Table of Contents

Introduction

According to Commercial Drones Statistics, Commercial drones, unmanned aerial vehicles (UAVs), or remotely piloted aircraft systems (RPAS) have rapidly become essential tools across various industries. These drones are comprised of essential components like frames, propellers, sensors, onboard computers, and communication systems. They serve diverse purposes, including agriculture, photography, construction, infrastructure inspection, search and rescue, and environmental monitoring.

The use of commercial drones is subject to regulations enforced by aviation authorities, which provide guidelines and safety measures. Market trends include technological advancements such as integrating artificial intelligence and swarming technology. Looking ahead, the future promises even wider adoption of drones in everyday operations, offering cost-effective and efficient solutions for industry-specific challenges.

Editor’s Choice

- The global drone market is experiencing remarkable growth, with revenues steadily increasing yearly at a compound annual growth rate (CAGR) of 12.7%.

- In 2022, the market generated a revenue of USD 30.6 billion, and this figure is expected to soar to USD 34.5 billion in 2023

- By 2026, the commercial drone market is anticipated to yield 35.37 billion USD, with this ascent continuing into 2027, where revenues are forecasted to reach 38.20 billion USD.

- As of 2023, DJI is dominant, with over 70% of the global drone market share. This is due to their excellence in aerial photography and videography gear.

- In May 2019, Parrot achieved a significant milestone by securing a contract valued at $11 million from the U.S. military to produce reconnaissance drones.

- As reported by Statista, the agriculture industry ranks among the foremost adopters of commercial drones, constituting a substantial 26% of the overall market share.

- As reported by Statista, North America is the dominant hub for commercial drones, representing roughly 40% of the worldwide market.

- Europe ranks as the second-largest commercial drone market, holding a share of around 30%.

Market Overview

Global Drone Market Size

- The global drone market is experiencing remarkable growth, with revenues steadily increasing yearly at a compound annual growth rate (CAGR) of 12.7%.

- In 2022, the market generated a revenue of USD 30.6 billion, and this figure is expected to soar to USD 34.5 billion in 2023, reflecting a significant upswing.

- As we look further ahead, the drone market is poised to break new records, with projections of USD 79.6 billion in 2030, USD 89.8 billion in 2031, and an impressive USD 101.1 billion in 2032.

Global Commercial Drone Market Size

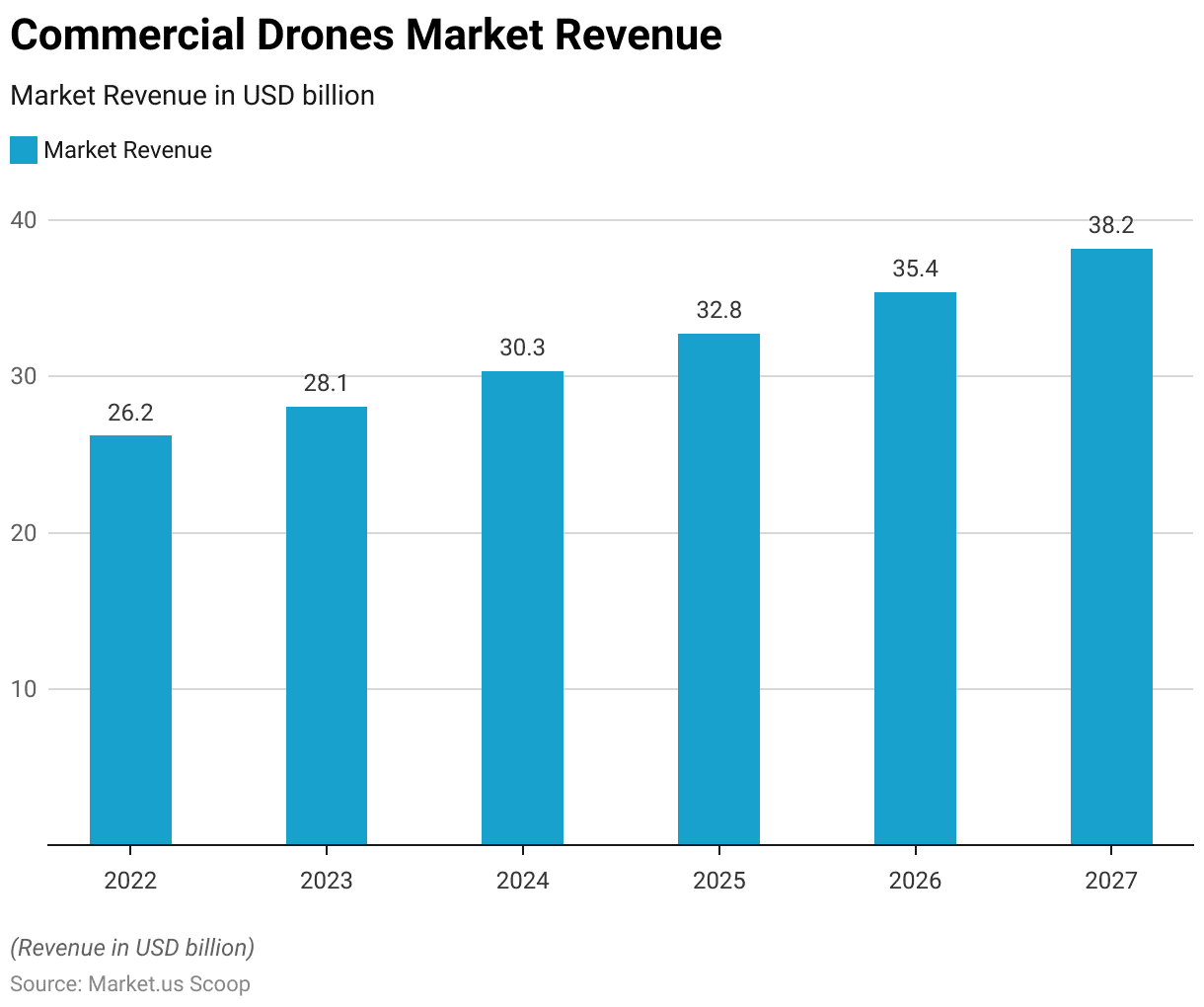

- The commercial drone market has grown impressive in recent years at a CAGR of 7.9%.

- In 2022, it reached a notable 26.20 billion USD, marking the beginning of this upward trajectory.

- As we progress into 2026, the commercial drone market is anticipated to yield 35.37 billion USD, with this ascent continuing into 2027, where revenues are forecasted to reach 38.20 billion USD.

Key Players in the Commercial Drones Industry

DJI (Dà-Jiāng Innovations Science and Technology Co., Ltd.)

- DJI is a Chinese technology company and one of the most recognizable names in the drone industry. It is a relatively young company, just 16 years old as of 2023.

- It was founded in 2006 by Frank Wang while he was still in college.

- In 2009, DJI made a name for itself by flying a drone prototype to the peak of Mount Everest. This daring feat helped them gain widespread attention.

- DJI’s Phantom 3, released in 2015 with live streaming capabilities, skyrocketed the company’s sales and reputation, making DJI the world’s top drone brand.

- As of 2023, DJI is dominant, with over 70% of the global drone market share. This is due to their excellence in aerial photography and videography gear.

- Additionally, DJI’s drone sales are expected to grow, reaching an estimated $55 billion by 2030, thanks to their wide range of applications across various industries.

Parrot

- Parrot SA, a French corporation headquartered in Paris, France, was founded in 1994 by a team composed of Jean-Pierre Talvard, Christine/M De Tourvel, and Henri Seydoux.

- Beginning in 2017, Parrot redirected its primary focus exclusively toward manufacturing drones.

- In 2014, Parrot gained notable recognition by introducing the mini-drones Jumping Sumo and Rolling Spider at the prestigious CES event in Las Vegas.

- During this same timeframe, Parrot also expanded its ownership share in Pix4D to reach 57%.

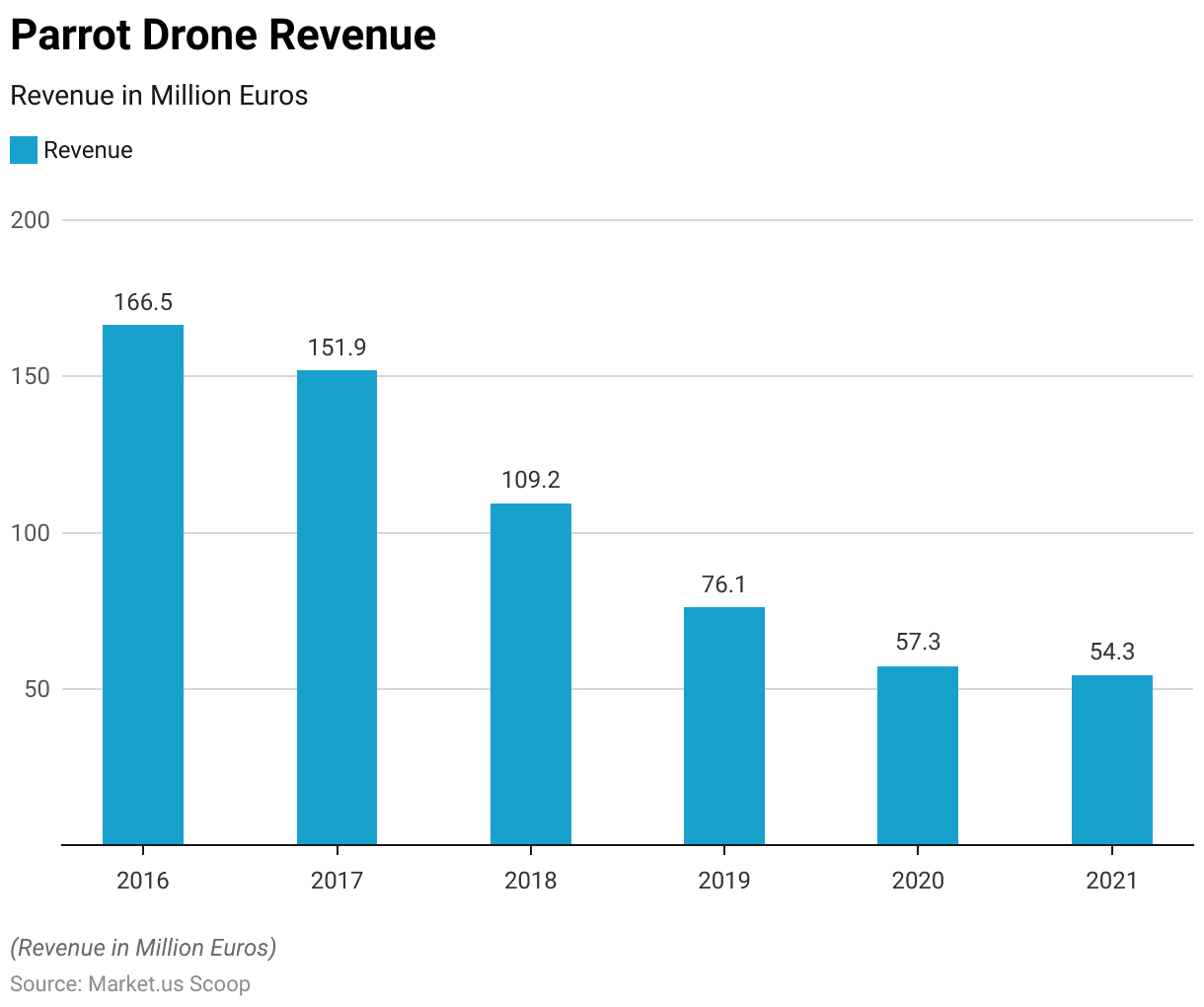

- In 2016, the company generated a substantial revenue of 166.5 million euros, reflecting a robust performance.

- However, in the subsequent years, Parrot faced revenue declines, with 2017 decreasing to 151.9 million euros, followed by a further drop to 109.2 million euros in 2018.

- The declining revenue trend continued into 2021 when the company’s revenue decreased to 54.3 million euros.

Yuneec International

- Yuneec International is a Chinese aircraft manufacturer founded in 1999 in Hong Kong and is a leader in electronic aviation.

- The company’s commercial drones include the H520, used for aerial inspection and mapping, and the Typhoon H Plus, used for aerial photography and videography. Yuneec has a strong presence in the European market and is expanding globally.

- In 2003, the company expanded globally and opened offices in Hong Kong, Shanghai, Los Angeles, and Hamburg.

- In 2010, Yuneec won the Lindbergh Electric Aircraft Prize for its two-seater electric aircraft.

- In 2013, the company’s single-seat electric aircraft, the E-Spyder, was certified as an electric aircraft.

Autel Robotics

- Autel Robotics is a Chinese drone manufacturer that produces drones for commercial use.

- The company was established in 2014.

- The company’s commercial drones include the EVO II, used for aerial photography and videography, and the Dragonfish, used for search and rescue missions.

- Autel has generated a revenue of $16 million in 2022.

- Autel Robotics is known for its high-quality drones and is gaining popularity in the commercial drone market.

Skydio

- Skydio, an American drone manufacturer headquartered in San Mateo, California, was established in 2014 by three individuals who had completed their studies at the Massachusetts Institute of Technology: Adam Bry, Abe Bachrach, and Matt Donahoe.

- In 2018, the company marked its foray into the consumer market with the launch of the Skydio R1, a drone priced at $2,500.

- A significant milestone for Skydio came in March 2021 when the company achieved unicorn status, signifying its valuation surpassing $1 billion, a first for a U.S. drone manufacturer.

Commercial Drones by Industry

Agriculture

- As reported by Statista, the agriculture industry ranks among the foremost adopters of commercial drones, constituting a substantial 26% of the overall market share.

- Projections from DroneSourced indicate that the global market for agricultural drones is poised for significant growth, with an anticipated size reaching $864.4 million by 2022.

Construction

- The construction sector has experienced notable growth in the adoption of commercial drones.

- Projections from Statista indicate that by 2025, the construction industry is forecasted to represent 12% of the total market share for commercial drones.

- Furthermore, DroneSourced estimates the global market size for construction drones to reach $11.96 billion by 2025, underscoring the industry’s increasing reliance on drone technology.

Delivery and Logistics

- Delivery and logistics enterprises have embraced commercial drones to expedite and enhance package deliveries.

- As per Statista projections, by 2025, the delivery and logistics sector is anticipated to comprise 7% of the overall market share for commercial drones.

- Furthermore, DroneSourced predicts that the global market for delivery drones is set to achieve a value of $11.2 billion by 2022.

Real Estate and Surveying

- The real estate and surveying sectors have experienced a growing adoption of commercial drones to enhance their operations.

- According to Statista’s projections, the real estate industry is poised to represent 5% of the overall market share for commercial drones by 2025.

- Additionally, DroneSourced forecasts that the global market for real estate drones is expected to achieve a value of $4.2 billion by 2025.

Emergency Services

- Emergency services have embraced the utility of commercial drones in their operations, particularly in search and rescue missions, disaster response, and firefighting efforts.

- According to Statista’s projections, the emergency services sector is set to make up a noteworthy 4% of the overall market share for commercial drones by 2025.

- Furthermore, DroneSourced anticipates significant growth in the global market size for emergency services drones, forecasting it to reach an impressive $1.8 billion by the same year.

Commercial Drones Statistics by Region

North America

- As reported by Statista, North America is the dominant hub for commercial drones, representing roughly 40% of the worldwide market.

- The United States takes the lead within this region with an impressive market share exceeding 85%.

- Notably, the commercial drone sector in North America is poised for substantial growth, with an anticipated compound annual growth rate (CAGR) of 19.5% from 2021 to 2028.

Europe

- Europe ranks as the second-largest commercial drone market, holding a share of around 30%.

- This market’s momentum is chiefly fueled by the growing integration of drones in sectors like agriculture, construction, and infrastructure.

- As per DroneSourced’s insights, it is projected that the count of commercial drones in Europe will reach 1.2 million by 2025, demonstrating a robust compound annual growth rate (CAGR) of 25.6%.

Asia-Pacific

- The Asia-Pacific area is witnessing the most rapid expansion in the commercial drone market, experiencing a noteworthy compound annual growth rate (CAGR) of 28.4% from 2021 to 2028, as per Statista.

- Notably, China is the largest market within this region, commanding a market share exceeding 60%.

Latin America

- In Latin America, the market for commercial drones is on an upward trajectory, demonstrating a significant compound annual growth rate (CAGR) of 21.7% between 2021 and 2028, as reported by Statista.

- Notably, Brazil leads the way as the largest market within the region, commanding more than half of the market share.

Middle East and Africa

- In the Middle East and Africa, the commercial drone market is on an upward trajectory, displaying a significant compound annual growth rate (CAGR) of 23.1% between 2021 and 2028, as noted by Statista.

- Notably, the United Arab Emirates is the largest market within this region, representing more than 40% of the market share.

- On a global scale, the commercial drone market is anticipated to exhibit robust growth, with an overall CAGR of 23.8% from 2021 to 2028, as per Statista’s projections.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)