Table of Contents

Digital Identity Market Size

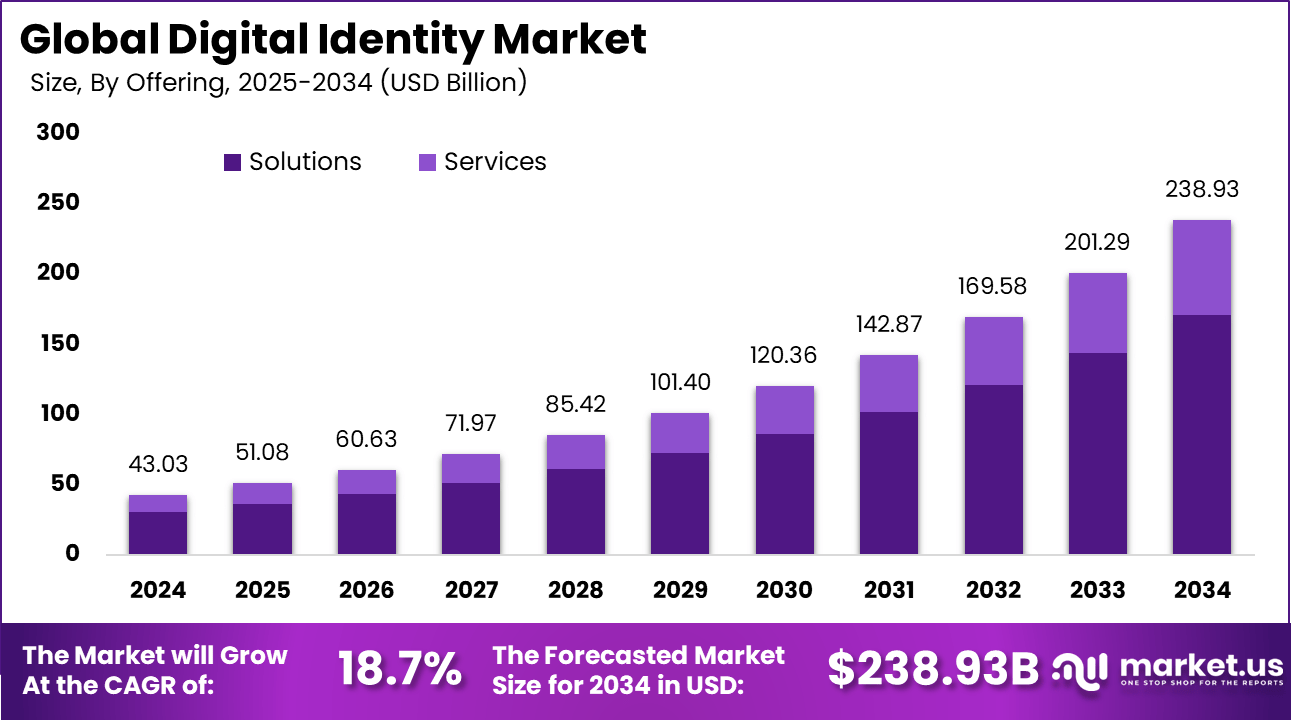

The global digital identity market was valued at USD 43.03 billion in 2024 and is projected to reach approximately USD 238.93 billion by 2034, expanding at a CAGR of 18.7% during the forecast period from 2025 to 2034. In 2024, North America dominated the market with more than 40.3% share, generating around USD 17.34 billion in revenue, driven by strong adoption of secure authentication and identity verification technologies.

The digital identity market focuses on technologies and systems that enable individuals, organizations, and devices to establish and verify their identities in the online world securely and efficiently. These solutions encompass a wide range of methods, including biometric authentication such as facial recognition and fingerprint scanning, multi-factor authentication combining passwords with one-time codes, and blockchain-based decentralized identifiers that give users more control over their personal data.

Rising incidents of cyber attacks and identity theft serve as primary forces propelling the digital identity market, compelling organizations to adopt robust verification systems to protect sensitive information. Stricter regulatory requirements worldwide, particularly in sectors like finance, healthcare, and public services, mandate enhanced identity management to comply with data protection standards and avoid hefty penalties. Additionally, the surge in remote work and digital transactions following global shifts in work patterns has heightened the demand for seamless, secure access methods that support productivity without compromising safety.

Key Takeaways

- In 2024, solutions dominated with a 71.5% share, reflecting strong demand for integrated and end-to-end digital identity platforms across enterprises and public institutions.

- Identity verification accounted for 28.4%, driven by rising requirements for secure onboarding, fraud prevention, and compliance with KYC and AML frameworks.

- Cloud-based deployment led with 60.2%, highlighting the shift toward scalable, flexible, and cost-efficient identity architectures.

- Large enterprises represented 67.3% of adoption, as complex and distributed workforces require advanced identity governance and access controls.

- The BFSI sector captured 24.5%, underlining its dependence on robust identity systems to protect transactions and customer authentication processes.

- The U.S. market showed strong momentum, supported by digital transformation efforts, regulatory pressure, and increasing fraud risks.

- North America led globally with over 40.3% share, backed by mature cybersecurity practices and high enterprise investment levels.

Digital Identity Statistics

- Global awareness remains limited, with only 58% of respondents stating they understand the concept of digital identity.

- About 42% correctly identified digital identity as information that exists about an individual online.

- Around 14% associated digital identity only with e-signatures, while 5% believed it referred solely to email addresses.

- Consumer readiness is high, as 90% already use or are willing to use a single secure digital identity service.

- Banks are the most trusted providers, preferred by 49% of consumers for delivering digital identity services.

- Major technology platforms are trusted by 26% of respondents, reflecting confidence in established digital ecosystems.

- Government services are trusted by 23%, indicating growing acceptance of public-sector digital identity initiatives.

Increasing Adoption of Technologies

Adoption of advanced technologies like AI-driven behavioral biometrics and zero-knowledge proofs accelerates as they offer superior accuracy and privacy compared to traditional password systems. These innovations integrate effortlessly into existing mobile devices and web applications, allowing for frictionless authentication during high-stakes activities like payments or data sharing. Public and private sector collaborations, including mobile ID frameworks rolled out in various countries as of mid-2025, demonstrate practical scalability, encouraging widespread use by addressing long-standing barriers like user resistance and interoperability challenges.

Investment Opportunities

Opportunities for investment lie in developing privacy-preserving identity platforms that align with evolving regulations and counter emerging AI-powered threats to authentication. Niche areas such as identity solutions for Internet of Things ecosystems and cross-border verification systems present strong potential, driven by the growing interconnectivity of devices and global trade. Businesses stand to benefit through reduced operational costs from fraud prevention and expanded revenue streams via innovative services like verifiable credentials for decentralized finance.

Organizations implementing digital identity solutions achieve substantial efficiencies by automating verification processes, which cuts down manual reviews and accelerates customer journeys from signup to service access. These systems foster greater customer loyalty through enhanced trust, as users appreciate secure environments that protect their data without intrusive checks. Compliance becomes routine rather than burdensome, freeing resources for core operations while mitigating risks that could lead to operational disruptions or legal issues.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 43.0 Bn |

| Forecast Revenue (2034) | USD 238.9 Bn |

| CAGR(2025-2034) | 18.7% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Emerging Trends

In the digital identity market, one prominent trend is the widespread use of biometric authentication across consumer and enterprise applications. Fingerprint scanning, facial recognition, and iris verification are being embedded into identity systems to strengthen assurance that users are who they claim to be. These biometric methods reduce reliance on traditional passwords, enhancing security while simplifying user access across digital services.

Another trend is the integration of digital identity platforms with mobile and cloud ecosystems. Organisations are enabling identity verification, authentication, and access management directly through mobile devices and cloud-based platforms to support remote work, digital services, and secure online interactions. This shift promotes seamless user experiences as identities can be verified and managed from anywhere without compromising control.

Growth Factors

A key growth factor in the digital identity market is the increasing demand for secure online interactions as digital services expand. Businesses and government agencies are prioritising identity solutions that prevent fraud, reduce account compromise, and enable trusted transactions. As individuals engage more frequently in e-commerce, online banking, telehealth, and remote services, demand for robust digital identity systems continues to rise.

Another important factor supporting growth is the heightened regulatory focus on privacy and identity protection. Laws and industry standards require organisations to implement stronger identity verification and access controls to protect personal data and comply with legal obligations. This regulatory backdrop encourages investment in digital identity technologies that can enforce policies while safeguarding user privacy.

Driver

A primary driver of the digital identity market is the rising incidence of cybersecurity threats targeting identity credentials. Compromised usernames, weak passwords, and unauthorised access attempts expose individuals and organisations to financial loss and reputation damage. Digital identity solutions that incorporate strong authentication, risk-based access control, and continuous verification help mitigate these threats by making it harder for unauthorised actors to exploit credentials.

Another driver is the pursuit of frictionless user experiences. Users increasingly expect fast, intuitive access to digital services without cumbersome login procedures. Digital identity systems that support single sign-on, biometric authentication, and adaptive access help organisations balance strong security with seamless user journeys.

Restraint

A notable restraint in the digital identity market is the complexity of integrating identity systems with legacy IT infrastructure. Many organisations operate older systems that were not designed for modern identity frameworks. Ensuring compatibility and smooth interoperability with current digital identity solutions requires careful planning, technical expertise, and often significant investment.

Another restraint is user privacy concerns related to identity data collection and storage. Individuals may be hesitant to adopt digital identity services if there is uncertainty about how their biometric or personal information is used and protected. Building trust and transparency around data practices remains a critical challenge for providers.

Opportunity

A strong opportunity exists in the development of privacy-preserving identity technologies, such as decentralised identifiers and zero knowledge proofs, which allow verification without exposing underlying personal data. These approaches can enhance user trust and broaden adoption in sectors where privacy is paramount.

Another opportunity lies in cross-industry collaboration to establish interoperable identity ecosystems. When identity systems can work across banking, healthcare, government services, and retail platforms, users benefit from a unified and secure identity experience. This interoperability can unlock new value and convenience for both individuals and organisations.

Challenge

A central challenge for the digital identity market is ensuring robust security at scale as digital interactions proliferate. Identity systems must handle vast volumes of authentication events while maintaining low risk of breaches and minimal false acceptance or rejection rates. Balancing performance with security remains a technically demanding task.

Another challenge is governing identity systems in environments with divergent regulations and standards. Digital identity solutions often span multiple jurisdictions with different privacy, data protection, and authentication requirements. Navigating this regulatory mosaic while delivering consistent service quality is a persistent challenge for global deployments.

Key Market Segments

By Offering

- Solutions

- Hardware

- RFID Readers & Encoders

- Hardware-based Tokens

- Processor ID Cards

- Others

- Software

- Hardware

- Services

- Professional Services

- Integration & Deployment

- Support & Maintenance

- Training & Development

- Managed Services

- Professional Services

By Solution Type

- Identity Verification

- Authentication

- Identity Lifecycle Management

- Audit, Compliance, and Governance

- Others

By Deployment

- On-Premises

- Cloud

By Organization Size

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- BFSI

- Government

- Healthcare

- Retail & Ecommerce

- Telecommunications

- IT & ITes

- Energy & Utilities

- Education

- Manufacturing

- Others

Top Key Players in the Market

- Thales Group

- IDEMIA Group

- NEC Corporation

- Experian plc

- Microsoft Corporation

- Okta Inc.

- Ping Identity Holding Corp.

- Daon Inc.

- Jumio Corporation

- iProov Ltd.

- Tessi SA

- Signicat AS

- Onfido Ltd.

- ForgeRock Inc.

- OneSpan Inc.

- AuthID Inc.

- Shufti Pro Ltd.

- Veriff OU

- TransUnion LLC

- GB Group plc

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)