Table of Contents

Introduction

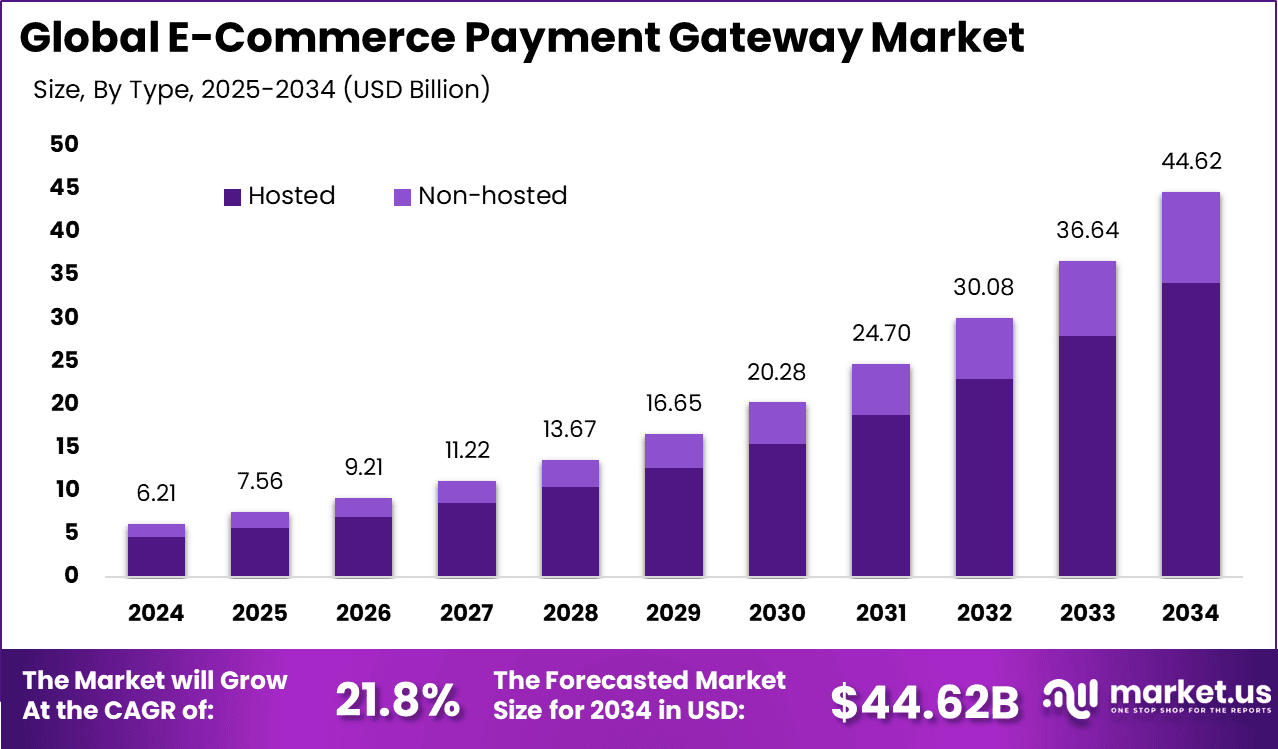

The global E-Commerce Payment Gateway Market is expected to reach USD 44.62 billion by 2034, up from USD 6.21 billion in 2024, growing at a remarkable CAGR of 21.8% from 2025 to 2034. This growth is driven by the increasing adoption of digital payment solutions in the e-commerce sector, enhanced by the growing reliance on secure and seamless payment gateways for online transactions.

How Growth is Impacting the Economy

The rapid expansion of the E-commerce Payment Gateway Market is fueling significant economic activity, particularly in the financial technology (fintech) and e-commerce sectors. As more businesses move online, the demand for secure, fast, and reliable payment solutions has surged. This has led to the development of advanced payment gateway technologies, which are improving the efficiency of online transactions.

The market growth also stimulates job creation in areas such as software development, cybersecurity, and digital marketing. Additionally, the increased reliance on payment gateways by global businesses enhances the cross-border trade, providing new revenue streams and strengthening global economic ties. Moreover, innovations in payment solutions, such as mobile wallets and contactless payments, are driving increased consumption, contributing to overall economic growth.

➤ Unlock growth! Get your sample now! @ https://market.us/report/e-commerce-payment-gateway-market/free-sample/

Impact on Global Businesses

As the demand for secure payment systems grows, businesses in the fintech and e-commerce industries are facing rising costs related to technology development, cybersecurity measures, and compliance with regulatory standards. The increasing complexity of digital payment solutions is driving businesses to invest heavily in research and development.

Additionally, supply chain shifts are occurring as payment gateway providers are moving toward integrated solutions that offer smoother transactions across different platforms. This shift is benefiting the e-commerce sector by enabling more seamless cross-border transactions. The increased adoption of mobile and contactless payments is impacting the retail and hospitality sectors, pushing them to integrate more payment gateway solutions to meet evolving consumer preferences.

Strategies for Businesses

To capitalize on the growth in the E-Commerce Payment Gateway Market, businesses should focus on developing secure, user-friendly, and scalable payment solutions. Integrating multi-currency and cross-border transaction capabilities can help companies expand their reach into global markets. Additionally, investing in innovative payment technologies, such as AI-powered fraud detection and mobile wallets, will improve customer trust and reduce transaction friction. Collaborating with e-commerce platforms, retailers, and financial institutions can enhance business opportunities and expand market share. By enhancing the security and efficiency of payment systems, businesses can stay competitive in an increasingly digital economy.

Key Takeaways

- The global E-commerce Payment Gateway Market is expected to grow from USD 6.21 billion in 2024 to USD 44.62 billion by 2034, at a CAGR of 21.8%.

- North America currently holds the largest market share with 37.6%, generating USD 2.33 billion in revenue in 2024.

- Businesses should focus on developing secure, scalable, and efficient payment solutions, with an emphasis on mobile and cross-border payments.

- The growth of mobile wallets, AI-powered fraud detection, and multi-currency capabilities will drive future market expansion.

➤ Stay ahead—secure your copy now @ https://market.us/purchase-report/?report_id=153871

Analyst Viewpoint (Present + Future Positive View)

Currently, the E-commerce Payment Gateway Market is experiencing strong growth, driven by increased e-commerce activity and the growing demand for secure, efficient online payment solutions. As digital payment technologies continue to evolve, the market is expected to maintain a positive growth trajectory. In the future, advancements in mobile payments, artificial intelligence, and blockchain will drive further innovations, creating new business opportunities and improving the overall consumer experience. The outlook for the market remains highly favorable as global digital transactions continue to rise.

Regional Analysis

North America dominates the global E-commerce Payment Gateway Market, with 37.6% market share, driven by a well-established e-commerce ecosystem and the presence of major fintech companies. Europe is also experiencing strong growth, particularly in countries like the UK and Germany, where digital payments are widely adopted across e-commerce platforms. The Asia-Pacific region is expected to witness the fastest growth due to the increasing number of online shoppers and the rise of mobile payment adoption in countries like China and India. Other regions, including Latin America and the Middle East, are gradually increasing their share in the market as digital payment solutions become more accessible.

➤ Don’t Stop Here—check Our Library

- Augmented Reality Navigation Market

- Digital Services Consulting Market

- Cognitive Supply Chain Market

- Anti Spam Software Market

Business Opportunities

The E-commerce Payment Gateway Market presents numerous opportunities for businesses in fintech, e-commerce, and financial institutions. Developing advanced payment gateway solutions that support mobile wallets, contactless payments, and cross-border transactions will be crucial in tapping into the expanding market. Additionally, integrating AI-powered fraud detection systems and enhancing security features will help build consumer trust and reduce operational risks. Collaboration with online retailers, payment processors, and fintech startups will help companies capitalize on the growing need for secure and efficient payment solutions in the e-commerce space.

Key Segmentation

Technology:

- Mobile Wallets – 45.0%

- Credit/Debit Card Payments – 35.0%

- Bank Transfers – 15.0%

- Other (Cryptocurrency, E-checks) – 5.0%

End-User:

- E-commerce Retailers – 50.0%

- Travel and Hospitality – 20.0%

- Digital Service Providers – 15.0%

- Others (Healthcare, Education) – 15.0%

Payment Method:

- Contactless Payments – 40.0%

- Tokenization – 35.0%

- Biometric Authentication – 25.0%

Deployment:

- Cloud-Based – 70.0%

- On-Premise – 30.0%

Key Player Analysis

Leading players in the E-commerce Payment Gateway Market are focusing on enhancing the security, scalability, and user experience of their payment systems. These companies are integrating AI and machine learning technologies to offer more robust fraud protection and improve transaction processing speeds. Collaborations with e-commerce platforms, payment processors, and fintech providers are helping companies expand their reach and offer multi-currency solutions. As the market evolves, companies are also investing in the development of blockchain-based payment systems to provide more secure and transparent transactions.

Top Key Players in the Market

- Adyen

- Amazon Payments Inc.

- Net

- Bitpay, Inc.

- Braintree

- PayPal Holdings, Inc.

- PayU Group

- Stripe

- Verifone Holdings, Inc.

- Wepay, Inc.

- Others

Recent Developments

- In January 2025, a leading payment gateway provider introduced AI-powered fraud detection tools to enhance security for online transactions.

- In December 2024, a major fintech company launched a multi-currency payment gateway to support global e-commerce businesses.

- In November 2024, an e-commerce platform integrated a blockchain-based payment system for faster and more secure cross-border transactions.

- In October 2024, a global payment processor partnered with retailers to offer contactless payment solutions at checkout.

- In September 2024, a major digital wallet provider expanded its services to include biometric authentication for secure payments.

Conclusion

The global E-commerce Payment Gateway Market is experiencing rapid growth, projected to reach USD 44.62 billion by 2034, with a CAGR of 21.8%. Businesses should focus on developing secure, scalable, and efficient payment solutions to capitalize on this growth. Innovations in mobile payments, fraud detection, and multi-currency capabilities will continue to drive the market forward, presenting ample opportunities for growth in the fintech and e-commerce sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)