Table of Contents

Report Overview

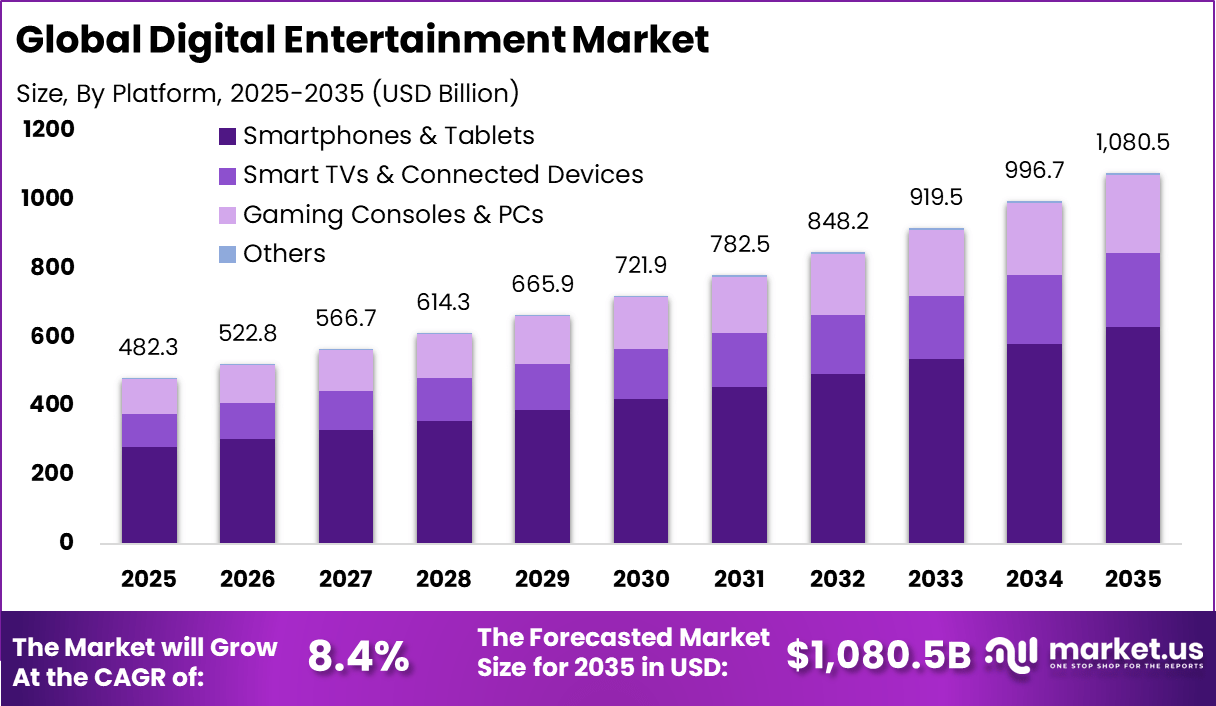

The global Digital Entertainment market was valued at USD 482.3 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 1,080.5 billion by 2035, expanding at a CAGR of 8.4% from 2026 to 2035. This growth is supported by rising consumption of digital media, online gaming, streaming platforms, and interactive content. Increasing smartphone usage and improved internet connectivity are further contributing to market expansion.

The digital entertainment market refers to content, platforms, and technologies that deliver audio-visual and interactive experiences through digital channels. This includes streaming video, digital music, online gaming, e-sports, virtual reality (VR) and augmented reality (AR) experiences, mobile entertainment apps, and social media content consumption. Distribution occurs via the internet, mobile networks, and connected devices such as smart TVs, smartphones, tablets, and gaming consoles. Adoption spans global consumers, content creators, advertisers, and media enterprises seeking scalable, personalised, and on-demand entertainment experiences.

Market Key Takeaways

- Video streaming led the market by content type with a 48.6% share, supported by sustained demand for OTT platforms, original programming, and flexible on demand viewing options.

- Smartphones and tablets dominated platform usage with 58.4%, reflecting a strong shift toward mobile first consumption and continuous access to entertainment across locations.

- Subscription based models accounted for 52.7% of total revenue, driven by recurring payment structures, bundled offerings, and growing consumer comfort with monthly and annual plans.

- Individual consumers represented 94.3% of end user demand, confirming that digital entertainment remains primarily consumer driven rather than enterprise focused.

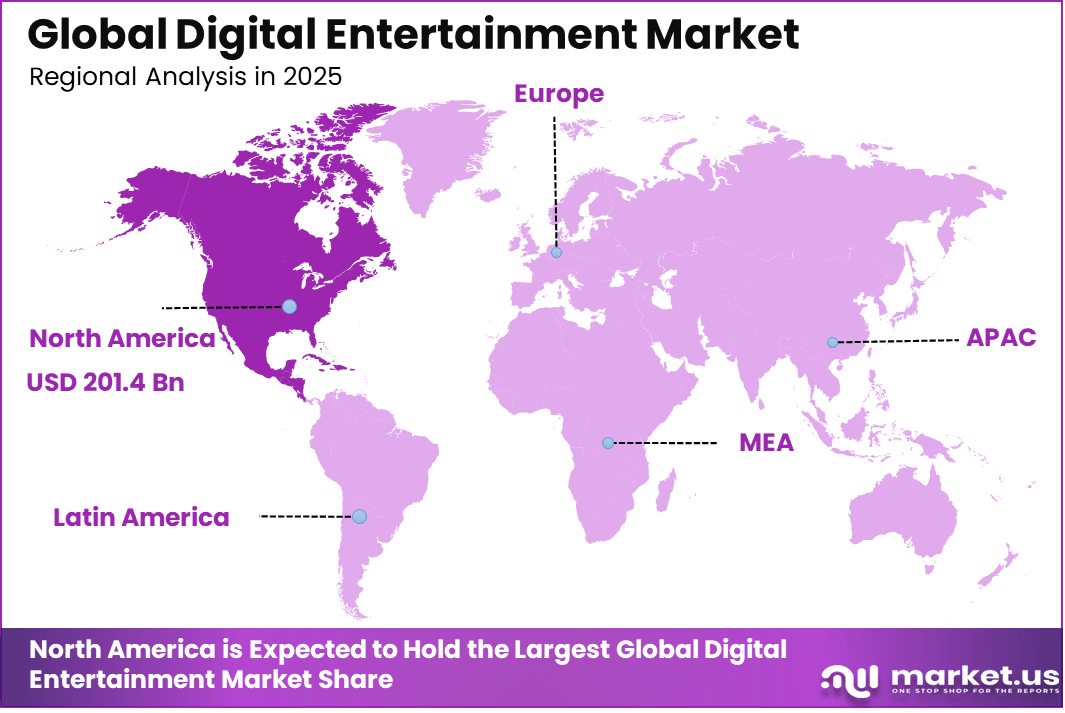

- North America held a leading 41.8% share of the global market, supported by high digital penetration, premium content spending, and advanced streaming ecosystems.

- The U.S. market reached USD 181.4 billion, expanding at a 7.12% growth rate, driven by strong adoption of streaming services, mobile entertainment, and subscription platforms.

Key Global Market Statistics

- Gaming emerged as the largest global entertainment segment, generating around USD 184 billion annually, nearly double the combined revenues of film and music. Industry revenues are expected to exceed USD 300 billion by 2028, supported by mobile gaming, live service models, and esports.

- Social media usage reached approximately 5.66 billion active identities by late 2025, covering nearly 68.7% of the global population, positioning it as a primary channel for digital engagement and content discovery.

- The average global internet user now spends about 33 hours and 27 minutes per week consuming digital media, reflecting sustained growth in online content engagement.

- Smartphones accounted for 46% of the total digital media market in 2024, while mobile gaming alone generated USD 92.6 billion, reinforcing mobile devices as the main growth engine.

- Advertising revenue is increasingly overtaking direct consumer payments. By 2029, global advertising revenues are expected to exceed consumer spending by more than USD 300 billion.

- Subscription churn remained a challenge, as 39% of consumers canceled at least one subscription in late 2024. In response, ad supported tiers expanded rapidly, growing at an estimated 14% pace, helping platforms balance churn with revenue stability.

Top Driving Factors

High-speed internet and mobile connectivity drive the Digital Entertainment Market by enabling seamless access to high-definition content and live streaming. Smartphone adoption has surged, allowing users to consume entertainment on the go, which expands the user base significantly. These factors contribute to higher engagement and revenue growth across platforms.

Streaming platform expansion further accelerates market momentum as subscriptions for video and music services multiply. Improved broadband infrastructure supports richer media experiences, drawing in more subscribers. Overall, these drivers align with evolving lifestyles that prioritize flexibility in consumption.

Demand Analysis

Demand in the Digital Entertainment Market rises from consumer shifts to on-demand options that fit busy schedules, replacing traditional broadcast timings. Personalization through curated playlists and recommendations meets user needs for tailored content, sustaining high engagement levels. Mobile-first habits amplify this trend, with smartphones dominating access points.

Video streaming holds the largest share due to demand for OTT platforms and original series, while gaming and music follow closely. Regional variations show strong growth in areas with high digital penetration, like North America. Future demand will hinge on content diversity and affordability.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 41.8% of total revenue. The region generated around USD 201.4 billion, supported by a mature digital ecosystem and strong consumer spending on entertainment services. High adoption of subscription based platforms and advanced content distribution networks strengthened regional leadership. As a result, North America continues to shape innovation and consumption trends in the digital entertainment market.

Investment Opportunities

Investment prospects abound in digital entertainment through scaled platforms like streaming services and interactive gaming firms showing strong cash flow. Emerging markets offer high growth via mobile entertainment and monetization improvements. Focus on content IP and tech integration yields returns amid sector maturation. Gaming and AR/VR segments promise explosive expansion, especially with 5G rollout. Selective bets on profitable leaders balance risks from competition. Long-term plays in personalized content and cloud services align with user trends.

Business Benefits

Businesses gain global audience reach and precise targeting from digital platforms, enhancing marketing efficiency. Data insights from user behavior enable tailored content, boosting loyalty and conversions. Immersive techs increase dwell time and revenue per user. Direct-to-consumer models cut intermediaries, providing control over distribution and monetization. Real-time analytics support quick adaptations to trends, improving profitability. Overall, these benefits foster sustainable growth in a competitive landscape.

Regulatory Environment

Regulations shape digital entertainment via rules on content moderation, privacy, and platform liability, varying by region. Frameworks like IT Rules require takedowns and age restrictions to protect users. Platforms invest in compliance tools like AI moderation to navigate these mandates.

Global differences challenge operations, prompting tailored policies per market. Focus areas include data protection and cultural standards, influencing content strategies. Adaptation ensures trust and avoids penalties in a scrutinized industry.

Key Market Segments

By Content Type

- Video Streaming

- Music Streaming

- Online Gaming

- Digital Reading

- Others

By Platform

- Smartphones & Tablets

- Smart TVs & Connected Devices

- Gaming Consoles & PCs

- Others

By Revenue Model

- Subscription

- Advertising-based

- Others

By End-User

- Individual Consumers

- Households

- Advertisers & Brands

- Others

Top Key Players in the Market

- Netflix, Inc.

- Amazon.com, Inc.

- Alphabet, Inc.

- Meta Platforms, Inc.

- Tencent Holdings, Ltd.

- Sony Group Corporation

- Microsoft Corporation

- Apple, Inc.

- The Walt Disney Company

- Spotify Technology S.A.

- ByteDance, Ltd. (TikTok)

- Nintendo Co., Ltd.

- Electronic Arts, Inc.

- Activision Blizzard, Inc.

- Warner Bros. Discovery, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 482.3 Bn |

| Forecast Revenue (2035) | USD 1,080.5 Bn |

| CAGR(2026-2035) | 8.4% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |