Table of Contents

Connected Living Room Market Size

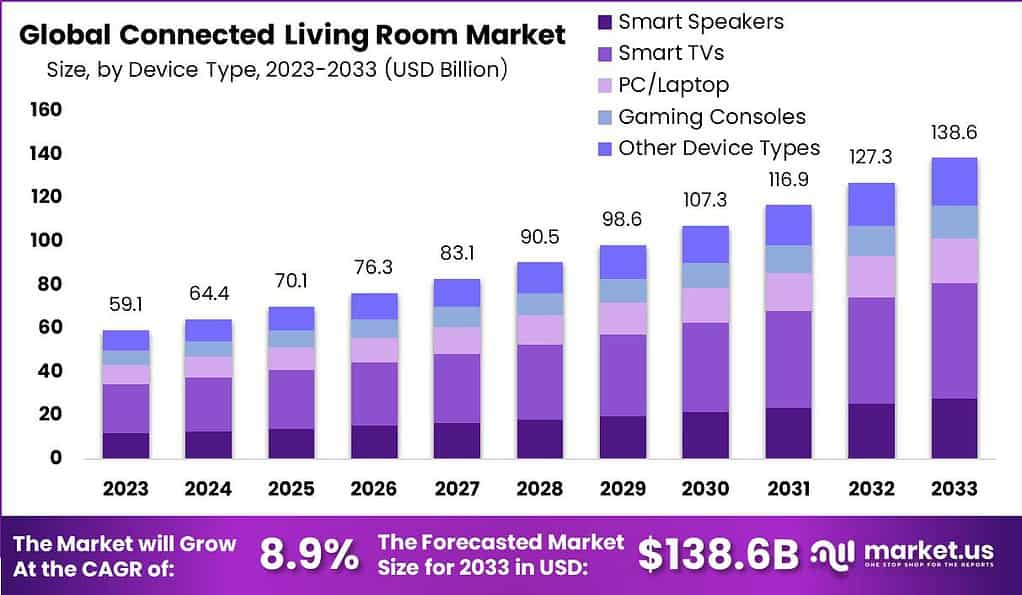

The global Connected Living Room market was valued at USD 59.1 billion in 2023 and is expected to expand steadily over the forecast period. The market is projected to reach approximately USD 138.6 billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033. This growth is driven by rising adoption of smart TVs, connected audio systems, and integrated home entertainment platforms. Increasing consumer preference for seamless and immersive digital experiences is further supporting market expansion.

Market Overview

The connected living rooms market refers to the ecosystem of hardware, software, and services that enable seamless connectivity and intelligent experiences in residential living spaces. This includes smart TVs, streaming devices, voice assistants, gaming consoles, media servers, smart lighting, IoT sensors, and integrated entertainment platforms that work together to deliver personalized content, home automation, and immersive interaction. Connected living room solutions support content discovery, device interoperability, home networking, and synchronized media experiences. Adoption spans households seeking enhanced convenience, entertainment, and lifestyle integration.

Market growth has been shaped by rising consumer expectations for seamless digital experiences, proliferation of broadband connectivity, and expansion of content streaming services. Traditional living room environments have evolved from passive TV watching to interactive multimedia hubs that integrate social interaction, gaming, and smart home controls. As smart devices become central to daily living, connected living rooms deliver unified control and enriched experiences that span entertainment, comfort, and productivity.

Market Key Takeaways

- The connected living room market is expected to reach USD 138.6 billion by 2033, rising from USD 59.1 billion in 2023, expanding at a steady 8.9% growth rate. This growth is supported by rising demand for smart entertainment, voice enabled devices, and integrated home experiences.

- In 2023, smart TVs held a dominant 38.3% share, confirming their role as the central hub of connected living room ecosystems. Built in connectivity and voice assistants continued to enhance user interaction and device integration.

- The video streaming segment led with more than 66.7% share in 2023, reflecting strong consumer preference for on demand content and subscription based streaming services.

- North America maintained regional leadership with over 35.4% share in 2023, supported by high smart device penetration, strong broadband infrastructure, and early adoption of home automation technologies.

- Sales of smart TVs with voice assistants and connected features increased by about 25% in 2023, highlighting rising consumer demand for interactive and intelligent viewing experiences.

- Around 43% of U.S. households had at least one streaming media device connected to their living room TV by 2022, enabling access to diverse digital content platforms.

- Demand for connected lighting solutions in living rooms is expected to grow by 30% in 2024, driven by interest in personalized ambiance and energy efficient control systems.

- Integration with broader smart home ecosystems gained importance, as 51% of consumers showed interest in connecting living room entertainment with security, lighting, and climate systems.

- Privacy and security emerged as key decision factors, with 67% of users willing to pay more for connected living room solutions that offer stronger data protection.

- Adoption of connected home theater systems increased by 28% in 2023, supported by demand for immersive audio visual experiences with voice control and smart home integration.

- Solutions offering advanced analytics, such as personalized recommendations and usage insights, are projected to grow by 40% in 2024, improving content discovery and user satisfaction.

- Demand for multi room audio and video streaming rose sharply, with this segment growing by 32% in 2023, driven by the need for seamless whole home entertainment experiences.

Top Driving Factors

One major driving factor of the connected living rooms market is the rapid adoption of over-the-top (OTT) streaming services and digital content consumption. Consumers increasingly choose on demand and personalized content over scheduled broadcast television. Connected living room platforms that support multiple streaming apps, unified search, and recommendation engines improve content accessibility and consumption satisfaction. This trend strengthens demand for smart and integrated living room technologies.

Another key driver is the proliferation of smart devices and voice controlled interfaces. Devices such as smart speakers and voice assistants enable intuitive control of connected living room systems, reducing complexity and enhancing user engagement. Consumers value hands-free interaction for content playback, lighting control, and environmental adjustments. The presence of voice and app based control reinforces the appeal of connected living room ecosystems.

Demand Analysis

Demand for connected living room solutions is influenced by demographic and lifestyle changes. Younger generations and tech savvy households prioritize modern, integrated digital experiences that support multitasking and interactivity. Streaming, social sharing, and online gaming are core elements of contemporary living room usage patterns. This demographic alignment grows demand for connected solutions.

Demand is also shaped by the increased use of living spaces for remote work and hybrid lifestyles. Smart displays, video conferencing capabilities, and synchronized media systems support flexible living and working arrangements. Connected living rooms become multifunctional environments that accommodate entertainment, communication, and productivity. These broader usage scenarios reinforce market relevance.

Increasing Adoption Technologies

Advances in wireless connectivity technologies such as Wi-Fi 6 and emerging 5G support high bandwidth streaming and low latency interactions. These connectivity improvements reduce buffering, improve multi-device performance, and support richer content delivery. Enhanced networking reliability expands the range of viable connected living room applications.

Artificial intelligence and machine learning technologies are also accelerating adoption by enabling personalized recommendations, automated content curation, and predictive device behaviour. AI powered interfaces can adapt settings based on user preferences, schedule patterns, and environmental context. These intelligent features improve usability and deepen engagement with connected living room ecosystems.

One key reason consumers adopt connected living room solutions is improved entertainment experience. Integrated platforms that unify streaming, gaming, and multimedia support enriched viewing and interactive engagement. Personalized recommendations and synchronized user profiles enhance content relevance. These features align with modern entertainment expectations.

Another reason is enhanced convenience and lifestyle integration. Connected living rooms allow centralized control of lighting, sound, media, and smart home devices from a single interface or voice command. Remote access and automation reduce manual adjustments and streamline daily routines. Convenience and control are major motivators for adoption.

Investment Opportunities

Investment opportunities in the connected living rooms market exist in interoperable platforms that support unified control across devices and vendors. Solutions that bridge ecosystems and reduce fragmentation attract interest from consumers and integrators. Investors may focus on middleware, standards based hubs, and open APIs that improve compatibility.

Another opportunity lies in immersive technologies such as augmented reality, virtual reality, and advanced audio systems integrated with living room ecosystems. These technologies can elevate entertainment and interactive experiences, capturing premium adoption. Investment in high fidelity interfaces and content partnerships supports differentiated offerings.

Business Benefits

Adoption of connected living room technologies enhances consumer satisfaction and long term engagement. Personalized, seamless experiences lead to increased usage and deeper brand loyalty. Content providers and device manufacturers benefit from data driven insights that inform product development and tailored services.

Connected living room ecosystems also generate recurring revenue through subscriptions, software updates, and value added services. Providers can monetize features such as premium content access, smart home integration, and device analytics. These revenue streams support sustainable business models and ongoing innovation.

Regulatory Environment

The regulatory environment for the connected living rooms market is influenced by data privacy and cybersecurity standards that govern how personal information is collected, stored, and used across connected devices. Providers must ensure compliance with regional privacy laws and implement robust security measures that protect consumer data. Transparent practices build trust and legal conformity.

Safety and interoperability standards also shape how devices communicate and operate within connected ecosystems. Compliance with established protocols ensures reliable performance and reduces risk of malfunction or conflict. Regulatory adherence fosters consumer confidence and supports long term adoption of connected living room technologies.

Key Market Segments

By Device Type

- Smart Speakers

- Smart TVs

- PC/Laptop

- Gaming Consoles

- Other Device Types

By Application

- Video Streaming

- Gaming

- Audio Streaming

Top Market Leaders

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Sony Corporation

- Google LLC

- Hitachi, Ltd.

- LG Corporation

- Panasonic Corporation

- Amazon.com, Inc.

- Microsoft Corporation

- Roku, Inc.

- Vizio, Inc.

- Koninklijke Philips N.V.

- Other Key Players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 59.1 Bn |

| Forecast Revenue (2033) | USD 138.6 Bn |

| CAGR (2024-2033) | 8.9% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)