Table of Contents

Introduction

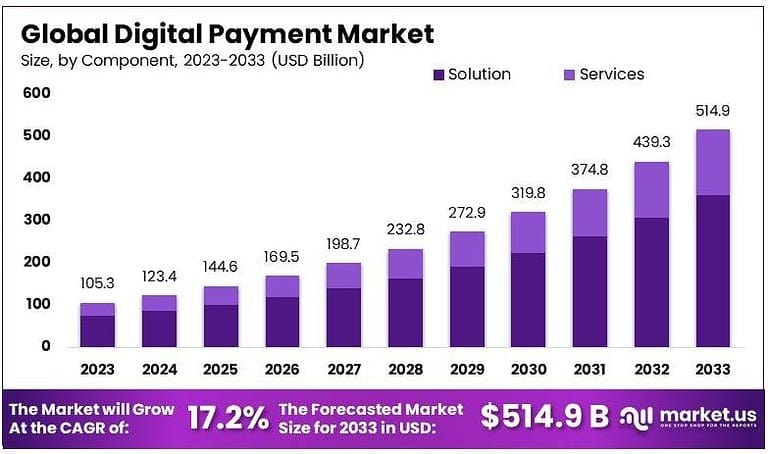

The Global Digital Payment Market is expected to grow substantially, reaching USD 514.9 Billion by 2033, up from USD 105.3 Billion in 2023, reflecting a CAGR of 17.2% during the forecast period from 2024 to 2033. This growth is driven by the increasing adoption of digital payment solutions across various sectors, including e-commerce, banking, retail, and consumer services. The market expansion is also fueled by advancements in technologies like mobile wallets, contactless payments, and blockchain, as well as the growing demand for secure and seamless payment systems worldwide.

How Growth is Impacting the Economy

The rapid growth of the Digital Payment Market is having a profound impact on the global economy by transforming financial transactions and streamlining payment processes. Digital payments are increasingly replacing cash, leading to greater financial inclusion and access to services, especially in emerging economies. As businesses and consumers adopt digital payment solutions, there is a surge in economic activities such as online retail, international remittances, and cross-border transactions.

This digital transformation is also driving job creation in sectors like fintech, technology, cybersecurity, and mobile commerce. Furthermore, the market growth is helping to reduce transaction costs, improve efficiency, and foster innovation in financial services, ultimately contributing to higher productivity and economic growth.

➤ Unlock growth! Get your sample now! – https://market.us/report/digital-payment-market/free-sample/

Impact on Global Businesses

The growing adoption of digital payment solutions is reshaping global businesses, especially in sectors like retail, banking, and e-commerce. While digital payments offer numerous advantages, such as convenience, security, and faster transaction processing, businesses face rising costs associated with implementing these solutions, including investments in technology infrastructure, compliance with regulations, and cybersecurity measures.

Sector-specific impacts are most noticeable in retail and e-commerce, where the shift to digital payments is helping businesses reach a larger customer base while reducing the reliance on physical cash. In the financial services sector, digital payment adoption is driving innovation, leading to the development of more personalized and efficient financial products. Additionally, the supply chain is evolving, with payment solutions being integrated into logistics and invoicing systems to enable seamless transactions across borders.

Strategies for Businesses

- Invest in Payment Infrastructure: Businesses should prioritize investing in secure, scalable digital payment platforms to meet consumer demand for seamless transactions.

- Leverage Data Analytics: Companies can use data analytics to offer personalized payment solutions, optimize customer experience, and reduce transaction costs.

- Enhance Cybersecurity: Ensuring robust security measures, such as encryption and multi-factor authentication, is crucial to protect consumer data and build trust in digital payments.

- Expand Mobile Payment Options: Providing mobile wallets and contactless payment solutions can help businesses tap into the growing mobile-first consumer base.

- Collaborate with Payment Providers: Partnering with fintech companies and payment gateways can allow businesses to offer innovative, integrated payment solutions.

Key Takeaways

- The Digital Payment Market is projected to grow at a CAGR of 17.2%.

- The market size is expected to reach USD 514.9 Billion by 2033.

- Increased adoption of mobile wallets, contactless payments, and blockchain will continue to drive market growth.

- Businesses must focus on cybersecurity, scalability, and user experience to remain competitive.

- Financial services, e-commerce, and retail sectors will be key beneficiaries of digital payment adoption.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=129542

Analyst Viewpoint

The Digital Payment Market is on a rapid growth trajectory, driven by advancements in payment technologies and the growing demand for secure, convenient, and faster transactions. As consumers and businesses continue to embrace digital payments, the market will expand across multiple sectors, particularly e-commerce, retail, and financial services. The future of digital payments looks promising, with innovations in mobile payments, AI-driven fraud detection, and blockchain technologies playing a pivotal role in shaping the industry.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| E-commerce Transactions | Increased online shopping and global connectivity driving digital payment adoption |

| Cross-border Payments | Growing need for fast, secure international money transfers |

| Mobile Wallets | Rising smartphone penetration and demand for contactless payments |

| Financial Services | Digital payment solutions improving access to banking and credit services |

Regional Analysis

North America is expected to maintain its dominant position in the Digital Payment Market, holding a significant share of the market due to high adoption rates of digital payment technologies across industries like retail, banking, and healthcare. Europe is also witnessing steady growth, particularly in mobile payments and contactless solutions.

The Asia-Pacific (APAC) region is expected to experience the fastest growth, driven by the increasing smartphone penetration, the shift towards cashless economies, and government initiatives promoting digital payments in countries like India and China. Latin America and Middle East & Africa (MEA) are expected to grow steadily, as digital payment adoption rises with increased mobile internet access and fintech innovations.

Business Opportunities

The growing Digital Payment Market presents numerous opportunities for businesses, particularly those in fintech, retail, and e-commerce. Companies can explore opportunities in mobile wallet development, cross-border payment solutions, and blockchain-based payment systems to meet the growing demand for secure and efficient transaction methods.

Additionally, businesses can leverage data analytics to provide personalized services and improve customer loyalty. Partnerships with payment gateways, financial institutions, and technology providers can enable businesses to integrate cutting-edge digital payment solutions into their existing systems, driving innovation and enhancing the customer experience.

Key Segmentation

The Digital Payment Market can be segmented into Payment Method, End-User Industry, and Region:

- Payment Method: Mobile Wallets, Bank Transfers, Credit/Debit Cards, Cryptocurrency Payments

- End-User Industry: E-commerce, Banking & Financial Services, Retail, Travel & Hospitality

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Key Player Analysis

Key players in the Digital Payment Market are focusing on expanding their payment offerings, integrating new technologies such as AI, machine learning, and blockchain to enhance payment security and user experience. Companies are forming strategic partnerships with retailers, banks, and fintech firms to offer integrated payment solutions that streamline transaction processes. As the demand for digital payments grows, these players are innovating in areas such as mobile payments, contactless technology, and cross-border transactions, positioning themselves to capture market share in an increasingly digital economy.

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard Inc.

- Apple Inc.

- Google LLC

- Amazon.com, Inc.

- Adyen N.V.

- Stripe, Inc.

- Tencent Holdings Limited

- Global Payments Inc.

- One97 Communications Limited

- ACI Worldwide

- Other Key Players

Recent Developments

- Launch of AI-driven fraud detection systems to enhance the security of digital payments.

- Introduction of blockchain-based payment solutions for faster and more secure cross-border transactions.

- Expansion of mobile wallet services, integrating loyalty programs and personalized offers.

- Growth of cryptocurrency payment platforms, allowing businesses to accept digital currencies for transactions.

- Increased partnerships between digital payment providers and e-commerce platforms to improve transaction speed and user experience.

Conclusion

The Digital Payment Market is set for significant growth, driven by advancements in mobile payments, security, and blockchain technologies. As the global economy becomes more digital, the demand for fast, secure, and convenient payment solutions will continue to rise. Businesses must adapt by embracing innovation, improving user experience, and ensuring robust security measures to remain competitive in the rapidly evolving digital payment landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)