Table of Contents

- Introduction

- Editor’s Choice

- Global Collaboration Software Market Overview

- Usage of Digital Workplace Technologies Among Workers Worldwide – By Category

- Popular Business Intelligence Software

- Major Office Productivity Software

- Top Video Conferencing Software

- Adoption of Collaboration Software Solutions

- Benefits of Collaboration Software Solutions

- Challenges in the Adoption of Collaboration Software Solutions

Introduction

According to Collaboration Software Statistics, Collaboration software is vital for enhancing communication, teamwork, and project management in organizations. It features real-time messaging, video calls, task management, and document-sharing capabilities.

The main advantages include boosting productivity by minimizing emails and meetings, fostering clearer communication, and accommodating remote work. However, it faces challenges like adoption resistance, information overload, and security concerns.

Looking ahead, trends like artificial intelligence for task automation, virtual reality for more engaging interactions, and blockchain for security promise to innovate and improve collaboration tools, making teamwork more efficient in the evolving digital environment.

Editor’s Choice

- The global collaboration software market revenue reached $6.56 billion in 2023.

- The trend of deceleration of the collaboration software market continued in 2023 and 2024, with growth rates tapering to 3.87% and 3.11%, respectively.

- In the competitive landscape of the collaboration software market, Microsoft leads with a commanding 38% market share, reflecting its dominant position.

- The United States leads by a wide margin, generating $7,611 million, which underscores its dominant position in this sector.

- Collaboration tools experienced a notable increase in adoption, with the share of respondents using them rising from 55% in 2019 to 79% in 2021, underscoring the growing importance of teamwork and communication in remote settings.

- Microsoft’s Office Productivity and Business Process segment leads the office productivity software landscape with a substantial revenue of $14.7 billion.

- In 2021, a significant 79% of workers globally utilized digital collaboration tools.

Global Collaboration Software Market Overview

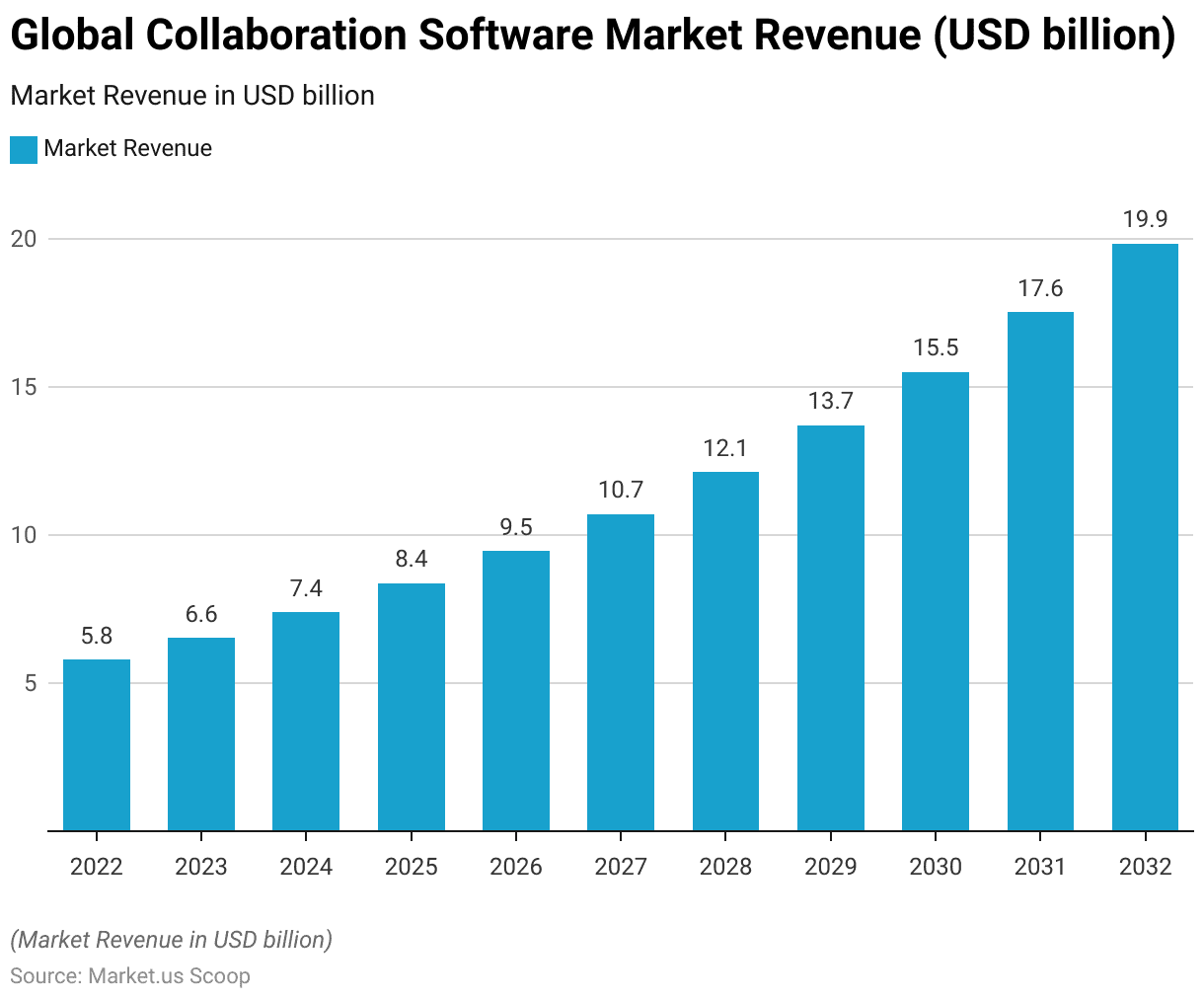

Global Collaboration Software Market Size

- The global collaboration software market has been on a trajectory of steady growth at a CAGR of 13.1%, as evidenced by its revenue figures.

- In 2022, the market was valued at $5.80 billion. By 2023, it experienced growth, reaching $6.56 billion, and continued to rise to $7.42 billion in 2024.

- The upward trend persisted through the years, with market revenues hitting $8.39 billion in 2025, $9.49 billion in 2026, and further climbing to $10.73 billion in 2027.

- Entering the next decade, the market continued to expand, with revenues reaching $15.53 billion in 2030, escalating to $17.56 billion by 2031, and finally, achieving a notable $19.86 billion in 2032.

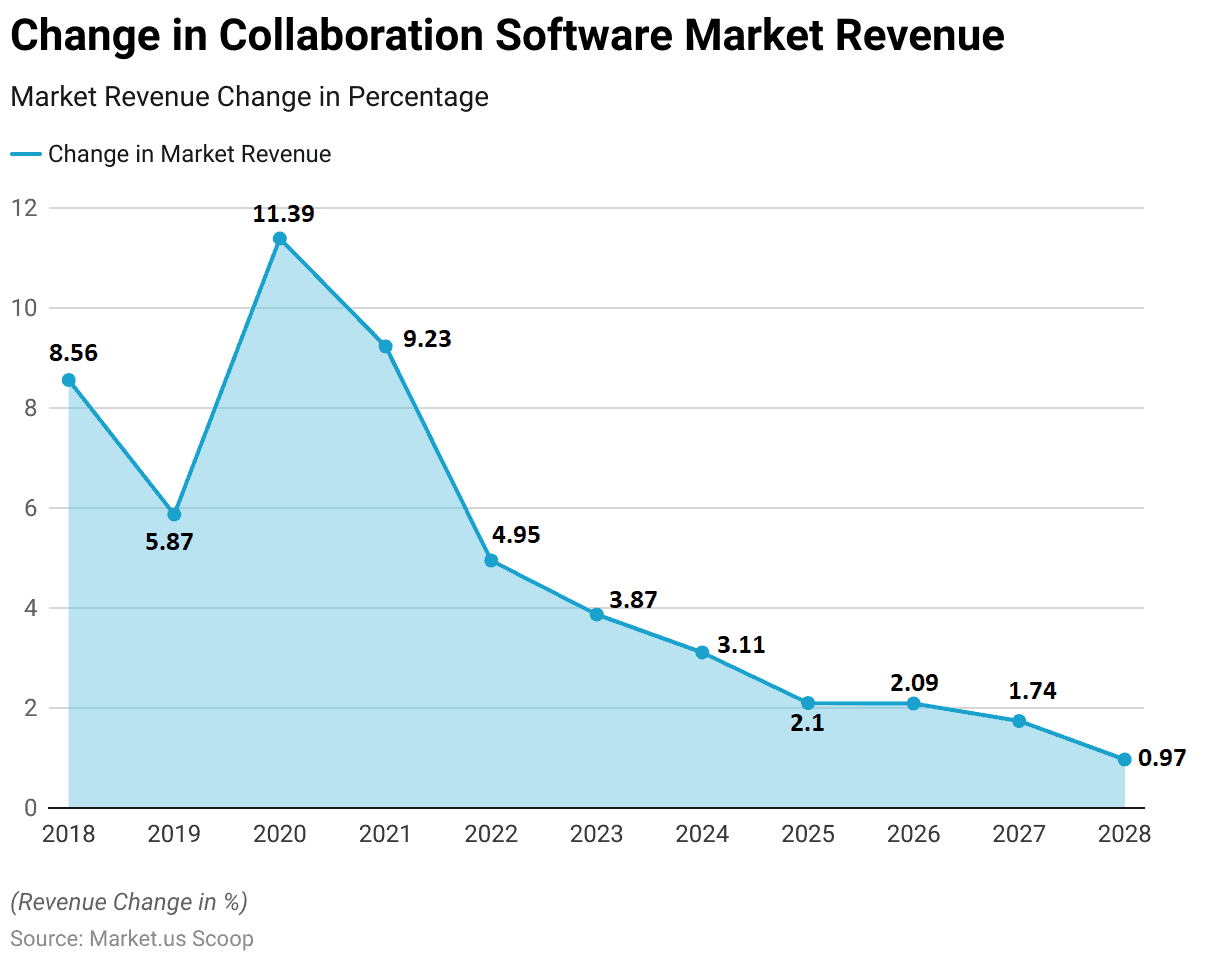

Change in the Collaboration Software Market Revenue

- Over the years, the collaboration software market has seen fluctuating growth rates in its revenue.

- Starting in 2018, the market expanded by 8.56%, reflecting a robust increase.

- This growth slightly decelerated in 2019, with a 5.87% rise, before surging to an 11.39% increase in 2020, likely driven by the global shift towards remote work amid the pandemic.

- In 2021, the growth moderated to 9.23%, followed by a further slowdown to 4.95% in 2022. The trend of deceleration continued into 2023 and 2024, with growth rates tapering to 3.87% and 3.11%, respectively.

- In 2028, the growth slowed significantly to just 0.97%, suggesting a mature market with limited expansion opportunities.

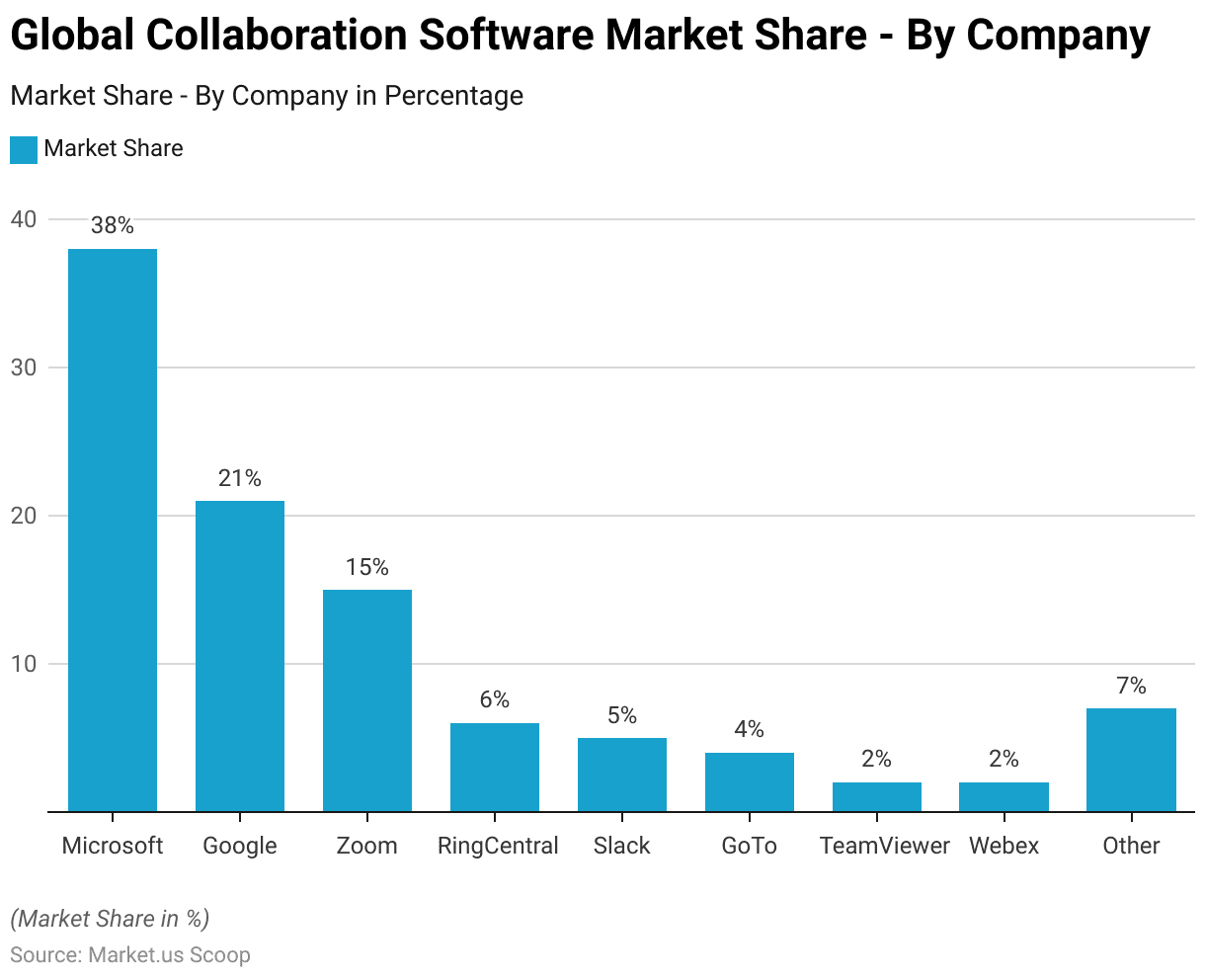

Key Brands in the Collaboration Software Market

- In the competitive landscape of the collaboration software market, Microsoft leads with a commanding 38% market share, reflecting its dominant position.

- Google follows with a significant 21% share, showcasing its substantial presence.

- Zoom captures 15% of the market, emphasizing its strong foothold in video conferencing.

- RingCentral holds a smaller portion, with 6%, while Slack trails closely with 5%, indicating its niche but impactful role.

- GoTo contributes 4% to the market share, highlighting its steady presence.

- TeamViewer and Webex each hold a modest 2%, demonstrating their specialized roles within the sector.

- The remaining 7% of the market is occupied by other players, pointing to a diverse and fragmented market landscape beyond the leading brands.

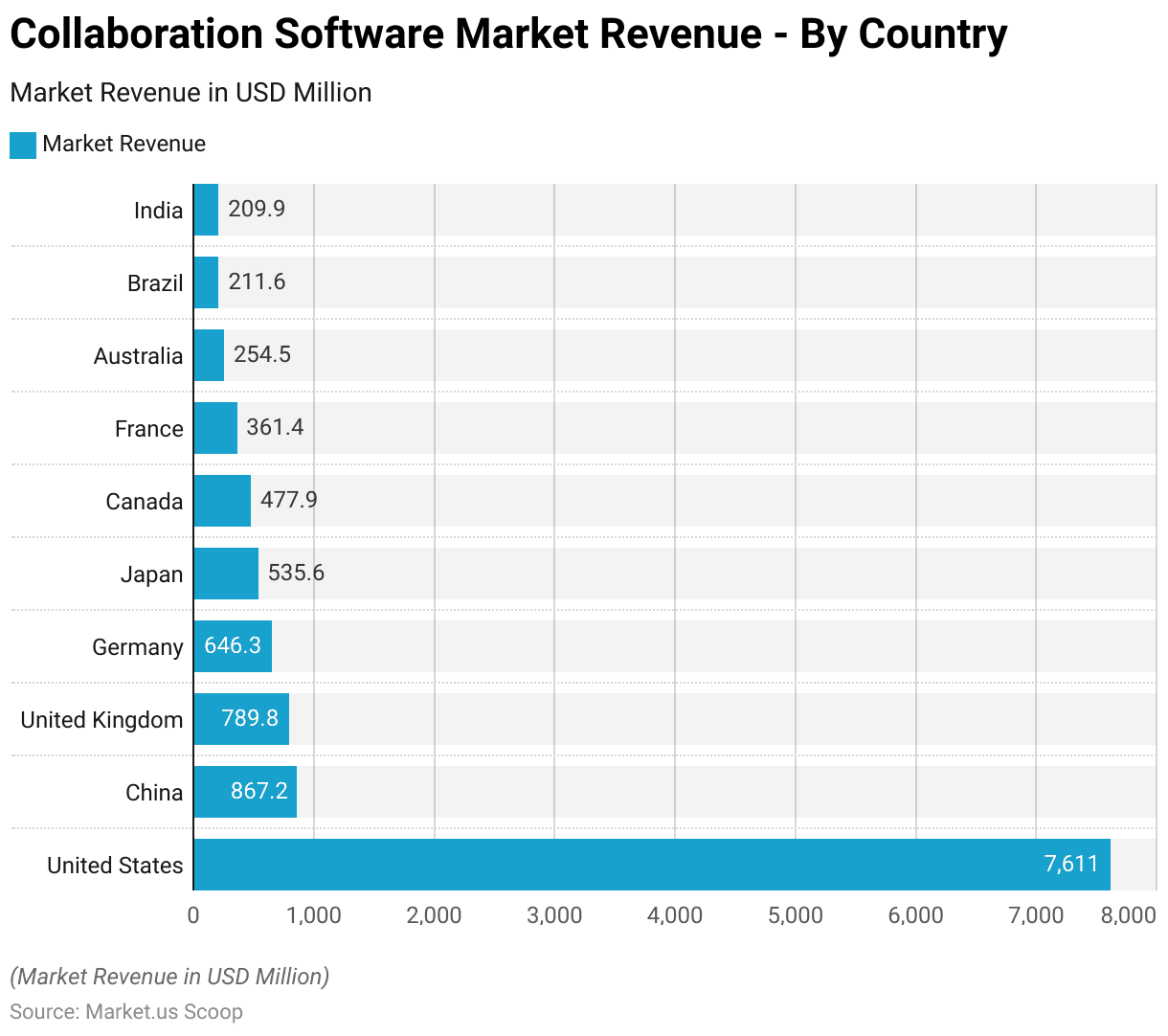

Regional Analysis of the Collaboration Software Market

- The collaboration software market exhibits significant revenue disparities across different countries.

- The United States leads by a wide margin, generating $7,611 million, which underscores its dominant position in this sector.

- China follows with a revenue of $867.2 million, reflecting its growing market. The United Kingdom also shows strong performance, with revenues reaching $789.8 million.

- Germany and Japan contribute $646.3 million and $535.6 million, respectively, highlighting their robust markets.

- Canada’s market generates $477.9 million, while France’s stands at $361.4 million, showing notable contributions to the global landscape.

- Australia and Brazil, with revenues of $254.5 million and $211.6 million, respectively, indicate the market’s expansion into diverse regions.

- India, closely trailing with a revenue of $209.9 million, reflects its emerging role in the global collaboration software space.

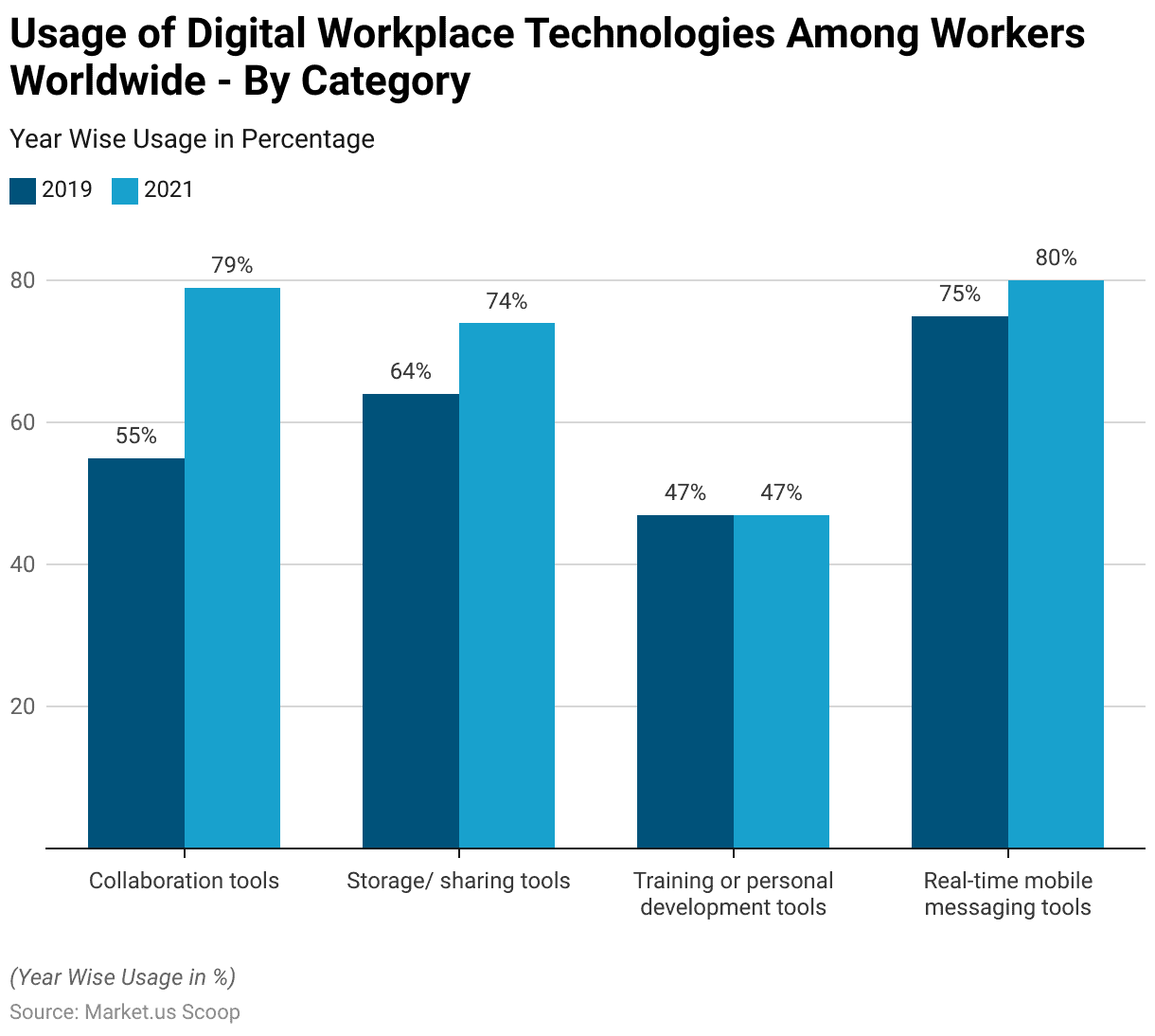

Usage of Digital Workplace Technologies Among Workers Worldwide – By Category

- Between 2019 and 2021, the usage of digital workplace technologies among workers worldwide saw significant changes across various categories, reflecting the evolving dynamics of the modern workplace.

- Collaboration tools experienced a notable increase in adoption, with the share of respondents using them rising from 55% in 2019 to 79% in 2021, underscoring the growing importance of teamwork and communication in remote settings.

- Storage and sharing tools also saw an uptick, moving from 64% to 74%, highlighting the increased need for accessible and efficient data management.

- In contrast, the utilization of training or personal development tools remained steady at 47%, indicating a stable demand for self-improvement and skill-enhancement resources.

- Real-time mobile messaging tools, essential for instant communication, slightly grew in popularity, with their usage moving from 75% to 80%.

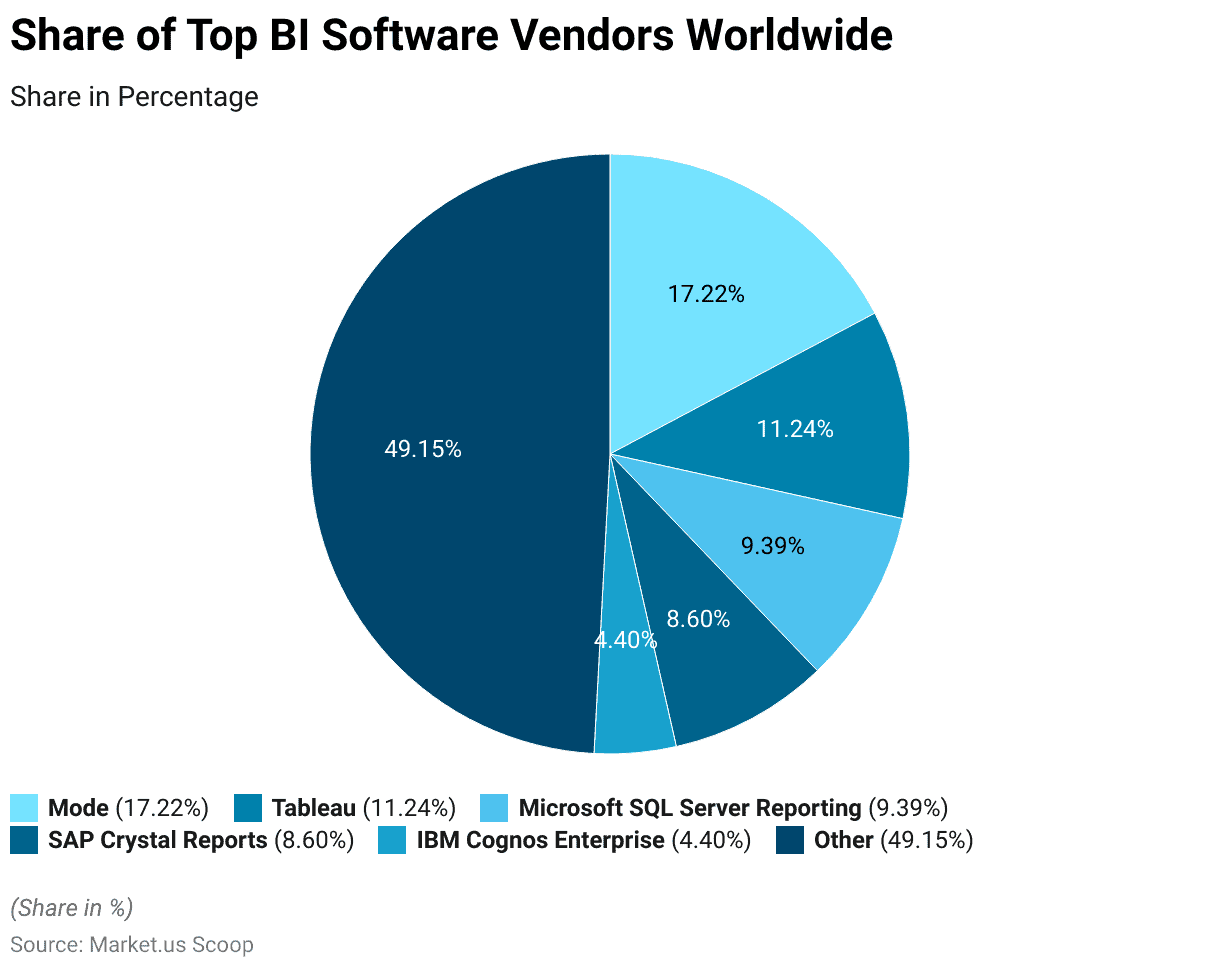

Popular Business Intelligence Software

- In the global Business Intelligence (BI) software market, the distribution of market share among the top BI software vendors showcases a diverse competitive landscape.

- Mode leads the pack with a significant 17.22% share, indicating its prominent position in the industry.

- Following Mode, Tableau holds an 11.24% market share, reflecting its strong presence and the widespread adoption of its visualization tools.

- Microsoft SQL Server Reporting Services captures 9.39% of the market, demonstrating Microsoft’s influence in the BI space.

- SAP Crystal Reports, another key player, accounts for 8.60% of the market, showcasing its role in reporting and analytics.

- IBM Cognos Enterprise holds a smaller portion of the market at 4.40%, indicating its niche but stable position.

- The remaining 49.15% of the market is occupied by ‘Other’ vendors, highlighting the fragmentation of the BI software market and the existence of numerous smaller players that cater to specific needs and segments.

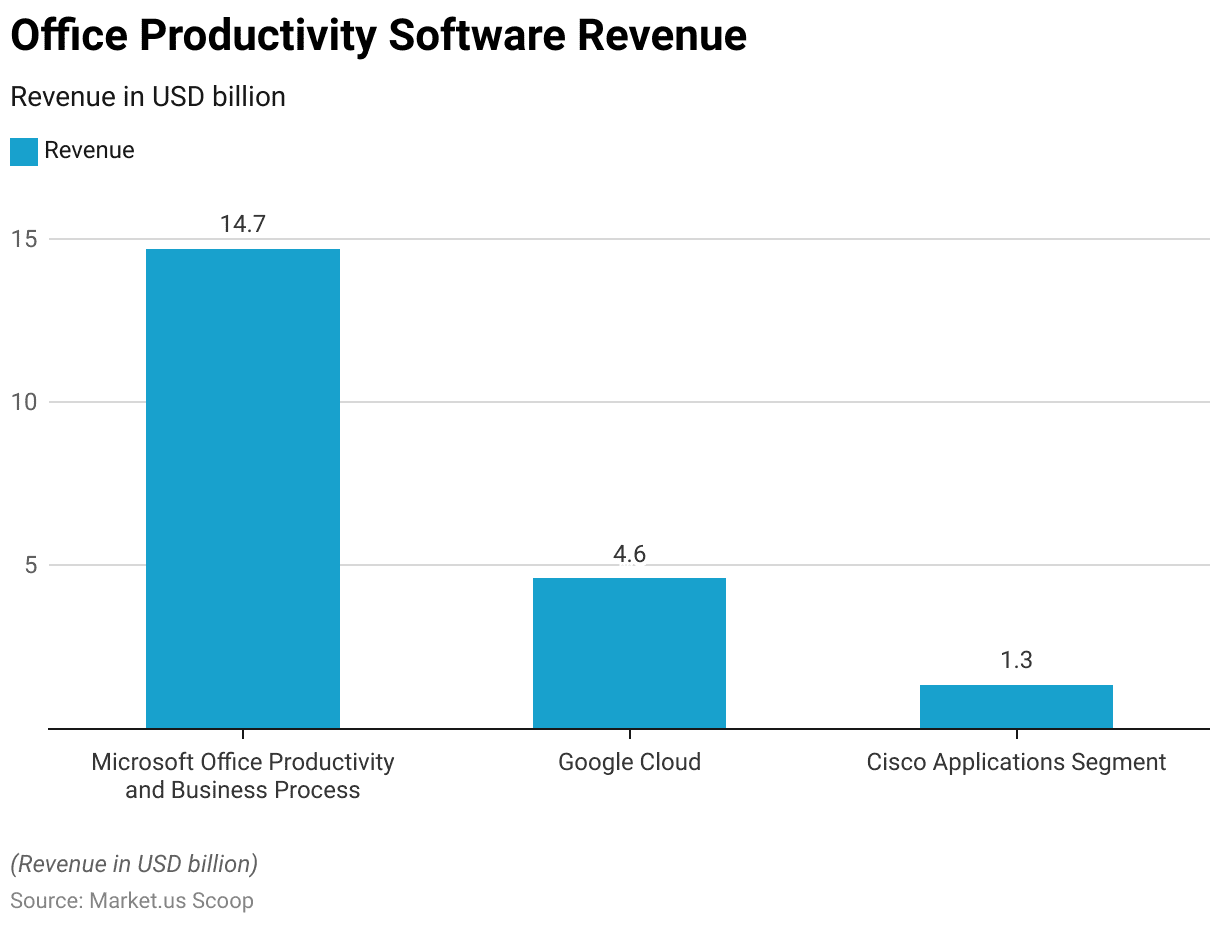

Major Office Productivity Software

- The landscape of major office productivity software is defined by significant revenue streams that reflect the market share and dominance of leading tech companies.

- Microsoft’s Office Productivity and Business Process segment leads with a substantial revenue of $14.7 billion.

- Google Cloud follows with a revenue of $4.6 billion, indicating its strong presence in the market with cloud-based productivity tools that foster collaboration and efficiency.

- Cisco’s Applications Segment, contributing $1.34 billion in revenue, also plays a crucial role by offering a suite of collaboration tools that enhance communication and productivity in businesses.

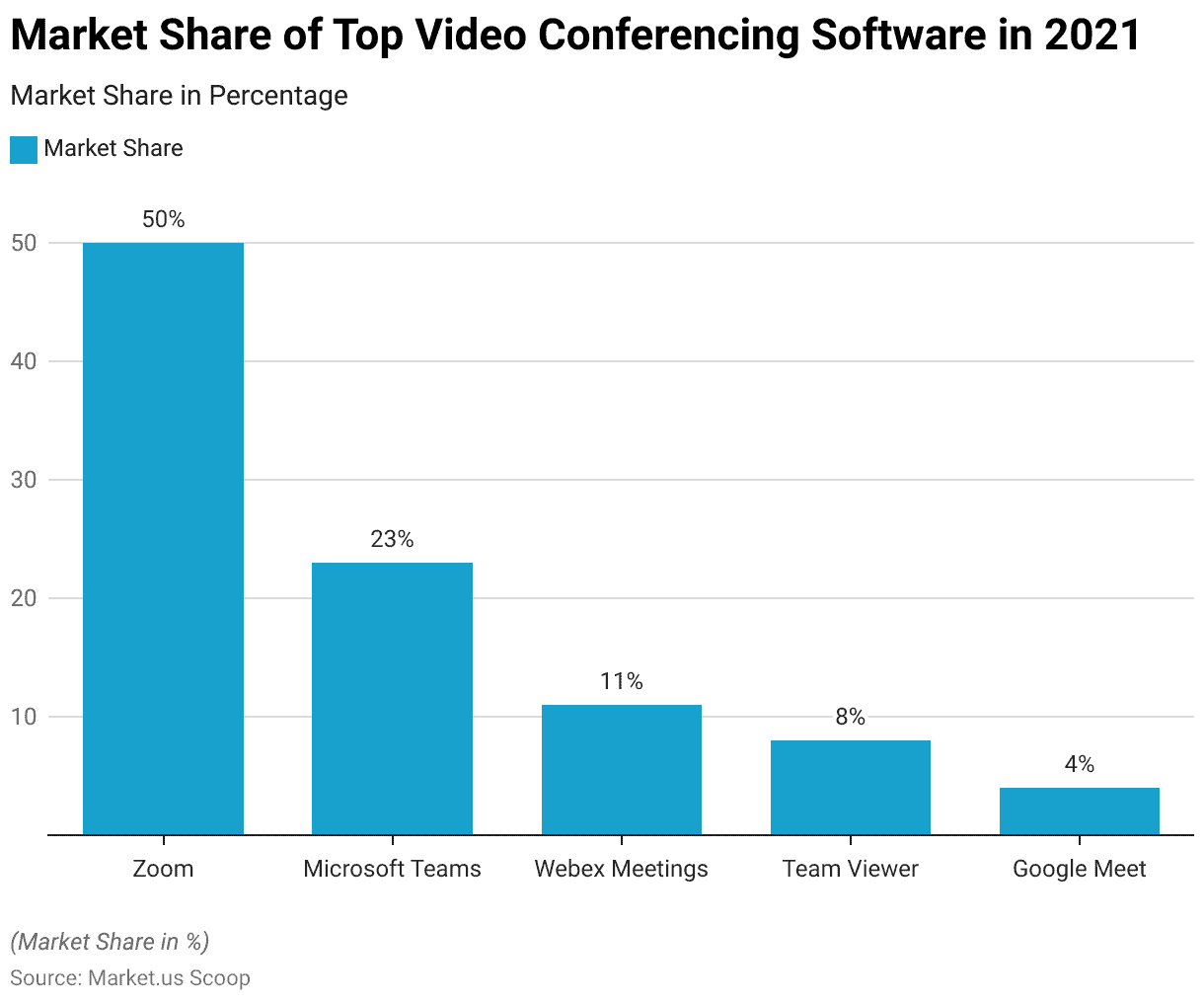

Top Video Conferencing Software

- In 2021, the video conferencing software market was predominantly led by Zoom, capturing a significant 50% market share, highlighting its dominance and widespread adoption for virtual meetings.

- Microsoft Teams followed as a strong contender, securing 23% of the market, reflecting its integration within the corporate and educational sectors.

- Webex Meetings held an 11% share, indicating its steady presence in the professional video conferencing space.

- Team Viewer, known for its remote control and support features alongside video conferencing, accounted for 8% of the market.

- Google Meet, part of the Google Workspace suite, maintained a 4% share, showcasing its role in facilitating online meetings and collaborations.

Adoption of Collaboration Software Solutions

- In 2021, a significant 79% of workers globally utilized digital collaboration tools.

- An overwhelming 99% of individuals working remotely reported using, on average, 4.8 different conferencing apps.

- There was a dramatic surge in the adoption of online collaboration platforms, witnessing a 322% increase from May 2019 to May 2020.

- 90% of Microsoft Teams users prefer to use the platform solely on their desktop devices.

- Meanwhile, 70% of the usage for Zoom on mobile devices is attributed to users who exclusively use the app on mobile.

- In the United States, individuals dedicated a total of 6 billion minutes to utilizing collaboration tools in May 2020.

Benefits of Collaboration Software Solutions

- A majority of teleworkers, 65%, view video conferencing and instant messaging as effective alternatives to face-to-face interactions.

- Approximately 40% of employees believe their jobs can be primarily conducted from home.

- A significant 73% of the workforce favors the continuation of flexible remote work options due to the flexibility they provide.

- In line with this trend, 63% of organizations experiencing growth have adopted “productivity-anywhere” models facilitated by online collaboration tools.

- Additionally, 70% of technology entrepreneurs have observed that remote work has either maintained or enhanced productivity levels.

Challenges in the Adoption of Collaboration Software Solutions

- 58% of enterprises identify risk assessment as the primary security and compliance function necessary for managing communications effectively.

- Meanwhile, 64% of organizations regularly encounter challenges when attempting to integrate technologies and applications from various collaboration vendors.

- Based on productivity signals from Microsoft 365, 54% of remote workers report feeling overworked, and 39% describe feeling exhausted.

- Between July and September 2021, there was a surge of over 200% in the utilization of AI capabilities, indicating a demand for enhanced engagement in meetings.

- Additionally, 98% of employees express regular dissatisfaction with video meetings conducted from home.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)