Table of Contents

Introduction

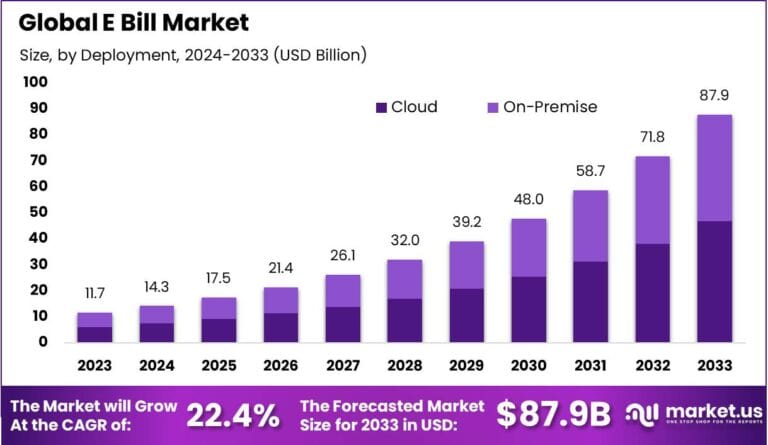

The global E-Bill Market is projected to grow significantly, reaching USD 87.9 Billion by 2033, up from USD 11.65 Billion in 2023, with a strong CAGR of 22.40% from 2024 to 2033. This rapid growth is fueled by the increasing adoption of digital payment solutions and automation of billing processes across various sectors.

North America held the largest market share in 2023, accounting for over 29.3% of the market and generating USD 3.4 billion in revenues. The rise of e-billing is transforming payment processes, offering businesses and consumers more convenience, security, and efficiency in financial transactions.

How Growth is Impacting the Economy

The growth of the e-bill market is significantly influencing the global economy, particularly in financial services and digital payments. As businesses increasingly adopt e-billing systems, operational efficiencies are improving, leading to reduced costs and faster processing times. This transformation is driving higher productivity levels and fostering innovation in related industries, such as fintech and software development. The market expansion is also fueling job creation in technology, customer service, and digital infrastructure sectors.

Additionally, e-billing provides businesses with opportunities to reduce paper waste, contributing to environmental sustainability and lower operational costs. Furthermore, as digital payment solutions gain traction, they are enhancing financial inclusion, particularly in regions with limited access to traditional banking systems. Overall, the rapid growth of the e-bill market is creating a ripple effect across industries, providing both economic and environmental benefits by making payment systems more efficient, secure, and sustainable.

➤ To Elevate Your Business – Request Sample Here @ https://market.us/report/e-bill-market/free-sample/

Impact on Global Businesses

The growth of the e-bill market is reshaping businesses worldwide, particularly in sectors such as finance, utilities, retail, and healthcare. Rising operational costs due to traditional billing systems are pushing companies to adopt e-billing solutions that are more cost-effective and scalable. In addition, the shift towards digital billing systems is also influencing global supply chains, especially in sectors like logistics, where e-billing is being integrated with automated inventory and payment tracking systems.

Sector-specific impacts include enhanced cash flow management, better customer service, and reduced fraud risks in financial services. Companies in sectors like utilities and telecoms are increasingly leveraging e-bills for recurring payments, making payment collection faster and more reliable. The demand for advanced security protocols in digital payment systems is also driving investment in cybersecurity solutions. Ultimately, businesses are adopting e-billing not just for efficiency, but to meet customer demands for more streamlined, transparent, and environmentally-friendly billing processes.

Strategies for Businesses

To capitalize on the growth of the e-bill market, businesses should focus on improving the integration of e-billing systems into their existing infrastructure. Investing in secure, scalable, and user-friendly platforms that offer customizable billing options will help businesses enhance customer satisfaction and reduce churn. Companies should also prioritize compliance with regional and global regulations governing digital payments, ensuring data security and privacy.

Partnering with fintech firms to offer cross-border e-billing solutions will enable businesses to tap into global markets while also catering to a wider customer base. Educating customers on the advantages of e-billing, such as convenience and environmental impact, will further accelerate adoption. Additionally, integrating advanced technologies like AI and blockchain into e-billing systems can provide more personalized billing experiences, further enhancing customer engagement and retention.

Key Takeaways

- The global e-bill market is expected to grow at a CAGR of 22.40%, reaching USD 87.9 billion by 2033.

- North America held the largest market share in 2023, contributing USD 3.4 billion in revenue.

- The rise of digital billing is driving cost reductions, improved cash flow management, and enhanced customer service.

- The market is fostering innovation in fintech and cybersecurity, opening new opportunities for businesses.

- Businesses should focus on scalability, security, and customer education to capitalize on e-bill growth.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=136232

Analyst Viewpoint

The e-bill market is experiencing rapid growth, driven by the increasing shift towards digital solutions in billing and payment processes. Presently, businesses are embracing e-billing to improve operational efficiency, reduce costs, and enhance customer satisfaction. Moving forward, this trend will continue to grow as technology advances and customer expectations evolve. In the future, businesses that adopt secure, scalable e-billing solutions will gain a competitive edge in the market. As digital payment systems become more integrated into global financial infrastructures, the e-bill market will continue to expand, offering new opportunities for innovation and economic growth.

Regional Analysis

In 2023, North America dominated the global e-bill market, capturing more than 29.3% of the market share and generating USD 3.4 billion in revenue. The region’s strong digital infrastructure, widespread use of smartphones, and high adoption rates of digital payment solutions contributed to its market leadership.

Europe is expected to see steady growth as regulatory frameworks and the push for digital transformation in finance and government agencies drive e-billing adoption. The Asia Pacific region is projected to experience the highest growth, driven by increasing smartphone penetration, the rise of fintech, and government initiatives promoting digital financial solutions. Latin America and the Middle East are emerging markets with expanding e-billing adoption, creating growth opportunities for businesses.

Business Opportunities

The e-bill market offers numerous business opportunities for technology providers, financial institutions, and companies in various sectors. With the increasing demand for digital payment solutions, businesses can focus on developing secure, user-friendly e-billing platforms tailored to different industries. There is also an opportunity to provide cross-border e-billing solutions, catering to businesses and consumers in multiple regions.

Additionally, the growing demand for mobile payments and digital wallets offers opportunities for mobile-first e-billing solutions. Companies in the fintech and cybersecurity sectors can capitalize on the market by offering advanced payment security features and fraud prevention solutions. Lastly, government-backed initiatives and digital transformation projects in emerging economies present growth opportunities for businesses providing e-billing infrastructure and services.

Key Segmentation

The global e-bill market can be segmented by end-user, including utilities, telecoms, financial services, and retail, with utilities and telecoms leading the market. By payment method, it includes mobile wallets, credit cards, and bank transfers, with mobile wallets expected to see the highest adoption. The market is also segmented by region, with North America holding the largest share, followed by Europe, APAC, Latin America, and the Middle East. Additionally, the market can be segmented by technology, including cloud-based platforms and on-premises solutions, with cloud-based solutions expected to dominate due to their scalability and cost-effectiveness.

Key Player Analysis

Key players in the e-bill market are focusing on enhancing the security and scalability of their digital billing solutions. Companies are investing in R&D to offer more advanced features like mobile-first billing, AI-based fraud detection, and real-time analytics. Partnerships with financial institutions and tech firms are crucial for expanding their market reach and improving product offerings. Companies are also increasingly focusing on regulatory compliance to ensure their e-billing systems adhere to global data privacy and security standards. With the growing demand for digital payment solutions, key players are looking to expand their offerings in emerging markets, providing affordable and accessible e-billing solutions to a wider audience.

- Block, Inc.

- Invoicera, Inc.

- Intuit Inc.

- Sana Commerce B.V.

- Tradeshift, Inc.

- Billtrust, Inc.

- Billwerk GmbH

- Bill.com, Inc.

- 2ndSite, Inc.

- Zoho Corporation Pvt. Ltd.

- Xero Limited

- Sage Intacct, Inc.

- Sleek Bill S.R.L.

- RecVue, Inc.

- Chaser Limited

- Other Key Players

Recent Developments

- In January 2025, a leading e-billing provider launched a new cloud-based platform to streamline payment processing for telecom companies.

- In December 2024, a major payment solution company integrated AI-powered fraud detection into its e-billing system for financial services.

- In November 2024, a global e-bill provider partnered with a fintech firm to introduce cross-border e-billing services.

- In October 2024, a leading e-bill platform expanded its product offerings to include mobile-first billing solutions for emerging markets.

- In September 2024, a telecom operator adopted an automated e-billing system, reducing operational costs by 25%.

Conclusion

The e-bill market is set for significant growth, driven by increasing digital payment adoption and technological advancements in billing systems. As the market expands, businesses focusing on secure, scalable, and user-friendly solutions will have the opportunity to capitalize on this rapid transformation. The future of e-billing looks promising, offering growth opportunities in both established and emerging markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)