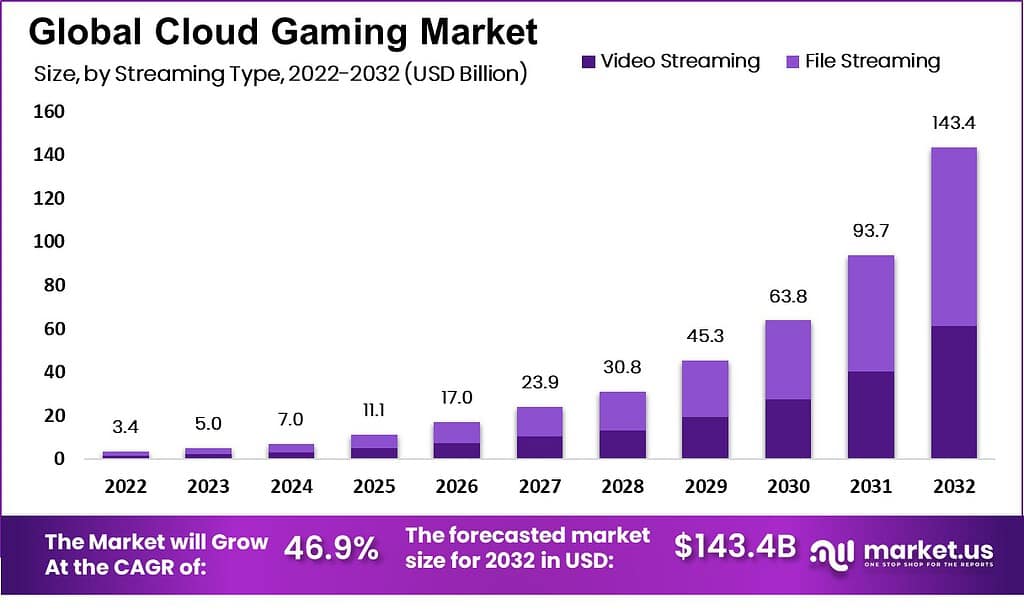

- The cloud gaming market has experienced remarkable growth in recent years and is anticipated to continue growing at a CAGR of 46.9%.

- In 2022, the market generated $3.4 billion in revenue, projected to rise to $143.4 billion in 2023.

- NVIDIA Corporation is dominant in the cloud gaming market, commanding a substantial 21% share.

- During the first quarter of 2021, Google Stadia garnered over 3 million app downloads.

- In April 2020, the Xbox Cloud Gaming service boasted 10 million subscribers.

- The average revenue per user in the cloud gaming sector shifted in 2022 with a decrease to $14.64, followed by relatively stable figures in 2023 at $14.7.

- According to a survey conducted in April 2021 among gamers in the United States. PlayStation Network (PSN) and Xbox Live both earned high satisfaction rates. With 46% of users expressing they were “Very Satisfied” and an additional 26% stating they were “Somewhat Satisfied.”

Global Cloud Gaming Market Size Statistics

- The cloud gaming market has experienced remarkable growth in recent years and is anticipated to continue growing at a CAGR of 46.9%.

- In 2022, the market generated $3.4 billion in revenue, and this figure is projected to soar to $5.0 billion in 2023, demonstrating a significant uptick.

- The trend will likely continue to accelerate as we move into the mid-2020s. With the market reaching $7.0 billion in 2024 and doubling to $11.1 billion in 2025.

- By 2026, the revenue is expected to surge to $17.0 billion, and this remarkable trajectory is likely to persist, culminating in an impressive $30.8 billion in 2028.

- The following years are expected to grow exponentially, with revenue skyrocketing to $45.3 billion in 2029, $63.8 billion in 2030, and an astonishing $93.7 billion in 2031.

- As we look ahead, the cloud gaming market is projected to continue its upward trajectory. With revenue estimated to reach an impressive $143.4 billion in 2032.

- This growth underscores the increasing significance of cloud gaming as it transforms the gaming industry and captures the imagination of players worldwide.

(Source: Market.us)

Key Players in the Global Cloud Gaming Market

- In the competitive landscape of the cloud gaming market, several prominent players vie for market share.

- Among these, NVIDIA Corporation stands out as a dominant force, commanding a substantial 21% share.

- Microsoft Corporation is another major player, closely following with a 14% share, while Google Inc. secures an 11% share.

- Intel Corporation and IBM Corporation also hold significant positions, with 16% and 9% shares, respectively.

- Amazon Inc. and Electronic Arts, Inc. each contribute 10% and 7% to the market, while Apple Inc. claims an 8% share.

- These established players collectively shape the cloud gaming industry, leaving a 4% share for other vital participants.

- As the cloud gaming market continues to evolve, competition and innovation among these companies will play a pivotal role in defining the industry’s future landscape.

(Source: Market.us)

Popular Cloud Gaming Platforms

Google Stadia

- Google Stadia boasts a library of more than 100 games.

- During the first quarter of 2021, Google Stadia garnered over 3 million app downloads.

- As of October 2021, Google Stadia has received over 180,000 reviews on the Google Play Store, maintaining an average rating of 4.1 stars.

- Subscribers to Stadia Pro benefit from enhanced game resolution, reaching 4K, whereas the free version offers a resolution of 1080p.

- In October 2020, Stadia’s data consumption per hour ranged from approximately 7 GB to 20 GB, depending on the selected resolution.

- As of September 2021, Google Stadia extended its support to a diverse range of more than 30 devices, encompassing Chromecast and Android TV devices.

- Stadia’s maximum latency is around 188 ms, contrasting with the 40 ms latency experienced on local hardware.

- According to a 2020 survey, 16.1% of Stadia users identify as female.

- Google Stadia offers users two subscription options: Stadia Pro, priced at $9.99 monthly, and a no-cost tier known as Stadia Base.

- During the first quarter of 2021, Google Stadia accounted for 8.69% of installations among game streaming services.

(Source: Venturebeat, tomshardware, Stadia, androidcentral, Axios, Pushsquare, Gamesindustry)

NVIDIA GeForce NOW

- GeForce Now had 300,000 users during its beta phase, with an additional 1 million eagerly awaiting access.

- In February 2020, the service surpassed 1 million registered users.

- By April 2021, GeForce Now’s user base had expanded significantly, reaching 10 million subscribers.

- As of August 2022, the service had further doubled its subscriber count, boasting 20 million users.

- Subscribers who opt for the $19.99 monthly subscription can anticipate enhanced server performance.

- GeForce Now lets you stream your game collection in the cloud. Before the upgrade, the top-tier performance was akin to that of an RTX 3080 GPU.

- In 2020, the platform incorporated 800 games, including 80 titles that could be played for free. The leading free game was Fortnite.

- Gamers dedicated 100 million hours to multiplayer games and invested 16 million in indie titles.

- The most famous indie game happened to be ARK: Survival Evolved.

- Users streamed the in-game night city of Cyberpunk 2077 with RTX enabled for 4 million hours.

- A staggering 130 million gaming highlights were recorded using Nvidia Highlights. Windows PC emerged as the primary choice for game streaming.

(Source: VentureBeat, NVIDIA, Tech Crunch)

Xbox Cloud Gaming

- In April 2020, the Xbox Cloud Gaming service boasted 10 million subscribers.

- By September 2020, this figure had grown to 15 million subscribers.

- In January 2021, the service’s subscriber count increased to 18 million.

- By January 2022, the service had reached a milestone of 25 million subscribers.

- By 2026, Xbox Cloud Gaming is poised to claim the most extensive cloud gaming platform title.

- The service achieved revenue exceeding $450 million in 2021 and during that year. PS Now held the top spot in terms of revenue among cloud gaming services.

- Additionally, forecasts are suggesting that the worth of the cloud gaming industry will experience substantial growth. Surging from $400 million to $1.05 billion, marking a remarkable 300% increase.

- In 2019, Xbox Cloud Gaming had 740,000 subscribers. By the second quarter of 2020, the service had experienced a substantial surge, reaching 2 million subscribers.

- This marked a remarkable 91% increase when compared to Google Stadia Pro.

- Moving forward to the fourth quarter of 2020, Xbox Cloud Gaming’s subscriber numbers expanded to 4.4 million. Surpassing the combined subscriber count of Google Stadia Pro, Facebook Gaming, and Amazon Luna by 87%.

- In the second quarter of 2021, the service continued its upward trajectory, amassing 7.5 million subscribers, surpassing the combined total of Google Stadia Pro, Facebook Gaming, and Amazon Luna by 68%.

- By the conclusion of 2021, Xbox Cloud Gaming proudly announced 13.2 million subscribers, signifying a notable 55% lead over the combined subscriber count of Google Stadia, Facebook Gaming, and Amazon Luna.

(Source: Statista, Game World Observer)

Cloud Gaming Users Statistics

Number of Users and Penetration Rate

- The adoption of cloud gaming has witnessed remarkable growth over the years, reflecting a substantial increase in users and the penetration rate.

- In 2017, there were 37 million cloud gaming users, constituting a 0.5% penetration rate.

- The subsequent years saw a gradual yet steady rise, with 2018 recording 39.4 million users and maintaining the 0.5% penetration rate.

- By 2019, the user base had expanded to 45.9 million, elevating the penetration rate to 0.6%.

- However, the real surge occurred in 2020, when cloud gaming users skyrocketed to 62.5 million, reaching a 0.8% penetration rate.

- This growth trend intensified in 2021, with a significant leap to 102.6 million users, equating to a 1.4% penetration rate.

- In the subsequent years, they demonstrated even more substantial growth, with 2022 boasting 182.3 million users and a 2.4% penetration rate, followed by 295 million users in 2023, reflecting a 3.8% penetration rate.

- Looking ahead, the cloud gaming user base is projected to continue expanding, reaching 395.9 million users in 2024, 455.4 million in 2025, and culminating at 493 million users by 2027, signifying a steady ascent in the adoption of cloud gaming.

(Source: Statista)

Cloud Gaming Statistics by Average Revenue Per User

- The average revenue per user in the cloud gaming sector has seen fluctuating trends, reflecting both growth and occasional dips.

- In 2017, the average revenue per user stood at $12.95.

- This figure increased gradually, reaching $14.71 in 2018 and further escalating to $16.6 in 2019.

- However, in 2020, there was a slight drop as it settled at $17.38.

- The following year, 2021, saw a dip to $16.23.

- The trend shifted in 2022, decreasing to $14.64, followed by relatively stable figures in 2023 at $14.7.

- Notably, from 2024 onwards, the average revenue per user displayed a substantial upswing. Climbing to $17.46 in 2024, $22.97 in 2025, $30.35 in 2026, and ultimately reaching $37.95 in 2027.

- These fluctuations and the significant increase in later years illustrate the cloud gaming market’s evolving dynamics and growing potential.

(Source: Statista)

Cloud Gaming Statistics by Regional Variations

Americas

- Cloud gaming user penetration rates vary across different countries in the Americas.

- Canada leads the region with a robust penetration rate of 15%, indicating a significant portion of the population actively engaging in cloud gaming.

- In the United States, cloud gaming has also made considerable strides, with a penetration rate of 10.1%.

- Meanwhile, the penetration rate in Mexico stands at 4.2%, demonstrating a notable but somewhat lower adoption level.

- Further south in Brazil, cloud gaming is gradually gaining traction with a penetration rate of 1.5%.

- Argentina and Chile follow suit, with 2.4% and 3.9% penetration rates, respectively.

- These statistics collectively illustrate the varying degrees of cloud gaming adoption throughout the Americas, with Canada and the United States leading user penetration.

(Source: Statista)

Europe

- Cloud gaming user penetration rates exhibit considerable diversity across various European countries.

- Norway leads the pack with an impressive penetration rate of 22.7%, indicating a strong affinity for cloud gaming among its population.

- Finland and Ireland closely follow, boasting substantial penetration rates of 21.4% and 22.2%, respectively.

- Sweden also demonstrates a noteworthy level of adoption, with a rate of 21%.

- In the United Kingdom and France, cloud gaming is making significant inroads, with 11.6% and 9.1% penetration rates, respectively.

- Meanwhile, in several Eastern European countries such as Poland, Latvia, Romania, Russia, and Ukraine, the penetration rates are more modest, ranging from 0.9% to 4%.

- Portugal and Spain, in the Iberian Peninsula, share a penetration rate of 7.9%.

- These disparities highlight the varying degrees of cloud gaming adoption across Europe, with some nations at the forefront of this evolving gaming landscape while others are gradually catching up.

(Source: Statista)

Asia-Pacific, Middle-East & Oceania

- Cloud gaming user penetration rates exhibit notable diversity across several countries in Asia, the Middle East, and Oceania.

- Japan leads the region with a substantial penetration rate of 11.6%, followed closely by China with 9.9%, showcasing significant interest and adoption of cloud gaming.

- In Australia, cloud gaming has gained substantial traction with an impressive penetration rate of 18%.

- In contrast, India’s penetration rate is 1.2%, indicating relatively limited adoption.

- Saudi Arabia and Morocco display moderate penetration rates of 2.6% and 2.5%, respectively.

- These statistics underscore the varying degrees of cloud gaming adoption in this diverse geographic region, with some countries emerging as strong proponents of the technology while others are in the early stages of exploration and adoption.

(Source: Statista)

Cloud Gaming Statistics by User Satisfaction

- According to a survey conducted in April 2021 among gamers in the United States, various gaming services garnered varying user satisfaction levels.

- PlayStation Network (PSN) and Xbox Live both earned high satisfaction rates, with 46% of users expressing they were “Very Satisfied” and an additional 26% stating they were “Somewhat Satisfied.”

- Steam, a popular gaming platform, also fared well, with 43% “Very Satisfied” and 33% “Somewhat Satisfied.”

- Discord, known for its gaming and communication features, had a similar satisfaction profile with 46% “Very Satisfied” and 30% “Somewhat Satisfied.”

- Amazon Luna and Google Stadia, cloud gaming services, achieved notably high satisfaction levels, with 69% and 58% “Very Satisfied,” respectively.

- Apple Arcade, a mobile gaming subscription, also received positive feedback, with 55% being “Delighted.” Roblox, a user-generated game platform, had 47% “Very Satisfied.”

- In contrast, Slack, a communication tool, had lower satisfaction rates, with only 38% being “Very satisfied.”

- Finally, Battle.net, Blizzard’s gaming platform, was well-received, with 57% being “Very satisfied.”

- These findings illustrate the varying degrees of satisfaction among users of different gaming services, reflecting the diverse preferences and experiences within the gaming community in the United States.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- Microsoft acquires ZeniMax Media: In early 2023, Microsoft completed its $7.5 billion acquisition of ZeniMax Media, the parent company of Bethesda Softworks. This acquisition aims to bolster Microsoft’s Xbox Game Pass library with a wealth of new titles, enhancing its cloud gaming service, Xbox Cloud Gaming.

- Nvidia acquires CiiNow: Nvidia acquired CiiNow, a cloud gaming technology company, for $300 million in late 2023. This merger is expected to strengthen Nvidia’s GeForce NOW cloud gaming platform by integrating CiiNow’s advanced streaming technology.

New Product Launches:

- Amazon Luna: Amazon launched Luna, its cloud gaming service, in mid-2023. Luna offers a variety of game channels that users can subscribe to, including Ubisoft+ and the Luna+ channel, providing a wide range of games that can be played on multiple devices.

- Google Stadia Pro Expansion: In early 2024, Google expanded its Stadia Pro service, offering more exclusive titles, enhanced 4K streaming, and additional features aimed at improving the overall gaming experience for subscribers.

Funding:

- Boosteroid secures $150 million: Boosteroid, a cloud gaming service provider, raised $150 million in a funding round in 2023 to expand its data centers globally and enhance its platform’s performance and game library.

- Shadow raises $100 million: In early 2024, Shadow, a cloud gaming and PC virtualization company, secured $100 million to develop its technology further and expand its user base, focusing on making high-performance gaming accessible to more users.

Technological Advancements:

- 5G Integration in Cloud Gaming: The rollout of 5G networks is significantly enhancing cloud gaming experiences by reducing latency and improving data transfer speeds, enabling smoother gameplay and higher-quality streaming on mobile devices.

- AI-Powered Optimization: Advances in AI are being used to optimize cloud gaming platforms, improving game streaming quality, reducing latency, and enhancing the user experience through dynamic resolution scaling and adaptive bitrate streaming.

Market Dynamics:

- Growth in Cloud Gaming Market: The global cloud gaming market is projected to grow at a CAGR of 29.5% from 2023 to 2028, driven by increasing adoption of high-speed internet, rising popularity of gaming, and advancements in cloud technology.

- Increased Adoption in Emerging Markets: Cloud gaming is seeing significant adoption in emerging markets due to the lower barrier to entry, allowing users to play high-quality games without the need for expensive hardware.

Regulatory and Strategic Developments:

- EU Digital Strategy for Cloud Gaming: The European Union’s digital strategy includes initiatives to support the growth of cloud gaming, focusing on infrastructure development and regulatory frameworks to ensure fair competition and consumer protection.

- US Regulatory Approvals: In early 2024, the US Federal Trade Commission (FTC) approved several mergers and acquisitions in the cloud gaming sector, promoting innovation while ensuring that market competition remains robust.

Research and Development:

- Improved Game Streaming Algorithms: R&D efforts are focusing on developing improved game streaming algorithms that can deliver high-quality visuals and responsive gameplay even under varying network conditions.

- Cross-Platform Gaming Enhancements: Researchers are working on enhancing cross-platform gaming capabilities, allowing seamless gameplay experiences across different devices and operating systems, which is crucial for the growth of cloud gaming.

Conclusion

Cloud Gaming Statistics – The cloud gaming industry has experienced remarkable growth, with soaring revenues and diverse user demographics.

Technological advancements have reduced latency, enhancing the gaming experience, while various monetization models. Including subscriptions and in-game purchases, have contributed to revenue growth.

However, challenges like data security and bandwidth requirements persist. Cloud gaming is reshaping the industry, prompting traditional players to adapt their business models. Making high-quality gaming more accessible and fostering collaborations.

As the industry continues to evolve, it is clear that cloud gaming is not a passing trend but a transformative force with the potential to redefine how we access and experience video games.

FAQs

Major players in the cloud gaming industry include Google Stadia, NVIDIA GeForce NOW, Microsoft’s Xbox Cloud Gaming (formerly Project xCloud), Sony’s PlayStation Now, and other regional platforms and startups.

Game latency refers to the delay between a player’s input and the corresponding action happening in the game. In cloud gaming, latency can be a concern because player inputs must travel to remote servers and back. Lower latency is essential for a smoother gaming experience.

A stable and high-speed internet connection is crucial for cloud gaming. The exact requirements can vary depending on the platform, but a minimum of 10-20 Mbps is recommended for 720p streaming and higher speeds for 1080p or 4K gaming.

Cloud gaming is poised to play a significant role in the future of gaming, but it may coexist with traditional gaming for a long time. Its accessibility and potential to reach a broader audience make it an essential part of the evolution of the gaming industry.

Challenges include potential issues with latency, data privacy concerns, bandwidth requirements, and the need for robust internet infrastructure. Additionally, not all games are available on cloud platforms, and the quality of service can vary depending on your location.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)