Table of Contents

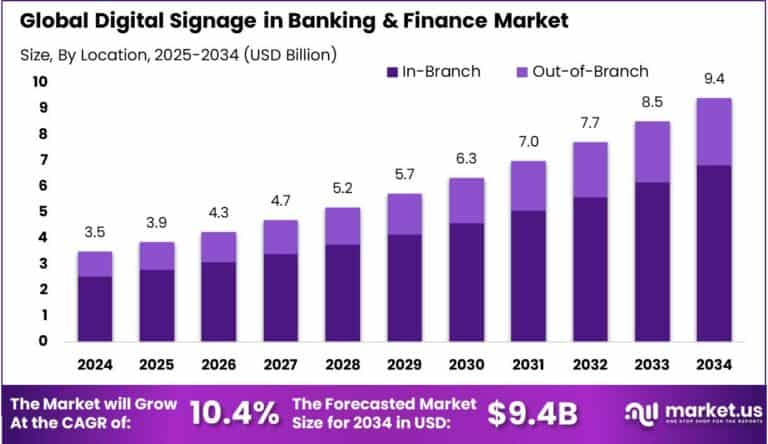

The Digital Signage in Banking & Finance Market is projected to grow significantly, reaching USD 9.4 billion by 2034, up from USD 3.5 billion in 2024, at a CAGR of 10.40%. North America leads the market, with a 37.2% market share and revenues of approximately USD 1.3 billion in 2024.

The Digital Notice Board segment dominates with 27.3% market share, while hardware accounts for 55.9%. LED technology holds a dominant position, capturing 46.8% of the market. Additionally, 8K resolution signage is gaining traction, holding 36.2% share. In-branch customer engagement continues to drive demand, with over 72.5% of the market share.

How Tariffs are Impacting the Economy

Tariffs have widespread economic effects, primarily by raising the costs of imported goods and services, which leads to increased production expenses for businesses. In the case of the digital signage market, tariffs on hardware such as LED panels, digital notice boards, and other essential components have significantly increased the cost of production.

These higher production costs are typically passed down to consumers, causing inflation and reducing purchasing power. Additionally, tariffs disrupt global supply chains by making certain materials more expensive or harder to access, leading to delays in product development and service delivery. For the banking and finance sector, higher costs for digital signage hardware and software solutions may result in longer implementation times for technology upgrades and increased costs for end-users.

Moreover, the uncertainty created by tariffs can make it difficult for companies to forecast expenses, leading to cautious investment and planning. Over time, these impacts may reduce competitiveness and slow the growth of the digital signage market.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/digital-signage-in-banking-finance-market/free-sample/

Impact on Global Businesses

Rising tariffs are increasing costs for global businesses, particularly those in industries like digital signage that rely on international supply chains for hardware and software components. As tariffs drive up the cost of essential components, such as LED screens, digital notice boards, and advanced software, businesses are experiencing higher production costs.

These increased expenses are often passed on to consumers, leading to higher prices for digital signage solutions. Additionally, companies are facing disruptions in their supply chains as they search for new suppliers in countries with fewer tariff barriers.

For the banking and finance sector, these changes may cause delays in the rollout of new digital signage solutions, impacting customer engagement and in-branch experiences. Companies in this space are being forced to re-evaluate their sourcing and supply chain strategies, which could result in longer lead times, increased costs, and potential disruptions to service quality.

Strategies for Businesses

To mitigate the impact of rising tariffs, businesses in the digital signage sector should diversify their supply chains and explore sourcing from countries with lower or no tariffs. By establishing relationships with regional suppliers, companies can reduce their reliance on imports and avoid tariff-induced price hikes.

Additionally, businesses can invest in more efficient, cost-effective hardware and software solutions that help offset rising production costs. For companies in the banking and finance sector, adopting cloud-based digital signage solutions can reduce dependency on expensive hardware while maintaining high-quality customer engagement.

Companies can also explore long-term partnerships with local manufacturers to ensure more stable pricing and reduce the impact of tariff fluctuations. By focusing on innovation, improving operational efficiency, and maintaining flexible pricing models, businesses can navigate tariff challenges and remain competitive.

➤ Explore more strategies get full access now @ https://market.us/purchase-report/?report_id=140408

Key Takeaways

- The Digital Signage in Banking & Finance Market is expected to grow at a CAGR of 10.40%, reaching USD 9.4 billion by 2034.

- North America holds a dominant market share of 37.2%, with revenues of USD 1.3 billion in 2024.

- The Digital Notice Board and LED segments dominate the market, capturing 27.3% and 46.8% shares, respectively.

- Tariffs are driving up production costs and disrupting supply chains, particularly in hardware and software components.

- Companies must adapt by diversifying supply chains, investing in cloud-based solutions, and improving operational efficiency.

Analyst Viewpoint

The Digital Signage in Banking & Finance Market is experiencing significant growth, driven by increased demand for customer engagement and in-branch solutions. Despite the challenges posed by rising tariffs, companies that focus on cost-effective digital signage solutions, such as LED and cloud-based technologies, will remain competitive.

The shift toward 8K resolution displays and digital notice boards highlights a growing demand for innovative and engaging customer experiences in banking and finance. With continued technological advancements and an expanding customer base, the market is expected to maintain strong growth, offering substantial opportunities for businesses that can navigate tariff challenges and capitalize on emerging trends.

Regional Analysis

North America remains the dominant region in the Digital Signage in Banking & Finance Market, capturing 37.2% of the global share in 2024, with revenues of approximately USD 1.3 billion. The U.S. market alone is expected to grow at a CAGR of 9.4%, reaching USD 11.9 billion by 2024.

The demand for digital signage in the banking and finance sector is driven by increasing adoption of customer engagement solutions and the integration of advanced technologies such as 8K resolution. Europe and Asia-Pacific are also expected to see significant growth, with emerging economies in Asia-Pacific leading the way in digital signage adoption.

➤ Discover More Trending Research

- LendTech Market

- Predictive Dialer Software Market

- Agentic AI in HR & Recruitment Market

- Voice Commerce Market

Business Opportunities

The Digital Signage in Banking & Finance Market presents numerous opportunities, particularly in customer engagement and in-branch solutions. As financial institutions increasingly adopt digital signage to enhance customer experience and improve operational efficiency, businesses in the digital signage industry can capitalize on the growing demand for high-quality displays and interactive solutions.

The rise in cloud-based digital signage solutions also offers opportunities for businesses to reduce hardware costs while offering scalable and customizable solutions. With the growing focus on innovative customer engagement tools, there is an opportunity for companies to expand their product offerings and develop integrated digital signage solutions tailored to the banking and finance sector.

Key Segmentation

The Digital Signage in Banking & Finance Market is segmented by technology type, application, and region. By technology, the market includes LED displays, digital notice boards, and 8K resolution signage, with LED capturing the largest share at 46.8% in 2024.

The customer engagement segment dominates application-wise, holding over 30.6% of the market share, followed by in-branch solutions at 72.5%. Regionally, North America leads the market with a 37.2% share, followed by Europe and Asia-Pacific, where adoption is growing rapidly. The increasing integration of advanced display technologies and interactive solutions across the banking and finance sectors is fueling market expansion.

Key Player Analysis

Key players in the Digital Signage in Banking & Finance Market are focusing on developing innovative solutions that enhance customer engagement and improve operational efficiency. Companies are investing in advanced display technologies, such as LED and 8K resolution signage, to meet the growing demand for high-quality, immersive customer experiences.

Additionally, strategic partnerships with financial institutions are allowing companies to tailor their products to the specific needs of the banking and finance sectors. By embracing cloud-based solutions and offering scalable, cost-effective services, players in the digital signage space are positioning themselves for long-term growth in a competitive market.

Top Key Players in the Market

- ADFLOW Networks

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics

- Microsoft Corporation

- NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- Samsung

- Scala

- Winmate Inc.

- Allsee Technologies Limited

- The Element Group

- STRATACACHE

- Others

Recent Developments

Recent developments in the Digital Signage in Banking & Finance Market include the launch of AI-powered customer engagement solutions and the integration of 8K resolution displays in banking branches. Companies are also focusing on expanding their cloud-based digital signage offerings to provide more scalable and cost-efficient solutions.

Conclusion

The Digital Signage in Banking & Finance Market is set for substantial growth, driven by technological advancements and increasing demand for customer engagement solutions. North America continues to lead the market, with growing opportunities in other regions as digital signage adoption accelerates. Despite tariff challenges, businesses that innovate and invest in cost-effective solutions will remain competitive.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)