Table of Contents

Overview

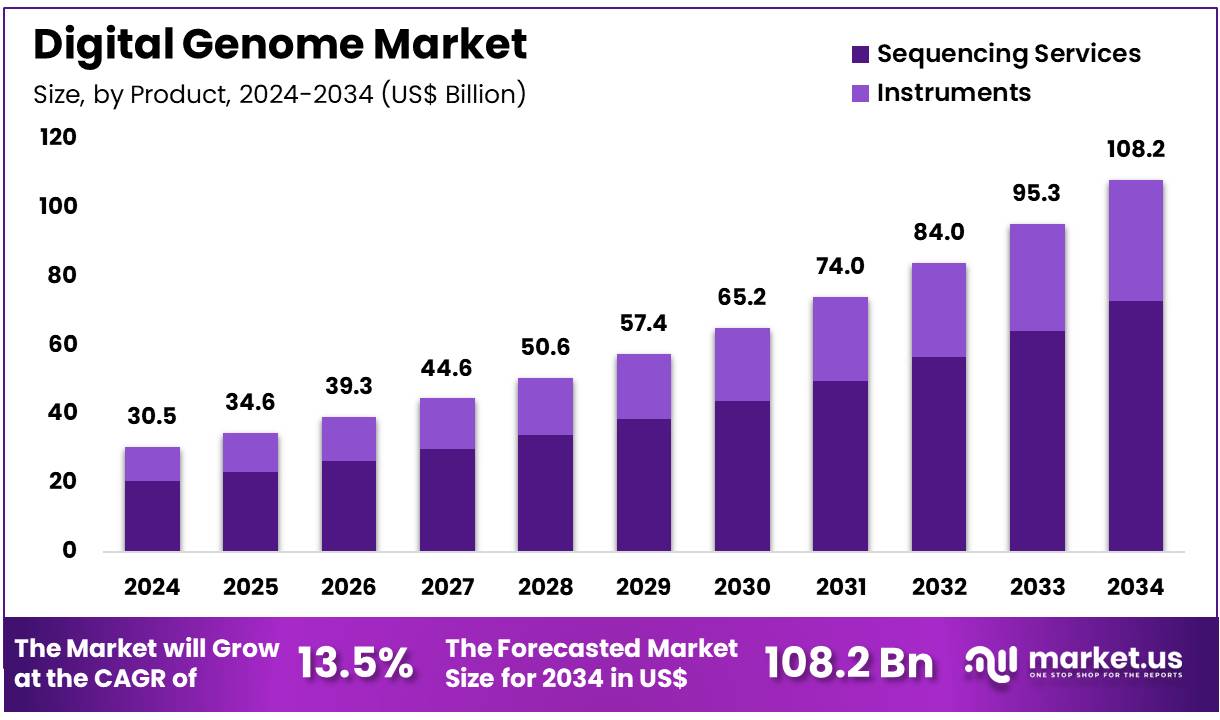

New York, NY – Feb 11, 2026 – Global Digital Genome Market size is expected to be worth around US$ 108.2 billion by 2034 from US$ 30.5 billion in 2024, growing at a CAGR of 13.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.8% share with a revenue of US$ 12.1 Billion.

The foundational structure of the Digital Genome has been formally established, marking a significant advancement in data-driven biological intelligence and precision analytics. The Digital Genome represents a structured, computational framework designed to encode, organize, and interpret complex biological and molecular information into a unified digital architecture. This formation enables high-throughput data integration, scalable analysis, and improved interoperability across research, clinical, and industrial platforms.

The initial framework integrates genomic sequencing data, phenotypic attributes, and biomarker intelligence into a standardized digital matrix. Advanced algorithms and machine learning models are embedded within the system to facilitate pattern recognition, predictive modeling, and decision support. As a result, enhanced accuracy in diagnostics, drug discovery, and personalized medicine development can be achieved.

The development phase has prioritized data security, regulatory compliance, and system scalability to support global research ecosystems. Cloud-enabled infrastructure ensures real-time processing capabilities and seamless collaboration among stakeholders.

The establishment of the Digital Genome basic formation is expected to accelerate innovation across biotechnology, healthcare, and life sciences industries. Increased investment in digital biology platforms and precision medicine initiatives has further strengthened the growth outlook. This milestone reflects the ongoing transformation of genomic science into an integrated, digitally empowered ecosystem designed to support next-generation research and clinical applications.

Key Takeaways

- In 2024, the global digital genome market was valued at US$ 30.5 billion. The market is projected to expand at a CAGR of 13.5% during the forecast period and is anticipated to reach US$ 108.2 billion by 2034.

- Based on product type, the market is categorized into sequencing services and instruments. Sequencing services emerged as the leading segment in 2024, accounting for 67.3% of the total market share.

- By application, the market is segmented into agriculture & animal research and diagnostics. The diagnostics segment dominated the market, capturing a substantial share of 63.5% in 2024.

- In terms of end users, the market is divided into research centers & government institutes and academic institutions. Research centers & government institutes held the highest revenue share, representing 58.1% of the overall market in 2024.

- Regionally, North America maintained its leading position, contributing 39.8% of the total market share in 2024.

Regional Analysis

North America led the digital genome market in 2024, accounting for 39.8% of total revenue. Market dominance has been supported by strong advancements in genome engineering, robust research funding, and rising demand for precision medicine. The region has witnessed accelerated adoption of digital genome platforms enabling genome-scale analysis.

In April 2021, Inscripta commercialized its automated benchtop genome engineering platform, strengthening technological accessibility and research efficiency. The company’s USD 150 million Series E funding further reinforced innovation and expansion initiatives across the biotechnology ecosystem.

Asia Pacific is projected to register the highest CAGR during the forecast period. Growth is being driven by expanding biotechnology infrastructure, increasing healthcare demand, and government-backed genomics initiatives.

In March 2024, the Genome India Project, coordinated by the Department of Biotechnology, completed sequencing 10,000 genomes. Continued investments across China, India, and Japan are expected to support sustained regional market expansion.

Emerging trends around the Digital Genome

Genome sequencing is becoming a scale activity (cost + national programs)

- The “cost per genome has dropped from very high early-era levels to roughly the low-thousands USD range in recent years, supporting routine clinical use.

- Large national datasets are being built: the NIH All of Us program reported >832,000 participants, >452,000 EHRs, and >586,000 biosamples (Aug 24, 2024).

- In the UK, >100,000 whole genomes have been sequenced through the NHS Genomic Medicine Service (reported Aug 12, 2024).

A shift from “one test to “a reusable, re-interpretable genome record

- It is increasingly expected that results will be revisited and updated as variant knowledge improves. This is supported by measurable reclassification: in a cohort of 1,689,845 individuals, 7.3% of unique VUS (variants of uncertain significance) were reclassified.

- This drives demand for “digital genome platforms that can track versions, evidence, and clinical alerts over time.

Faster turnaround times are being prioritized for acute care

- Rapid WGS workflows have enabled results within 24–48 hours in some settings, supporting critical neonatal and pediatric decision-making.

- This trend supports operational models where the digital genome is treated like an urgent diagnostic service (similar to STAT labs).

Interoperability with EHR systems is being formalized (standards-led integration)

- Cancer and genomics reporting is being structured through standards such as HL7 FHIR and mCODE, which includes genomics elements intended to support assessment and treatment decisions.

- National and academic work is increasingly focused on mapping genomics reports to FHIR Genomics IG and related standards to reduce custom integrations.

AI-supported interpretation is expanding to handle variant volume

- Only a small fraction of possible missense changes have been clinically classified, so AI tools are being used to triage evidence at scale. A Science report on AlphaMissense describes predictions across 216 million possible single amino-acid changes (proteome-wide).

- Broader AI summaries report that for >71 million missense variants, large shares can be labeled as likely pathogenic or benign (e.g., ~32% pathogenic, ~57% benign in one commonly cited breakdown).

High-value use cases of the Digital Genome

Rare disease diagnosis (especially pediatrics)

- Genome sequencing shows strong diagnostic performance in rare disease pathways: one meta-analysis reported a pooled diagnostic yield of ~34.2% for genome-wide sequencing, compared with ~18.1% for non-genome-wide approaches in within-cohort studies.

- This use case is commonly positioned as the anchor for “digital genome adoption because the genome can be reused when symptoms evolve.

Cancer care personalization (tumor profiling + inherited risk)

- The NHS program laid groundwork for routine whole genome sequencing in children with cancer and seriously ill children with likely genetic disorders, showing how genomic data becomes part of standard pathways.

- In practice, the digital genome concept is applied as a structured genomic report linked to oncology records (supported by mCODE genomics elements).

Pharmacogenomics (safer dosing, fewer adverse reactions)

- The FDA maintains a live Table of Pharmacogenomic Biomarkers in Drug Labeling, showing how genetic markers appear in prescribing information.

- A peer-reviewed analysis of FDA-approved drugs reported 258 unique biomarker–drug pairs (2000–2020), indicating wide and growing clinical relevance.

- In a digital genome model, medication decisions can be supported by stored genotypes so that re-testing is reduced.

Infectious disease genomics (outbreak detection and variant tracking)

- Public health sequencing has scaled sharply. CDC’s 2022 highlights reported 690,000 SARS-CoV-2 samples sequenced in 2022 across 68 labs (vs 521,658 in 2021).

- Here, the “digital genome concept is applied to pathogen genomes, supporting faster detection of variants and transmission patterns.

Preventive risk stratification using polygenic risk scores (PRS)

- PRS is being used to identify larger at-risk groups than classic single-gene disorders. One review reported that ~8% of a population could show ≥3-fold increased risk for coronary artery disease using PRS-based approaches.

- In a digital genome framework, PRS can be recalculated as models improve, because the underlying genotype remains available.

Conclusion

The establishment of the Digital Genome foundational framework represents a pivotal advancement in precision-driven biological intelligence. A structured digital architecture has enabled scalable integration of genomic, phenotypic, and biomarker data, strengthening diagnostics, therapeutic development, and predictive analytics.

Market expansion, projected to reach US$ 108.2 billion by 2034 at a CAGR of 13.5%, reflects rising adoption across healthcare and biotechnology sectors. Growth is supported by declining sequencing costs, national genomic programs, AI-enabled interpretation, and interoperability standards.

As digital genome platforms mature, enhanced clinical utility, data security, and global collaboration are expected to accelerate innovation and support next-generation research and personalized medicine ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)