Table of Contents

Overview

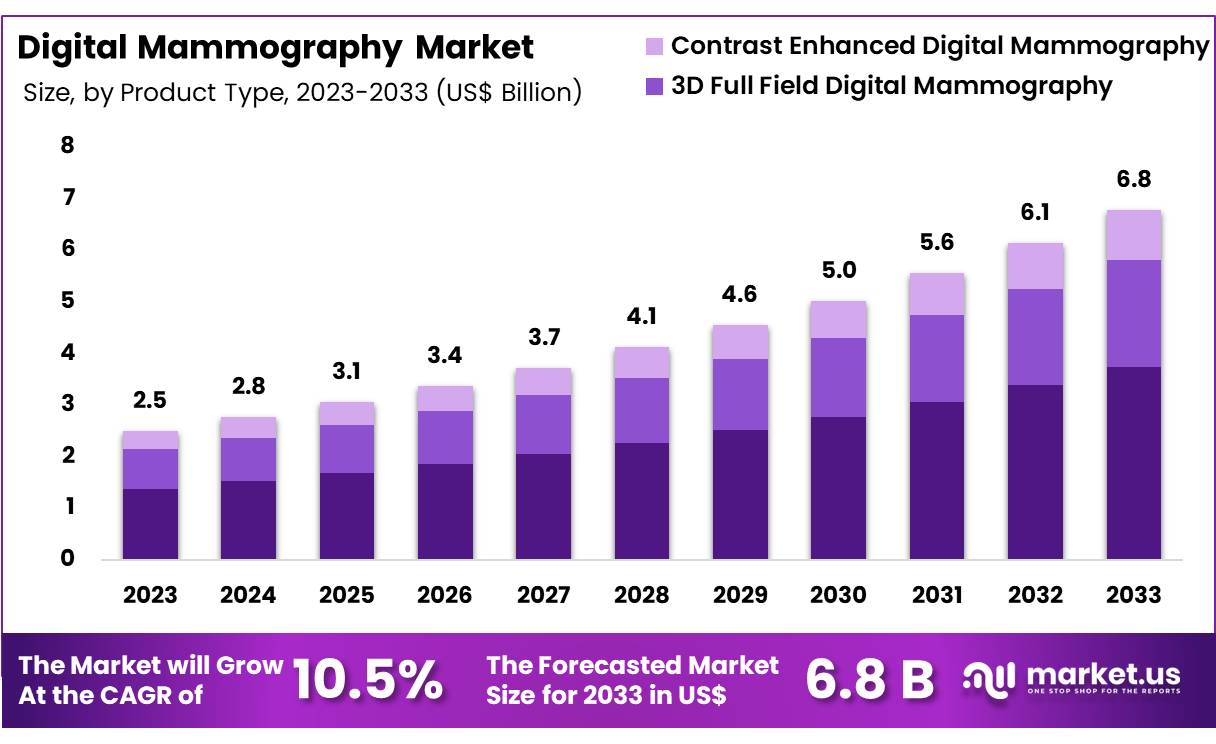

New York, NY – Feb 10, 2026 – Global Digital Mammography Market size is expected to be worth around US$ 6.8 billion by 2033 from US$ 2.5 billion in 2023, growing at a CAGR of 10.5% during the forecast period 2024 to 2033. In 2023, North America led the market, achieving over 40.3% share with a revenue of US$ 1.0 Billion.

Digital mammography has been established as a critical advancement in breast imaging, supporting early detection and accurate diagnosis of breast cancer. This imaging technique uses digital receptors instead of traditional film to capture detailed images of breast tissue, which can then be enhanced, stored, and shared electronically.

The adoption of digital mammography has been driven by its ability to deliver higher image resolution, improved contrast, and greater diagnostic precision, particularly in women with dense breast tissue. Compared to conventional methods, digital systems enable radiologists to adjust image brightness and magnification, allowing subtle abnormalities to be identified more effectively. As a result, diagnostic confidence and clinical efficiency are significantly improved.

In addition, digital mammography contributes to reduced radiation exposure while maintaining high image quality. The integration of advanced software, artificial intelligence tools, and computer-aided detection systems further enhances workflow efficiency and supports consistent clinical outcomes. These technological developments have strengthened screening programs and supported population-level breast cancer prevention strategies.

The growth of digital mammography adoption can be attributed to increasing awareness of breast cancer, rising screening initiatives, and ongoing investments in healthcare infrastructure. As healthcare systems continue to prioritize early diagnosis and patient-centered care, digital mammography is expected to play an increasingly important role in modern diagnostic imaging, reinforcing its position as a standard of care in breast health management.

Key Takeaways

- In 2023, the Digital Mammography market generated revenue of approximately US$ 2.5 billion and is projected to expand at a compound annual growth rate (CAGR) of 10.5%, reaching an estimated value of US$ 6.8 billion by 2033.

- By product type, the market is categorized into 2D full field digital mammography, 3D full field digital mammography, and contrast-enhanced digital mammography. Among these, 2D full field digital mammography dominated the market in 2023, accounting for 55.2% of the total market share.

- Based on end use, the market is segmented into hospitals, diagnostic centers, and others. Hospitals emerged as the leading end-use segment, capturing a substantial 63.8% share of the market in 2023.

- From a regional perspective, North America held a dominant position in the global Digital Mammography market, securing a 40.3% market share in 2023.

Regional Analysis

North America accounted for the largest share of the Digital Mammography market in 2023, capturing 40.3% of total revenue. This dominance has been supported by high awareness levels regarding breast cancer and the strong emphasis on early detection. The availability of advanced digital mammography systems offering superior image quality and faster diagnostic results has improved clinical accuracy and accelerated adoption across hospitals and diagnostic facilities.

In addition, well-established screening guidelines, favorable reimbursement policies, and continuous investments in healthcare infrastructure have further supported market growth. Ongoing technological innovation has also improved system efficiency and accessibility, reinforcing sustained demand across the region.

The Asia Pacific region is projected to register the highest CAGR during the forecast period. Market growth is being driven by rising breast cancer awareness, expanding government-led screening programs, and increasing healthcare investments in emerging economies. Rapid infrastructure development, improving access to diagnostic services, and a growing focus on preventive healthcare are expected to accelerate the adoption of digital mammography across the region.

Emerging trends in Digital Mammography

Fast shift from 2D-only to 3D (Digital Breast Tomosynthesis, DBT) as the default

- DBT is being adopted as routine screening in many sites because fewer “call-backs” can be achieved while finding more cancers.

- In the US MQSA program, 8,266 of 8,963 certified facilities had DBT units (≈ 92.2%), and 12,780 DBT units were accredited (as of March 1, 2025).

- In a large BCSC cohort analysis, DBT was associated with ~15% lower recall and ~21% higher cancer detection vs digital mammography.

AI support is moving from pilots to real screening workflows

- AI is increasingly being used for triage (low-risk single read, high-risk double read) and as a second reader, mainly to reduce radiologist workload while keeping safety metrics stable.

- In the MASAI randomized trial safety analysis, screen-reading workload was reduced by 44.3% with AI support.

- Other population/implementation studies have reported meaningful workload reductions (example: 33.5% reduction in reads in a population screening program).

Contrast-Enhanced Mammography (CEM/CESM) is expanding as an “MRI-like” option with simpler access

- CEM is being used more often for problem-solving and staging when MRI capacity is limited, because high diagnostic performance and shorter exam time can be achieved in many settings.

- In one 2024 comparative study, CEM showed 98.40% sensitivity and 81.91% specificity, while MRI showed 100% sensitivity and 75.33% specificity

Breast density reporting is becoming standardized and is driving supplemental imaging decisions

- In the US, MQSA amendments require standardized breast density notification; this is pushing clinics to improve reporting consistency and to define follow-up pathways for dense breasts.

- Enforcement of the MQSA final rule requirements (including breast density notification) began on September 10, 2024.

Operational modernization: higher throughput, remote reading, and quality oversight

- Digital systems are being integrated with PACS/cloud and structured reporting so that throughput and auditability can be improved.

- MQSA reporting shows scale and operational pressure: ~41.5 million annual mammography procedures were reported (as of May 1, 2024), and inspection data show ~87.5% of inspections with no violation (as of April 2024 scorecard reporting).

High-value use cases of Digital Mammography

Population breast cancer screening (routine early detection)

- This remains the largest use case by volume, where standardized workflows and quality controls are required.

- In the US MQSA system, 8,963 certified facilities and 26,539 accredited units were reported (as of March 1, 2025).

Reducing unnecessary follow-ups using 3D (DBT) in screening

- DBT is used to reduce overlaps in breast tissue that can look like a false alarm on 2D images.

- Real-world cohort evidence has shown ~15% recall reduction with DBT vs digital mammography, while cancer detection increased (~21%).

- This supports a practical clinic goal: fewer call-backs without reducing detection.

Dense-breast pathways: selecting additional imaging when needed

- Digital mammography is used as the first test, while density reporting is used to decide if supplemental imaging is appropriate (based on local guidelines and risk).

- Standard density notification requirements in the US have been implemented under MQSA enforcement starting September 10, 2024, which is increasing structured decision-making for dense breasts.

Diagnostic work-up of symptoms or abnormal screening results

- Digital mammography (often with DBT) is used for targeted diagnostic views when a lump, pain, nipple discharge, or an abnormal screening image is present.

- Practice targets for recalls are commonly discussed in the clinical literature; for example, an optimal recall “range” of ~7–9% has been described for cancer detection performance in 2D and 3D screening contexts.

Therapy planning and monitoring with CEM when MRI access is limited

- CEM can be used for staging, extent evaluation, and treatment response assessment in selected patients, especially where MRI access or tolerance is a barrier.

- In comparative evidence, CEM has shown high sensitivity and solid specificity (example: 98.40% / 81.91% for CEM vs 100% / 75.33% for MRI in one study).

Conclusion

Digital mammography has become a core technology in modern breast cancer screening and diagnosis, driven by clear clinical and operational benefits. The transition toward 3D tomosynthesis, growing use of AI-assisted reading, and expansion of contrast-enhanced mammography are improving detection accuracy while reducing unnecessary recalls and workload.

Standardized breast density reporting and cloud-based workflows are strengthening consistency and quality at scale. Supported by strong screening volumes, regulatory backing, and continued technology investment, digital mammography is reinforcing its role as a standard of care. Its adoption is expected to accelerate further as healthcare systems prioritize early detection, efficiency, and patient-centered imaging solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)