Table of Contents

- Digital Art and Design Tools Market Size

- Key Takeaways

- Digital Art and Design Tools Market Overview

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Table

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Top Driving Factors

- Demand Analysis

- Increasing Adoption Technologies

- Key Reasons for Adopting These Solutions

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Key Market Segments

Digital Art and Design Tools Market Size

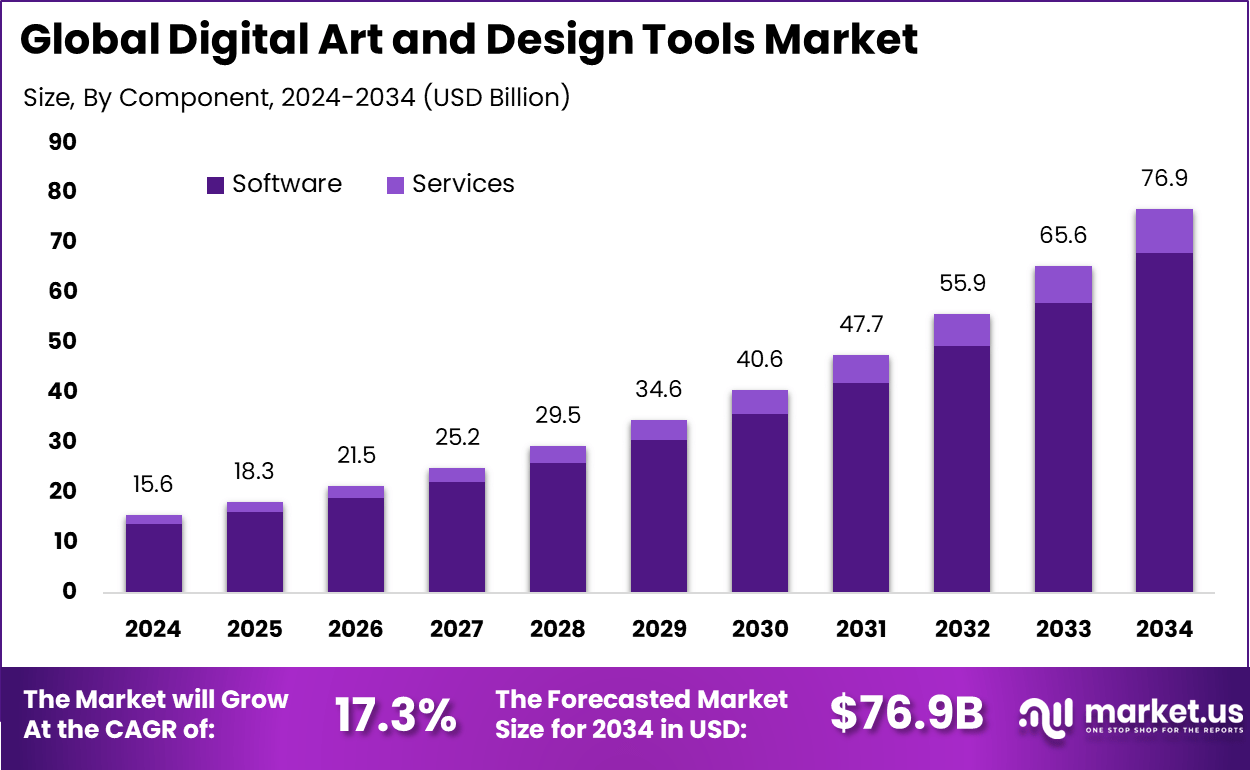

The global Digital Art and Design Tools market was valued at USD 15.6 billion in 2024 and is expected to expand at a strong pace over the forecast period. The market is projected to reach approximately USD 76.9 billion by 2034, growing at a CAGR of 17.3% from 2025 to 2034. This growth is supported by rising demand for digital content creation across media, entertainment, education, and marketing sectors. Increasing use of advanced design software by professionals and individual creators is further supporting market expansion.

In 2024, North America held a dominant position in the global market, accounting for more than 38.15% of total revenue. The region generated around USD 5.95 billion, supported by strong adoption of creative technologies and a well established digital economy. High presence of creative professionals and widespread use of cloud based design platforms strengthened regional leadership. As a result, North America continued to play a central role in shaping market innovation and adoption trends.

Key Takeaways

- Software solutions led the digital art and design tools market in 2024 with an 88.5% share, reflecting heavy dependence on advanced creative software for illustration, editing, and end-to-end design workflows.

- Raster graphics tools accounted for 38.7%, supported by their extensive use in digital painting, photo manipulation, and visual storytelling.

- Cloud-based deployment captured 71.6%, driven by the need for anytime access, cross-device collaboration, and continuous feature updates.

- Professional artists and designers represented 52.4% of total usage, highlighting strong adoption across studios, agencies, and freelance ecosystems.

- The media and entertainment sector held 41.3%, underpinned by demand from gaming, film, animation, and digital content production.

- The U.S. market reached USD 5.36 billion in 2024, expanding at a 15.14% CAGR, fueled by growth in the creator economy and digital media consumption.

- North America maintained global leadership with over 38.15% share, supported by mature creative industries, high software penetration, and robust digital infrastructure.

Digital Art and Design Tools Market Overview

The digital art and design tools market refers to software and platforms that enable creation, editing, and management of visual and multimedia content. These tools include vector and raster editors, 3D modeling applications, digital painting interfaces, and collaborative design platforms. They are used by artists, designers, content creators, advertising agencies, and enterprises that produce visual media. Adoption of these tools supports creative workflows, quality content production, and seamless collaboration across distributed teams.

Growth in this market has been driven by increasing demand for digital content across media, entertainment, marketing, and product design sectors. The proliferation of online platforms and social media has created a continuous need for engaging visual assets. Improvements in computing capabilities, graphic processing, and user friendly interfaces have made professional design tools more accessible. As businesses and individuals seek high quality creative output, the role of digital art and design tools has become more central.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Growth of digital content creation | Rising demand for visual content across media | ~4.6% | Global | Short Term |

| Expansion of creator economy | Increase in independent designers and freelancers | ~4.1% | North America, Europe | Short to Mid Term |

| Adoption by enterprises | Use of design tools in marketing and branding | ~3.5% | Global | Mid Term |

| Advancements in design automation | Faster workflows and assisted creation | ~2.9% | Global | Mid Term |

| Cross platform compatibility | Seamless use across devices and operating systems | ~2.2% | Global | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| Software piracy | Unauthorized use impacting revenues | ~3.2% | Asia Pacific, Latin America | Short Term |

| Subscription fatigue | Resistance to recurring pricing models | ~2.6% | North America, Europe | Short to Mid Term |

| High switching costs | User reluctance to migrate tools | ~2.1% | Global | Mid Term |

| Compatibility limitations | Performance issues on low end hardware | ~1.7% | Emerging Markets | Short Term |

| Data security concerns | Cloud based asset protection risks | ~1.3% | Global | Long Term |

Restraint Impact Table

| Restraint Factor | Restraint Description | Impact on Market Expansion (%) | Most Affected Regions | Duration of Impact |

|---|---|---|---|---|

| Pricing sensitivity | High cost for premium tools | ~3.4% | Emerging Markets | Short Term |

| Learning curve | Time required to master advanced tools | ~2.8% | Global | Short to Mid Term |

| Limited offline functionality | Dependence on internet connectivity | ~2.2% | Emerging Markets | Mid Term |

| Fragmented tool ecosystem | Multiple tools needed for workflows | ~1.9% | Global | Long Term |

| Hardware dependency | Requirement for high performance devices | ~1.4% | Global | Short Term |

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Individual creators | Very High | ~46% | Creative flexibility and monetization | Subscription based usage |

| Enterprises | High | ~27% | Brand consistency and scale | License based procurement |

| Educational institutions | Moderate | ~14% | Digital skill development | Volume licensing |

| Design agencies | Moderate | ~9% | Workflow efficiency | Tool bundling |

| Hobbyists | Low to Moderate | ~4% | Creative experimentation | Freemium usage |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| Cloud based design platforms | Anywhere access and collaboration | ~4.8% | Mature |

| AI assisted design tools | Automated layout and enhancement | ~4.1% | Growing |

| Vector and raster engines | High precision design rendering | ~3.3% | Mature |

| Real time collaboration | Multi user design workflows | ~2.9% | Growing |

| Asset libraries | Faster content creation | ~2.2% | Mature |

Top Driving Factors

One major driving factor is the rapid expansion of digital media consumption. Businesses and content creators must produce visual content at scale to capture audience attention across websites, apps, and social channels. This volume of content production creates demand for tools that support efficiency, precision, and versatility in design tasks. Organizations are investing in solutions that reduce time to execute creative work while maintaining high quality.

Another factor driving the market is the growth of creative industries that depend on advanced visual content. Sectors such as gaming, film production, e learning, and digital advertising require sophisticated design tools. These industries use digital art applications to develop immersive experiences, animations, and interactive content. As content complexity and user expectations rise, investment in capable design tools has strengthened.

Demand Analysis

Demand for digital art and design tools has been influenced by the rise of freelance professionals and creative studios. Independent creators and small agencies favor tools that offer flexibility, affordability, and cloud collaboration. Subscription based models have lowered entry barriers and made enterprise grade solutions more attainable. This shift has expanded the user base beyond traditional design teams to a broader creative community.

Enterprise demand is also increasing as organizations integrate visual content into branding and customer engagement efforts. Marketing departments and product teams use design tools to produce advertisements, product visuals, and promotional materials. Remote work practices have further accelerated the need for cloud based platforms that support distributed collaboration. As a result, demand spans individual, small business, and corporate use cases.

Increasing Adoption Technologies

Cloud based collaboration technologies are driving adoption by enabling real time design work and asset sharing across teams. These platforms allow multiple users to contribute to projects concurrently while maintaining version control and secure storage. Cloud infrastructure supports scalability, remote access, and reduced dependency on local hardware resources. These capabilities are particularly valuable in hybrid and distributed work environments.

Artificial intelligence and machine learning technologies are being integrated to enhance user experience and productivity. These features can automate routine tasks such as background removal, layout generation, and color adjustment. AI driven suggestions help users explore creative variations and improve output quality. The combination of automation and intelligent design support increases the efficiency of creative workflows.

Key Reasons for Adopting These Solutions

One reason organizations adopt digital art and design tools is the need to improve creative output and professional quality. High quality visuals contribute to stronger brand presence and more compelling user experiences. Design tools provide capabilities that are difficult to achieve manually, such as precise vector manipulation and advanced 3D rendering. This creative support helps businesses differentiate in competitive markets.

Another reason for adoption is streamlined workflow and collaboration. Integrated toolsets reduce the need to switch between multiple applications, saving time and reducing errors. Cloud based design platforms allow contributors to work together regardless of location. These efficiencies support faster project completion and responsive creative cycles.

Investment Opportunities

Investment opportunities in this market exist in platforms that integrate advanced analytics with creative tools. Analytics can provide insights into user engagement, design performance, or trend patterns that inform creative decisions. Solutions that combine data driven insights with intuitive design workflows may attract enterprise interest. Focused investment in integrated platforms can strengthen market differentiation.

Another opportunity lies in tools that support emerging media formats such as augmented reality and virtual reality. These immersive environments require specialized design capabilities that traditional tools may not fully support. Platforms tailored to experiential content creation can capture growth from entertainment, education, and simulation industries. Investments in these areas may yield competitive advantages as demand for immersive experiences rises.

Business Benefits

Adoption of digital art and design tools enables businesses to produce creative content efficiently and consistently. Centralized design platforms reduce time spent on manual processes and support rapid iteration. This efficiency can lower production costs and improve responsiveness to market needs. Consistent visual quality also strengthens brand identity and customer recognition.

These tools also support enhanced collaboration and knowledge sharing across teams. Shared platforms and asset libraries allow designers, marketers, and product teams to align on creative goals. Real time collaboration reduces delays and accelerates decision making. Improved teamwork contributes to better integrated and more effective creative outcomes.

Regulatory Environment

The regulatory environment for digital art and design tools includes intellectual property and copyright laws that govern the use and distribution of creative works. Users and organizations must ensure that assets created or used within these tools comply with licensing terms and rights ownership. Proper management of design elements, fonts, and stock visuals reduces legal exposure. These legal frameworks influence how tools incorporate content libraries and asset sharing features.

Data protection and privacy regulations also impact cloud based design platforms. Tools that collect user information, project metadata, or usage analytics must comply with regional privacy standards. Providers and users are required to implement secure data handling practices and transparent policies. Compliance with these standards fosters trust and supports lawful operation across markets.

Key Market Segments

By Component

- Software

- Services

By Tool Type

- Raster Graphics Software

- Vector Graphics Software

- 3D Modeling & Animation Software

- Digital Painting & Illustration Software

- UI/UX & Prototyping Tools

- Others

By Deployment Mode

- Cloud-based

- On-premises

By End-User

- Professional Artists & Designers

- Hobbyists & Enthusiasts

- Enterprises

- Educational Institutions

By End-User Industry

- Media & Entertainment

- Advertising & Marketing

- Gaming

- Architecture & Engineering

- Education

- Others

Top Key Players in the Market

- Adobe, Inc.

- Canva

- Corel Corporation

- Autodesk, Inc.

- Figma, Inc.

- Sketch B.V.

- Affinity

- Clip Studio Paint

- Procreate

- Blender Foundation

- Unity Technologies

- SideFX

- Pixologic, Inc.

- Maxon Computer GmbH

- GIMP Development Team

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)