Table of Contents

Introduction

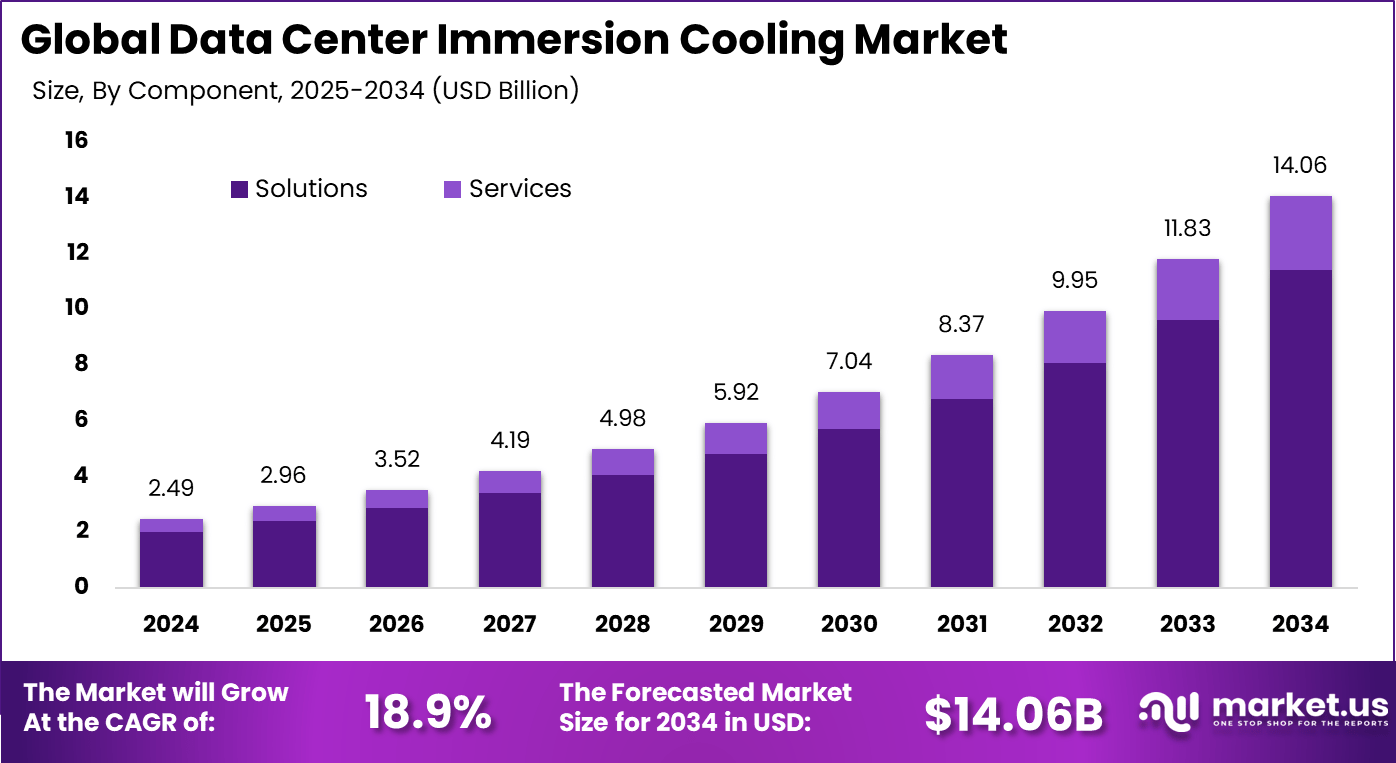

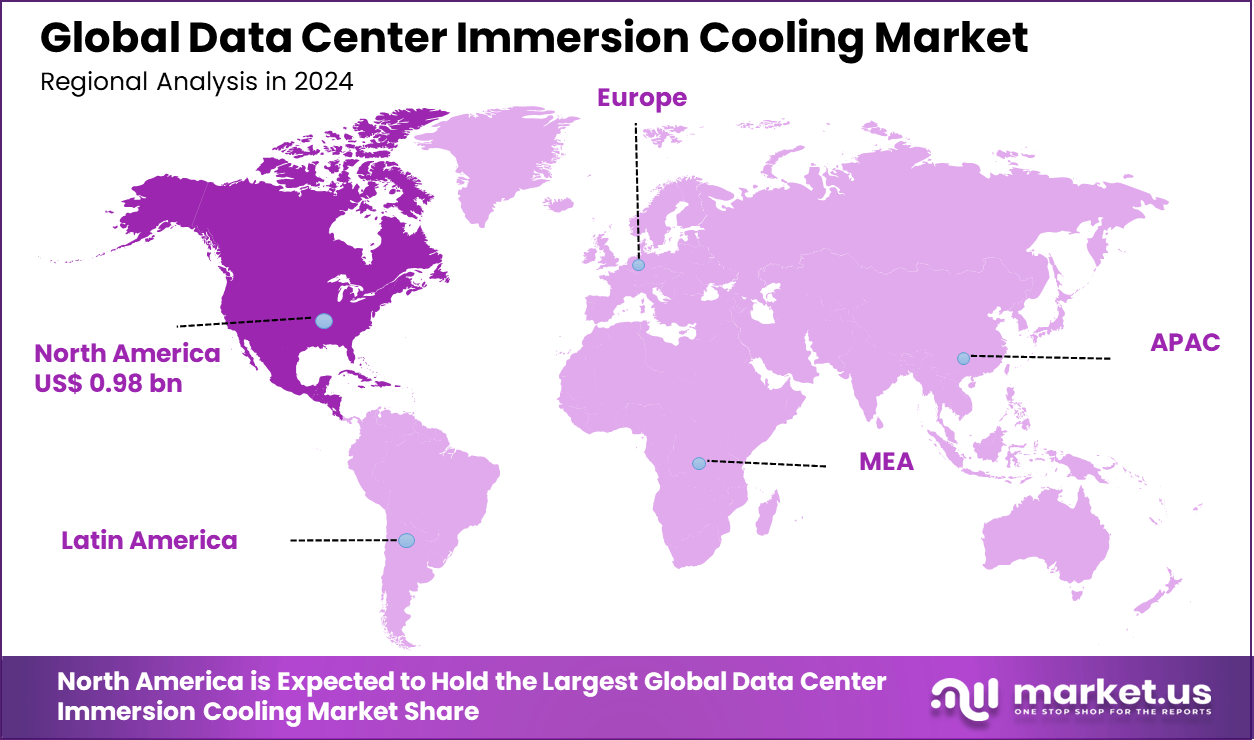

The global data center immersion cooling market was valued at USD 2.49 billion in 2024 and is projected to reach approximately USD 14.06 billion by 2034, expanding at a CAGR of 18.9% during the forecast period from 2025 to 2034. North America led the market in 2024 with more than 39.5% share, generating around USD 0.98 billion in revenue, supported by rising deployment of high density computing and energy efficient cooling solutions.

The data center immersion cooling market focuses on advanced cooling systems where servers and electronic components are submerged in specially engineered non conductive liquids. This approach removes heat directly from hardware, improving thermal efficiency compared to traditional air cooling methods. The market has gained attention as data centers face rising heat density due to high performance computing, artificial intelligence workloads, and dense server deployments. Immersion cooling is increasingly viewed as a practical solution for improving reliability, extending equipment life, and supporting next generation computing infrastructure.

Unlock upto 60% off Christmas Sale deal on this research report @ https://market.us/purchase-report/?report_id=162740

Key Takeaway

- Solutions dominated with 81.3%, as operators favor integrated immersion cooling systems to improve efficiency and cut energy use.

- Single-phase cooling led with 62.8%, driven by simpler operations and lower maintenance needs.

- The mining and oil segment accounted for 45.1%, supported by heavy adoption in cryptocurrency mining and high-performance computing setups.

- Large enterprises captured 75.9%, reflecting strong investment in sustainable and high-capacity data center infrastructure.

- The hyperscale segment held 35.2%, showing rising use of immersion cooling in cloud and AI-focused data centers.

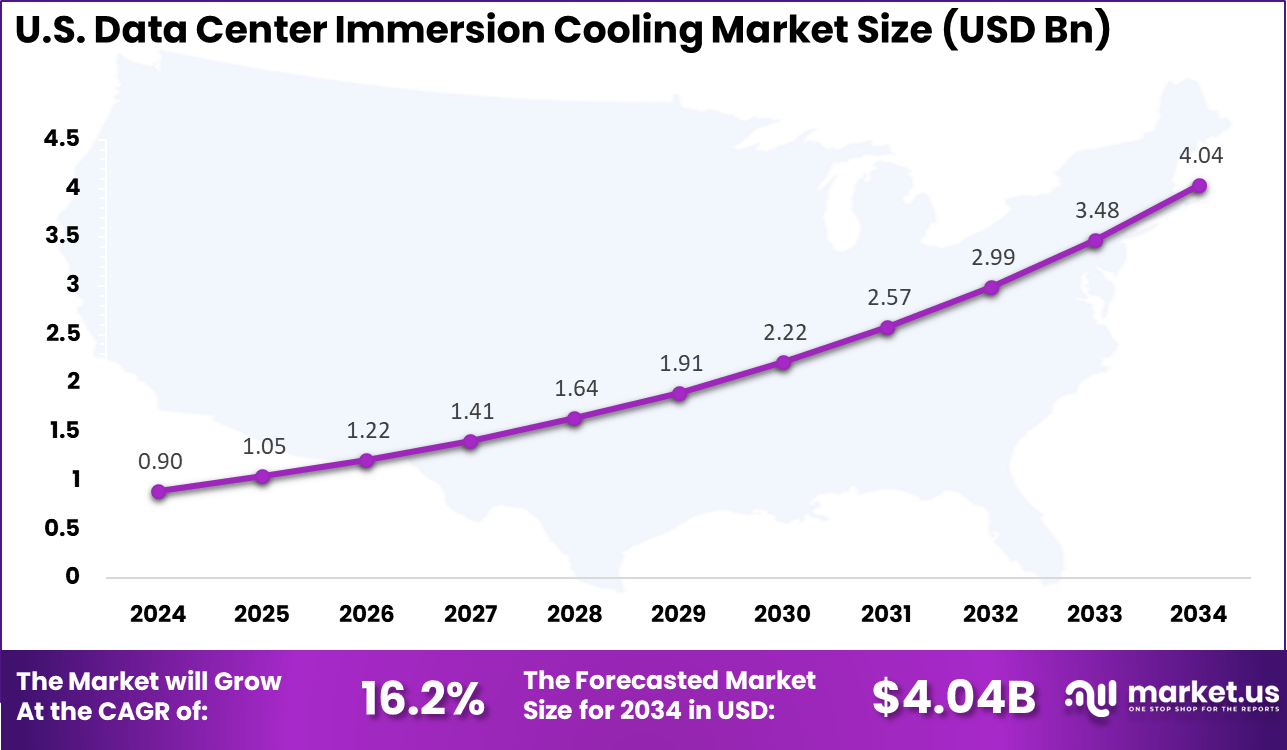

- The U.S. market reached USD 0.90 billion in 2024, growing at a solid 16.2% CAGR due to data center modernization efforts.

- North America led globally with a 39.5% share, backed by hyperscale expansion, advanced technologies, and sustainability-driven investments.

Top Driving Factors

Growth of this market is driven by the rapid increase in data processing requirements and the growing use of power intensive applications such as AI training and blockchain computing. Traditional cooling systems are often unable to manage high heat loads efficiently, leading operators to explore alternative technologies. Rising energy costs and stricter sustainability goals have also encouraged adoption, as immersion cooling can reduce power usage related to cooling. In addition, space constraints in urban data centers have increased demand for solutions that allow higher compute density within smaller footprints.

Demand for immersion cooling systems is increasing steadily among hyperscale data centers, colocation providers, and high performance computing facilities. Operators are adopting these systems to improve cooling efficiency and manage thermal challenges without major facility redesign. Interest is also growing among edge data centers and specialized computing environments where heat control is critical. As computing intensity continues to rise and efficiency becomes a priority, demand for immersion cooling solutions is expected to strengthen across global data center infrastructure.

Regional Analysis

United States

The US market reached USD 4.40 Billion in 2024 and registered a strong CAGR of 16.2%. Growth is fueled by data center modernization and increased focus on energy-efficient cooling technologies. Rising adoption of AI workloads, cloud services, and edge computing continues to strengthen demand. Operators in the US actively invest in advanced cooling to improve performance and reduce operational costs.

North America

North America led globally with a 39.5% share, supported by hyperscale data center expansion and rapid technology adoption. The region benefits from strong digital infrastructure and early use of advanced cooling solutions. Sustainability initiatives and regulatory pressure to reduce energy usage further support regional growth. Data center operators across North America increasingly view immersion cooling as a long-term efficiency solution.

Emerging Trends

One notable trend is the adoption of immersion cooling for AI and machine learning workloads. These workloads generate heavy heat output, and traditional air cooling often struggles to support dense server clusters. Immersion cooling provides stable temperatures and allows tighter hardware placement, which suits high power workloads.

Another trend is rising interest in sustainable cooling solutions. Many data center operators are exploring immersion cooling to reduce energy consumption related to air conditioning. This trend aligns with corporate sustainability goals and global efforts to lower energy use in digital infrastructure.

Growth Factors

A major growth factor is the increasing demand for computing power across cloud services, edge computing, blockchain operations and scientific research. As heat loads rise, immersion cooling offers a way to support dense computing in limited space while maintaining stable operation. Another growth factor comes from the push for energy efficiency. Cooling accounts for a significant portion of data center electricity use. Immersion cooling systems reduce dependence on large air handling units, which supports lower energy consumption and reduces long term operating cost.

Driver Analysis

A key driver is the growing need to manage heat in advanced servers. Modern processors and accelerators operate at high power levels, and immersion cooling provides direct contact cooling that removes heat faster than air based systems. This improves system reliability and reduces thermal throttling. Another driver is interest in reducing water use. Many traditional cooling systems rely on evaporative cooling and consume large volumes of water. Immersion cooling limits this use and supports regions where water conservation is a priority.

Restraint Analysis

A major restraint is the higher upfront cost of immersion cooling systems. Data center operators must invest in tanks, special fluids and redesigned server layouts. This initial expense can delay adoption, especially for existing facilities. Another restraint is the need for specialized maintenance and handling of cooling fluids. Operators must ensure proper fluid purity, monitor degradation and follow strict procedures. This requirement may discourage organizations with limited technical capacity.

Opportunity Analysis

There is strong opportunity in retrofitting existing data centers with partial or full immersion cooling. Many facilities are reaching thermal limits and need solutions that allow expansion without major construction. Modular immersion systems can address this need. Another opportunity exists in supporting new edge data centers. Smaller regional facilities often face space and power limits. Immersion cooling allows high density computing in compact locations, which benefits providers building edge networks for AI, IoT and content delivery.

Key Market Segments

By Component

- Solution

- Cooling fluids

- Cooling racks/modules

- Filters

- Pumps

- Heat exchangers

- Others

- Service

- Installation & maintenance

- Training & consulting

By Cooling Technique

- Single-phase cooling

- Two-phase cooling

By Cooling Fluid

- Mineral oil

- Synthetic fluid

- Fluorocarbons-based fluid

By Organization Size

- SME

- Large enterprises

By Application

- Hyperscale

- Supercomputing

- Enterprise HPC

- Cryptocurrency

- Edge/5G computing

- Others

Top Key Players in the Market

- Green Revolution Cooling (GRC) Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc (Immersion Cooling Fluids)

- Cargill Inc. (NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.49 Bn |

| Forecast Revenue (2034) | USD 14.06 Bn |

| CAGR(2025-2034) | 18.9% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)